Dental Laboratory Welders Market Trends

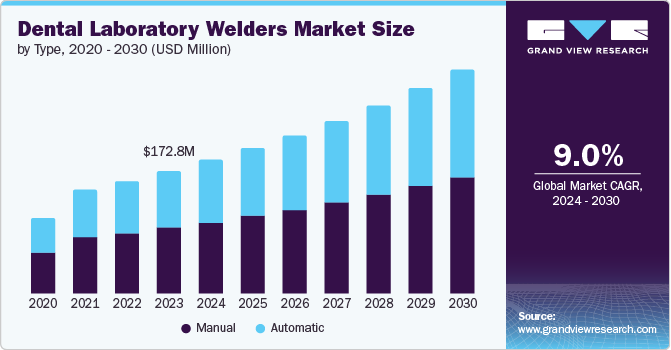

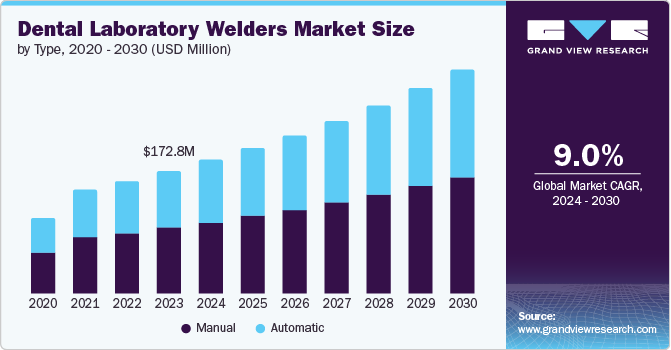

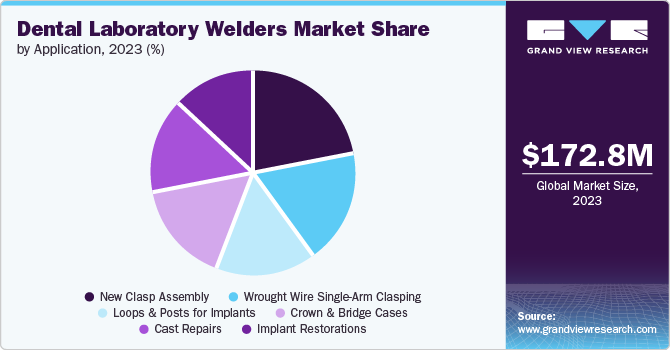

The global dental laboratory welders market size was valued at USD 172.8 million in 2023 and is expected to grow at a CAGR of 9.0% from 2024 to 2030. The dental lab welder focuses on equipment for welding dental prostheses and devices, ensuring accuracy and stability. These welders are essential for successful dental restorations and repairs. Advances in dental technology and increasing demand for cosmetic and restorative dental procedures drive the market growth. Furthermore, the increasing incidences of dental diseases and an increasing number of dental laboratories across the globe are contributing to the expansion of the market.

The market is driven by the rising demand for new clasp assemblies, owing to the need for strong clasps to hold partial dentures in place. This has triggered the need for dental laboratory welders. With the increasing development of new techniques of clasp assembly, there is a corresponding growth in demand for dental laboratory welders. The global dental laboratory welder market is also characterized by the increasing development of minimally invasive dental treatment methods. This approach uses procedures that retain the tooth structure and cause minimal discomfort to patients.

Dental implants are one of the most non-invasive procedures that involve welded parts to ensure the appropriate positioning of implants. These procedures are best done through laser welding as this technology is accurate and makes strong welds that emit less heat with minimal damage to the neighboring tissues. This method is ideal for both doctors and patients. Some benefits of laser welding in dentistry include high mechanical strength, reduced distortion caused by shrinking heat-affected zones, low danger of contamination, faster processing times, and corrosion-resistant joints. Such innovations are expected to foster market growth.

Type Insights

The manual segment dominated the market and accounted for a share of 53.5% in 2023. This dominance can be attributed to the control and flexibility of manual welds used by dentists for dental prosthetics. In addition, they are more cost-effective than the automatic segment, making them attractive for several dental laboratories.

The automatic segment is expected to register a CAGR of 9.4% during the forecast period. The automated welders provide more accuracy and precision compared with other manual welders, leading to better quality control. In addition, the welder machine simplifies operations and increases productivity in dental laboratories. Therefore, the ease of using automated welders is beneficial to such laboratories.

Application Insights

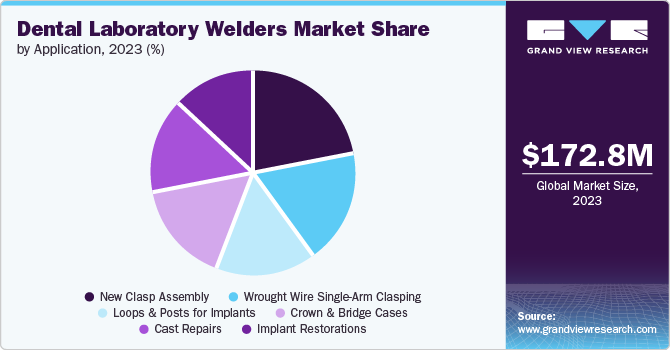

New clasp assembly accounted for the largest market revenue share of 14.8% in 2023. The increase in the use of partial dentures affirms the segment growth. Additionally, the dental industry is trending towards preserving the tooth structure, and partial dentures are expected to grow more popular, thus, adding to the segment growth.

The implant restoration segment is expected to register a CAGR of 9.1% during the forecast period. This is attributed to the increasing popularity of implants as a durable solution that has created a demand for welders who can assemble complex components for implant restorations. These restorations require precise and safe welds to ensure proper performance and durability. Furthermore, the development of welding technology, specially designed for implants is anticipated to drive market growth.

Regional Insights

The dental laboratory welders market in North America dominated globally with a share of 39.8% in 2023. This is attributed to the high prevalence of dental diseases in this region which creates a demand for dental restorations such as crowns, and bridges, all of which rely on welding. Additionally, oral health awareness and the willingness to invest in cosmetic dentistry in the North American population are anticipated to drive market growth. The availability of dental insurance in several parts of North America offer access to these dental procedures making them more widely used by dental practitioners.

U.S. Dental Laboratory Welders Market Trends

The dental laboratory welders market in the U.S. dominated North America with a share of 77.5% in 2023 due to a well-developed healthcare industry, high adoption of dental implants, an increase in the geriatric population that requires oral care, and improvements in welding techniques.

Europe Dental Laboratory Welders Market Trends

Europe dental laboratory welders market was identified as a lucrative region in this industry. According to the World Health Organization, the European region held a high prevalence of major oral disease cases (50.1% of the adult population) throughout the six WHO regions worldwide.

The UK dental laboratory welder market is expected to grow rapidly in the coming years due to a steady growth in the aging population, contributing to the rise in demand for dental implants, such as dentures, that require welding. Additionally, with the reliance on welded materials, growing awareness of the benefits of cosmetic dentistry, such as advances in dental technology provide increased demand for treatment making welded dentures increasingly popular with the UK patients.

Asia Pacific Dental Laboratory Welders Market Trends

Asia Pacific dental laboratory welders market is anticipated to witness significant growth due to the growing middle-income groups in the region having disposable income, allowing them to invest in dental treatments with welded components such as crowns and bridges. Furthermore, the increasing awareness of dental hygiene and the popularity of cosmetic dentistry in countries such as China and India offer a huge market for dental practitioners in Asia Pacific.

China dental laboratory welders market held a substantial share in 2023 due to China’s large population with high disposable income, which has resulted in several consumers seeking affordable dental care. Welders enable cost-effective dental prosthetics such as crowns and bridges, making them accessible to a wider range of patients. Additionally, China’s growing dental industry, driven by a skilled workforce and robust manufacturing processes is anticipated to drive the market growth.

Key Dental Laboratory Welders Company Insights

Some key companies in the global dental laboratory welders market include LaserStar, IPG Photonics, Max Photonics, Orion, and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

IPG Photonics Corporation manufactures fiber lasers, used for various applications in the field of medicine. They offer a wide range of fiber laser sources, amplifiers, and related components.

-

Sunstone Engineering LLC mainly deals in the manufacturing of micro welding and engraving equipment used in performing welds in very small areas with high accuracy and precision.

Key Dental Laboratory Welders Companies:

The following are the leading companies in the dental laboratory welders market. These companies collectively hold the largest market share and dictate industry trends.

- LaserStar Technologies

- Sunstone Engineering LLC

- Primotec

- ElettroLaser

- IPG photonics

- Max Photonics

- Alpha Laser

- Orion

- Dentalcompare

- Micro Precision Welding

Dental Laboratory Welders Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 188.0 million

|

|

Revenue forecast in 2030

|

USD 315.0 million

|

|

Growth rate

|

CAGR of 9.0% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company share, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

|

|

Key companies profiled

|

LaserStar; Sunstone Engineering LLC; Primotec; ElettroLaser; IPG photonics; Max Photonics; Alpha Laser; Orion; Dentalcompare; Micro Precision Welding

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

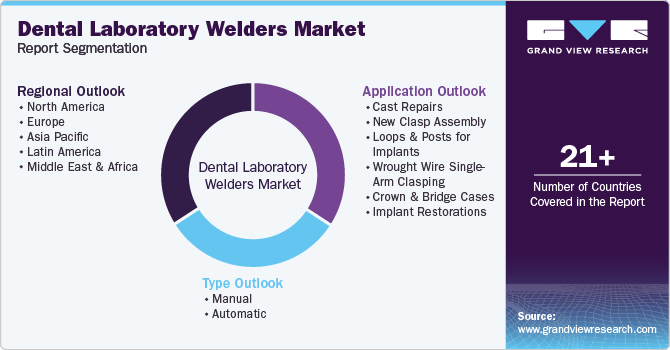

Global Dental Laboratory Welders Market Report Segmentation

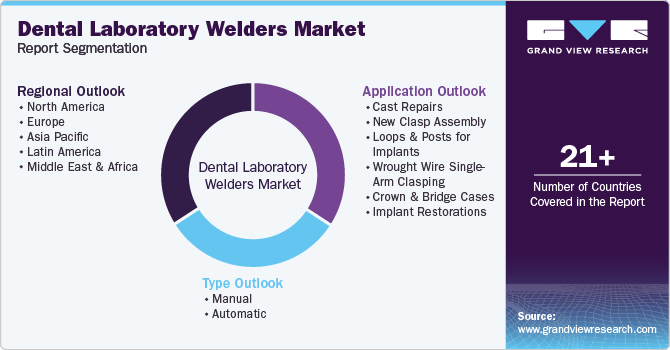

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global dental laboratory welders market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)