- Home

- »

- Medical Devices

- »

-

Dental Implants And Prosthetics Contract Manufacturing Market Report, 2030GVR Report cover

![Dental Implants And Prosthetics Contract Manufacturing Market Size, Share & Trends Report]()

Dental Implants And Prosthetics Contract Manufacturing Market Size, Share & Trends Analysis Report By Product (Dental Implants, Dental Prosthetics), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-168-5

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

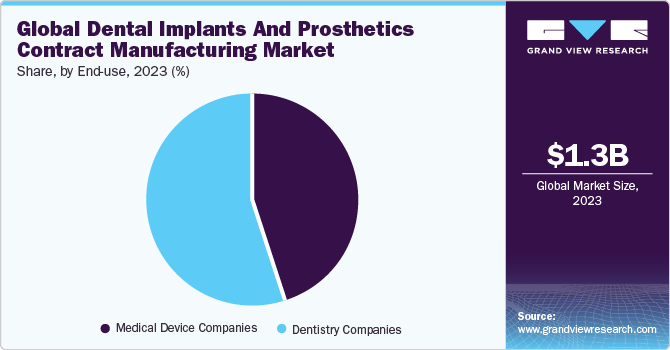

The global dental implants and prosthetics contract manufacturing market size was estimated at USD 1.30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2030. Growing trend of outsourcing, increasing use of dental implants and prosthetics due to the rising prevalence of various dental ailments, and complexity of manufacturing these devices are driving the market. Access to advanced manufacturing technologies, cost-effectiveness, and increasing number of CMOs are some major factors positively affecting market growth.

High market growth is majorly due to increasing pressure on OEMs to reduce costs and enhance the timeline for taking a product to market. In addition, macroeconomic factors such as the increasing edentulism population globally and the rising number of minimally invasive procedures are boosting demand for dental products, including dental implants and prosthetics.

Moreover, medical device firms are determined to reduce costs as profit margins are decreasing. To limit fixed costs, companies are implementing shift work. Small & medium-sized companies lack skilled labor & technical resources to complete projects. Contract manufacturing enables addressing these issues. OEMs are looking for partners with deep capabilities and the ability to fill technology gaps in their portfolios & enhance time to market for innovations. Hence, they prefer contract manufacturers with the scale & sophistication required to support the increasingly complex global supply chains.

Furthermore, digital dentistry has played a crucial role in advancing the field of dental implants and prosthetics, contributing to their growth in several ways. Digital dentistry has introduced several latest technologies, such as computer-aided design/manufacturing (CAD/CAM), 3D printing technology, guided implant surgery, which has supported innovation across dental implants and prosthetics, thus boosting market growth. For instance, in November 2022, ZimVie Inc. a company operating in the dental and spine sectors, announced the launch of TSX Implant in the U.S. TSX Implants have been specifically crafted for immediate extraction and loading protocols, offering enhanced placement predictability for dental peri-implant health, long-term osseointegration, crestal bone maintenance, and prosthetic stability.

Market Concentration & Characteristics

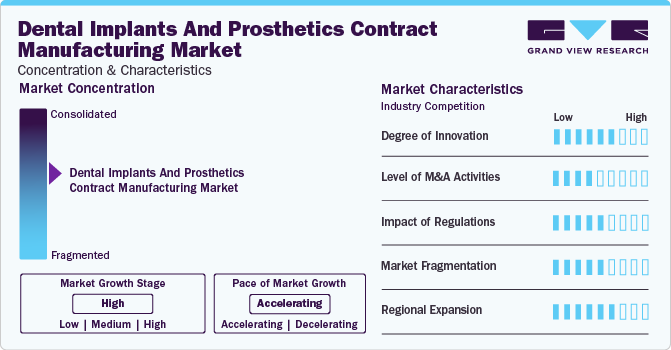

Market growth stage is stable, and pace of the market growth is accelerating. The dental implants and prosthetics contract manufacturing market is characterized by evolving technologies, regulatory considerations, materials innovation, and increasing globalization and outsourcing of manufacturing processes to leverage cost advantages and specialized capabilities.

Degree of Innovation: Prompt adoption of novel technologies, such as 3D printing, digital dentistry, and CAD/CAM, within a manufacturing process. Integration of smart technologies for enhanced patient monitoring and functionality in prosthetics are a few of the innovations made across dental industry, thus boosting demand for dental implants and prosthetics. Frequent innovation in biocompatible materials to enhance performance and longevity of dental prosthetics and implants is another major market characteristic witnessed in the dental products industry.

Impact of Regulations: Stringent quality protocols and regulatory norms govern the dental implants and prosthetics market, and contract manufacturers must follow regulatory guidelines to ensure efficacy and safety of their products.

Mergers and acquisition activities in dental implants and prosthetics contract manufacturing market are increasing and growing at a stable rate during the analysis timeframe. A significant number of companies are focusing on acquisition strategies to expand its service portfolios and regional scope.

The market is characterized by the presence of a large number of contract manufacturers catering to specific segments such as dental crowns, bridges, implants, and dentures. Specialization in specific technologies and materials has led to a fragmented market scenario.

The rising trend of outsourcing and globalization of development and manufacturing processes to leverage specialized capabilities and cost advantages is another considerable market characteristic supporting the industry growth. Contract developers and manufacturers can operate globally to capitalize on regional expertise and serve a broader market base. Moreover, emerging economies such as China and India are anticipated to witness lucrative growth during the forecast period owing to the cost-effectiveness of services in emerging countries.

End-use Insights

Dentistry companies held the largest market revenue share in 2023. Outsourcing allows dentistry companies to leverage specialized state-of-the-art technologies and expertise provided by contract manufacturers. This enables OEMs to ensure precision-engineered and high-quality production of dental products. Such partnerships assist OEMs in focusing on their core competencies, such as product innovation and patient care, while leaving complexities of manufacturing to specialists. Furthermore, growing number of dental companies launching new products is another considerable factor supporting demand for contract manufacturing services. For instance, in March 2022, Implant Direct launched the Simply Iconic implant system. This conical hex implant has substantially influenced dental landscape, particularly for periodontists, implantologists, highly skilled general dentists, and oral and maxillofacial surgeons.

Medical device companies are expected to register fastest CAGR during the forecast period. Outsourcing offers cost efficiencies, as contract developers streamline the process of manufacturing and economies of scale. Collaboration with external partners helps medical device companies navigate complexities of production and stay abreast of technological innovations, thus simultaneously meeting the rising demand for personalized and advanced dental implants in an ever-evolving healthcare landscape.

Product Insights

Dental prosthetics led the market and held 60.7% of the global revenue in 2023. This high percentage can be attributed to robust pipeline of dental prosthetics, persuaded by several factors, such as innovation across prosthetic materials, adoption of latest novel technologies for developing and manufacturing advanced prosthetics, and growing demand for enhanced oral health solutions. Furthermore, rising emphasis on patient-centered care has boosted demand for customized or personalized prosthetics to match individual patient preferences and needs, simultaneously providing better comfort, aesthetics, and functionalities.

Digital dentistry is one of the major factors supporting the development of novel prosthetics. For instance, in October 2022, SprintRay Inc., a globally recognized leader in 3D printing solutions and digital dentistry, announced the launch of OnX Tough, a novel ceramic hybrid resin crafted for dental prosthetics 3D printing. The dental prosthetics segment has been further classified into bridges & crowns, dentures, and abutments. The bridges & crowns segment is anticipated to dominate the market.

The dental implants segment is anticipated to witness a stable CAGR during the analysis timeframe. Increasing demand for cosmetic dentistry and increased awareness about oral hygiene resulted in inflated demand for dental implant solutions. Dental implants require specialized manufacturing processing in molding and shaping based on patients’ needs. Products involved are generally made-to-order, creating the need for intelligent distribution and implementation services to be outsourced for dental devices. Dental implant contract manufacturing services are anticipated to witness robust demand during the analysis period as these devices are required in smaller volumes and are complex to manufacture.

Furthermore, increasing awareness and growing adoption of dental implants in developing economies is another factor supporting market expansion. As per Straumann Group, in South Korea, dental reimbursement for senior citizens began in 2014, leading to more than 70% of dentists specializing in implant dentistry by 2022, elucidating the elevated penetration rate. Dental implants have been further classified into titanium implants and zirconium implants.

Regional Insights

North America dominated the market and held a 36.4% share in 2023. North America is one of the major contributors to the growth of the market. This region is home to numerous dentistry companies, which outsource part of their production functions to contract manufacturers, thereby contributing toward the market's growth. High cost of R&D is a major challenge, which has encouraged various medical device and dental companies in North America to outsource functions to third-party vendors with a high level of expertise in the domain.

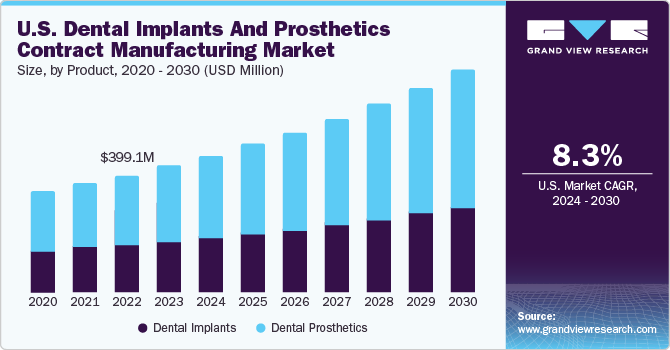

The U.S. is anticipated to hold the highest market share in the North America region. Increased outsourcing practices by dental companies and support of CMOs in reducing operational and capital expenses are among the key factors responsible for its lucrative growth. Medical device companies in the U.S. are popular globally for their technologically advanced products. In addition, strong R&D practices in the country and promotion of new therapies have significantly contributed to considerable market share held by the U.S. Furthermore, the need to maintain high client satisfaction amid intense competition is anticipated to fuel market expansion in the country further. According to a study by Consumer Reports, Inc., 8 out of 10 Americans prefer a product made in the U.S. over an imported one. According to Inc. magazine (Mansueto Ventures), nearly 85% of U.S. consumers believe that products made in the U.S. are of higher quality.

Asia Pacific is anticipated to witness significant growth in the market. Countries such as Japan, China, and India will witness lucrative growth rates across the analysis timeframe. This growth owes to significantly increasing investments in dentistry technologies across the region. Factors such as high-cost savings, improved regulatory framework, several regional contract manufacturers, and an increased number of medical device companies venturing into the region are expected to drive the Asia Pacific market. Furthermore, availability of a skilled workforce within the region at a lower cost compared to the U.S. is another factor that is anticipated to propel market growth.

Key Companies & Market Share Insights

Some of the key players operating in the market include Elos Medtech AB; BIOPLATE; and ARCH Medical Solutions Corp.

-

Elos Medtech AB is an international contract manufacturer with expertise in producing components for dental implant industry and class I and II medical devices. Its manufacturing services include a comprehensive supply-chain service encompassing finalization, labeling, packaging for end customers, and global inventory shipment. Further, it provides product manufacturing services such as design transfer - PPAP- control protocol, test production - quality assurance and quality agreement, series production and delivery, ongoing cost optimization and design for manufacturing, assembly, sterilization, and others.

-

ARCH Medical Solutions Corp excels in producing small components and micro-machining catering to dental market OEMs. The company offers capacity and scalability in dental manufacturing. Furthermore, their quality systems are meticulously designed to align with the FDA's Quality System Regulation standards, specifically 21 CFR Part 820.

Halder GmbH, Micron Products INC. Wesley Coe Ltd are some of the emerging market participants in the dental implants and prosthetics contract manufacturing market.

-

Halder GmbH is a prominent MedTech contract manufacturer, concentrating primarily on dental sector within the DACH region.

-

Micron Products INC’s orthopedic implant manufacturing solutions, certified under ISO 13485 and registered with the FDA for cGMP, encompass precise machining, finishing, porous coatings, passivation, and sterilization.

Key Dental Implants And Prosthetics Contract Manufacturing Companies:

- Elos Medtech AB

- BIOPLATE

- Halder GmbH

- Micron Products INC.

- Cendres+Métaux Medtech

- YOMURA

- ARCH Medical Solutions Corp

- Tectri SA

- Wesley Coe Ltd

- SteriPackGroup

Recent Developments

-

In July 2023, ARCH Medical Solutions Corp. announced the acquisition of gSource LLC. The company specializes in precision manufacturing of a comprehensive range of medical equipment and provides custom contract manufacturing services for medical Original Equipment Manufacturers (OEMs). The acquisition is anticipated to enhance service offering of ARCH Medical Solutions Corp in the field of dental products.

-

In July 2023, Elos Medtech AB announced an agreement to acquire Klingel Holding GmbH, a prominent CDMO, which is anticipated to enhance Elos Medtech's capabilities and expertise and fortify its position in the industry.

-

In July 2022, Envista Holdings Corporation disclosed extension and broadening of its commercial collaboration with Dentalcorp Holdings Ltd., the largest Dental Service Organization (DSO) and network of dental practices in Canada.

Dental Implants and Prosthetics Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.40 billion

Revenue forecast in 2030

USD 2.27 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Elos Medtech AB; BIOPLATE; Halder GmbH; Micron Products INC.; Cendres+Métaux Medtech; YOMURA; ARCH Medical Solutions Corp; Tectri SA; Wesley Coe Ltd; SteriPackGroup

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Implants And Prosthetics Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental implants and prosthetics contract manufacturing market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Implants

-

Titanium Implants

-

Zirconium Implants

-

-

Dental Prosthetics

-

Bridges & Crowns

-

Dentures

-

Abutments

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Dentistry Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental implants and prosthetics contract manufacturing market size was valued at USD 1.30 billion in 2023 and is projected to reach USD 1.40 billion by 2024.

b. The global dental implants and prosthetics contract manufacturing market is projected to grow at a compound annual growth rate (CAGR) of 8.3% reaching USD 2.27 billion by 2030.

b. Dental prosthetics led the market and accounted for 60.7% of the global revenue in 2023. This high percentage can be attributed to robust pipeline of dental prosthetics, persuaded by several factors, such as innovation across prosthetic materials, adoption of latest novel technologies for developing and manufacturing advanced prosthetics, and growing demand for enhanced oral health solutions.

b. Some of the key players operating in the market include Elos Medtech AB; BIOPLATE; and ARCH Medical Solutions Corp.

b. Growing trend of outsourcing, increasing use of dental implants and prosthetics due to rising prevalence of various dental ailments, and complexity of manufacturing these devices are driving the dental implants and prosthetics contract manufacturing market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."