- Home

- »

- Medical Devices

- »

-

High-fluoride Dental Products Market Size Report, 2030GVR Report cover

![High-fluoride Dental Products Market Size, Share & Trends Report]()

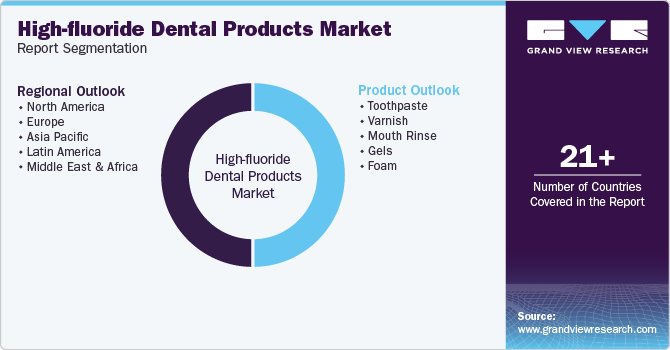

High-fluoride Dental Products Market Size, Share & Trends Analysis Report By Product (Toothpaste, Mouth Rinse, Gels, Varnish, Foam), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-321-2

- Number of Report Pages: 133

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

High-fluoride Dental Products Market Trends

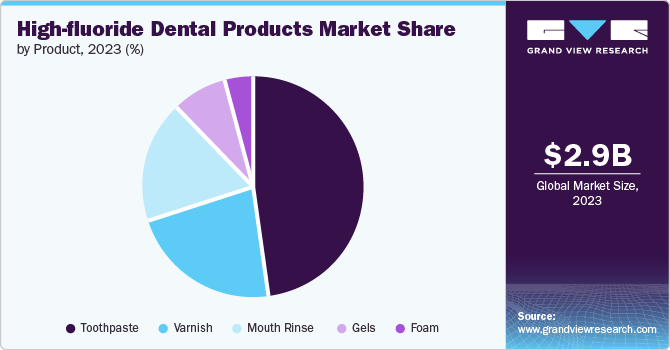

The global high-fluoride dental products market size was estimated at USD 2.89 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. This growth is driven by increasing dental caries rates, heightened oral health awareness, and government initiatives to improve access to oral care. Technological advancements, such as developing innovative fluoride products and integrating digital technologies, enhance treatment effectiveness and convenience.

The market's expansion into emerging regions and strategic partnerships are also crucial for its growth. Furthermore, the market is evolving with technological innovations like smart toothbrushes, fluoride varnishes, and nano-based fluoride treatments, which are improving oral health outcomes and reducing the need for invasive procedures. Key players are launching new products, forming strategic alliances, and expanding regionally to seize these growth opportunities, as evidenced by Ultradent Products, Inc.'s acquisition of Vamasa SA de CV in Mexico. These factors collectively indicate a promising future for high-fluoride dental products.

The market is witnessing substantial growth, primarily driven by the escalating prevalence of dental caries, a widespread oral disease affecting a significant portion of the global population, including 60-90% of school-aged children and nearly 100% of adults worldwide. This widespread issue, along with identifying dental caries as a major public health concern in the U.S., where more than half of teenagers and nearly 90% of adults have experienced tooth decay, underscores the urgent need for effective prevention and treatment methods.

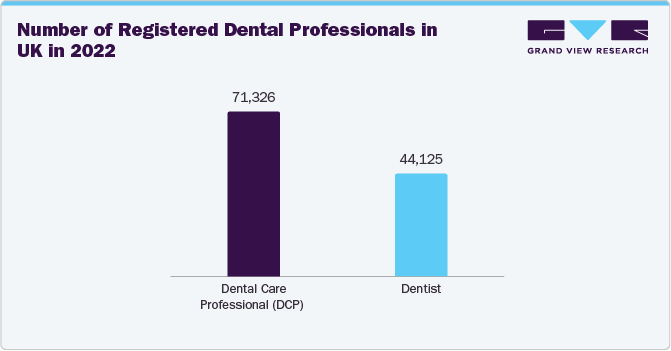

In addition, the prevalence of gum or periodontal diseases and mouth cancers among the geriatric population, with nearly 30% of individuals aged 65 to 74 years globally having no natural teeth and over 53% suffering from a moderate to severe form of periodontitis, highlights aging as a significant risk factor for dental diseases. These factors, combined with the market's inherent growth drivers, such as the rise in oral health awareness and the introduction of innovative fluoride products and digital technologies, position the market for a promising future. Moreover, an increase in several dental professionals and dental visits further boosts the market growth during the forecast period.

The market is propelled forward by the escalating awareness of dental hygiene, with organizations like the American Dental Association (ADA) and the WHO advocating for fluoride treatments to prevent tooth decay. This awareness, coupled with the ADA's National Children's Dental Health Month and CDC statistics highlighting the importance of dental health, underscores the market's growth potential. However, challenges such as the high cost of dental treatment and inadequate reimbursement schemes in some countries, leading to fewer dentist consultations compared to medical doctor consultations, persist.

Despite these challenges, the market is supported by the efforts of dental professionals and major players in the industry, leveraging technological advancements and the integration of telemedicine to reach a broader patient base and enhance the accessibility of fluoride treatments. As the market evolves, broadening product ranges and utilizing technology to meet varied patient needs is crucial for tackling high treatment costs and ensuring fluoride treatments are accessible to all, thereby enhancing oral health outcomes and reducing disparities in dental care access.

Moreover, the rise in behavioral risk factors, such as smoking and diabetes, increases the risk of dental caries and other oral health issues. Global smoking prevalence stood at 32.6% in 2020, with significant impacts on gum disease, while diabetes, affecting nearly 25.2 million U.S. adults, is linked to higher dental expenditures and a higher prevalence of periodontal disease. These conditions necessitate preventive dental care, including fluoride treatments, to strengthen tooth enamel and prevent cavities. The ADA and WHO emphasize the importance of fluoride treatments in preventing tooth decay, underscoring the market's potential for growth. However, challenges such as high treatment costs and financial barriers, particularly for people with diabetes, persist. Despite these challenges, the integration of telemedicine, technological advancements in dental services, and efforts to increase oral health awareness are supporting the market's evolution.

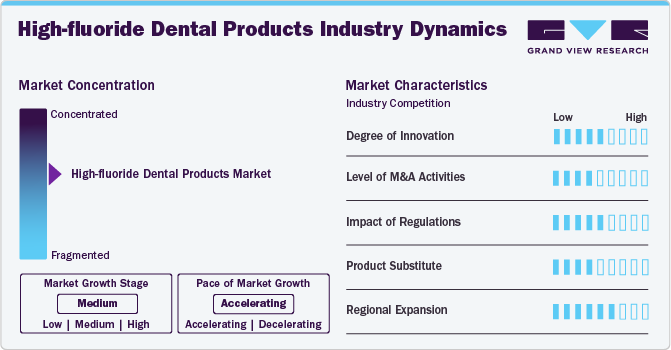

Industry Dynamics

The market is highly consolidated, with a few key players dominating it. This reflects its competitive nature and the significant investments required for research and development.

The market is experiencing continuous innovation through research and development, aiming to enhance existing products and introduce new solutions that address evolving consumer needs and technological advancements. This focus on innovation is driven by the competitive landscape and the quest for superior oral health outcomes, ensuring that the market remains dynamic and responsive to changing trends and consumer preferences.

The market recently experienced a rise in merger and acquisition (M&A) activities, such as Ultradent's strategic acquisition of a majority stake in Vamasa SA de CV, a leading Mexican dental distributor, in April 2021. This acquisition strengthens Ultradent's presence in Latin America, expands its distribution network, deepens market penetration, and delivers high-quality dental solutions to a broader regional customer base.

The regulatory scenario in the market is complex and varies by region. In the United States, high dental fluoride products are regulated by the Food and Drug Administration (FDA) and must comply with strict quality and safety standards. In Europe, high dental fluoride products are regulated under the European Medicines Agency (EMA) and must comply with the European Union's Medical Device Regulation (MDR). In other regions, such as Asia and Latin America, regulations may be less stringent but are becoming increasingly important as demand for high-quality dental products grows. Overall, regulatory compliance is a critical factor in the market, and companies must navigate a complex regulatory landscape to ensure the safety and efficacy of their products.

Major players in the global market are actively pursuing market expansion strategies. For instance, in April 2022, Ultradent strengthened its presence in Latin America by acquiring a majority stake in Vamasa sa de cv, a leading distributor of dental products in Mexico. This strategic acquisition would enable Ultradent to enhance its distribution network, deepen market penetration, and deliver high-quality dental solutions to a broader regional customer base.

Product Insights

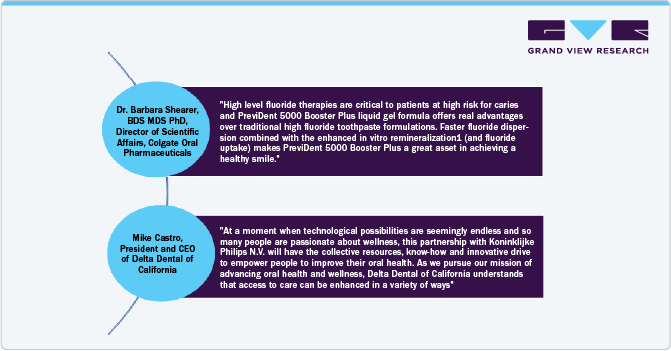

The toothpaste segment dominated the market and held the largest revenue share of 48.33% in 2023 and is expected to grow at a CAGR of 4.6% from 2024 to 2030. This dominance is attributed to its significant role in preventive dental care, offering additional protection against dental caries and tooth decay through higher fluoride concentrations than regular toothpaste. Sodium monofluorophosphate and sodium fluoride are the most utilized fluoride compounds in these products, catering to the global prevalence of dental caries affecting 60% to 90% of school-aged children and a majority of adults. Major players like Colgate-Palmolive and 3M Company have capitalized on this demand by launching high dental fluoride toothpaste products, such as Colgate PreviDent 5000 Booster Plus, which contains the highest fluoride content available in any toothpaste or mouthwash. This segment's growth is further supported by increasing awareness and adoption of such products, highlighting the market's competitive landscape and the strategic efforts of key players to innovate and meet the evolving needs of consumers.

The varnish segment is showing lucrative growth due to its effectiveness in preventing tooth decay, offering a highly concentrated fluoride product applied topically by dental professionals. Fluoride varnish's ability to strengthen tooth enamel and reduce the risk of acid erosion makes it an ideal solution for patients with moderate-to-high caries levels. The segment has seen a surge in product launches, with companies introducing new flavors and formulations to cater to consumer demand, such as BISCO's FluoroCal 5% Sodium Fluoride Varnish with Tri-Calcium Phosphate. In addition, fluoride varnish's affordability and ease of use, particularly for children, have contributed to its popularity as an anticavity treatment. Major players like Colgate-Palmolive, Dentsply Sirona, and Young Innovations, Inc., have recognized the segment's potential, launching products designed for in-office application to provide a concentrated dose of fluoride, addressing specific oral health issues and enhancing tooth resistance to acid dissolution. This innovative approach to fluoride application, combined with the segment's focus on innovation and meeting the diverse needs of consumers, positions the varnish segment for significant growth in the coming years.

Regional Insights

North America held the largest revenue share of 35.10% in 2023 due to the rising awareness of dental hygiene and the escalating prevalence of dental caries. A study by BioMin Technologies Limited in January 2022 highlighted the superior effectiveness of fluoride-based toothpaste in preventing tooth decay compared to ordinary toothpaste. BioMin F, featuring patented bioactive technology incorporating calcium, phosphate, and fluoride, exemplifies the innovative approach to combating tooth decay. The growing emphasis on dental hygiene and the increasing incidence of dental caries is anticipated to bolster the demand for toothpaste, thereby propelling the growth of this sector. In response to the burgeoning demand for eco-friendly oral healthcare products, several companies have introduced oral care solutions that align with environmental consciousness, such as Alacer Corp.'s Natean brand, launched in March 2022. In addition, the trend of increasing dental visits, with 63% of adults aged 18 and over visiting a dentist within the past year, is expected to drive the demand for oral care products further to maintain oral hygiene, fueling market growth. The U.S. market is poised for continued expansion, influenced by increasing dental hygiene awareness, the rising prevalence of dental caries, the launch of new eco-conscious oral healthcare products, and the proven benefits of fluoride-based toothpaste.

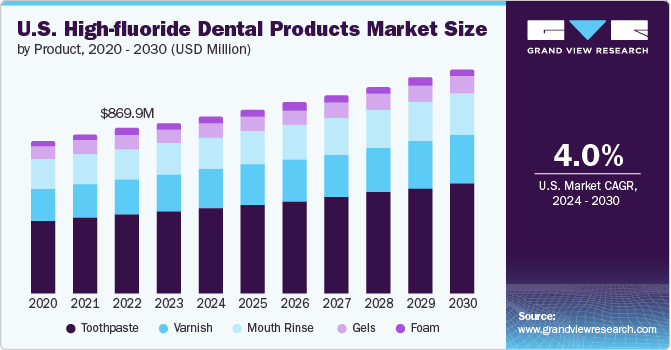

U.S. High-fluoride Dental Products Market Trends

The high-fluoride dental products market in the U.S. dominated the North American market with a revenue share of 88.95% in 2023 due to several factors: increasing awareness of the importance of oral health, advancements in fluoride technology, and efforts of manufacturers & healthcare providers to promote dental hygiene. Several key players in the dental high fluoride treatment market have been investing in R&D to improve the effectiveness of their products. For instance, Colgate-Palmolive, a major brand in the dental care market, has introduced a line of high-fluoride content mouth rinses and gels. These products are formulated to provide a concentrated dose of fluoride, helping strengthen tooth enamel and reduce the risk of tooth decay.

Europe High-fluoride Dental Products Market Trends

The high-fluoride dental products market in Europe is a second dominating region due to increasing awareness of oral health and the importance of preventive dental care. As more people become educated about the benefits of fluoride treatments, the demand for these products is expected to rise. In addition, advancements in fluoride technology have led to the development of more effective and efficient dental fluoride treatments, further fueling market growth.

Germany high-fluoride dental products market dominated the region with the highest revenue share in 2023 due to increasing awareness of oral health, advancements in fluoride technology, and regulatory initiatives aimed at promoting dental hygiene. According to a report by the German Dental Association, nearly 70% of the population visits a dental professional annually, indicating a strong emphasis on preventive dental care. The low cost of manufacturing combined with ease of use is one factor contributing to the growth of this market segment. In addition, growing awareness about dental hygiene and the rising prevalence of dental caries is expected to further propel the demand for dental high-fluoride products.

The high-fluoride dental products market in the UK held the second-largest market share in 2023. The market is driven by increasing concern about tooth decay among youngsters. According to a public health report in the UK, 23% of 5-year-olds have experienced dental decay, with 14% coming from wealthier communities. This issue has led to hospitals performing nearly 180 procedures per day to remove decayed teeth, costing the NHS over USD 43.4 million.

Asia Pacific High-fluoride Dental Products Market Trends

The high-fluoride dental products market in Asia Pacific is expected to witness the highest CAGR of 4.9% during the forecast period. The demand for fluoride treatments is surging in regions like India, China, and Australia, driven by increasing awareness about oral health and the rising prevalence of dental caries. These countries, with their large populations and growing middle class, are investing heavily in dental care, making preventive measures like fluoride treatments a priority. The WHO emphasizes fluoride's critical role in preventing tooth decay, leading to increased efforts across the Asia Pacific to integrate fluoride treatments into routine dental care. Governments, such as India's, are promoting fluoride treatments as part of national oral health programs, while China is encouraging the use of fluoride-containing products to combat dental caries. With high rates of dental caries and low adherence to recommended oral hygiene practices, there's a significant opportunity to improve dental health outcomes through education and access to fluoride treatments.

China high-fluoride dental products market held the largest revenue market share in 2023. This growth is due to the increasing awareness about dental hygiene and the rising prevalence of dental caries among children. China is one of the most technologically advanced countries in the world, which significantly contributes to the development of its healthcare industry. The country has a large, middle-income group that is increasingly seeking innovative and cost-effective high-fluoride dental products, attracting major players to the market. According to a study published in the International Dental Journal in 2021, the prevalence of dental caries in deciduous teeth among children aged 3 to 5 was 59.6%, while among children aged 12 to 15, the prevalence of dental caries was 34.9%. This increasing prevalence of dental caries among children is expected to drive demand for high-fluoride dental products in the country. Furthermore, the rise in the geriatric population is expected to contribute to market growth, as older adults are more prone to dental issues.

The high-fluoride dental products market in Japan held the second largest market share in the Asia Pacific region. This is due to the growing medical tourism, particularly from China, and the increasing local prevalence of dental caries. Medical tourism is a significant contributor to the market, as patients from neighboring countries seek Japan's high-quality dental care at a lower cost than in their home countries.

India high-fluoride dental products market is anticipated to witness significant CAGR of 5.6% during the forecast period. This is due to the increasing awareness about oral health and the high prevalence of dental caries. According to the Indian Dental Association, a significant portion of the population suffers from dental caries, making it a pressing public health concern. The government's initiatives, such as the National Oral Health Programme, aim to reduce dental caries incidence. Despite these efforts, oral health remains underprioritized, with high caries prevalence among children and adults. However, the market is expected to expand due to major initiatives and the rising prevalence of dental disorders. Challenges such as accessibility and affordability are addressed by the growing number of dental clinics and the increasing number of dentists, enhancing patient access to quality care. This, combined with rising oral health awareness and the high prevalence of dental caries, is expected to drive the market in India.

Latin America High-fluoride Dental Products Market Trends

The high-fluoride dental products market in Latin America is expected to witness lucrative growth during the forecast period. This is due to the increasing awareness of dental hygiene and the rising prevalence of dental caries in the region. Brazil, Mexico, and Argentina are the major markets in the region, with a large population and a high prevalence of dental diseases. According to a report by the WHO, dental caries is one of the most common oral health problems in Latin America, affecting people of all ages The increasing demand for cosmetic dentistry procedures also drives the market in Latin America.

Brazil high-fluoride dental products market is expected to grow due to significant population size, including a growing geriatric population, and the government's commitment to oral healthcare. Initiatives like the National Oral Health Policy-Brazil Smiling (Brasil Sorridente) aim to promote oral health and prevent dental diseases. A survey indicates high dental care awareness among adolescents, with nearly 84.9% reporting recent dentist visits. The stable regulatory system, growing demand for dental high fluoride treatments, and government-led initiatives to promote oral health awareness, especially among socially disadvantaged groups, contribute to Brazil's dominance in the market. The National Health Surveillance Agency (ANVISA) ensures the safety and efficacy of dental products, providing a stable regulatory environment that supports market growth.

MEA High-fluoride Dental Procedures Market Trends

The high-fluoride dental products market in MEA is expected to grow lucratively due to the advanced healthcare infrastructure and strong government-funded social security schemes, which are expected to drive the dental high-fluoride treatment market. The National Transformation Program of Dubai, aimed at fully privatizing healthcare facilities, is expected to improve the quality of healthcare further and drive market growth.

South Africa high-fluoride dental products market held the largest revenue market share during 2023. This is due to critical public health concerns of dental caries, particularly among children, with a prevalence rate of 44.94%, according to a 2022 review. This high rate of dental caries can lead to significant impacts on children's health and academic performance, emphasizing the need for effective interventions. The South African government's efforts to improve access to dental care services, including the establishment of oral health clinics and mobile dental units in rural areas, alongside the high prevalence of dental caries, are driving the growth of the market. In addition, the availability of dental fluoride treatments in both public and private settings, contributing to broader dental care packages, is increasing awareness and demand for these services, further fuelling market growth.

Key High-fluoride Dental Products Company Insights

The market is experiencing substantial expansion, propelled by key companies broadening their product lines and incorporating cutting-edge technologies to secure a larger market presence and engage a broader audience. In January 2022, Colgate-Palmolive Company partnered with 3Shape to launch the Colgate Illuminator teeth whitening tool for dental clinics across the U.S. This product aims to deliver a personalized tooth whitening experience with the help of the 3Shape Unite Platform.

Key High-fluoride Dental Products Companies:

The following are the leading companies in the high-fluoride dental products market. These companies collectively hold the largest market share and dictate industry trends.

- Colgate-Palmolive Company

- Koninklijke Philips N.V.

- Dentsply Sirona

- VOCO

- DÜRRDENTAL

- Young Dental

- Ivoclar Vivadent

- Ultradent Products, Inc.

- DMG Dental

- Church & Dwight Co., Inc.

Recent Developments

-

In March 2023, Colgate launched Colgate Total Plaque Pro-Release, a toothpaste that effectively reduces harmful plaque bacteria, leading to two times less gum-damaging plaque than regular fluoride toothpaste when used daily. This new product offers an enhanced plaque-fighting formula, promoting better gum health and overall oral hygiene.

-

In April 2022, Ultradent strengthened its presence in Latin America by acquiring a majority stake in Vamasa SA de CV, a leading distributor of dental products in Mexico. This strategic acquisition would enable Ultradent to enhance its distribution network, deepen market penetration, and deliver high-quality dental solutions to a broader customer base in the region.

-

In January 2022, Colgate-Palmolive Company partnered with 3Shape to launch the Colgate Illuminator teeth whitening tool for dental clinics across the U.S. This product is aimed to deliver a personalized tooth whitening experience with the help of the 3Shape Unite Platform.

-

In October 2021, Ultradent has expanded its Enamelast fluoride varnish line with the launch of a flavor-free version designed for patients who wish to avoid lingering tastes or have allergies to certain flavorings. The new varnish retains the original Enamelast formula's advantages, offering improved retention and superior fluoride release & uptake, contributing to optimal dental health.

High-fluoride Dental Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.00 billion

Revenue forecast in 2030

USD 3.85 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Colgate-Palmolive Company; Koninklijke Philips N.V.; Dentsply Sirona; VOCO; DÜRRDENTAL; Young Dental; Ivoclar Vivadent; Ultradent Products, Inc.; DMG Dental; Church & Dwight Co., Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High-fluoride Dental Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global high-fluoride dental products market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Toothpaste

-

Varnish

-

Mouth Rinse

-

Gels

-

Foam

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global high-fluoride dental products market size was estimated at USD 2.89 billion in 2023 and is expected to reach USD 3.00 billion in 2024.

b. The global high-fluoride dental products market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 3.85 billion by 2030.

b. North America dominated the high-fluoride dental products market with a share of 35.1% in 2023. This is attributable to the high adoption rate of advanced dental care products and the increased awareness of preventive dental care. Moreover, presence of key manufacturers in the region have contributed to the growth of the market

b. Some of the players operating in this market are Colgate-Palmolive Company; Koninklijke Philips N.V.; Dentsply Sirona; VOCO; DÜRRDENTAL; Young Dental; Ivoclar Vivadent; Ultradent Products, Inc.; DMG Dental; and Church & Dwight Co., Inc.

b. Key factors that are driving the high-fluoride dental products market growth include the increasing dental caries rates, heightened oral health awareness, government initiatives to improve access to oral care, and technological advancements, such as the development of innovative fluoride products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."