- Home

- »

- Medical Devices

- »

-

Dental Crowns & Bridges Market Size & Share Report, 2030GVR Report cover

![Dental Crowns And Bridges Market Size, Share & Trends Report]()

Dental Crowns And Bridges Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Titanium, Zirconium), By Price (Premium, Value, Discounted), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-944-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Crowns And Bridges Market Trends

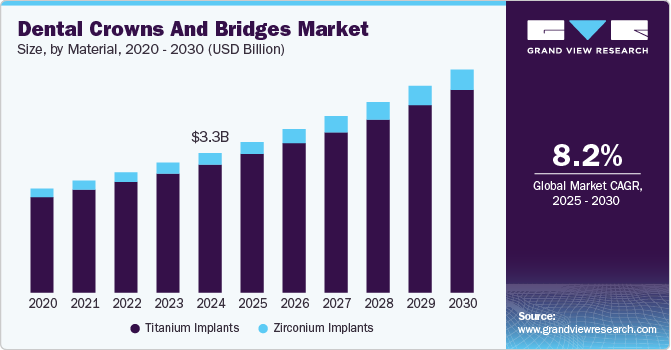

The global dental crowns and bridges market size was valued at USD 3.32 billion in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. This growth is driven by the increasing prevalence of dental issues such as tooth decay and periodontal diseases, necessitating restorative treatments like crowns and bridges. Additionally, the rising awareness about oral health and the importance of maintaining dental aesthetics encourage more people to seek these treatments. Technological advancements, including the adoption of CAD/CAM systems and improved materials like ceramic and zirconia, are enhancing the quality and efficiency of dental restorations.

The increasing prevalence of dental diseases and a growing geriatric population, both more susceptible to dental issues, contribute substantially to the rising demand for restorative solutions like crowns and bridges. Furthermore, the increasing aesthetic awareness among consumers is pushing the demand for cosmetic dentistry, as patients seek improved smiles and enhanced oral aesthetics. Additionally, the expanding dental tourism industry in regions like Asia Pacific, coupled with rising disposable incomes and an increase in dental clinics, further supports market growth by making dental services more accessible and affordable.

Material Insights

The titanium implants segment accounted for the largest share of 91.6% in 2024 attributed to titanium’s exceptional biocompatibility, strength, and resistance to corrosion, making it an ideal material for dental implants. Titanium implants have a long history of clinical success, leading to widespread acceptance among dental professionals. Their ability to integrate well with bone tissue through osseointegration enhances their stability and ensures longevity at various dental prices. Furthermore, the advancements in implant design and surface treatments have further improved the performance of titanium implants, solidifying their status as the material of choice for practitioners and patients.

The zirconium implants segment is expected to grow at a CAGR of 9.8% from 2025 to 2030 due to the rising preference for aesthetically pleasing dental solutions. Zirconium, known for its tooth-like appearance and translucency, offers a more natural look than traditional metal implants, making it particularly appealing to patients seeking cosmetic enhancements. Additionally, zirconium is highly biocompatible and exhibits excellent resistance to wear and fracture, addressing some of the common concerns associated with dental restorations. As awareness about the advantages of zirconium implants grows, alongside a shift towards minimally invasive procedures, the market is likely to see increased adoption of these implants.

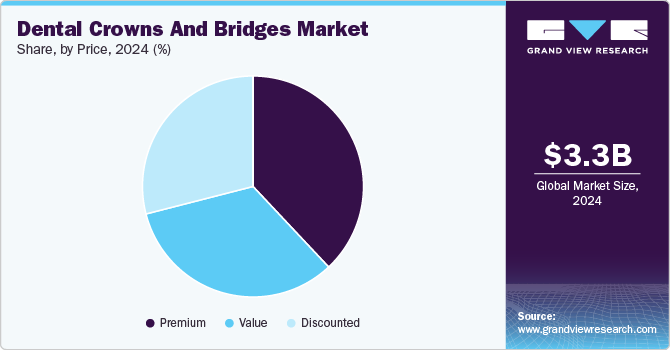

Price Insights

The premium segment dominated the global dental crowns and bridges market in 2024. Premium dental crowns and bridges typically utilize high-quality materials, such as porcelain-fused-to-metal or advanced ceramics, which enhance the aesthetic appeal and improve durability and functionality. Dental professionals often prefer these premium options for their patients, as they offer superior fit, strength, and a more natural appearance, which is crucial in visible areas of the mouth. Furthermore, the increasing awareness among consumers regarding oral health and aesthetics has led to a willingness to invest in high-quality dental solutions. As more patients seek personalized and aesthetically pleasing dental solutions, the premium segment is expected to thrive.

The value segment is projected to grow the fastest over the forecast period. This segment appeals to a broader demographic, including cost-sensitive patients who require effective dental solutions without the premium price tag. The growing middle-class population, particularly in emerging economies, drives demand for more affordable dental options. Value dental crowns and bridges often utilize cost-effective materials and simpler manufacturing processes, making them accessible to a wider range of patients. As healthcare systems evolve and dental insurance coverage expands, the affordability and availability of value segment products are expected to attract more consumers seeking necessary dental care.

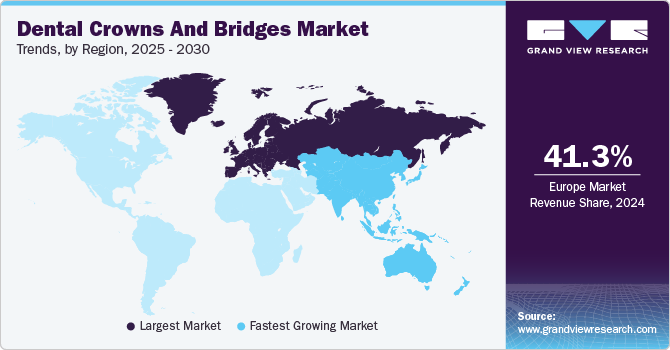

Regional Insights

North America dental crowns and bridges market accounted for a 28.8% revenue share of the global market in 2024. This prominence is largely driven by the region's sophisticated healthcare frameworks, elevated rates of dental procedure adoption, and a growing geriatric demographic that necessitates restorative dental interventions. The U.S. and Canada are the primary contributors to this market, strongly emphasizing cosmetic and preventive dentistry.

U.S. Dental Crowns And Bridges Market Trends

The U.S. dominated the North American dental crowns and bridges market in 2024. The high prevalence of oral health issues and the growing demand for cosmetic dentistry have driven the market's expansion. The U.S. market has seen a surge in adopting digital dentistry technologies, which offer precision and efficiency in dental restorations. Additionally, the aging population in the U.S. has contributed to the increased need for dental crowns and bridges, as older adults are more susceptible to dental diseases and tooth loss.

Europe Dental Crowns And Bridges Market Trends

Europe dental crowns and bridges market dominated the global market in 2024. The region's strong healthcare systems, high standards of dental care, and growing awareness of oral health have fueled the market's growth. European countries have been at the forefront of adopting advanced dental technologies, including CAD/CAM systems and digital imaging, which have enhanced the quality and efficiency of dental restorations. The increasing demand for aesthetic dental treatments and the rising geriatric population have also played a crucial role in driving the market in Europe.

Asia Pacific Dental Crowns And Bridges Market Trends

Asia Pacific dental crowns and bridges market is anticipated to grow fastest throughout the forecast period. The region's rapidly developing healthcare infrastructure, increasing disposable incomes, and rising awareness of oral health contribute to this growth. Countries like India and China are witnessing a surge in dental tourism, attracting patients worldwide for affordable and high-quality dental treatments1. The adoption of advanced technologies and the expansion of dental clinics and laboratories are expected to further boost the Asia Pacific market.

Key Dental Crowns And Bridges Company Insights

Some of the key companies in the dental crowns and bridges market include Dentsply, Nobel Biocare, Straumann Group, Zimmer Biomet, Danaher, Dentium Co., and others.

-

Dentsply Sirona is a prominent player in the dental crowns and bridges market, known for its comprehensive range of dental products and solutions. The company offers a variety of materials, including ceramics, porcelain-fused-to-metal (PFM), and zirconium, catering to different patient needs and preferences.

-

Straumann Group offers an extensive portfolio, including premium and non-premium implant systems and CAD/CAM prosthetics.

Key Dental Crowns And Bridges Companies:

The following are the leading companies in the dental crowns and bridges market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply

- Nobel Biocare

- Straumann Group

- Zimmer Biomet

- Danaher

- Dentium Co.

- Henry Schein

- 3M

- Osstem Implant

- BioHorizons

Recent Developments

-

In August 2024, Formlabs Dental secured FDA 510(k) Medical Device Clearance for its Premium Teeth Resin. This clearance enabled U.S. dental professionals to utilize 3D printing technology to fabricate a range of temporary dental restorations, including single-unit crowns, inlays, onlays, veneers, and up to seven-unit bridges. This versatile material solution streamlines the production process and expands the scope of applications for users in the United States, following similar EU clearances for these applications.

-

In July 2024, Stratasys unveiled the DentaJet XL, a state-of-the-art 3D printing solution designed to enhance operational efficiency in dental laboratories. This high-throughput system features enlarged resin cartridges and an expansive build platform, enabling simultaneous production of multiple dental components. Its super high-speed mode significantly reduces print cycles and minimizes post-processing time, optimizing workflows for precision dental applications such as crowns, bridges, implants, clear aligners, and surgical guides. With this advanced technology, dental professionals can achieve superior quality and faster turnaround times in model production.

Dental Crowns And Bridges Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.58 billion

Revenue forecast in 2030

USD 5.29 billion

Growth Rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, price, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; China; Japan; India; Thailand; South Korea; Australia; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Dentsply; Nobel Biocare; Straumann Group; Zimmer Biomet; Danaher; Dentium Co.; Henry Schein; 3M; Osstem Implant; BioHorizons

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

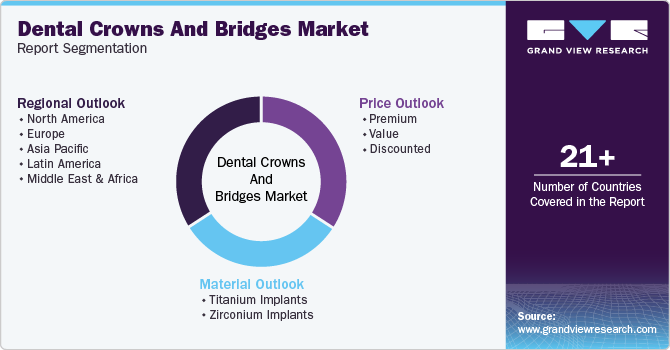

Global Dental Crowns And Bridges Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental crowns and bridges market report based on material, price, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Titanium Implants

-

Zirconium Implants

-

-

Price Outlook (Revenue, USD Million, 2018 - 2030)

-

Premium

-

Value

-

Discounted

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental crowns and bridges market size was estimated at USD 2.3 billion in 2019 and is expected to reach USD 2.5 billion in 2020.

b. The global dental crowns and bridges market is expected to grow at a compound annual growth rate of 7.8% from 2019 to 2026 to reach USD 3.8 billion by 2026.

b. Titanium segment dominated the dental crowns and bridges market with a share of 92.3% in 2019. This is attributable to ttractive features of the material, such as unmatched corrosion resistance, biocompatibility, great mechanical resistance, and high success rates.

b. Some key players operating in the dental crowns and bridges market include Dentsply, Nobel Biocare, Straumann Group, Zimmer Biomet, Danaher, Dentium Co., Henry Schein, 3M, Osstem Implant, and BioHorizons.

b. Key factors that are driving the market growth include rising prevalence of dental disorders, high demand for cosmetic dentistry, and growing dental medical tourism

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.