Dental Consumables Market Size, Share & Trends Analysis Report By Product, By Specialty (General, Pediatric, Endodontics, Oral Surgery), By End-use (Hospitals, Dental Clinics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-004-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Dental Consumables Market Size & Trends

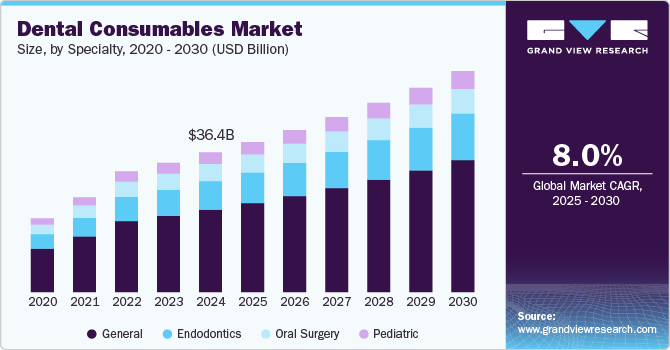

The global dental consumables market size was estimated at USD 36.4 billion in 2024 and is projected to grow at a CAGR of 8.0% from 2025 to 2030. The rising prevalence of dental diseases is one of the factors boosting market growth. According to the WHO article published in March 2023, approximately 2 billion people globally experience cavities in their permanent teeth, while around 514 million children are affected by cavities in their primary teeth. This widespread occurrence of dental caries significantly drives the demand for dental treatments, increasing the need for consumables such as fillings, crowns, and other materials, fueling market growth.

The rising incidence of dental decay is a key factor driving the demand for dental consumables, which are essential in restorative and preventive dental procedures. For instance, according to a data published by CDC in May 2024, over 50% of children between the ages of 6 and 8 have at least one cavity in their primary teeth, a trend that persists into adolescence, with a similar percentage of 12 to 19-year-olds experiencing cavities in their permanent teeth.

Moreover, the increasing prevalence rate is contributing to the unnecessary economic burden on the governments of developed and developing regions. For instance, In 2021, approximately USD 550 million was allocated to emergency room and admission expenses in Florida hospitals for dental conditions that could have been prevented. Similarly, the U.S. experiences a loss of approximately USD 45 billion in work productivity due to untreated oral diseases annually. In addition, emergency dental care results in the loss of 92.4 million work or school hours each year. This is encouraging governments of developing and developed countries to launch initiatives to enhance the adoption of technologically advanced dental care devices such as dental consumables.

U.S. Dental Expenditures, 2022 in (USD Billion)

|

Year |

Expenditure |

|

2020 |

156 |

|

2021 |

176 |

|

2022 |

165 |

Technological advancements drive market growth. For instance, In February 2024, ZimVie Inc., a key player in life sciences within the spine and dental sectors, introduced the TSX Implant in Japan. The TSX Implants are specifically designed to facilitate standard loading protocols and immediate extraction, providing improved placement predictability and strong primary stability in both soft and dense bone types. Built upon more than two decades of clinical experience, these implants are crafted to support peri-implant health, preserve crestal bone, ensure lasting osseointegration, and deliver stable prosthetic outcomes.

In July 2024, BioHorizons recently introduced the Tapered Pro Conical implants, marking the company's first dental implant line with a deep conical connection. These new implants build on the macro design of the Tapered Pro series and incorporate the patented CONELONG connection, designed to streamline surgical procedures. They are particularly suited for immediate implant cases, including single-tooth replacements and full arch restorations.

Number of Dentist in U.S.

|

Year |

Total Number of Dentists |

Dentists per 100,000 Population |

|

2023 |

202,304 |

60.4 |

|

2022 |

202,536 |

60.8 |

|

2021 |

201,927 |

60.8 |

|

2020 |

201,117 |

60.7 |

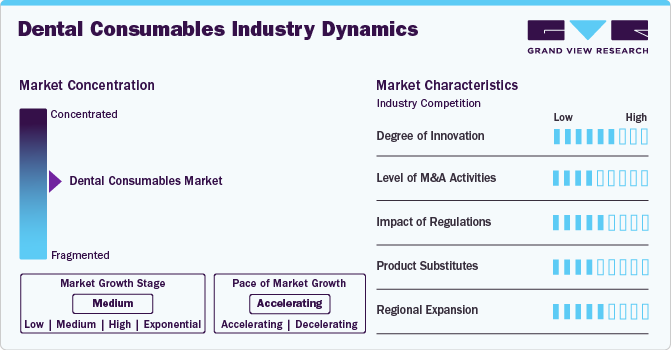

Market Concentration & Characteristics

The market is witnessing high innovation, with companies introducing advanced materials, bioactive compounds, and digital integration in dental products. These innovations improve consumables' durability, aesthetic appeal, and performance like fillings, crowns, and adhesives. In addition, digital tools such as CAD/CAM systems streamline the design and production of dental restorations, offering greater precision and patient satisfaction.

Several market players, such as Dentsply Sirona, Straumann Holding, Henry Schein, Inc., and Patterson Companies, Inc., are involved in merger and acquisition activities. Through M&A activity, these companies employ vital strategies such as product type innovation, strategic collaborations, and geographical expansion to enhance their presence and address the growing demand for dental consumables.

Regulations significantly impact the market by enforcing safety, quality, and efficacy standards. While strict regulatory protocols may slow down the approval process for new products, potentially delaying market entry and innovation, they also foster patient trust and product dependability. These regulations help ensure that only high-quality, safe consumables reach dental practices, supporting market growth by emphasizing patient safety and product reliability.

There are currently no direct substitutes. Their role in dental care is essential, providing the materials for restorative, preventive, and cosmetic treatments. These products are crucial in ensuring effective dental procedures and maintaining oral health.

Key players in the market are expanding their reach by entering new geographical regions, forging strategic alliances with local distributors, and customizing their product offerings to meet the unique healthcare needs of different regions. This approach enables them to cater to local demands more effectively and enhances their global market presence.

Product Insights

The dental implants segment led the market with the largest revenue share of 17.5% in 2024, due to the increasing prevalence of dental diseases, growing initiatives by critical companies, and increasing adoption. Dental implants are medical devices designed to replace missing tooth roots by being surgically embedded into the jawbone. Made from biocompatible materials like titanium, they provide a sturdy foundation for attaching artificial teeth, such as crowns or bridges. These implants mimic the function and structure of natural tooth roots, offering a permanent and stable solution for tooth replacement, enhancing both functionality and appearance. For instance, in June 2022, ZimVie Inc. announced the release of the FDA-approved T3 PRO Tapered Implant in the U.S. This new implant expands upon ZimVie’s existing line of dental implants, further advancing the success of the T3 Tapered Implant.

The CAD/CAM devices segment is anticipated to grow at a lucrative CAGR during the forecast period. An increase in technological innovations is one of the major factors expected to drive the growth of the CAD/CAM devices segment over the forecast period. Recent advancements have led to the development of more efficient devices with enhanced functionality. In January 2024, exocad unveiled DentalCAD 3.2 Elefsina, the newest iteration of its highly regarded CAD software designed for dental labs and full-service clinics. This version introduces over 60 new features tailored to meet customer needs, enhancing workflows from treatment planning through design and manufacturing processes.

Specialty Insights

Based on specialty, the general segment led the market with the largest revenue share of 59.1% in 2024. General dentistry plays a vital role in educating patients about oral hygiene practices. They guide brushing, flossing, and dietary choices, promoting oral health. In addition, they manage chronic conditions that may affect oral health, such as diabetes or cardiovascular diseases. Technological advancements drive the growth of the market. In March 2024, Desktop Health, the 3D printing division of Desktop Metal, introduced ScanUp, a new initiative to assist dentists in streamlining the adoption of digital dentistry technologies. This program is designed to enhance practice efficiency and elevate patient care.

The oral surgery segment is projected to grow at the fastest CAGR during the forecast period. The rising demand for specific oral surgical procedures is fueled by a heightened awareness of oral health. As people increasingly recognize the significance of maintaining proper oral hygiene and addressing dental problems on time, the need for oral surgery has grown. This includes procedures for managing complex dental conditions, such as extractions, implant placements, and corrective jaw surgeries. According to the Cleveland Clinic article published in June 2024,

A root canal is a procedure used to treat diseases inside the tooth's tissue, which is the deepest layer of the tooth. Every year, endodontists and dentists in the U.S. perform approximately 15 million root canal treatments.Thus, this factor contributes to the growth of the segment.

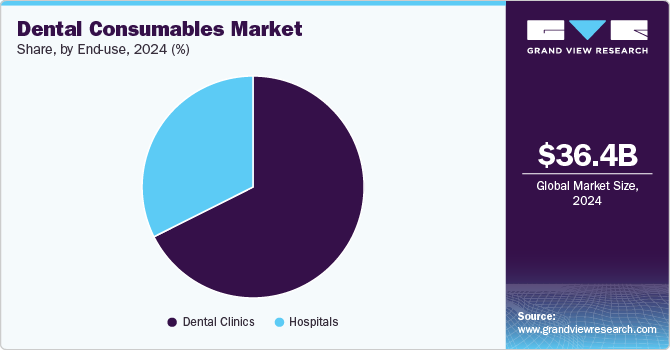

End-use Insights

Based on end use, the dental clinics segment led the market with largest revenue share at 67.6% in 2024. The increasing prevalence of dental disorders such as tooth decay, gum disease, and tooth loss drives demand for restorative treatments, including fillings, crowns, and implants. Moreover, the surge in funding and investments in dental care infrastructure, especially in emerging economies, has enabled clinics to adopt advanced techniques. For instance, in 2023, the Wisconsin Department of Health Services (DHS) allocated USD 5.1 million in grants to 14 safety net dental clinics not federally qualified health centers to improve access to dental care nationwide. The total grant funding is USD 1.7 million annually, with individual clinic awards ranging from USD 59,000 to USD 150,000 over three years.

The hospitals segment is expected to grow at a significant CAGR during the forecast period, due to several key factors. The rising incidence of dental diseases globally necessitates advanced solutions within hospitals to manage patient care effectively. Hospitals are often equipped with advanced technology and skilled professionals who can provide comprehensive care, making them the preferred choice for patients seeking dental consumables. Moreover, emergency hospital visits for avoidable oral health issues have surged significantly over the past years, with most of these visits occurring among young adults and low-income individuals. For instance, according to the American Dental Association, there are around 2 million hospital emergency department visits in the U.S. In addition, the growing emphasis on patient safety and comfort during dental procedures is influencing the operational strategies of dental hospitals. With a focus on minimizing patient anxiety and ensuring successful outcomes, hospitals are investing in high-quality dental consumables that offer better results and usability. Furthermore, many dental hospitals now offer a range of services, including periodontics and orthodontics, allowing for coordinated treatment plans that address various aspects of oral health.

Regional Insights

North America dental consumables market dominated the market with the largest revenue share of 47.54% in 2024, owing to an increased prevalence of dental diseases and the rising demand for dental procedures among the aging population. As per dental statistics by the Centers for Disease and Prevention (CDC) in October 2024, around 10% of adolescents, 12 to 19 years of age, possess at least one untreated cavity in their permanent teeth, whereas nearly 20% of adults 20 to 64 aged have at least single unprocessed cavity as well. The occurrence of untreated cavities is often more pronounced in specific demographic groups, influenced by factors such as race and ethnicity, income levels, and smoking behaviors.

U.S. Dental Consumables Market Trends

The U.S. dental consumables market accounted for the largest market share of North America in 2024. A shift towards preventive care and early intervention strategies among dental professionals contributes to the country's market growth. Moreover, increased awareness regarding oral health and its connection to overall health has led patients to seek regular dental check-ups and treatments. According to the CDC article published in April 2024, around 63.7% of the U.S. population aged 65 years and above had dental visits in the past year. Integrating digital diagnostics and treatment planning tools has further streamlined dental practice processes.

Europe Dental Consumables Market Trends

The Europe dental consumables market led the second-largest revenue market share in 2024. The industry is driven by favorable government initiatives, easy financing for researchers to develop breakthrough dental technologies such as dental lasers to reduce complications of complex surgeries, and others. Furthermore, the market is expected to grow due to the rising use of modern dental technologies that are cost-effective, time-saving, and have fewer health risks. Furthermore, major regional players will likely promote market expansion via technological breakthroughs. For instance, in August 2021, Botiss Biomaterials GmbH received CE approval for the dental magnesium biomaterial NOVAMag. The product will enhance the capabilities of bioresorbability, enabling the replacement over time with natural bone.

The Germany dental consumables market dominated with the largest revenue share of 25.6% in 2024. The rising number of dental diseases and technological advancements fuel the market's growth. Moreover, key regional players focus on product launches and regional market expansion. For instance, in January 2023, Kettenbach Dental launched Futar Easy in the U.S. as an expansionary strategy. The product was released in September 2022 for European patients.

The dental consumables market in UK held the second-largest market share in Europe in 2024. The rise in dental carriages highlights the need for continued innovation and advancements in healthcare technology to reduce this trend effectively. As more patients seek dental care and awareness of oral health grows, the demand for effective endodontic solutions is rising. For instance, in July 2024, Between January and March 2024, 2.56 million adults participated in the GP Patient Survey, sharing their perspectives on NHS dentistry. Advances in technology, such as the development of high-precision instruments and improved imaging techniques, enhance treatment outcomes and patient comfort, further propelling market growth.

The France dental consumables market is anticipated to witness at a significant CAGR of 9.0% during the forecast period. The increasing awareness about oral health and aesthetics in the French population and the rising initiatives by the government and various organizations to increase access to dental care to a wider population base. According to the French Dental Organization report, in July 2023, professional associations and various insurance schemes in the country signed a 5-year agreement with a focus on various areas such as investment in preventive and conservative care with a focus on the age group of 3 to 24 to create first "cavity-free generation," creating specific oral checkups on entry in elderly people's home, 100% cover for consecutive treatments along with annual dental checkups for children aged between 3 to 18 years, and reimbursement for various other procedures.

Asia Pacific Dental Consumables Market Trends

The dental consumables market in the Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. The growing number of dental care centers, rising dental tourism, increasing R&D activities, and growing awareness about dental care. In developing economies, including India, there is limited or no access to oral health services, leading to a high incidence of dental diseases. According to DCI figures, in April 2024, India hosts 323 colleges offering Bachelor of Dental Surgery degrees and 279 providing Master of Dental Surgery degrees. In addition, nine institutions offer postgraduate diplomas in various dental specialties, including dental consumables. Furthermore, 111 colleges focus on dental hygiene and mechanics.

The China dental consumables market accounted for the second largest share in Asia Pacific in 2024. China's increasing awareness of oral health and a growing middle class seeking advanced dental treatments. As urbanization progresses, more individuals access dental care services, leading to a higher demand for dental consumables procedures. For instance, in March 2024, the Hong Kong Dental Association (HKDA) launched a series of activities to promote oral health in conjunction with World Oral Health Day. As part of these efforts, HK Oral Health Week takes place from May 9 to 14, 2024, during which local dentists provide free oral check-ups and consultations to the public. This initiative, supported by prominent dental organizations, aims to raise public awareness of primary oral healthcare and aligns with the HKSAR Government's commitment to primary health and FDI Vision 2030.

The dental consumables market in Japan held the largest market share in Asia Pacific in 2024. The growing emphasis on dental aesthetics and the rising awareness about the importance of maintaining oral health encourage more individuals to seek dental consumables treatments, further bolstering market growth. For instance, in June 2024, Fujitsu Japan Limited and Kamoenai Village in Hokkaido launched an initiative to enhance dental care awareness. On June 27th and 28th, 2024, they will conduct oral checkups for around 40 students, utilizing Fujitsu's Preventive Dentistry Cloud Service to support a proactive dental health approach. This service detects the risk of tooth decay, enabling students and their guardians to track results on their smartphones and encouraging personal oral health awareness. Furthermore, the Japanese dental industry's commitment to high standards of care and the integration of digital dentistry are enhancing the precision and success rates of dental consumables procedures.

The India dental consumables market is experiencing significant growth. The surge in dental disorders and growing awareness about oral hygiene primarily drive the need for advanced dental consumables treatments. With its increasing disposable income, India's burgeoning middle class is more inclined to invest in healthcare, including elective dental procedures. The rise in dental tourism further supports this demographic shift. According to a Medical Buyer article published in July 2024, medical tourism in India is expected to reach approximately 7.3 million visitors in 2024, up from 6.1 million in 2023. Ranked 10th among 46 countries on the Medical Tourism Index for 2021-22, India is already the second-largest medical tourism hub in Asia. This growth presents a significant opportunity for expanding the market as more international patients seek dental care. Consequently, these dynamics foster a conducive environment for the proliferation of dental consumables.

Latin America Dental Consumables Market Trends

The dental consumables market in Latin America is growing and is primarily driven by the increasing prevalence of dental diseases and a growing dental health awareness among the population. For instance, in November 2023, as per a study on Global excellence in dental medicine: South America, 18,172 scientific articles in Dentistry were published globally. Brazil contributed the highest number at 1,698 followed closely by the U.S. with 1,682. Of these, 2,321 articles originated from Latin America, with Brazil representing 73.15% of this output across 23 countries. Regarding the H-index, Brazil ranks 3rd among the top 50 countries in Dentistry with an H-index of 158. Other South American nations include Chile at 35th (H-index 56), Colombia at 39th (H-index 48), and Argentina at 44th (H-index 42). The U.S. leads with an H-index of 255, followed by the UK at 182.

The Brazil dental consumables market is expanding due to several distinct growth drivers. The growing awareness among Brazilians regarding oral hygiene and dental health has increased dental visits and endodontic procedures. Brazil has been incorporating AI technologies in dental practices to reduce patient-provider disputes and increase the process efficiency. For instance, in June 2022, Pearl launched Second Opinion, a clinical chairside AI software that assists dentists in identifying different dental conditions, such as tooth decay and root abscesses. Integrating novel technologies can improve dental diagnostic capabilities, enhancing the patient’s dental treatment procedures.

Middle East & Africa Dental Consumables Market Trends

The dental consumables market in Middle East & Africa is expected to grow at a lucrative CAGR during the forecast period, due to the rising dental diseases and the increasing adoption of advanced medical technologies in the region. Furthermore, key collaborations by regional market players will aid market growth. For instance, in May 2022, AB Dental and Trucare collaborated to launch AB Dental in the UAE. AB Dental provides manufacturing and marketing capabilities for dental products such as implants, dentures, and other prosthetics.

The Saudi Arabia dental consumables market is anticipated to grow at a CAGR of 7.4% over the forecast period. The Saudi government's supportive policies towards healthcare infrastructure, including substantial investments in the latest dental technologies and facilities, have created a conducive market expansion environment. For instance, in May 2024, the Saudi Dental Society announced various activities during World Oral Health Day (WOHD) 2024 in Saudi Arabia to enhance the general public's understanding of oral health and promote the proactive management of chronic oral conditions and diseases. These initiatives, coupled with the growing prevalence of dental disorders among the Saudi population, are propelling the demand for endodontic services and, consequently, the devices associated with them.

Key Dental Consumables Company Insights

Some of the key players operating in the industry include Dentsply Sirona, Straumann Holding, and Henry Schein, Inc. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Ivoclar and Benco Dental are emerging players in dental consumables.

Key Dental Consumables Companies:

The following are the leading companies in the dental consumables market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona

- Straumann Holding

- 3M

- Henry Schein, Inc.

- Patterson Companies, Inc.

- Envista (Danaher Corporation)

- Zimmer Biomet

- Ivoclar

- Coltene Group

- Benco Dental

Recent Developments

-

In April 2024, Ivoclar Group, a key manufacturer of integrated solutions for high-quality dental treatments, revealed its partnership with SprintRay, a U.S.-based technology company. This collaboration aims to establish new benchmarks in 3D printing within the dental industry, enhancing the capabilities available to dentists, dental technicians, and hygienists.

-

In August 2024,Dentsply Sirona introduced the X-Smart Pro+ and Reciproc Blue in the U.S., offering a streamlined, one-file solution for endodontic procedures. This launch aims to simplify root canal treatments by providing a highly efficient and reliable system.

-

In June 2023, Ivoclar collaborated with Cayster, Inc. to make the intraoral scanning experience more seamless to dentists, laboratories trainers

-

In May 2023, Straumann Holding Group acquired GalvoSurge Dental AG to correct the dental implant method and offer a modern notion to treat peri-implantitis.

Dental Consumables Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 39.1 billion |

|

Revenue forecast in 2030 |

USD 57.7 billion |

|

Growth rate |

CAGR of 8.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, specialty, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Mexico; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Dentsply Sirona; Straumann Holding; 3M; Henry Schein, Inc.; Patterson Companies, Inc.; Envista (Danaher Corporation); CompZimmer Biomet7; Ivoclar; Coltene Group; Benco Dental |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Dental Consumables Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental consumables market report based on product, specialty, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Implants

-

Crowns & Bridges

-

Dental Biomaterials

-

Orthodontic Materials

-

Endodontic Materials

-

Periodontic Materials

-

Dentures

-

CAD/CAM Devices

-

Retail Dental Hygiene Essentials

-

Others

-

-

Specialty Outlook (Revenue, USD Million, 2018 - 2030)

-

General

-

Pediatric

-

Endodontics

-

Oral Surgery

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Dental Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental consumables market size was estimated at 36.4 billion in 2024 and is expected to reach USD 39.2 billion in 2025

b. The global dental consumables market is expected to grow at a compound annual growth rate of 8.0% from 2025 to 2030 to reach USD 57.7 billion by 2030.

b. North America dominated the portable ultrasound devices market with a share of 47.5% in 2024. This is attributable to the rising incidence of dental illnesses, increasing demands for cosmetic dental treatments, and developing dental tourism in global markets

b. Some key players operating in the dental consumables market include Dentsply Sirona, Henry Schein Inc, 3M, Align technology, Zimmer Biomet, Straumann holding, Patterson Companies Inc., Ivoclar Vivadent AG, Envista Holdings, Nobel Biocare, Carestream

b. Key factors that are driving the market growth include increased advancements in dental technology, a growing senior population dealing with oral disorders, and increasing demands for cosmetic dental treatments.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."