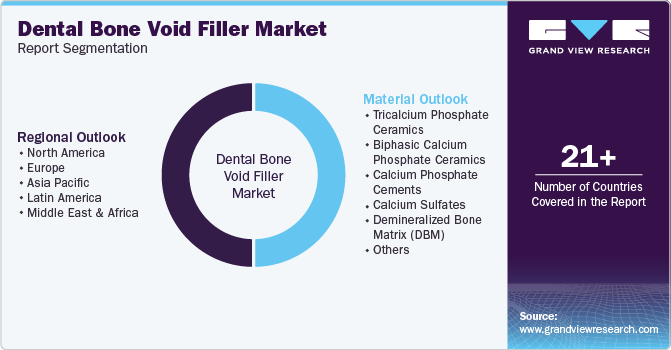

Dental Bone Void Filler Market Size, Share & Trends Analysis Report By Material (Tricalcium Phosphate Ceramics, Biphasic Calcium Phosphate Ceramics, Calcium Phosphate Cement, Calcium Sulfates, Demineralized Bone Matrix), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-510-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Dental Bone Void Filler Market Size & Trends

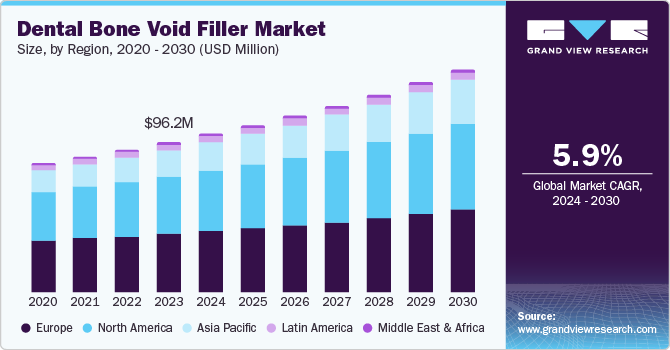

The global dental bone void filler market size was valued at USD 96.2 million in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. This growth can be attributed to the increasing number of synthetic products. Synthetic fillers include tri-calcium phosphates and calcium sulfate that have advantages, such as there is no risk of any disease transference and has a relatively long shelf life. As the global population ages, the incidence of dental issues such as tooth decay, periodontal diseases, and tooth loss is on the rise, necessitating the use of dental bone void fillers in various restorative procedures. Additionally, the growing awareness about oral health and the importance of maintaining dental hygiene has encouraged more people to seek dental treatments, further boosting the demand for these fillers.

In addition, technological advancements such as the development of synthetic bone grafts and bioactive materials have enhanced the effectiveness and safety of dental bone void fillers. These advanced materials, including hydroxyapatite and tricalcium phosphate, offer superior biocompatibility and osteoconductivity, making them highly preferred by dental professionals. Bone tissue engineering has developed a new technology for regeneration through the introduction of scaffolds that pose a three-dimensional architecture that closely mimics the native extracellular matrix. Such arrangement eventually enhances cell differentiation, proliferation and adhesion, and overall tissue regeneration. Moreover, the integration of digital dentistry and computer-aided design/computer-aided manufacturing (CAD/CAM) technologies has improved the precision and efficiency of dental procedures, leading to better patient outcomes and increased adoption of dental bone void fillers.

Furthermore, the market growth was stimulated by the increasing number of dental implant procedures. Dental implants have become an increasingly popular choice for tooth replacement due to their durability and natural appearance. However, successful implant placement often requires adequate bone volume and density, which can be achieved using dental bone void fillers. The rising demand for dental implants has thus directly contributed to the growth of the dental bone void filler market.

Material Insights

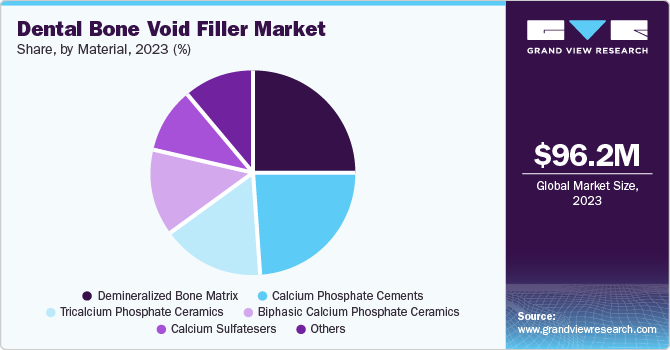

Demineralized Bone Matrix (DBM) dominated the market in 2023 owing to the increasing incidence of musculoskeletal disorders. The market witnessed a high surge for this material among dental professionals to cater to the rising complexity of bone grafting procedures leading to the increasing demand for demineralized bone matrix. Additionally, innovative processing techniques, such as freeze-drying and lyophilization, help preserve the natural growth factors and extracellular matrix components of DBM grafts, thereby improving their osteoinductive potential.

Tricalcium Phosphate (TCP) is expected to grow at a CAGR of 6.9% over the forecast period owing to its excellent biocompatibility and osteoconductivity, which are essential for effective bone regeneration and integration. TCP closely mimics the mineral composition of natural bone, promoting new bone growth and healing, which makes it highly effective in dental applications. This similarity to native bone structure enhances its acceptance by the body, reducing the risk of rejection and complications. Furthermore, TCP can be easily molded and shaped to fit various bone defects, providing a customizable solution for dental professionals. This adaptability is particularly beneficial in complex dental procedures where precise fitting of the filler material is crucial for optimal outcomes. Additionally, the radiopacity of TCP allows for easy monitoring of the healing process through imaging techniques, ensuring that bone regeneration is progressing as expected.

Regional Insights

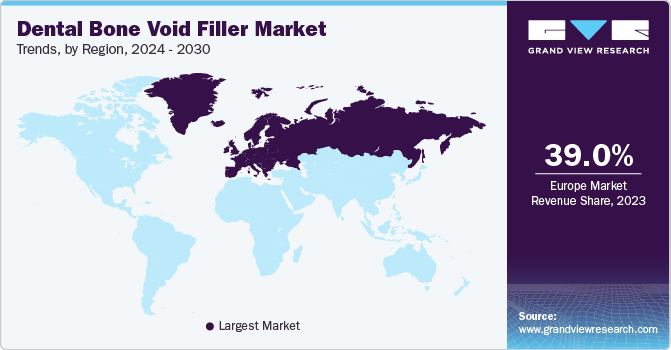

The dental bone void filler market in Europe held a lucrative share of 39.0% in 2023 owing to the increasing prevalence of dental conditions and the high rate of tooth extractions in the region. With a significant portion of the population experiencing dental issues such as tooth decay, periodontal diseases, and tooth loss, the demand for dental bone void fillers is on the rise. Additionally, the growing geriatric population in Europe, which is more susceptible to dental problems, has further fueled market growth.

North America Dental Bone Void Filler Market Trends

The dental bone void filler market in North America held 38.2% of the global revenue share in 2023. The market was driven by technological advancements such as the development of synthetic bone grafts and bioactive materials. Additionally, the increasing prevalence of oral health disorders, including oral cancer and periodontal disease, is anticipated to drive market growth.

U.S. Dental Bone Void Filler Market Trends

The U.S. dental bone void filler market was driven by the rising awareness about oral health and the importance of maintaining dental hygiene, leading to patients increasingly seeking dental treatments. This growing awareness, coupled with the increasing number of dental implant procedures, has boosted the demand for dental bone void fillers. In addition, companies have heavily invested in research and development activities to introduce innovative products and expand their product portfolios. Furthermore, insurance coverage for dental procedures, including those involving bone void fillers, has made these treatments more accessible to a larger population.

Asia Pacific Dental Bone Void Filler Market Trends

The Asia Pacific dental bone void filler market accounted for 17.6% of the share in 2023 This growth can be attributed to a large patient population, thereby creating demand for dental services & equipment. Additionally, developing oral care infrastructure in developing economies including India is expected to further propel the market growth.

Key Dental Bone Void Filler Company Insights

The global dental bone void filler market is highly competitive with the presence of several domestic and international players. Key market participants include Curasan, Inc., Olympus Terumo Biomaterials Corporation, Medtronic, and others. Companies have majorly invested in launching new products with research and development activities and technological developments.

-

Curasan, Inc. is a leading company in the field of biosurgery, specializing in the development, manufacturing, and marketing of biomaterials for bone and tissue regeneration. With a strong focus on dental and orthopedic applications, Curasan offers a comprehensive range of products under well-known brands such as CERASORB and ALLOSORB. These products are designed to mimic human bone and support the regeneration of tissues, providing effective solutions for dental, spinal, and orthopedic surgeries.

Key Dental Bone Void Filler Companies:

The following are the leading companies in the dental bone void filler market. These companies collectively hold the largest market share and dictate industry trends.

- Curasan, Inc.

- Olympus Terumo Biomaterials Corporation

- Medtronic

- Graftys

- Johnson & Johnson Services, Inc

- Stryker

- Osteogene Tech

- BONESUPPORT AB

- ORTHOREBIRTH CO.LTD

Recent Developments

-

In April 2023, ZimVie Inc. announced the launch of RegenerOssCC Allograft Particulate and RegenerOssBone Graft Plug. Both grafts are available across the North American Region.

-

In July 2022, curasan AG expanded its portfolio with CERASORB Calcium Phosphate Cement (CPC ) Bone Void Fillers for orthopedic, maxillofacial, and trauma surgery.

Dental Bone Void Filler Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 101.4 million |

|

Revenue forecast in 2030 |

USD 143.3 million |

|

Growth rate |

CAGR of 5.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait. |

|

Key companies profiled |

Curasan, Inc.; Olympus Terumo Biomaterials Corporation; Medtronic; Graftys; Johnson & Johnson Services, Inc; Stryker; Osteogene Tech; BONESUPPORT AB; ORTHOREBIRTH CO.LTD |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Dental Bone Void Filler Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental bone void filler market report based on material and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Tricalcium phosphate ceramics

-

Biphasic calcium phosphate ceramics

-

Calcium phosphate cements

-

Calcium sulfates

-

Demineralized Bone Matrix (DBM)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."