- Home

- »

- Medical Devices

- »

-

Dental Articulators Market Size, Share, Industry Report, 2030GVR Report cover

![Dental Articulators Market Size, Share & Trends Report]()

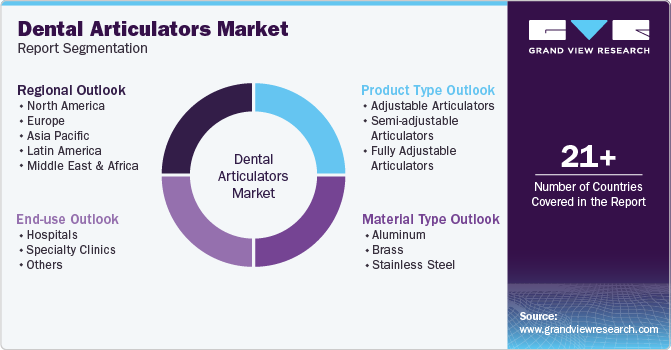

Dental Articulators Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Adjustable, Semi-adjustable, Fully Adjustable), By Material Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-393-5

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

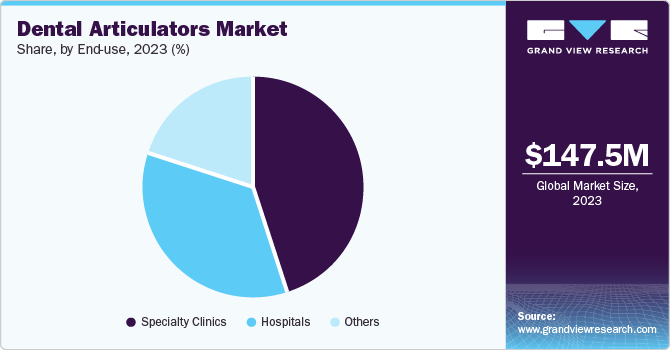

The global dental articulators market size was valued at USD 147.5 million in 2023 and is anticipated to grow at a CAGR of 6.2% from 2024 to 2030. The increasing prevalence of dental disorders and the rising awareness about oral health are leading to a higher demand for dental procedures and, consequently, dental articulators. Technological advancements in dental equipment, including the development of more precise and user-friendly articulators, are also contributing to market growth.

In addition, the growing geriatric population, which is more prone to dental issues, is boosting the need for dental care services. Furthermore, expanding dental tourism, particularly in emerging economies, provides new opportunities for market players. Lastly, supportive government initiatives and increased healthcare expenditure further propel the market forward.

The dental articulators market is experiencing a trend of incorporating digital technology, such as CAD/CAM systems, to improve the precision and efficiency of dental restorations. There is also a growing demand for lightweight and ergonomic articulators that enhance user comfort and reduce fatigue. Furthermore, there is anticipated to be a rise in the utilization of 3D printing technology, allowing for the production of highly customized and accurate dental models. The emergence of tele-dentistry and remote consultations is expected to impact the market, requiring advanced diagnostic tools and equipment. Additionally, there is a notable focus on sustainability, with manufacturers actively exploring eco-friendly materials and production methods to meet the increasing demand for environmentally conscious products.

Product Insights

The semi-adjustable articulators segment accounted for 52.0% of the market revenue in 2023 attributed to its versatility and widespread use in dental practices. Semi-adjustable articulators are favored for their ability to simulate various mandibular movements, making them suitable for most dental procedures. They balance functionality and cost, providing accurate results without the complexity and expense of fully adjustable articulators.

The adjustable articulators segment is expected to grow at a CAGR of 5.9% from 2024 to 2030. Adjustable articulators offer greater precision and customization, allowing dental professionals to replicate complex jaw movements more accurately. This makes them particularly valuable in specialized dental procedures and advanced restorative work. The increasing focus on personalized dental care and the rising prevalence of complex dental conditions drive the demand for adjustable articulators.

Material Insights

The aluminum segment held the largest revenue share in 2023. Aluminum is widely favored for its lightweight properties, which enhance dental articulators' ease of handling and maneuverability. Additionally, aluminum articulators are known for their durability and resistance to corrosion, making them a reliable choice for long-term use in dental practices. The cost-effectiveness of aluminum compared to other materials also contributes to its popularity, allowing manufacturers to produce high-quality articulators at a lower cost. Furthermore, advancements in aluminum processing technologies have led to the development of more precise and efficient articulators, further boosting their adoption in the market.

The stainless steel segment is expected to grow at a CAGR of 6.0% over the forecast period. Stainless steel articulators are highly valued for their strength and robustness, which make them suitable for complex dental procedures that require high precision and stability. The material’s resistance to wear and tear ensures a longer lifespan, providing a cost-effective solution for dental professionals.

In addition, stainless steel’s biocompatibility and ease of sterilization make it a preferred choice in clinical settings where hygiene is paramount. The increasing demand for advanced dental treatments and the growing focus on patient safety and care quality are key drivers for the growth of the stainless steel segment. As dental technologies continue to evolve, the adoption of stainless steel articulators is expected to rise, supported by ongoing innovations and improvements in material science.

End Use Insights

The specialty clinics segment dominated the market in 2023 due to the specialized nature of services offered by these clinics, which often require advanced and precise dental equipment. Specialty clinics, which focus on areas such as orthodontics, prosthodontics, and cosmetic dentistry, rely heavily on dental articulators for accurate diagnosis and treatment planning. The increasing prevalence of dental disorders and the rising demand for aesthetic dental procedures have further fueled the growth of this segment.

The hospital segment is expected to grow steadily over the forecast period. Hospitals are increasingly incorporating comprehensive dental departments to provide a wide range of dental services, from routine check-ups to complex surgical procedures. The integration of dental services within hospitals offers patients the convenience of accessing multiple healthcare services under one roof. This trend is particularly prominent in emerging economies, where healthcare infrastructure is rapidly expanding. The steady growth of the hospital segment can also be attributed to the rising number of dental surgeries and the increasing focus on multidisciplinary care.

Regional Insights

North America dental articulators market accounted for 37.6% revenue in 2023. This significant share is driven by the high prevalence of dental disorders, advanced healthcare infrastructure, and the presence of major market players. The region’s focus on technological advancements and the adoption of innovative dental equipment further strengthens market growth.

The U.S. dominated the North American dental articulators market in 2023, owing to its well-established dental care system and high healthcare expenditure. The increasing awareness about oral health and the rising demand for cosmetic dentistry are key factors contributing to the market’s dominance. Additionally, the presence of leading dental equipment manufacturers in the country supports market expansion.

Asia Pacific Dental Articulators Market Trends

The Asia Pacific dental articulators market is expected to grow at a CAGR of 7.4% from 2024 to 2030. This growth is driven by the rising prevalence of dental diseases, increasing healthcare expenditure, and the expanding dental tourism industry. Countries such as India and China are witnessing significant investments in healthcare infrastructure, further propelling market growth.

China dental articulators market is a key player in the Asia Pacific dental articulators market, with rapid advancements in dental technology and increasing government initiatives to improve healthcare services. The growing middle-class population and rising disposable incomes are also contributing to the increased demand for dental care and advanced dental equipment.

Europe Dental Articulators Market Trends

The European dental articulators market is expected to grow steadily over the forecast period. Factors such as the high prevalence of dental disorders, advanced healthcare systems, and strong government support for healthcare initiatives drive market growth. Additionally, the presence of leading dental equipment manufacturers in countries such as Germany and the UK supports market expansion.

The UK dental articulators market is a significant contributor to the European dental articulators market, driven by its advanced dental care infrastructure and high awareness of oral health. The increasing demand for cosmetic dentistry and the presence of leading dental equipment manufacturers further support market growth. Government initiatives to improve dental care services also play a crucial role.

Latin America Dental Articulators Market Trends

The Latin American dental articulators market is experiencing growth due to the rising prevalence of dental diseases and increasing healthcare expenditure. Countries such as Brazil and Mexico are investing in healthcare infrastructure and dental care services, driving market expansion. The growing awareness about oral health and the increasing demand for advanced dental equipment further support market growth.

Key Dental Articulators Company Insights

The global dental articulators market is driven by several key companies, including Dentsply Sirona, Zimmer Biomet, Amann Girrbach AG, and SAM, among others.

-

Dentsply Sirona offers a comprehensive range of dental articulators. Their products are widely used in dental practices and laboratories for various applications, including restorative and prosthetic dentistry.

-

Zimmer Biomet is renowned for its advanced dental solutions, including high-quality articulators. Zimmer Biomet’s articulators are claimed to provide accurate simulations of jaw movements, aiding in the creation of precise dental restorations.

Key Dental Articulators Companies:

The following are the leading companies in the dental articulators market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona

- Zimmer Biomet

- So-Young International, Inc.

- Amann Girrbach AG

- SAM

- Prestige Dental Products UK Ltd.

- Hager & Werken GmBH& Co. KG

- Ivoclar Vivadent AG

- Dent flex

- Schuler Dental

Recent Developments

-

In February 2023, Exocad introduced an additional module named xSNAP for DentalCAD 3.1 Rijeka. This module allows users to replicate natural mandibular movements without using a traditional articulator. xSNAP represents the initial 3D joint system for dental models made with a 3D printer, making it possible to mimic dynamic jaw movements.

Dental Articulators Market Scope

Report Attribute

Details

Market size value in 2024

USD 157.1 million

Revenue forecast in 2030

USD 225.4 million

Growth rate

CAGR of 6.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Key companies profiled

Dentsply Sirona, Zimmer Biomet, So-Young International, Inc., Amann Girrbach AG, SAM, Prestige Dental Products UK Ltd., Hager & Werken GmBH& Co. KG, Ivoclar Vivadent AG, Dent flex, Schuler Dental

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Articulators Market Report Segmentation

This report forecasts revenue & volume growth of the dental articulators market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agrochemicals market report based on product, material, end use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adjustable Articulators

-

Semi-adjustable Articulators

-

Fully Adjustable Articulators

-

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Brass

-

Stainless Steel

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.