- Home

- »

- Pharmaceuticals

- »

-

Dementia Treatment Market Size, Industry Report, 2030GVR Report cover

![Dementia Treatment Market Size, Share & Trends Report]()

Dementia Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Indication, By Drug Class, By Route Of Administration (Oral, Transdermal Patch, Injectable), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-258-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dementia Treatment Market Summary

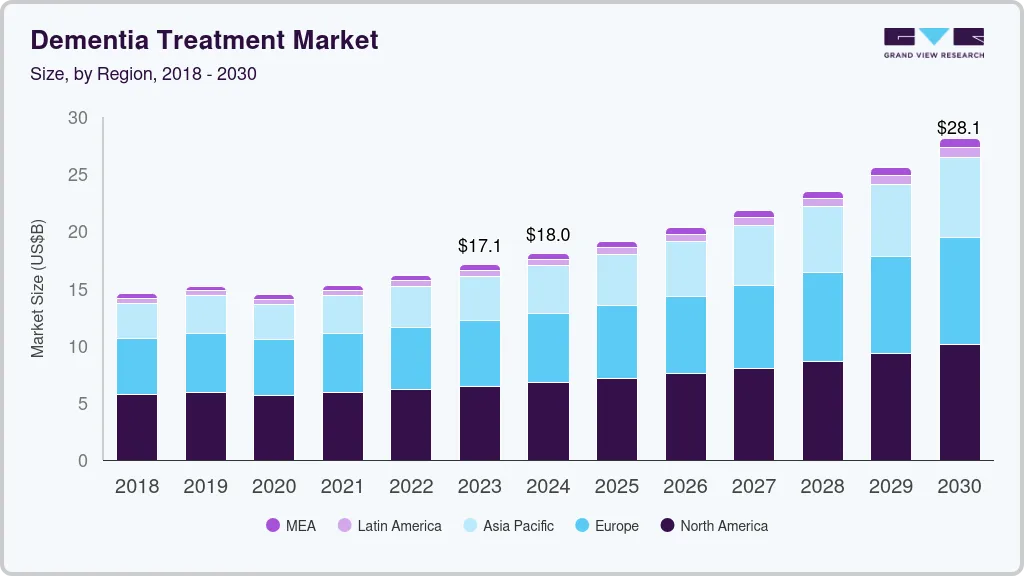

The global dementia treatment market size was estimated at USD 18.03 billion in 2024 and is projected to reach USD 28.11 billion by 2030, growing at a CAGR of 8.0% from 2025 to 2030. The market growth is attributed to the high disease prevalence, rising geriatric population, introduction of novel therapeutic products, and increasing R&D activities in the market.

Key Market Trends & Insights

- North America dementia treatment market dominated the global market with a revenue share of 37.6% in 2024.

- The dementia treatment market in the U.S. dominated the North America market with a revenue share of 83.5% in 2024.

- By indication, the Alzheimer’s disease (AD) dementia segment led the global market with a share of 59.8% in 2024.

- By drug class, the cholinesterase inhibitors segment led the market with a share of 44.2% in 2024.

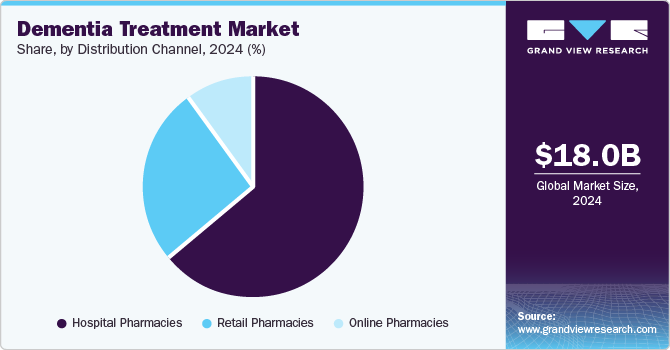

- By distribution channel, the hospital pharmacy segment led the market with a share of 64.3% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 18.03 Billion

- 2030 Projected Market Size: USD 28.11 Billion

- CAGR (2025-2030): 8.0%

- North America: Largest market in 2024

For instance, according to the NCBI, in 2023, in the U.S., around 6.7 million people aged 65 years and above had Alzheimer’s disease dementia and it is estimated to reach around 13.8 million by 2060. Moreover, increasing supportive government initiatives and growing awareness programs to educate people about the disease are further anticipated to drive market growth. The increasing prevalence of dementia is one of the major factors driving market growth.

According to the WHO data published in March 2023, more than 55 million people suffer from dementia worldwide and it is predicted to reach 78 million and 139 million by 2030 and 2050, respectively. Moreover, around 10 million new cases of the disease are reported every year. The prevalence of the disease is comparatively higher in developing economies, such as China, India, and Brazil. The introduction and development of novel therapeutic products for different types of dementia is expected to support the growth. In November 2023, Eisai Co., Ltd. announced the launch of Leqembi in the U.S. market and the company aimed that the drug would be prescribed to 10,000 patients by the end of March 2024. Leqembi received approval from the U.S. FDA in July 2023.

Favorable initiatives are being undertaken by government and non-government bodies to improve the overall healthcare services for patients and spread awareness among people. In December 2023, the U.S. Department of Health & Human Services (HHS) released a roadmap of strategies to support research activities, increase treatment rates, improve health services to support dementia patients, and encourage action to reduce risk factors associated with the disease. Similarly, in September 2022, Corium, Inc. announced the availability of Adlarity (donepezil transdermal system) for prescription in the U.S. for the treatment of mild, moderate, or severe dementia related to Alzheimer’s disease. In March 2022, the U.S. FDA approved Adlarity for the treatment of Alzheimer’s disease dementia.

Moreover, government bodies are providing financial aid to accelerate clinical research to develop novel drugs for the targeted disease. For instance, in November 2023, the National Institutes of Health announced a funding opportunity for the development of novel therapeutic drugs for Alzheimer’s disease and related dementia. The funding will be provided to support phase 1 and 2 clinical trials to accelerate the evaluation of promising drug candidates. The presence of strong pipeline candidates under clinical trials for dementia is expected to boost market expansion. As of January 2023, there were 36 drugs in phase-3, 87 drugs in phase-2, and 31 drugs in phase-1 clinical trials.

Increasing R&D activities to develop novel biological and other drug classes are anticipated to fuel market growth. Clinical studies related to anti-amyloid antibodies show promising results in clinical trials. For instance, lecanemab and donanemab drug candidates showed cognitive decline by 27% at 18 months of treatment and about 35% at 18 months of treatment, respectively. Moreover, amyloid clearance was observed in 68% of participants in the phase-3 trial of lecanemab and 80% in the donanemab phase-3 trial.

Indication Insights

The Alzheimer’s disease (AD) dementia segment led the global market with a share of 59.8% in 2024, owing to the high number of disease cases associated with AD, high treatment rates, and increased awareness among people. According to the WHO, Alzheimer’s disease is the most common form of the disease, which contributes to 60%-70% of all dementia cases. Moreover, increasing approval of novel therapeutic drugs for the treatment is expected to drive segment growth. For instance, in September 2023, Eisai Co., Ltd. received market approval from the Ministry of Health, Labor and Welfare for lecanemab to treat dementia due to AD in Japan.

The Lewy body dementia (LBD) segment is anticipated to grow at the fastest CAGR of 10.6% from 2025 to 2030 owing to the increasing cases and severity of this health condition. It is more rapid than other types of dementia and patients can experience more symptoms and sudden decline. According to the Lewy Body Society, LBD accounts for 15% of all types of disease forms and it is expected to increase in the coming years.

Drug Class Insights

The cholinesterase inhibitors segment led the market with a share of 44.2% in 2024. High prescription rates of donepezil, rivastigmine, and galantamine and better results are some of the key factors supporting market growth. Moreover, the increasing adoption of transdermal cholinesterase inhibitors and their high safety & effectiveness are further supporting market growth. For instance, in July 2024, the US FDA approved Alpha Cognition Inc.’s ALPHA-1062 (Zunveyl), an Acetylcholinesterase (AChE) inhibitor, for treating mild-to-moderate Alzheimer’s disease in the U.S.

Combination drugs are projected to grow at the fastest rate of 10.2% over the forecast period. Increasing adoption of combination therapy due to its better results and increasing introduction of novel combination drugs are key factors driving market growth. For instance, in January 2025, Amneal Pharmaceuticals LLC received U.S. FDA approval for memantine/donepezil, indicated for moderate to severe Alzheimer’s dementia, granting 180-day exclusivity within the U.S. Increasing approval of cholinesterase inhibitors and NMDA receptor antagonist combinations across the globe is boosting segment growth.

Route of Administration Insights

The oral route of administration led the market with a share of 54.3% in 2023. High market penetration of oral drugs, such as memantine, donepezil, rivastigmine, galantamine, and others, a large number of pharmaceutical companies offering these oral drugs, and increasing approval of oral drugs are the key factors driving the segment expansion. For instance, in December 2024, Cognition Therapeutics announced positive topline results from its Phase 2 SHIMMER study in the U.S., demonstrating CT1812’s therapeutic potential for treating dementia with Lewy bodies across multiple measures, including behavior and cognition.

Injectable drugs are expected to experience the fastest growth of 9.6% over the forecast period. Increasing R&D activities to develop novel biological therapeutics, approval of injectable drugs, and improved results in treating dementia are some major factors anticipated to drive segment growth. For instance, in January 2024, Eisai and Biogen announced the approval of LEQEMBI (lecanemab) in China for treating mild cognitive impairment and mild Alzheimer’s disease dementia, with launch preparations underway. The increasing introduction of novel injectable drugs is expected to propel the segment growth significantly.

Distribution Channel Insights

The hospital pharmacy segment led the market with a share of 64.3% in 2023. The increasing hospitalization rate due to dementia among the geriatric population is supporting the segment’s growth. According to the Alzheimer’s Association Report 2023, there were 518 hospitalizations per 1,000 Medicare beneficiaries aged 65 years and older having Alzheimer’s or other types of dementia as compared to only 234 hospitalizations per 1,000 Medicare beneficiaries without these conditions.

Online pharmacies are projected to grow at the fastest CAGR of 10.6% over the forecast period. Increased user base of internet & smartphone, ease of ordering medications through an e-commerce platform, and increasing e-commerce services offering medicinal products globally are expected to fuel segment growth in the coming years. Moreover, increasing adoption of telemedicine to manage mental health is further anticipated to support segment growth in the coming years.

Regional Insights

North America dementia treatment market dominated the global market with a revenue share of 37.6% in 2024. High disease prevalence, presence of key pharmaceutical companies involved in the marketing & development of novel dementia drugs, and favorable government initiatives are some of the key factors supporting market growth. For instance, in January 2024, Health Canada approved REXULTI (brexpiprazole), co-developed by Otsuka and Lundbeck to managing agitation associated with Alzheimer’s dementia.

U.S. Dementia Treatment Market Trends

The dementia treatment market in the U.S. dominated the North America market with a revenue share of 83.5% in 2024, aided by a strong presence of key players, better reimbursement policies, improved healthcare infrastructure, and favorable initiatives undertaken by government & non-government bodies to improve the healthcare services for dementia patients. For instance, in October 2023, U.S.-based CuraSen Therapeutics announced the initiation of a human clinical trial with a new neurodegenerative disease drug, CST-3056 in the 4th quarter of 2024. The company has received funding of USD 5.8 million from the Alzheimer’s Drug Discovery Foundation.

Europe Dementia Treatment Market Trends

Europe dementia treatment market held substantial market share in 2024. According to the Alzheimer Europe Dementia in the Europe Yearbook 2024, the number of cases with dementia in the European Union is estimated to be 7,853,705, and in the broader European region, 9,780,678. These numbers are expected to increase significantly in the coming years. Europe’s aging population and increasing life expectancy has led to a significant rise in cases of dementia.

The dementia treatment market in Germany is expected to grow rapidly in the forecast period. Germany has made significant progress in addressing dementia, with research and funding playing a crucial role. For instance, In September 2023, a study by the Robert Koch Institute in Germany predicted a rise in dementia cases from 1.7 million in 2023 to 3.0 million cases by 2070 in Germany. The German Federal Ministry of Education and Research has been at the forefront of dementia research, while the EU Joint Programme - Neurodegenerative Disease Research (JPND) has launched a transnational call for health and social care research. Notably, Germany contributed to global efforts, aiming to find a treatment for Alzheimer’s by 2025. This commitment is demonstrated by conferences such as ISAD-2025 in Berlin, which highlights the nation’s focus on dementia treatment.

Asia Pacific Dementia Treatment Market Trends

Asia Pacific dementia treatment market is expected to register the fastest CAGR of 9.5% in the forecast period. The presence of a large target population, high unmet clinical needs, and developing healthcare is anticipated to provide high growth potential for the regional market. It is expected that more than 75% of Alzheimer’s disease and related dementias to occur in low- and middle-income countries by 2050. Developing countries, such as China and India, have a large patient base with high unmet medical needs that create market opportunities for key players in the region.

The dementia treatment market in India is anticipated to grow at the fastest rate over the forecast period. Market growth in the country is supported by large target population, high unmet clinical needs, developing healthcare infrastructure, and a rising geriatric population. Ongoing research in India encompasses synaptic plasticity therapies, novel molecule synthesis, and digital media innovations to enhance dementia care and explore stem cell treatments. In October 2024, according to the Government of India, scientists from the Agharkar Research Institute, Pune, designed novel molecules for Alzheimer’s treatment, developing non-toxic molecules and used them to create selective cholinesterase inhibitors for potential application in India.

Key Dementia Treatment Company Insights

Some leading players operating in the market include Eisai Co., Ltd. Lilly, Daiichi Sankyo Company, Ltd., and Biogen. Key companies are adopting different strategies, such as new product development, collaboration, and partnership, to increase their industry footprint. Emerging companies are focusing on achieving funding support from government bodies and healthcare organizations to support their research activities related to the development of novel treatments for dementia. For instance, in October 2024, AbbVie Inc. announced the acquisition of Aliada Therapeutics. This strengthens their focus on Alzheimer’s research in North America, with the lead compound, ALIA-1758, showing promise. The acquisition leverages novel blood-brain barrier technology.

-

Biogen, a leader in neurology, is developing treatments for Alzheimer’s, focusing on therapies targeting Alzheimer’s pathology, including early-stage disease. They are working on novel therapies and drugs.

-

Lundbeck is developing treatments for brain disorders. They are pioneering treatments for Alzheimer’s and have treatments for this disease, including dealing with symptoms of Alzheimer’s disease. They are working on improving the quality of life for patients.

Key Dementia Treatment Companies:

The following are the leading companies in the dementia treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Eisai Co., Ltd.

- Eli Lilly and Company

- Novartis AG

- DAIICHI SANKYO COMPANY, LIMITED

- AbbVie Inc.

- Lundbeck

- Biogen

- Cipla

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.

Recent Developments

-

In February 2025, the University of Edinburgh, UK, initiated a BHF-funded project led by Dr. Jing Qiu. The study explores Nrf2’s role in vascular dementia by targeting endothelial cells in the brain. It aims to identify therapeutic strategies and involves collaborative efforts.

-

In July 2024, the FDA approved Alpha Cognition’s oral therapy ZUNVEYL for treating Alzheimer’s disease in the US, offering a novel dual mechanism of action and improved tolerability.

-

In July 2024, the FDA approved Lilly’s Kisunla (donanemab-azbt) in the US. The Alzheimer’s treatment demonstrated up to 35% slower cognitive decline and was the first amyloid plaque-targeting therapy with a limited treatment duration.

-

In February 2024, the FDA granted Breakthrough Therapy Designation to latozinemab in the U.S. Alector and GSK announced this, marking the drug’s potential for treating frontotemporal dementia due to a progranulin gene mutation (FTD-GRN).

Dementia Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.10 billion

Revenue forecast in 2030

USD 28.11 billion

Growth rate

CAGR of 8.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report Updated

February 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Indication, drug class, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Eisai Co., Ltd.; Eli Lilly and Company; Novartis AG; DAIICHI SANKYO COMPANY, LIMITED; AbbVie Inc.; Lundbeck; Biogen; Cipla; Sun Pharmaceutical Industries Ltd.; Viatris Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dementia Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dementia treatment market report based on indication, drug class, route of administration, distribution channel, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Alzheimer’s Disease Dementia

-

Vascular Dementia

-

Lewy Body Dementia

-

Frontotemporal Dementia (FTD)

-

Parkinson Disease Dementia

-

Others

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Cholinesterase Inhibitors

-

NMDA Receptor Antagonist

-

MAO Inhibitors

-

Combination Drug

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Transdermal Patch

-

Injectable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.