- Home

- »

- Consumer F&B

- »

-

Deli Meat Market Size And Share, Industry Report, 2030GVR Report cover

![Deli Meat Market Size, Share & Trends Report]()

Deli Meat Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Pork, Chicken, Beef), By Product (Cured Meat, Uncured Meat), By Distribution (Supermarkets & Hypermarkets, Convenience Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-494-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Deli Meat Market Summary

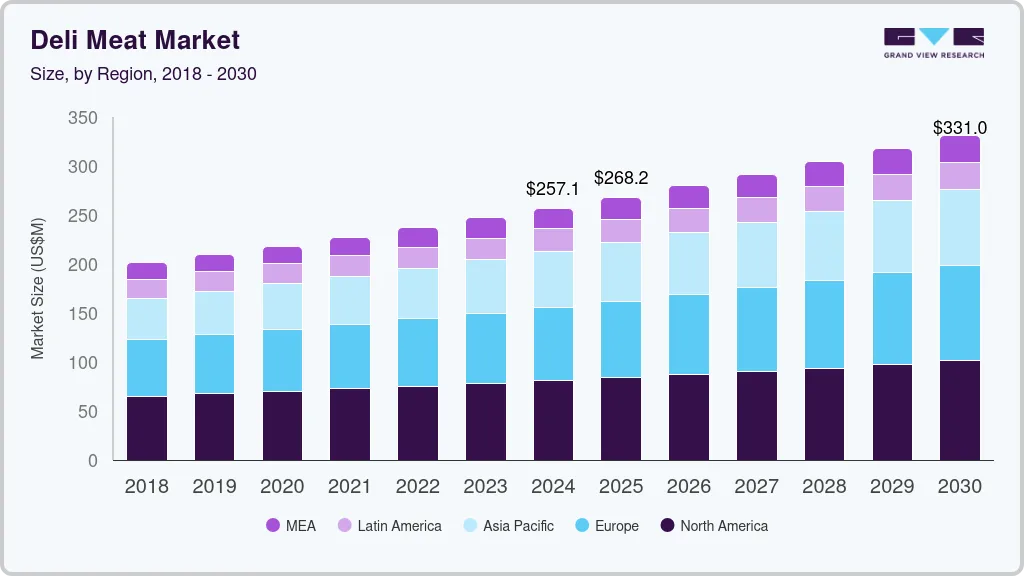

The global deli meat market size was valued at USD 257.13 million in 2024 and is projected to reach USD 331.0 million by 2030, growing at a CAGR of 4.3% from 2025 to 2030. Growing need for convenience food among urban population is a major driving factor encouraging market growth.

Key Market Trends & Insights

- North America deli meat market accounted for the largest 31.5% of the revenue share in 2024.

- The deli meat market in the U.S. dominated the regional market.

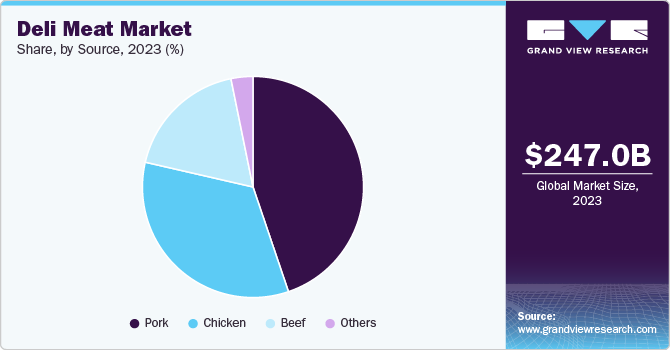

- By source, the pork segment accounted for the largest revenue share of 44.7% in 2024.

- By product, the cured deli meat segment dominated the market in 2024.

- By distribution, the Supermarkets and hypermarkets accounting for largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 257.13 Million

- 2030 Projected Market Size: USD 331.0 Million

- CAGR (2025-2030): 4.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With rapid urbanization, consumers are seeking quick and convenient meal alternatives complementing their busy lifestyles. Deli meats, often available as ready-to-eat (RTE) products, provide a practical solution for those looking to save time on meal preparation. This shift toward convenience has led to a surge in the popularity of packaged deli meats, which are readily accessible in supermarkets and convenience stores.Another significant factor contributing to market growth is the rising health consciousness among consumers. There is a growing awareness of the health benefits of organic and natural deli meats, which are perceived as healthier alternatives to traditionally processed meats. Consumers are increasingly scrutinizing food labels, leading to a preference for products free from preservatives, additives, and artificial ingredients. This trend has prompted manufacturers to expand their product range to include organic and clean-label deli meat alternatives, catering to the demand for healthier food choices.

Product innovation plays a crucial role in driving the growth of the deli meat market. Manufacturers continuously launch new flavors, varieties, and formulations to appeal to consumers with diverse tastes. Introducing specialty and artisanal cold cuts has gained traction, attracting consumers interested in unique flavor profiles and high-quality ingredients. Developing plant-based deli meat alternatives also showcase the growing consumer inclination toward vegetarian and vegan diets, further expanding the market's reach. These innovations enhance product variety and encourage trial and repeat purchases among consumers.

Expanding distribution channels is another important driver of growth in the industry. Supermarkets and hypermarkets dominate the retail landscape, accounting for a significant share of deli meat sales. E-commerce has also transformed the consumers purchase patterns for deli meats, with online grocery shopping becoming increasingly popular. This shift allows consumers to access a broader range of products from the comfort of their homes, enhancing convenience and driving sales growth. Furthermore, partnerships between retailers and food brands have facilitated greater visibility and availability of deli meat products.

Regional dynamics also influence the growth of the industry. Due to established eating habits and extensive distribution networks, North America remains a stronghold for deli meat consumption. However, emerging markets in Asia-Pacific are projected to experience rapid growth as consumer preferences shift toward western-style diets that incorporate deli meats. The increasing disposable income in these regions enables consumers to explore new culinary experiences, thus driving demand for deli meat products.

The impact of lifestyle changes is another critical driver for industry growth. As more people adopt fast-paced lifestyles characterized by longer working hours and increased mobility, there is a greater reliance on convenient food options including deli meats. The trend toward snacking and on-the-go meals has further solidified the role of deli meats as essential components in modern diets. This evolving consumer behavior underscores the significance of adaptability within the deli meat market as it responds to ongoing shifts in dietary patterns and preferences.

One of the most significant challenges for industry is the growing health concerns associated with processed meats. Research has linked the consumption of processed meats to increased risks of various health issues, including heart disease, cancer, and obesity. The World Health Organization (WHO) has classified certain processed meats as carcinogenic, which has heightened public awareness and concern about their health implications. This shift in consumer perception leads many to seek alternatives, such as plant-based proteins or fresh, minimally processed meats, thereby reducing demand for traditional deli meats.

The rise of plant-based diets has introduced intense competition for the deli meat market. Alternatives such as tofu, tempeh, and lab-grown meats are gaining popularity among consumers looking for healthier or more sustainable options. This competition threatens traditional deli meat market’s share and compels manufacturers to innovate and diversify their product offerings to retain consumer interest. As more consumers gravitate toward these alternatives, deli meat producers may face declining sales unless they can effectively respond to this trend.

Source Insights

The pork segment accounted for the largest revenue share of 44.7% of the global market in 2024. Increasing demand for convenient, ready-to-eat food options is a key driver for the segment’s growth. With busier lifestyles, consumers seek quick meal solutions requiring minimal preparation. Deli pork products, such as pre-sliced ham and salami, compliments this trend, providing a convenient option for sandwiches, salads, and other meals. The popularity of grab-and-go meals has further fueled this demand, making deli pork an attractive choice for time-pressed consumers looking for easy meal components.

Chicken as a source of deli meat is expected to grow at a fastest CAGR of 4.8% from 2025 to 2030. Consumers are becoming more health-conscious and are actively seeking lean protein sources to incorporate into their diets. Chicken is often perceived as a healthier alternative to red meat due to its lower fat content and high protein levels. This perception drives the demand for deli chicken products, which are marketed as nutritious substitutes suitable for various dietary preferences. Additionally, the rise of health trends emphasizing high-protein diets has further increased interest in deli chicken as a versatile ingredient that can be used in salads, sandwiches, and wraps.

Product Insights

The cured deli meat segment dominated the market in 2024. Increasing popularity of cured meats owing to their convenience and flavor profiles drive the growth of the segment. Cured meats, such as salami, prosciutto, and various sausages, are often ready to eat or require minimal preparation. Owing to fast-paced lifestyle, consumers are inclined toward quick meal solutions complementing their hectic schedules. The demand for convenient and ready-to-eat foods has surged, making cured meat attractive for those seeking easy meal components or snacks.

Cured meats are deeply embedded in culinary traditions worldwide, especially in Mediterranean, Spanish, and Italian cuisines. The rise of gourmet food culture has further popularized these products as consumers seek authentic flavors and artisanal quality. Culinary trends emphasizing charcuterie boards and gourmet sandwiches have increased the visibility and desirability of cured meats in restaurants and at home. This cultural appreciation for cured meats has significantly influenced consumer purchasing behavior.

Uncured meat is expected to grow at a significant pace from 2025 to 2030. Owing to the concerns associated with processed foods, the uncured meat segment is able to contribute considerably in the overall deli meat industry. Shifting dietary preferences plays a significant role in the growth of uncured meat consumption. As more individuals adopt diets emphasizing whole foods and lean proteins while reducing processed foods, uncured meats align well with these dietary goals. The rise of snacking culture also supports this trend; as uncured meat products can serve as high-protein snacks that cater to on-the-go lifestyles. This alignment with contemporary dietary trends further enhances the appeal of uncured meats over their cured counterparts.

Uncured meats offer culinary versatility that appeals to both home cooks and professional chefs. Many consumers appreciate the ability to customize flavors without the strong taste imparted by traditional curing methods. This versatility allows uncured meats to be used in a variety of dishes ranging from sandwiches to salads, without overwhelming other ingredients. As culinary trends evolve toward fresh and innovative cooking styles, uncured meats fit seamlessly to contemporary cooking, allowing for greater creativity in meal preparation.

Distribution Insight

Supermarkets and hypermarkets dominated the industry, accounting for largest revenue share in 2024. These large retail environments provide consumers with one-stop shopping experience, allowing them to purchase various products, including deli meats, on a single visit. The convenience of having multiple product options under one roof, along with promotional discounts and in-store sampling, enhances consumer engagement and encourages impulse purchases. The growth of this channel is driven by consumers' preference for product variety and the ability to physically inspect products before buying, which is particularly important for perishable items such as deli meats.

Online distribution of deli meat is expected to grow at a fastest CAGR from 2025 to 2030. The online retail channel is experiencing rapid growth, fueled by the increasing popularity of e-commerce and changing consumer shopping habits. Online grocery shopping offers high degree of convenience, allowing consumers to order deli meats from the comfort of their homes and have them delivered directly to their doorsteps. This channel particularly appeals to busy individuals and families who have limited time to visit physical stores. Additionally, online platforms often provide access to a wider variety of deli meat options, including specialty and international products that may not be available in local stores. The projected growth rate for online sales in the deli meat market reflects the increasing integration of technology into everyday shopping experiences.

Specialty stores focus on high-quality or niche products, including gourmet deli meats. These stores attract consumers seeking unique flavors, artisanal products, or organic options which are typically not found in larger supermarkets. The personalized service often provided in specialty stores enhances the shopping experience, as knowledgeable staff can offer product recommendations and information. As consumers become more discerning about their food choices and seek out premium products, specialty stores are well-positioned to capitalize on this trend, contributing to their growth within the deli meat market.

Regional Insights

North America Deli Meat Market Trends

North America deli meat market accounted for the largest 31.5% of the revenue share in 2024. The rising demand for convenience foods primarily drives the deli meat industry in North America. Busy lifestyles have led consumers to seek quick meal solutions that require minimal preparation, such as pre-packaged deli meat for sandwiches and salads. The region's extensive network of supermarkets and hypermarkets facilitates easy access to a wide variety of deli meat products, further enhancing consumer convenience. Additionally, a growing trend toward health-conscious eating among consumers increasingly favoring high-protein options is also encouraging the growth of deli meat industry in the region.

U.S. Deli Meat Market Trends

The deli meat market in the U.S. dominated the regional market. The U.S. market has seen significant product innovation, with manufacturers introducing new flavors, sources, and formulations to attract a broader audience. The availability of diverse alternatives, including gourmet flavors, organic varieties, and specialty products, appeals to consumers looking for unique culinary experiences. This continuous innovation enhances consumer choice and encourages trial purchases, contributing to the market's overall growth.

Europe Deli Meat Market Trends

The Europe deli meat market is projected to expand at a significant CAGR from 2025 to 2030. This growth is driven by rising demand for convenient, protein-rich food products, a growing preference for ready-to-eat meals, and increasing consumer awareness regarding nutritional value and product quality. Pork remained the dominant revenue generator in 2024, owing to its traditional consumption patterns and widespread culinary application across several European countries. However, chicken is poised to be the fastest-growing and most lucrative segment during the forecast period, driven by shifting consumer preferences toward leaner, lower-fat meat options and a heightened focus on health and wellness. Germany is expected to register the highest CAGR between 2025 and 2030, fueled by strong consumer demand, advancements in food processing technologies, and the growing presence of domestic and international deli meat brands.

Asia Pacific Deli Meat Market Trends

The deli meat market in Asia Pacific is expected to grow at the fastest CAGR of 5.1% from 2025 to 2030. The Asia-Pacific region is experiencing rapid growth due to changing dietary habits and increasing urbanization. As more consumers are adopting western eating patterns, there is a growing interest in convenient food options such as deli meats. The rise in fast-food culture and busy lifestyles has increased demand for ready-to-eat products that can be easily incorporated into meals. Furthermore, the expansion of modern retail formats and e-commerce platforms provides greater access to various deli meats, catering to consumers' evolving tastes. This shift toward convenience and variety supports significant growth potential for the deli meat market in this region.

China Deli Meat Market Trends

The deli meat market in China dominated the regional market in 2024. The country’s growth underscores increasing consumer demand for convenient, ready-to-eat protein options driven by evolving lifestyles, urbanization, and rising disposable incomes. Among the various product segments, pork emerged as the leading revenue contributor in 2024, reflecting its deep-rooted cultural and culinary relevance in the Chinese market. However, the chicken segment is anticipated to exhibit the fastest growth over the forecast period, positioning it as the most lucrative category. This trend is largely attributed to growing health consciousness among consumers, as well as increasing preference for leaner and lower-fat protein sources.

Key Deli Meat Company Insights

The competitive landscape of the deli meat industry is characterized by ongoing product innovation. Companies continuously develop new flavors and healthier options to meet consumer demand for convenience and quality. Additionally, e-commerce has prompted many players to enhance their online presence, making it easier for consumers to access various deli meat products. As consumer preferences shift toward healthier eating habits and convenient meal solutions, these key players are well-positioned to capitalize on growth opportunities within the deli meat market through strategic partnerships, product diversification, and expansion into emerging markets.

Key Deli Meat Companies:

The following are the leading companies in the deli meat market. These companies collectively hold the largest market share and dictate industry trends.

- Hormel Foods Corporation

- Cargill Incorporated

- Tyson Foods, Inc.

- JBS

- Maple Leaf Foods

- Conagra Foodservice

- American Foods Group, LLC

- Carl Buddig and Company

- West Liberty Foods LLC

- Dietz & Watson

- Sysco Corporation

Recent Developments

-

In November 2023, Mama’s Creations, Inc., a leading national provider of fresh deli prepared foods, launched its nationwide direct-to-consumer e-commerce platform. The platform aims to boost deli meat sales and expand market reach in U.S.

-

In October 2023, USDA’s Food Safety and Inspection Service (FSIS) announced new initiatives to enhance protections against Listeria in ready-to-eat meat and poultry products.

Deli Meat Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 268.2 million

Revenue Forecast in 2030

USD 331.0 million

Growth Rate

CAGR of 4.3% from 2025 to 2030

The base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Source, product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, Australia and New Zealand, South Korea, Brazil, Egypt.

Key companies profiled

Hormel Foods Corporation , Cargill Incorporated , Tyson Foods, Inc. , JBS , Maple Leaf Foods ,Conagra Foodservice, Inc, American Foods Group, LLC , Carl Buddig and Company , West Liberty Foods LLC, Dietz & Watson , Sysco Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Deli Meat Market Report Segmentation

This report forecasts revenue growth at global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global deli meat market report based on source, product, distribution channel and region.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Pork

-

Chicken

-

Beef

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cured Meat

-

Uncured Meat

-

-

DistributionOutlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets and Hypermarkets

-

Convenience Store

-

Specialty Store

-

Online Retailers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

SouthKorea

-

Australia and New Zealand

-

-

Middle East and Africa

-

Egypt

-

-

Latin America

-

Brazil

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.