Degaussing System Market Size, Share & Trends Analysis Report By Component (Power Supplies, Degaussing Coils), By Solution, By Vessel Type (Small Vessels, Medium Vessels), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-387-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Degaussing System Market Size & Trends

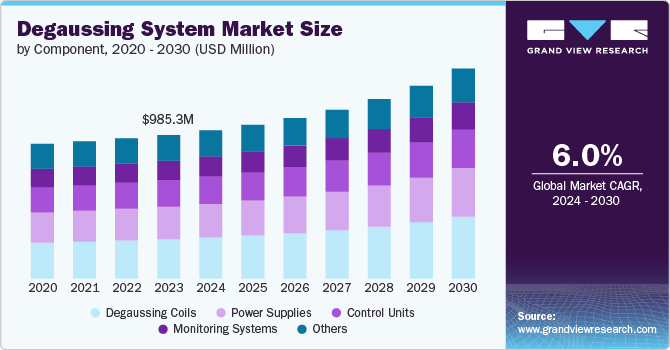

The global degaussing system market size was estimated at USD 985.3 million in 2023 and is expected to grow at a CAGR of 6.0% from 2024 to 2030. The key market drivers are the increasing need for naval fleet protection against modern threats such as magnetic mines and advanced torpedoes. As maritime security becomes more complex, navies worldwide are investing heavily in advanced degaussing systems to ensure their vessels remain undetectable to these threats.

The rising geopolitical tensions and maritime disputes in regions including the South China Sea and the Mediterranean are prompting nations to enhance their naval capabilities, further fueling the demand for degaussing systems. A significant market trend is the continuous technological advancements in degaussing systems. Modern systems are increasingly automated, featuring real-time monitoring and control units that enhance efficiency and reduce operational costs. The integration of advanced materials, such as superconducting materials and high-performance magnetic alloys, is also improving the effectiveness and reliability of degaussing systems.

Moreover, there is a growing trend towards modular and scalable degaussing solutions that can be easily integrated into different types of vessels, from small patrol boats to large aircraft carriers. This modularity allows for more flexible and cost-effective upgrades and maintenance. Another notable trend is the increasing collaboration between defense contractors and research institutions to develop next-generation degaussing technologies. These partnerships are leading to innovations that not only improve the performance of degaussing systems but also make them more environmentally friendly. For instance, energy-efficient systems that minimize power consumption and reduce electromagnetic interference are becoming more prevalent, aligning with global sustainability goals.

The market opportunities for degaussing systems are substantial, driven by the modernization and expansion of naval fleets across the world. Emerging economies, particularly in the Asia Pacific region, are investing heavily in naval infrastructure and defense capabilities, presenting significant opportunities for degaussing system providers. Additionally, the retrofitting of existing vessels with advanced degaussing systems offers a lucrative market segment, as navies seek to extend the operational life and enhance the capabilities of their current fleets.

Furthermore, the increasing adoption of unmanned and autonomous vessels in naval operations presents new opportunities for degaussing system manufacturers. These vessels require advanced degaussing solutions to ensure stealth and protection in various maritime environments. As the technology for unmanned vessels evolves, the demand for specialized degaussing systems tailored to these platforms is expected to grow.

Component Insights

The degaussing coils segment dominated the market in 2023 and accounted for a more than 27% share of global revenue. Degaussing coils are the core component of degaussing systems and dominate the market due to their essential role in neutralizing the magnetic field of a vessel, thereby reducing its magnetic signature and protecting it from magnetic mines and torpedoes. These coils are typically installed along the hull of the vessel and require precise engineering to ensure effective degaussing. The market for degaussing coils is experiencing rapid growth, driven by the increasing demand for advanced naval defense systems and the ongoing modernization of naval fleets worldwide. As naval threats become more sophisticated, the need for effective degaussing solutions grows, fueling the demand for high-performance degaussing coils. Additionally, the development of new materials and technologies, such as superconducting materials and advanced magnetic alloys, is enhancing the efficiency and effectiveness of degaussing coils, further driving market growth. The combination of these factors makes degaussing coils the dominant and fastest-growing segment in the market.

The power supplies segment is projected to witness a significant CAGR throughout the forecast period due to their crucial role in providing the necessary electrical power to operate the degaussing coils. These power supplies must be reliable, durable, and capable of handling the varying power demands of different vessel types. The increasing complexity and size of modern naval vessels necessitate more robust and efficient power supplies, driving their demand. Furthermore, advancements in power supply technology, such as the integration of solid-state components and improved power efficiency, are enhancing their performance and reliability. These technological advancements contribute to the growing market share of power supplies in the market. The emphasis on reducing electromagnetic interference in naval operations and the increased adoption of degaussing systems in new and retrofitted vessels also bolster the demand for advanced power supplies. As naval fleets expand and modernize, the market for power supplies in degaussing systems is expected to maintain its significant share, driven by continuous innovation and the critical need for reliable power solutions.

Solution Insights

The degaussing segment dominated the market in 2023 due to its critical importance in naval defense. Degaussing systems are essential for reducing a vessel's magnetic signature, making it less detectable by enemy mines and torpedoes. The growing emphasis on enhancing naval fleet security and the increasing threat of sophisticated underwater mines drive the demand for degaussing solutions. Modern degaussing systems are highly advanced, incorporating automated control units and real-time monitoring systems to optimize performance and ensure effective magnetic field neutralization. The rising number of naval vessels being commissioned and the retrofitting of existing vessels with advanced degaussing systems further contribute to the market's growth. As maritime security concerns continue to escalate globally, the degaussing segment is expected to maintain its dominance and rapid growth trajectory.

The deperming segment holds a significant share of the market as it is a vital process for resetting a vessel's magnetic signature to a baseline level. This process is typically performed at shipyards and involves the temporary installation of powerful degaussing coils around the vessel to neutralize its magnetic field. The market for deperming solutions is driven by the need for periodic maintenance of naval vessels to ensure their magnetic signature remains within safe limits. This is particularly important for vessels that operate in mine-infested waters or are involved in covert operations. The complexity and technical requirements of deperming solutions, coupled with the increasing number of naval vessels in service, drive the demand for these systems. Although not as rapidly growing as the degaussing segment, deperming remains a critical component of comprehensive naval defense strategies, ensuring a steady market share.

Vessel Type Insights

Medium vessels, which include submarines, corvettes, and destroyers, dominate the degaussing system market in 2023 due to their significant presence in naval fleets and their critical operational roles. These vessels often operate in high-threat environments and require advanced degaussing systems to protect against magnetic mines and torpedoes. The market for degaussing systems in medium vessels is driven by the ongoing modernization and expansion of naval fleets, with many countries investing in new submarines, corvettes, and destroyers. The development of advanced degaussing technologies, such as automated control units and real-time monitoring systems, enhances the effectiveness and reliability of degaussing systems in medium vessels. Additionally, the strategic importance of these vessels in naval operations ensures a steady demand for degaussing solutions. As naval forces continue to prioritize the protection and stealth capabilities of their fleets, the medium vessels segment is expected to maintain its dominant position in the market.

The small vessels segment, including OPVs (Offshore Patrol Vessels), MCMVs (Mine Countermeasure Vessels), and FACs (Fast Attack Crafts), is the fastest-growing in the market during the forecast period. These vessels, often involved in patrolling, surveillance, and mine countermeasure operations, require effective degaussing solutions to minimize their magnetic signatures and enhance their survivability. The increasing focus on coastal defense and maritime security, coupled with the rising number of small vessels being commissioned by navies and coast guards worldwide, drives the demand for degaussing systems in this segment. Furthermore, the development of compact and efficient degaussing systems tailored for small vessels contributes to the segment's rapid growth. As the geopolitical landscape continues to emphasize the importance of maritime security, the small vessels segment is expected to witness sustained growth, driven by technological advancements and increased investments in naval defense.

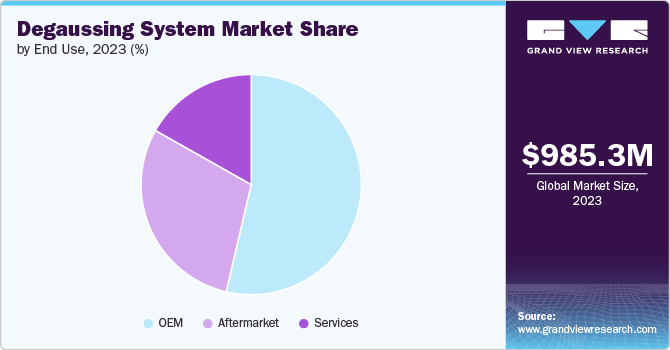

End Use Insights

The OEM (Original Equipment Manufacturer) segment dominated the market in 2023 and is projected to grow at the fastest CAGR during the forecast period. OEMs play a crucial role in the integration of degaussing systems during the construction of new naval vessels. The increasing demand for new, technologically advanced naval vessels drives the growth of the OEM segment. OEMs are continuously innovating to provide cutting-edge degaussing solutions that meet the stringent requirements of modern naval fleets. The growing emphasis on fleet expansion and modernization across various countries further fuels the demand for OEM-installed degaussing systems. Additionally, the collaboration between OEMs and naval forces to develop customized degaussing solutions enhances the segment's growth prospects. As naval defense budgets increase globally, the OEM segment is expected to continue its dominance and rapid growth in the market.

The aftermarket segment is experiencing significant growth in the market driven by the need for maintenance, upgrades, and retrofitting of existing naval vessels. As naval fleets age, the demand for aftermarket degaussing solutions increases to ensure the continued effectiveness of the vessels' magnetic protection. The aftermarket segment includes services such as system upgrades, replacement of outdated components, and the installation of advanced degaussing technologies. The rising focus on extending the operational life of naval vessels and enhancing their capabilities drives the demand for aftermarket degaussing solutions. Additionally, the availability of advanced aftermarket services and the increasing complexity of naval operations contribute to the segment's significant market share. As navies seek to maintain and upgrade their fleets to meet evolving security challenges, the aftermarket segment is expected to remain a critical component of the market.

Regional Insights

The market in North America is a significant and rapidly growing segment due to the strong presence of advanced naval forces and a high level of defense spending in the region. The United States, in particular, plays a pivotal role in driving the market growth, with substantial investments in naval modernization and expansion programs. The need to protect naval vessels from increasingly sophisticated threats, such as magnetic mines and torpedoes, underscores the demand for advanced degaussing systems. The region's focus on maintaining technological superiority in defense systems further propels the market. Additionally, collaboration between leading defense contractors and research institutions fosters innovation and the development of cutting-edge degaussing technologies. The North American market is also characterized by a high adoption rate of advanced degaussing systems in both new and retrofitted naval vessels. As geopolitical tensions and maritime security concerns continue to rise, North America is expected to maintain its significant market share and experience robust growth in the market.

U.S. Degaussing System Market Trends

U.S. plays a pivotal role in the North American market, driven by its extensive naval capabilities and substantial defense budget. The U.S. Navy's focus on maintaining technological superiority and ensuring the protection of its naval assets from magnetic threats fuels the demand for advanced degaussing systems. The country's commitment to naval modernization, including the construction of new vessels and the retrofitting of existing ones with state-of-the-art degaussing technologies, drives market growth. The U.S. market benefits from the presence of leading defense contractors and research institutions that continuously innovate and develop cutting-edge degaussing solutions. Additionally, the U.S. government's emphasis on strengthening maritime security and expanding naval operations globally contributes to the demand for degaussing systems. The strategic importance of the U.S. Navy in global security and its role in protecting international shipping lanes further underscore the need for effective degaussing solutions. With ongoing investments in naval capabilities and technological advancements, the U.S. is expected to maintain its dominant position in the global market.

Asia Pacific Degaussing System Market Trends

Asia Pacificis the largest and fastest-growing market for degaussing systems, driven by the rapid expansion and modernization of naval forces in countries such as China, India, Japan, and South Korea. The region's increasing geopolitical tensions and maritime disputes underscore the need for advanced naval defense systems, including degaussing systems, to protect vessels from magnetic mines and other threats. The growing emphasis on indigenous defense production and the development of advanced naval technologies contribute to the market's growth. Additionally, the region's significant investments in expanding naval capabilities and enhancing maritime security drive the demand for degaussing systems. The Asia Pacific market is characterized by a high level of technological innovation and collaboration between domestic and international defense contractors. As the region continues to prioritize naval modernization and defense spending, the Asia Pacific market is expected to experience robust growth and capture an increasing share of the global market.

Europe Degaussing System Market Trends

The market in Europe is marked driven by the presence of prominent naval forces and ongoing naval modernization initiatives across the region. Countries such as the United Kingdom, France, Germany, and Italy are key contributors to the market, with significant investments in upgrading their naval fleets and enhancing maritime security. The European market benefits from the region's strong defense industrial base and collaboration between governments and defense contractors to develop advanced degaussing solutions. The increasing threat of asymmetric warfare and the need to protect critical maritime infrastructure drive the demand for degaussing systems in Europe. Additionally, the European Union's emphasis on joint defense initiatives and interoperability among member states' naval forces further boosts market growth. The region's focus on sustainability and environmental protection also leads to the adoption of advanced, energy-efficient degaussing technologies. With continued investments in defense and technological advancements, Europe is expected to maintain a significant share in the global market.

Key Degaussing System Company Insights

Key players operating in the market include Wartsila, Larsen & Turbo Limited, Ultra Electronics Holdings plc, L3Harris Technologies Inc, American Superconductor Corporation, Polyamp AB, ECA Group, STL Systems AG, DA Group, and IFEN SPA. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Degaussing System Companies:

The following are the leading companies in the degaussing system market. These companies collectively hold the largest market share and dictate industry trends.

- Wartsila

- Larsen & Turbo Limited

- Ultra Electronics Holdings plc

- L3Harris Technologies Inc

- American Superconductor Corporation

- Polyamp AB

- ECA Group

- STL Systems AG

- DA Group

- IFEN SPA

Recent Developments

-

In May 2024, Fincantieri Marinette Marine (FMM), the U.S. subsidiary of Fincantieri was awarded a contract exceeding USD 1 billion for the construction of the fifth and sixth Constellation-class frigates for the U.S. Navy.

-

In December 2022, AMSC, a leading provider of megawatt-scale power resiliency solutions that enhance grid stability and fortify the Navy’s fleet capabilities, announced today that it has entered into a delivery contract with Huntington Ingalls Industries through its Ingalls Shipbuilding division. The contract is for a high-temperature superconductor (HTS)-based ship protection system, which will be deployed on the San Antonio-class amphibious transport dock ship, LPD-32.

Degaussing System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.02 billion |

|

Revenue forecast in 2030 |

USD 1.44 billion |

|

Growth rate |

CAGR of 6.0% from 2024 to 2030 |

|

Actual Data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, solution, vessel type, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa |

|

Key companies profiled |

Wartsila; Larsen & Turbo Limited; Ultra Electronics Holdings plc; L3Harris Technologies Inc; American Superconductor Corporation; Polyamp AB; ECA Group; STL Systems AG; DA Group; IFEN SPA. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scopes |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Degaussing System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global degaussing system market based on component, solution, vessel type, end use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Power Supplies

-

Degaussing Coils

-

Control Units

-

Monitoring Systems

-

Others

-

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Degaussing

-

Deperming

-

Ranging

-

-

Vessel Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Small Vessels

-

OPV

-

MCMV/Minesweeper

-

FAC (Fast Attack Craft)

-

-

Medium Vessels

-

Submarines

-

Corvettes

-

Destroyers

-

-

Large Vessels

-

Frigates

-

Aircraft Carriers

-

Amphibious Vessels

-

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

OEM

-

Aftermarket

-

Services

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global degaussing system market size was estimated at USD 985.3 million in 2023 and is expected to reach USD 1.02 billion in 2024.

b. The global degaussing system market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 1.44 billion by 2030.

b. North America dominated the degaussing system market with a share of over 35.0% in 2023 due to the strong presence of advanced naval forces and a high level of defense spending in the region.

b. Some key players operating in the degaussing system market include Wartsila, Larsen & Turbo Limited, Ultra Electronics Holdings plc, L3Harris Technologies Inc, American Superconductor Corporation, Polyamp AB, ECA Group, STL Systems AG, DA Group, and IFEN SPA

b. Key factors driving market growth include the increasing need for naval fleet protection against modern threats such as magnetic mines and advanced torpedoes

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."