- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Defoamers Market Size And Share, Industry Report, 2030GVR Report cover

![Defoamers Market Size, Share & Trends Report]()

Defoamers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Water-Based, Oil-Based, Silicone-Based, Others), By End-use (Paints, Coatings, & Inks, Adhesives & Sealants, Others), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-467-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Defoamers Market Summary

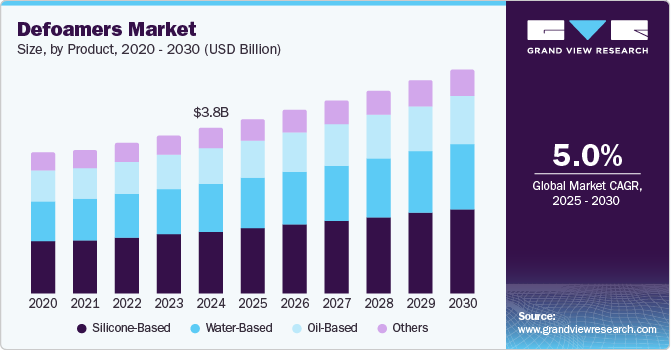

The defoamers market was estimated at USD 3.77 billion in 2024 and is projected to reach USD 5.05 billion by 2030, growing at a CAGR of 5.0% from 2025 to 2030. The market is driven by the escalating demand for agrochemicals and the rising need for wastewater treatment and water purification systems are significant.

Key Market Trends & Insights

- Asia Pacific held the largest revenue share in the global market of 37.5% in 2024.

- Europe defoamers market is expected to record the highest CAGR of 4.9% from 2025 to 2030.

- By product, silicone-based defoamers held the largest revenue share of 37.8% in 2024.

- By end use, the water treatment segment is projected to be the fastest-growing with a CAGR of 5.1% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 3.77 billion

- 2030 Projected Market Size: USD 5.05 billion

- CAGR (2025-2030): 5.0%

- Asia Pacific: Largest market in 2024

Agrochemical formulations often require defoamers to reduce foam formation during production and improve productivity and quality.

Defoamers play a vital role in wastewater treatment. They minimize foam in treatment processes, ensuring better water quality. As industrialization and urbanization increase, the need for efficient water purification systems and enhanced agrochemical products is also expected to surge. This is expected to boost the demand for defoamers across these sectors, contributing to the growth of the defoamers industry.

The growing preference for eco-friendly and biodegradable defoamers, driven by increasing environmental awareness and sustainability goals, is expected to accelerate the growth of the market. As industries face pressure to adopt greener solutions, demand for defoamers with minimal environmental impact surges. Innovations in defoaming technologies, including developing more efficient, cost-effective, and sustainable formulations, are further expected to support this shift. Advancements and innovations are expected to enhance the performance of defoamers and also aid in aligning them with regulatory requirements and consumer preferences. These factors are expected to favor market growth and aid in positioning the industry for long-term success.

Product Insights

The silicone-based defoamers segment recorded the largest revenue share of 37.8% in 2024 due to the exceptional performance and versatility of silicone defoamers. These defoamers offer superior stability, effectiveness, and long-lasting results across various applications, including industrial processes, paints, coatings, and textiles. Their ability to work efficiently in extreme conditions, such as high temperatures and varying pH levels, makes them a preferred choice for many industries. Besides, silicone-based defoamers provide low usage rates and excellent defoaming action, driving their widespread adoption and dominant market position.

The water-based defoamers segment is anticipated to record the highest CAGR of 5.4% over the forecast period, attributed to its eco-friendly nature and superior performance. As industries shift toward sustainable solutions, water-based defoamers offer a safer alternative to traditional oil-based products, reducing environmental impact and meeting stringent regulatory standards. These defoamers are widely utilized across various industries, including food processing, pharmaceuticals, and wastewater treatment, owing to their non-toxic properties, effectiveness, and ease of use. With surging demand for green technologies, the water-based defoamers industry is set to record significant growth in the coming years.

End Use Insights

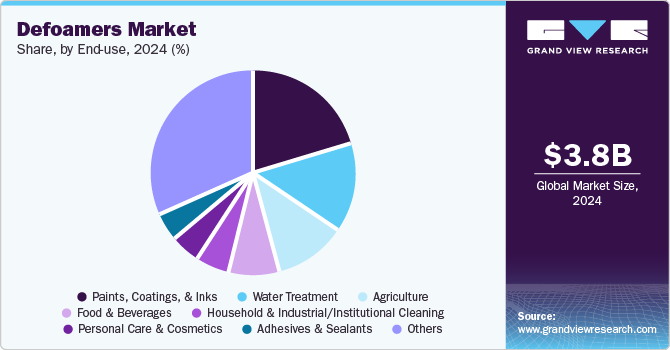

The paints, coatings, & inks segment held the largest share of 21.8% in 2024, owing to the essential role of defoamers in controlling foam during manufacturing and application processes. Defoamers are crucial in these industries, as foam can negatively impact product quality, consistency, and surface finish. The burgeoning demand for high-performance coatings and inks and the need for smoother application processes drives the demand for defoamers. In addition, the rise in eco-friendly formulations and regulatory requirements have further emphasized the importance of advanced defoaming solutions, reinforcing the dominant position of this segment.

The water treatment segment is projected to stand out as the fastest-growing segment, with a CAGR of 5.1% during the forecast period due to increasing global concerns about water quality and the burgeoning demand for effective wastewater management. As municipalities and industries face the challenge of treating large volumes of wastewater, defoamers are crucial in reducing foam formation during the purification processes. The rising need for clean water, stricter environmental regulations, and advancements in water treatment technologies are driving the demand for specialized, eco-friendly defoamers, making this segment a significant contributor to the industry expansion.

Regional Insights

The North America defoamers market is expected to grow with technological advancements, strict environmental regulations, and industrial expansion. The demand for defoamers in key sectors, including paints, coatings, water treatment, and food processing, is surging as companies seek more efficient and sustainable solutions. Furthermore, increasing focus of the region on eco-friendly and biodegradable defoamers aligns with regulatory requirements aimed at reducing environmental impact. With ongoing innovation and the adoption of advanced defoaming technologies, North America is expected to experience significant market expansion.

U.S. Defoamers Market Trends

The defoamers market in the U.S. is shaped by the growing trend toward using renewable resources and the adoption of green chemistry practices in production. As industries prioritize sustainability, a clear shift toward bio-based defoamers derived from renewable raw materials reduces environmental impact. Moreover, the increased demand for high-performance products, particularly in food and beverage, pharmaceuticals, and agriculture sectors, is driving the need for more effective defoamers. These products offer superior performance, durability, and efficiency, aligning with industry requirements for quality and sustainability, further accelerating market growth.

Canada defoamers market growth is driven by the rising expansion of the food and beverage sector and increased demand for water treatment solutions. As the food industry seeks to improve product quality and production efficiency, defoamers are crucial in controlling foam during manufacturing. Besides, surging concerns over water pollution and the need for efficient wastewater management are fueling the demand for defoamers in municipal and industrial water treatment. These trends and technological advancements are expected to propel the market forward.

Europe Defoamers Market Trends

Europe defoamers market is expected to record the highest CAGR of 4.9% from 2025 to 2030, propelled byits well-established industrial base and robust environmental regulations. Stringent policies of the region on wastewater treatment and waste management have significantly boosted the demand for defoamers in industries such as chemicals, food processing, and pharmaceuticals. The rising emphasis on sustainability and eco-friendly solutions has led to the adoption of water-based defoamers, which are widely utilized in various applications. Strong focus on innovation and investments in advanced water treatment technologies in Europe continue to fuel the market growth.

Germany defoamers market growth is driven due to the growing preference for eco-friendly and biodegradable defoamers, along with ongoing innovations in defoaming technologies. As industries increasingly prioritize sustainability, a burgeoning demand for defoamers made from renewable and environment-friendly materials exists. In addition, continuous advancements in defoaming technologies aimed at improving efficiency and reducing environmental impact are further boosting market growth. The strong industrial base of Germany, particularly in chemicals, pharmaceuticals, and wastewater treatment, is projected to fuel the demand for these innovative and sustainable defoaming solutions.

The demand from various end-use industries and the increased adoption of defoamers in pharmaceuticals is expected to drive the growth of the UK defoamers industry. Industries such as food processing, chemicals, and wastewater treatment require effective foam control, boosting the need for defoamers in their production processes. Furthermore, the rising adoption of defoamers by the pharmaceutical sector in drug manufacturing, where foam control is critical during processes of fermentation and formulation, further contributes to market growth. As these sectors expand, the demand for efficient, eco-friendly defoaming solutions is expected to surge in the UK.

Asia Pacific Defoamers Market Trends

Asia Pacific defoamers market held the largest revenue share of 37.5% in 2024, using agrochemicals in agriculture and increasing consumer awareness. The increasing use of pesticides, fertilizers, and herbicides to meet the demand of a growing population has driven the need for defoamers in agricultural applications to control foam during production and processing. Moreover, increasing consumer awareness about sustainability and environmental impact encourages adopting eco-friendly defoamers, further driving market growth. These factors, combined with a rapidly developing agricultural industry, are fueling the demand for defoamers in the region.

Growing environmental policies and regulations around waste management and industrial emissions, along with the food & beverage industry expansion, are anticipated to accelerate the market growth in China. Stricter regulations on water quality and wastewater treatment are increasing the demand for defoamers in industrial and municipal applications to control foam and improve process efficiency. Moreover, as China's food and beverage sector, particularly the dairy, brewing, and soft drinks segments, continues to grow, the need for defoamers in production processes to manage foam also rises, boosting market growth.

The shift toward non-silicone defoamers and growing demand in the oil & gas industry are projected to drive the India defoamers market growth. As industries increasingly focus on eco-friendly and biodegradable alternatives, non-silicone defoamers are gaining popularity due to their environmental benefits. In the oil and gas sector, defoamers are essential for optimizing drilling, production, and wastewater treatment processes by preventing foam buildup. With expanding industrial activities and surging environmental concerns, the demand for advanced, sustainable defoaming solutions is set to propel the defoamers industry in India.

Key Defoamers Company Insights

Some of the key companies in the defoamers industry include Kemira Oyj; Air Products and Chemicals, Inc.; Ashland Inc.; Bluestar Silicones International; Dow Inc.; Evonik Industries AG; Wacker Chemie AG; Shin-Etsu Chemical Co., Ltd.; BASF SE; Elementis PLC; Clariant AG; KCC Basildon; Eastman Chemical Company; Synalloy Chemicals; Tiny Chempro; and Trans-Chemco, Inc.

-

BASF SE delivers innovative and sustainable products and solutions across multiple sectors, such as agriculture, automotive, construction, electronics, and energy. Its goal is to improve everyday life with its diverse and comprehensive services.

-

Evonik Industries AG specializes in specialty chemicals, providing innovative solutions for healthcare, agriculture, and consumer goods industries. Their products improve performance and quality in tires, mattresses, medications, and animal feed.

Key Defoamers Companies:

The following are the leading companies in the defoamers market. These companies collectively hold the largest market share and dictate industry trends.

- Kemira Oyj

- Air Products and Chemicals, Inc.

- Ashland Inc.

- Bluestar Silicones International

- Dow Inc.

- Evonik Industries AG

- Wacker Chemie AG

- Shin-Etsu Chemical Co., Ltd.

- BASF SE

- Elementis PLC

- Clariant AG

- KCC Basildon

- Eastman Chemical Company

- Synalloy Chemicals

- Tiny Chempro

- Trans-Chemco, Inc

Recent Developments

-

In November 2024, Evonik Coating Additives launched two new defoamers, TEGO Foamex 16 and TEGO Foamex 11, designed to enhance sustainability and performance in waterborne architectural coatings. TEGO Foamex 16 targets low to medium PVC coatings, and TEGO Foamex 11 is optimized for high PVC coatings.

-

In November 2023, BASF expanded its defoamer production capacity at its Dilovasi plant in Türkiye with a new production line. This increase enables better response to the growing demand for Foamaster and Foamstar products across South-East Europe, the Middle East, and Africa.

-

In October 2023, Evonik launched TEGO Foamex 8880, a bio-based defoamer for waterborne inks. Hybrid technology with bio-based polymer and polyether siloxane provides effective foam prevention and easy integration at any ink manufacture stage or press-side addition.

Defoamers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.96 billion

Revenue forecast in 2030

USD 5.05 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France, Finland; Sweden; Italy; Spain; Benelux; China; India; Brazil; Chile; Peru

Key companies profiled

Kemira Oyj; Air Products and Chemicals, Inc.; Ashland Inc.; Bluestar Silicones International; Dow Inc.; Evonik Industries AG; Wacker Chemie AG; Shin-Etsu Chemical Co., Ltd.; BASF SE; Elementis PLC; Clariant AG; KCC Basildon; Eastman Chemical Company; Synalloy Chemicals; Tiny Chempro; Trans-Chemco, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

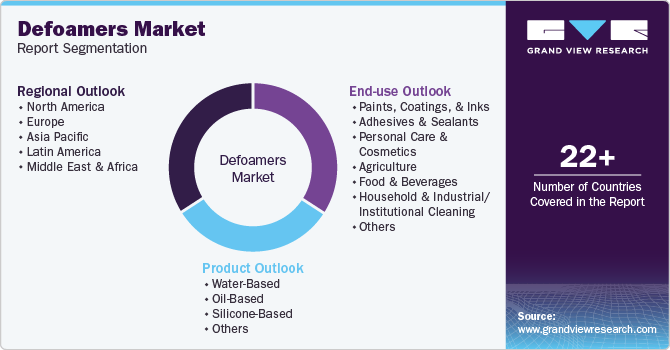

Global Defoamers Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global defoamers market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water-Based

-

Oil-Based

-

Silicone-Based

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints, Coatings, & Inks

-

Adhesives & Sealants

-

Personal Care & Cosmetics

-

Agriculture

-

Food & Beverages

-

Household & Industrial/Institutional Cleaning

-

Water Treatment

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Finland

-

Sweden

-

Italy

-

Spain

-

Benelux

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

Chile

-

Peru

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.