- Home

- »

- Automotive & Transportation

- »

-

Defense Logistics Market Size, Share & Growth Report, 2030GVR Report cover

![Defense Logistics Market Size, Share & Trends Report]()

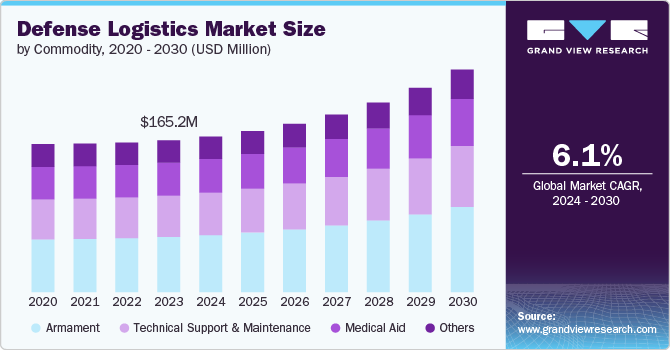

Defense Logistics Market (2024 - 2030) Size, Share & Trends Analysis Report By Commodity (Armament, Technical Support & Maintenance, Medical Aid), By Transport Mode, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-338-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Defense Logistics Market Summary

The global defense logistics market size was estimated at USD 165.2 billion in 2023 and is expected to register a CAGR of 6.1% from 2024 to 2030. The global demand for defense logistics services is experiencing significant growth, driven by a complex interplay of geopolitical factors, military modernization efforts, operational efficiency imperatives, security considerations, and international cooperation initiatives.

Key Market Trends & Insights

- North America dominated the global defense logistics market with the largest revenue share of 35.0% in 2023.

- The defense logistics market in the U.S. led the North America market and held the largest revenue share in 2023.

- By commodity, the armament segment led the market, holding the largest revenue share of 36.4% in 2023.

- By mode of transport, the airways segment is expected to grow at the fastest CAGR of 7.3% from 2024 to 2030.

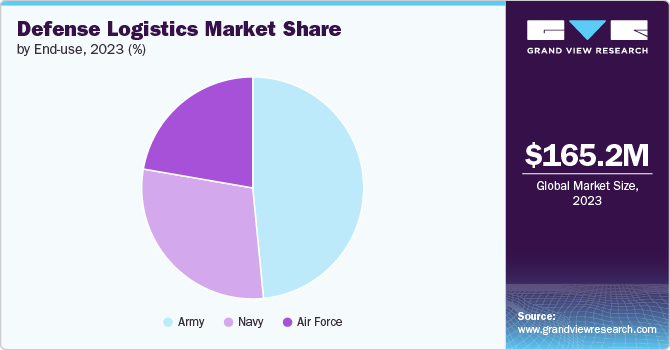

- By end use, the army segment held the dominant position in the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 165.2 Billion

- 2030 Projected Market Size: USD 242.4 Billion

- CAGR (2024-2030): 6.1%

- North America: Largest market in 2023

Geopolitical tensions across various regions have heightened the need for robust defense logistics capabilities. Nations are increasingly focused on securing supply chains and ensuring swift deployment of military resources in response to evolving threats and conflicts. This necessitates efficient transportation, supply chain management, and maintenance support to sustain military operations effectively.

In addition, many countries are investing in military modernization programs to upgrade their defense capabilities. These programs involve the acquisition of advanced equipment, technology, and infrastructure. As a result, there is a growing need for efficient defense logistics to ensure the timely delivery and maintenance of these modernized assets. Moreover, efficient defense logistics are essential not only for the initial delivery of equipment but also for ongoing support and maintenance throughout the lifecycle of these assets. This includes logistics services such as inventory management, spare parts distribution, technical support, and repair services, all of which are crucial for sustaining operational readiness and maximizing the lifespan of military equipment.

Technological advancements in the defense logistics market are transforming how military forces plan, execute, and sustain their operations. These advancements encompass a range of innovations aimed at improving efficiency, reliability, and flexibility in logistics support for defense forces worldwide. One significant area of technological advancement is in the use of digitalization and automation. This includes the adoption of advanced data analytics, artificial intelligence (AI), and machine learning algorithms to enhance decision-making processes in logistics planning and supply chain management. Predictive analytics, for instance, enables military planners to anticipate demand, optimize routes, and manage inventories more effectively, thereby reducing costs and improving responsiveness.

In addition, advancements in robotics and autonomous systems are revolutionizing logistics operations in the defense sector. Autonomous vehicles and drones are increasingly used for transportation and delivery tasks, particularly in challenging or hazardous environments where human intervention may be limited or impractical. These technologies not only enhance logistics speed and reliability but also contribute to minimizing risks to personnel and improving mission success rates.

However, one significant market restraint for defense logistics is regulatory and compliance challenges. These constraints arise from stringent regulations governing international trade, transportation of hazardous materials, and security protocols, which can significantly impact the efficiency and cost-effectiveness of logistics operations. For instance, export control regulations restrict the movement of military equipment and technologies across borders, requiring meticulous documentation and compliance with export licensing requirements. These regulations can lead to delays in shipments, increased administrative burden, and higher operational costs for defense logistics providers.

In addition, security and safety standards impose rigorous requirements on the handling, storage, and transportation of sensitive military assets and hazardous materials. Compliance with these standards demands specialized expertise, infrastructure, and investments in security measures, which can pose logistical challenges and increase operational expenses.

Commodity Insights

The armament segment held the largest market share of 36.4% in 2023 in the target market due to several underlying factors. Firstly, the continuous global demand for military armaments, which include weapons, ammunition, vehicles, and related hardware, drives significant investments in defense procurement. Many countries are actively modernizing their military forces, upgrading equipment to enhance capabilities and readiness in response to evolving security threats and geopolitical tensions.

Armaments present unique challenges that require specialized handling and infrastructure. These items are often large, heavy, and sensitive, requiring careful transportation, storage, and maintenance procedures to ensure operational readiness. The complexity of managing armament supply chains necessitates expertise in logistics planning, coordination, and execution, contributing to the segment's substantial market share.

The technical support & maintenance segment registered a significant CAGR of 6.3% in the target market. As military forces worldwide continue to modernize their equipment and technology, there is a growing need for comprehensive technical support and maintenance services. These services encompass a range of activities such as equipment repairs, upgrades, and preventive maintenance, all crucial for ensuring the operational readiness and longevity of military assets. In addition, advancements in defense technologies have led to increasingly complex systems and equipment that require specialized technical expertise for maintenance and support. Military organizations rely on external logistics providers with the capability to deliver high-quality technical services, including troubleshooting, diagnostics, and rapid response capabilities to minimize downtime and ensure mission readiness.

Mode of Transport Insights

The roadways segment held the largest market share of 42.5% in 2023. Road transportation offers enhanced flexibility and accessibility. Unlike other modes of transport, roadways provide the ability to reach a wide range of destinations, including remote or difficult-to-access areas. This flexibility is crucial for military operations, which often require the movement of personnel, equipment, and supplies to diverse locations, sometimes on short notice.

The extensive road networks in many regions further enhance this accessibility, allowing for efficient and direct transportation routes. In addition, road transport provides a high degree of control and security, which is paramount in defense logistics. Military organizations can maintain direct oversight of their cargo throughout the journey, implementing stringent security measures as needed. This level of control is particularly important when transporting sensitive or classified materials, as it minimizes the risk of interference or compromise.

The airways segment registered the highest CAGR of 7.3% over the forecast period. Air transport plays a crucial role in defense logistics due to its ability to quickly and efficiently deploy military personnel, equipment, and supplies to distant locations. The rising prominence of air transport in military logistics, along with the introduction of various options such as unmanned aerial vehicles (UAVs), is expected to drive the growth of the airways segment. UAVs are being increasingly utilized for delivering critical supplies, such as medical equipment, to remote or dangerous locations. For instance, the U.S. Army's plans to test UAV drones equipped with autonomous technology for battlefield medical supply delivery demonstrate the growing integration of these advanced technologies in military logistics operations.

End Use Insights

On the basis of end use, the market is classified into army, navy, and air force. The army segment dominated the market with a revenue share of 48.5% in 2023. This significant market presence can be attributed to several key factors that underscore the army's central role in defense operations and logistics. Armies typically represent the largest component of a nation's defense forces, requiring extensive logistical support to maintain operational readiness. This includes the transportation, supply, and maintenance of a wide array of equipment, ranging from vehicles and weaponry to communication systems and field infrastructure.

In addition, the army's diverse operational requirements necessitate robust logistics capabilities to support various mission types, including combat operations, peacekeeping missions, disaster relief efforts, and training exercises. Effective logistics ensure that troops are adequately supplied, equipped, and supported throughout their missions, contributing to mission success and troop welfare.

The air force segment is anticipated to register a significant CAGR of 5.8% over the forecast period in the target market. Air forces play a critical role in providing strategic airlift, rapid deployment, and air superiority capabilities during military operations. These capabilities are essential for conducting surveillance, reconnaissance, and combat missions across diverse and challenging environments, including remote or inaccessible areas where other transportation modes may be impractical or insufficient.

Regional Insights

The defense logistics market in North America held the highest market share of 35.0% in 2023. The region's dominance can be attributed to several factors, including consistent upward trends in defense budgets, which facilitate greater investments in the development of logistics infrastructure. North America is home to prominent industry players and has a strong focus on military capabilities, contributing to its significant market share in the defense logistics sector. In addition, North America benefits from a well-established transportation and logistics infrastructure, including air, sea, and land routes. This infrastructure supports efficient and secure transportation of military equipment, personnel, and supplies, facilitating rapid deployment, strategic mobility, and logistical support for defense operations.

U.S. Defense Logistics Market Trends

In 2023, the U.S. defense logistics market held the largest share, 77.3%, in the North America region. The U.S. military's global reach and operational tempo necessitate a highly integrated and responsive supply chain. This integrated approach spans multiple transportation modes, including air, sea, and land, facilitating rapid deployment and strategic mobility of personnel and resources. Such capabilities are essential for supporting diverse missions ranging from combat operations and humanitarian assistance to peacekeeping missions and disaster relief efforts. The ability to quickly mobilize and sustain operations in various geographic regions underscores the importance of robust and flexible logistics capabilities within the U.S. defense framework.

Asia Pacific Defense Logistics Market Trends

The Asia Pacific market is projected to grow at the highest rate, with an estimated CAGR of 7.0% over the forecast period. Rapid economic growth across many countries in the Asia Pacific region has spurred increased defense spending and modernization efforts. Countries are prioritizing the enhancement of their defense capabilities through the acquisition of advanced military equipment, technology upgrades, and infrastructure development, which in turn drives demand for sophisticated defense logistics solutions.

Europe Defense Logistics Market Trends

The demand for Defense logistics in Europe is experiencing significant growth, driven by several key factors. Many European countries are members of NATO (North Atlantic Treaty Organization) and participate in collective defense initiatives. This collective security framework necessitates coordinated logistics planning and interoperable capabilities to support joint military operations, exercises, and missions. The adoption of standardized logistics procedures and interoperable systems facilitates seamless integration and collaboration among allied forces.

Key Defense Logistics Company Insights

Some of the key companies operating in the Defense logistics market include FedEX, Deutsche Post AG, among others.

-

FedEx is one of the global leaders in transportation, logistics, warehousing & order fulfillment, and courier delivery services. The company’s operations and activities are categorized under four reportable business segments, namely FedEx Freight, FedEx Express, FedEx Services, and FedEx Ground. FedEx Express utilizes a vast air cargo network to ensure fast and timely deliveries across the globe to more than 220 countries. The company’s global network provides air-ground express service and is time-sensitive through more than 650 airports worldwide, transporting an average volume of 5.3 million packages daily.

-

Deutsche Post AG provides a wide range of services, including letter & parcel dispatch, freight transport, express delivery, e-commerce, and supply chain management solutions. The company has organized its business into five operating divisions, namely Post & Parcel Germany; Global Forwarding, Freight; Express; Supply Chain; and eCommerce Solutions. Deutsche Post AG’s Post & Parcel Germany division is engaged in providing various products and services ranging from physical & hybrid letters to merchandise for both private and business customers. The Express division transports urgent goods and documents door-to-door. The Global Forwarding Freight division provides air, land, and ocean freight forwarding services, including multimodal and sector-specific solutions.

CEVA Logistics and are some of the emerging market companies in the target market.

- CEVA Logistics is a global freight forwarding and logistics company that provides a wide range of supply chain management services. It operates in over 160 countries and provides a range of services including freight management, contract logistics, and transportation. CEVA Logistics focuses on offering integrated solutions to optimize supply chains and improve efficiency for its clients across various industries.

-

Scan Global Logistics is an international logistics and freight forwarding company headquartered in Copenhagen, Denmark. The company provides a wide range of logistics solutions, including air freight, sea freight, road transport, and warehousing. They serve various industries, such as automotive, healthcare, retail, and technology. Scan Global Logistics focuses on delivering customized and flexible solutions to meet the specific needs of their clients, emphasizing efficiency and reliability. With a global network of offices and partners, they are capable of handling complex supply chain requirements and providing end-to-end logistics services.

Key Defense Logistics Companies:

The following are the leading companies in the defense logistics market. These companies collectively hold the largest market share and dictate industry trends.

- FedEx

- Maritime Logistics

- Scan Global Logistics

- Deutsche Post AG

- A.P. Moller-Maersk

- Aero Cargo Logistics

- SEKO Logistics

- CargoTrans

- CEVA Logistics

- Kuehne+Nagel

Recent Developments

-

In May 2024, A.P. Moller-Maersk announced the opening of a new air freight in-transit gateway in Miami, Florida, to enhance connectivity between Asia, Latin America, and the U.S., providing a strategic node in its global air freight network. The 90,000-square-foot facility, fully staffed by Maersk professionals, aims to support transshipping European and Asian cargo to Latin America, improving transit times, connectivity, and reliability for customers.

-

In May 2022, FedEx. and Aurora Innovation, Inc. jointly announced the extension of their pilot program aimed at autonomously transporting FedEx shipments. The extension involved the inclusion of an additional commercial lane in Texas, marking a strategic advancement in their collaborative efforts toward autonomous shipping solutions.

-

DSV signed an agreement to acquire two U.S.-based logistics companies, Global Diversity Logistics and S&M Moving Systems West. This strategic acquisition aimed to enhance DSV's presence in the industry by providing a comprehensive range of services, including domestic road freight, international air and sea freight, tradeshow logistics, warehousing, and specialized solutions.

Defense logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 169.6 billion

Revenue forecast in 2030

USD 242.4 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Commodity, mode of transport, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa

Key companies profiled

FedEx; Maritime Logistics; Scan Global Logistics; Deutsche Post AG; A.P. Moller-Maersk; Aero Cargo Logistics; SEKO Logistics;CargoTrans; CEVA Logistics; Kuehne+Nagel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Defense Logistics Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global defense logistics market report based on commodity, mode of transport, end use, and region.

-

Commodity Outlook (Revenue, USD Billion, 2017 - 2030)

-

Armament

-

Technical Support & Maintenance

-

Medical Aid

-

Others

-

-

Mode of Transport Outlook (Revenue, USD Billion, 2017 - 2030)

-

Roadways

-

Waterways

-

Airways

-

Railways

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Army

-

Navy

-

Air Force

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global defense logistics market size was estimated at USD 165.2 billion in 2023 and is expected to reach USD 169.6 billion in 2024.

b. The global defense logistics market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 242.4 billion by 2030.

b. The army segment claimed the largest market share of 48.5% in 2023 in the defense logistics market, driven by surge in government defense expenditure, military modernization programs, rise in military conflicts and geopolitical tension, and the need for an effective and resilient supply chain for the military.

b. Prominent players in the Defense Logistics Market are FedEx, Maritime Logistics, Scan Global Logistics, Deutsche Post AG, A.P. Moller-Maersk, Aero Cargo Logistics, SEKO Logistics,CargoTrans, CEVA Logistics, and Kuehne+Nagel.

b. The defense logistics market is driven by factors such as the globalization of military operations, technological advancements, and a focus on sustainability. These factors contribute to the growth and development of the defense logistics market, ensuring the timely and effective delivery of resources and equipment to support military operations worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.