- Home

- »

- Homecare & Decor

- »

-

Decorative Rugs Market Size, Share & Trends Report, 2030GVR Report cover

![Decorative Rugs Market Size, Share & Trends Report]()

Decorative Rugs Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Machine-Made Rugs, Cotton), By Material (Wool, Cotton), By Application (Residential, Commercial), By Distribution Channel (Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-258-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Decorative Rugs Market Size & Trends

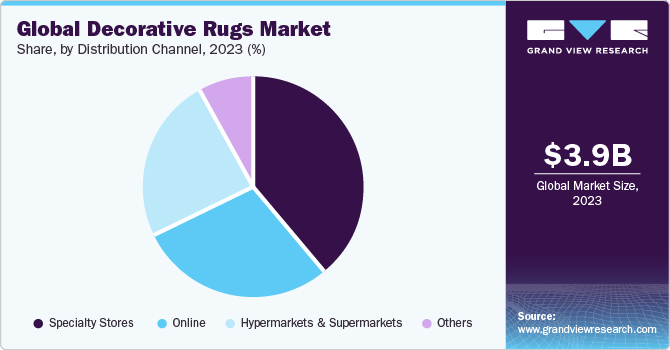

The global decorative rugs market size was valued at USD 3.86 billion in 2023 and is expected to register a CAGR of 6.2% from 2024 to 2030. The demand for decorative rugs is growing globally due to several factors. There is a rising trend of home decoration and renovation, driven by increased disposable income and a desire for personalized living spaces. Additionally, the growing popularity of online shopping has made decorative rugs more accessible to a global audience. Lastly, the increasing awareness of the role of interior design in enhancing living spaces has led to a higher demand for decorative rugs as a key element in home decor.

The trend of increased holiday spending, especially on decorations, is boosting demand for decorative rugs. As Americans allocate more of their holiday budget for decor, the desire to create festive and cozy atmospheres in their homes grows. According to a survey of 2,100 Americans conducted by Rainbow Restoration, the average expenditure on holiday decor is USD 147 per person annually. This trend is particularly evident in states like Mississippi, where residents spend an average of USD 522 extra on holiday expenses, including decor. As consumers seek to enhance their holiday ambiance, decorative rugs are becoming a popular choice to complement their festive home decorations, contributing to the growing demand for these products.

The shopping trends of Gen Z and Millennials, particularly their focus on home-related items, are boosting the decorative rugs industry. According to the 2023 YPulse “Shopping for the Home Report,” 33% of Millennials and 23% of Gen Zers plan to buy rugs for their homes in the coming year 2024. As these demographics age and become more financially stable, they will likely become even more prominent segments in the home decor market. This trend presents a significant opportunity for the decorative rugs market to cater to the preferences and purchasing habits of these younger consumers.

Sustainability is a rising trend in this market, with consumers across generations showing an increased preference for sustainable products. Polypropylene rugs are gaining popularity due to their approval for consumer use by the U.S. government and their perceived environmental benefits compared to other plastics. Gen Z's influence on their parents and grandparents is notable, with Gen X consumers' preference for sustainable brands increasing by nearly 25% according to an article by Forbes published in March 2022, and their willingness to pay more for sustainable products by 42% in the past two years. This trend of sustainability is expected to boost the market for decorative rugs as more consumers prioritize eco-friendly options.

Constant product launches are driving the decorative rugs industry’s growth by offering consumers innovative and stylish options to enhance their living spaces. In September 2023 Rugs USA partnered with designer Prabal Gurung to release rugs. This collaboration, featuring 28 stunning rugs in a range of patterns and sizes, demonstrates how designers are expanding their creative endeavors into home decor. With prices starting at USD 85 and including a variety of materials like machine-washable, 100% wool, and recycled materials, this collection showcases the diversity and affordability of modern decorative rugs. Such launches not only cater to consumers' desire for unique and high-quality products but also contribute to the overall growth and dynamism of this industry.

Market Concentration & Characteristics

The degree of innovation in the decorative rugs industry is significant, with constant advancements in design, materials, and technology. From sustainable materials like recycled fibers to innovative weaving techniques and customizable options, decorative rugs continue to evolve to meet the changing demands and preferences of consumers.

Regulations in the market play a significant role in ensuring product safety and consumer protection. They often focus on issues such as flammability, chemical content, and labeling requirements to ensure that rugs meet certain standards for quality and safety. Compliance with these regulations can impact the manufacturing process and product availability, influencing consumer purchasing decisions and market trends.

In the market, there are several substitutes available, including carpeting, hardwood flooring, and vinyl flooring. These substitutes offer different aesthetics and functionalities, providing consumers with a range of options to suit their preferences and needs.

The end-user concentration in the decorative rugs industry is diverse, ranging from individual consumers looking to enhance their homes to interior designers and decorators seeking to fulfill client projects. This diverse end-user base contributes to the market's stability and growth, as demand is driven by both personal and professional needs for stylish and functional rug options.

Product Insights

The machine-made rugs segment held a revenue share of about 42.2% in 2023. Machine-made rugs are more prominent in the decorative rugs industry due to their cost-effectiveness, consistency in quality and design, and ability to replicate intricate patterns and textures. These rugs are widely available, making them accessible to a larger consumer base compared to handmade rugs.The presence of prominent players like Oriental Weavers and Balta Group, offering high-quality machine-made rugs, contributes to the popularity of these rugs in the decorative rugs business. In 2022, for instance, Oriental Weavers' 79% revenue share was from its Woven Segment, which involves the production of three grades of machine-woven rugs and carpets. This underscores the market demand for machine-made rugs, which are known for their cost-effectiveness, consistent quality, and diverse product ranges.

The demand for flatweave rugs is expected to grow at a CAGR of about 7.0% from 2024 to 2030. Flatweave rugs are highly durable and require minimal maintenance, making them ideal for use in high-traffic areas. Their lightweight and flexible nature also contribute to their popularity, as they can be easily moved and used in various living spaces. Additionally, flatweave rugs often feature intricate patterns and designs, adding a stylish and personalized touch to any room.

Distribution Channel Insights

Sales of decorative rugs through specialty stores dominated the market with a share of 38.5% in 2023. Specialty stores, including home improvement giants like Home Depot, have been expanding their offerings and presence, which positively affects the decorative rugs industry. Home Depot's plans to open 12 stores in 2024 indicate continued growth and opportunity in the home improvement sector. Specialty stores offer a curated selection of decorative rugs, providing consumers with a wide range of options to enhance their homes. This expansion strategy not only increases accessibility to decorative rugs but also drives competition, leading to innovation and improved product offerings in the market.

Sales of decorative rugs through online channels is expected to grow at a CAGR of about 6.7% in the forecast period from 2024 to 2030. The demand for decorative rugs through online channels is expected to rise due to increased convenience and accessibility for consumers. Direct-to-consumer (D2C) brands play a significant role in this trend, offering unique and high-quality rugs directly to consumers, cutting out the middleman and providing a seamless shopping experience. In May 2023, D2C custom rug company Ernesta opened its eCommerce site to more customers.Ernesta's new strategy focuses on offering consumers a curated collection of custom-sized rugs through an online store, with an expanded reach of 30,000 ZIP codes. The company aims to simplify the rug shopping experience by allowing customers to choose up to five samples to visualize materials and textures in their homes before making a purchase.

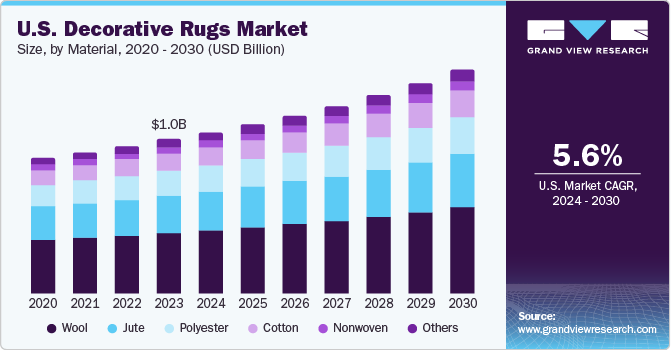

Material Insights

The woolen decorative rugs segment accounted for a revenue share of about 39.5% in 2023. Woolen rugs are in demand and popular due to their natural warmth, softness, and durability. They provide excellent insulation, making them ideal for colder climates, and their natural resilience helps them maintain their shape and appearance over time. A constant series of product launches has also been pushing demand for wool decorative rugs. In November 2023 for instance, Rugs USA collaborated with interior designer Emily Henderson to release a 20-piece exclusive collection of rugs. The collection featured Blue Fountain Checked Wool Rug handmade using 100% wool.

The demand for cotton decorative rugs is expected to grow at a CAGR of about 7.1% from 2024 to 2030. This is due to their soft texture, breathability, and versatility. Cotton rugs are lightweight and easy to maintain, making them suitable for a variety of indoor spaces. Additionally, cotton is a natural and sustainable material, aligning with the increasing consumer preference for eco-friendly products. In May 2023, Williams-Sonoma Inc. launched its GreenRow brand which aims to offer sustainable furniture and home décor. Its initial assortment of products included handcrafted rugs, made using non-toxic dyes extracted from vegetable dyes.

Application Insights

The residential segment held the largest revenue share of 67.3% in 2024. Rugs can transform a room by defining areas, adding color and texture, and creating a cozy ambiance. The customization and premiumization trend is driving the decorative rugs industry, as seen with the luxury brand Tamarian launching its Curated Custom program in January 2024. By offering custom designs and premium materials like 100% Nepalese wool, brands can cater to the higher-end market seeking unique and high-quality products that stand out from mass-produced options. This trend reflects a shift towards personalized and luxurious home decor, driving demand for custom and premium decorative rugs.

Demand for decorative rugs in the commercial sector is set to grow at a CAGR of about 6.5% from 2024 to 2030. Since interior architects and designers are using rugs more regularly to control acoustics and soften the look of hard surface flooring, the need for decorative carpets in commercial settings is expected to increase.Mannington Commercial launched its new Elevate Collection at NeoCon 2022, adding to its portfolio of floor-covering products. The collection features eight styles in a range of colors and patterns, offering designers a sophisticated and tailored option for commercial design projects.

Regional Insights

The decorative rugs market in North America held 35.8% of the global revenue share in 2023. This is due to a strong preference for home decor and interior design, a large base of affluent consumers willing to invest in high-quality rugs, and a well-established retail infrastructure that includes specialty stores and online channels.

U.S. Decorative Rugs Market Trends

The decorative rugs market in the U.S. is expected to grow at a CAGR of 5.6% from 2024 to 2030. The U.S. maintains its position as the leading global importer of rugs, importing a diverse range of styles, materials, and price ranges to meet the needs of its varied consumer market. Trading Economics data indicates that in 2023, U.S. imports of carpets and other textile floor coverings totaled USD 3.43 billion.

Asia Pacific Decorative Rugs Market Trends

The decorative rugs industry in Asia Pacific is set to grow at a CAGR of about 6.9% over the forecast period. This is due to the rising disposable incomes, urbanization, and interest in home decor. Market players are recognizing the growth potential in Asia Pacific, exemplified by IKEA's strategic expansions in Japan, China, and Korea. IKEA Japan's increased accessibility through pop-up stores, pick-up points, and zero-emission deliveries reflects a broader trend of companies investing in the region's market. This expansion is likely to impact the regional market positively.

Key Decorative Rugs Company Insights

The market is highly fragmented with the presence of numerous top and regional companies across major economies. Multinational companies such as Balta Group, Mohawk Industries Inc., and Oriental Weavers Group compete with local brands that offer consumer-centric products at competitive prices, driving innovation and product diversity in the market.

Key Decorative Rugs Companies:

The following are the leading companies in the decorative rugs market. These companies collectively hold the largest market share and dictate industry trends.

- Balta Group

- Mohawk Industries Inc.

- Oriental Weavers Group

- Nourison

- Capel Rugs

- Harounian Rugs International

- Loloi Inc.

- Milliken and Co.

- Momeni Inc.

- Agnella

Recent Developments

-

In November 2023, Oriental Weavers Group collaborated with a leading solar energy solutions provider, Amarenco Solarize, to power its factory in the Tenth of Ramadan area using solar energy. The goal of the 1.3 MWp solar power plant is to supply 80% of the factory's energy needs, which will result in a yearly decrease of 2,300 tons of carbon emissions.

-

In April 2022, Victoria Flooring, an international manufacturer, designer, and distributor of innovative flooring based in Worcestershire, acquired the rugs division of Balta Group, a Belgium-based flooring company. This acquisition includes Balta Group's UK polypropylene carpet and non-woven carpet businesses, as well as the renowned brand, Balta.

-

In January 2021, Mohawk Industries Inc. invested USD 22.5 million to expand its operations in Carroll County, aiming to enhance its facility in Hillsville. The expansion includes adding 19,000 square feet and installing new extrusion and loom equipment to boost production speed. The Hillsville facility specializes in manufacturing rug-backing from 100 percent recycled post-consumer materials, which is utilized in producing commercial rugs at its Rockbridge County facility and other Mohawk carpet manufacturing locations.

Decorative Rugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.05 billion

Revenue forecast in 2030

USD 5.81 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

The base year for estimation

2023

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; UK; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa

Key companies profiled

Balta Group; Mohawk Industries Inc.; Oriental Weavers Group; Nourison; Capel Rugs; Harounian Rugs International; Loloi Inc.; Milliken and Co.; Momeni Inc.; Agnella

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Decorative Rugs Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global decorative rugs market report based on product, material, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Machine-Made Rugs

-

Hand-tufted Rugs

-

Hand-knotted Rugs

-

Flatweave Rugs

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wool

-

Jute

-

Polyester

-

Cotton

-

Nonwoven

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global decorative rugs market size was estimated at USD 3.86 billion in 2023 and is expected to reach USD 4.05 billion in 2024.

b. The global decorative rugs market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 5.81 billion by 2030.

b. North America dominated the decorative rugs market with a share of around 35% in 2023. This is due to a strong preference for home decor and interior design, a large base of affluent consumers willing to invest in high-quality rugs, and a well-established retail infrastructure that includes specialty stores and online channels.

b. Some key players operating in the decorative rugs market include Balta Group; Mohawk Industries Inc.; Oriental Weavers Group; Nourison; Capel Rugs; Harounian Rugs International; Loloi Inc.; Milliken and Co.; Momeni Inc.; Agnella.

b. Key factors that are driving the decorative rugs market growth include a rising trend toward home decoration and renovation, driven by increased disposable income and a desire for personalized living spaces, growing popularity of online shopping, and increasing awareness of the role of interior design in enhancing living spaces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.