Deception Technology Market Size, Share & Trends Analysis Report By Component (Solution, Service), By Deception Stack, By Deployment, By Organization Size, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-375-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Deception Technology Market Size & Trends

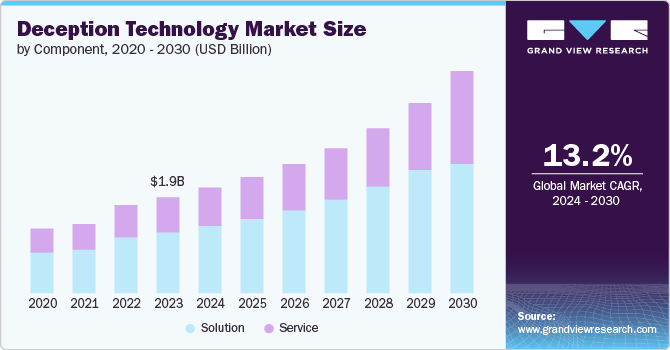

The global deception technology market size was estimated at USD 1.98 billion in 2023 and is projected to grow at a CAGR of 13.2% from 2024 to 2030. The market is experiencing significant growth, driven by the increasing sophistication of cyber threats and the rising frequency of cyberattacks. Organizations are recognizing the limitations of traditional cybersecurity measures and are turning to deception technology to enhance their defenses. The market's expansion is supported by growing investments in cybersecurity infrastructure and the development of innovative deception solutions by both established companies and startups. Adoption is particularly strong in industries with high-value data and critical operations, such as finance, healthcare, and government, where the need for robust security measures is paramount. As awareness of deception technology's benefits spreads, more sectors are expected to integrate these solutions into their cybersecurity strategies.

Effective implementation of deception technology relies not only on the technology itself but also on the education and awareness of users and security teams. Organizations are increasingly using deception technology to conduct realistic training and simulation exercises, helping security personnel improve their incident response skills and familiarity with deception tactics. Awareness programs are crucial for ensuring that employees understand the purpose and functioning of deception technology within their environments. This awareness helps in preventing accidental exposure of deception assets and enhances the overall security posture by aligning human behavior with deception strategies.

Artificial intelligence (AI) and machine learning (ML) are playing crucial roles in advancing deception technology, enabling the creation of more sophisticated and adaptive deception environments. AI-driven deception solutions can dynamically adjust decoys and traps based on attacker behavior, making it increasingly difficult for intruders to differentiate between real and fake assets. Machine learning algorithms analyze attack patterns and behavior to refine deception strategies and improve detection accuracy over time. These technologies also facilitate automated threat response by predicting potential attack paths and deploying appropriate countermeasures. The integration of AI and ML not only enhances the effectiveness of deception but also reduces the need for manual intervention, streamlining security operations. Subsequently, fostering the deception technology market growth.

Component Insights

The solution segment led the market and accounted for 63.5% of the global revenue in 2023. The increasing demand for more effective cybersecurity solutions stems from the escalating frequency and sophistication of cyber-attacks. Traditional security measures are no longer adequate as Advanced Persistent Threats (APTs) and zero-day attacks become more prevalent. This shift necessitates the adoption of proactive and deceptive defense mechanisms. Deception technology offers a robust method for detecting and mitigating these advanced threats by enticing attackers into decoy systems. This approach enables organizations to identify and respond to attacks early, preventing significant damage.

The demand for professional services is rising as organizations require assistance with the deployment, customization, and optimization of deception technologies. These services include consulting, implementation, and training, helping organizations maximize the effectiveness of their deception solutions. Professional services ensure that the deception technology is tailored to the specific needs of the organization. This customization enhances the overall security posture and provides better protection against sophisticated threats.

Deception Stack Insights

The data security segment held the largest global revenue share in 2023. Deception technology is becoming a critical component of advanced threat detection and response strategies in the data security segment. By deploying decoy data and deceptive environments, organizations can detect and divert malicious activities targeting their sensitive information. This approach allows for early identification of potential threats and minimizes the risk of data breaches. Integrating deception technology into threat detection frameworks enhances the ability to respond to sophisticated cyber-attacks with greater precision. Consequently, organizations are better equipped to protect their data from emerging and advanced threats.

A growing trend in the application security segment is the integration of deception technology with DevSecOps practices. Organizations are embedding deception tools into their development, security, and operations workflows to enhance application security from the ground up. This integration ensures that security is considered at every stage of the application lifecycle, from development to deployment and maintenance. By incorporating deception technology, organizations can detect and mitigate threats early in the development process, reducing vulnerabilities in production environments. This proactive approach helps create more secure applications and reduces the risk of cyber-attacks.

Deployment Insights

The cloud segment held the largest revenue share in 2023. The increasing use of multi-cloud strategies by organizations is driving the adoption of deception technology to protect these complex environments. Deception tools are being deployed across multiple cloud platforms to create a unified security framework that can detect and respond to threats in real-time. This trend addresses the unique security challenges posed by managing and securing resources spread across different cloud providers. By using deception technology, organizations can ensure consistent security policies and threat detection capabilities across all cloud environments. This growing trend helps mitigate risks associated with multi-cloud deployments and enhances overall cloud security.

A growing trend in the on-premises segment is the integration of deception technology with legacy IT systems. Many organizations still rely on older infrastructure that may lack advanced security features. By incorporating deception tools, these organizations can enhance their existing security measures without a complete overhaul of their systems. This integration helps detect and respond to threats that specifically target legacy environments. The trend of integrating deception technology with legacy systems ensures that even older IT infrastructures are protected against modern cyber threats.

Organization Size Insights

The large enterprises segment held the largest revenue share in 2023. The rise of Advanced Persistent Threats (APTs) is a significant driver of deception technology adoption among large enterprises. APTs involve prolonged and targeted cyberattacks that often bypass traditional security measures, necessitating more sophisticated defenses. As these threats become more prevalent, organizations are compelled to invest in technologies that can detect and mitigate such risks effectively. Deception technology provides a unique advantage by creating a controlled environment where attackers can be lured into interacting with decoys, allowing security teams to gather intelligence on their tactics and techniques. This capability not only enhances threat detection but also helps organizations develop more robust incident response strategies.

Government agencies are increasingly recognizing the importance of deception technology in safeguarding critical information. This is reflected in the inclusion of deception technology in various cybersecurity frameworks, which encourages its adoption across sectors, including SMEs. In the U.S., the National Institute of Standards and Technology (NIST) has incorporated deception technology into its Cybersecurity Framework, guiding its implementation and use. Similarly, the European Union's Network and Information Security (NIS) Directive emphasizes the importance of deception technology in enhancing the resilience of critical infrastructure. As governments continue to prioritize cybersecurity and implement stricter regulations, SMEs will be compelled to adopt advanced security measures like deception technology to comply with these standards and protect sensitive data.

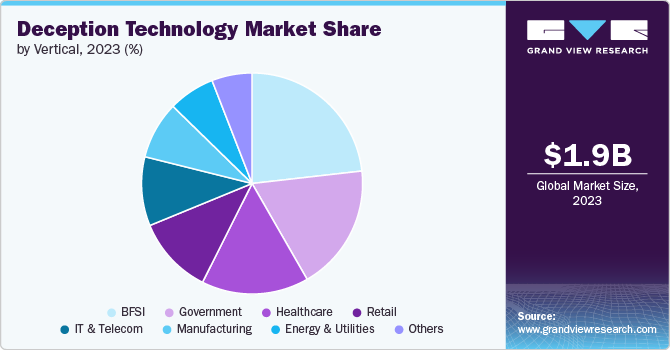

Vertical Insights

The BFSI segment held the largest market revenue share in 2023. Deception technology is increasingly used in the BFSI sector to mitigate insider threats, which pose significant risks due to the access employees have to critical financial data. Deception tools can create decoy files, documents, and systems that entice malicious insiders to reveal their intentions. By monitoring interactions with these decoys, organizations can detect suspicious behavior and unauthorized access attempts by employees or contractors. This trend aids in preventing data breaches and financial fraud perpetrated by insiders, enhancing overall security within financial institutions.

Real-time threat intelligence and incident response capabilities are essential trends driving the adoption of deception technology in manufacturing. Deception tools provide real-time alerts and actionable insights into cyber threats as they occur within manufacturing environments. By analyzing interactions with decoy assets, security teams can quickly detect and respond to threats, minimizing the impact on production and operational continuity. This trend supports proactive incident management and enhances the ability to mitigate risks associated with cyber incidents, ensuring uninterrupted manufacturing processes and protecting business operations.

Regional Insights

North America dominated the market and accounted for a 35.3% revenue share in 2023. Enhancing incident response capabilities is a growing trend in North America using deception technology. Organizations deploy deception tools to improve their ability to detect, analyze, and respond to cybersecurity incidents in real-time. By deploying decoy assets and monitoring interactions, security teams can identify malicious activities and mitigate potential threats before they escalate. This proactive approach helps in minimizing the impact of security breaches and maintaining operational continuity. The trend of enhancing incident response capabilities with deception technology supports effective incident management and strengthens overall cybersecurity resilience in North America.

U.S. Deception Technology Market Trends

A growing trend in the U.S. is the use of deception technology to enhance the detection and mitigation of insider threats. Organizations are increasingly concerned about malicious actions by employees, contractors, or partners with legitimate access to systems and data. Deception tools create decoy assets and environments that lure and detect suspicious behavior within networks. By monitoring interactions with these decoys, organizations can identify unauthorized activities and potential breaches initiated by insiders. This proactive approach helps mitigate risks and strengthens overall cybersecurity defenses against insider threats in the U.S.

Europe Deception Technology Market Trends

The Europe region faces an increasing number of sophisticated cyber threats, including ransomware, phishing, and insider attacks. Deception technology is being used to enhance defenses by creating decoy systems and data that attract and identify malicious activities. By analyzing interactions with decoys, organizations can detect threats early and mitigate risks before they impact critical operations. This proactive approach strengthens cybersecurity posture in Europe and helps businesses protect intellectual property, financial assets, and sensitive information from evolving cyber threats.

Asia Pacific Deception Technology Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region is experiencing an increase in cyber threats and security concerns, driven by rapid digital transformation and connectivity. Deception technology is being adopted to enhance defenses against advanced cyber-attacks such as ransomware, phishing, and nation-state threats. By creating decoy assets and environments, organizations can detect and divert attacks, gaining valuable insights into attacker behavior. This proactive approach strengthens cybersecurity posture in APAC and helps businesses protect critical data, intellectual property, and infrastructure from evolving threats.

Key Deception Technology Company Insights

The market for deception technology is characterized by intense competition and a significant concentration of market share among leading players such as Illusive Networks; Logrhythm, Inc.; Rapid7, Inc.; and Smokescreen Technologies as of 2023. These companies focus on expanding their customer bases to maintain a competitive advantage, employing strategic initiatives such as partnerships, mergers, acquisitions, collaborations, and the development of new products and technologies. For instance, In March 2023, Rapid7 acquired Minerva Labs Ltd., a leading provider of anti-evasion and ransomware prevention technology. This strategic move strengthens Rapid7's portfolio of cybersecurity solutions, enabling the company to offer enhanced protection against advanced threats to its customers. The acquisition aligns with Rapid7's mission to create a safer digital world by making cybersecurity more accessible.

Key Deception Technology Companies:

The following are the leading companies in the deception technology market. These companies collectively hold the largest market share and dictate industry trends.

- Acalvio Technologies

- Allure Security Technology, Inc.

- Attivo Networks, Inc.

- Cymmetria, Inc.

- Guardicore Ltd

- Illusive Networks

- Logrhythm, Inc.

- Rapid7, Inc.

- Smokescreen Technologies

- Topspin Security

- Trapx Security

- Varmour

Recent Developments

-

In July 2023, Acalvio Technologies partnered with CrowdStrike to enhance identity protection. The integration enables CrowdStrike customers to leverage Acalvio's automation and AI-driven recommendations to accelerate the creation and deployment of honeytokens and honey accounts through the CrowdStrike Falcon platform. This solution helps organizations combat the rising threat of identity-based attacks, a critical component of modern cybersecurity strategies.

-

In March 2023, Akamai Technologies announced the acquisition of Ondat, a cloud-based storage technology provider with a Kubernetes-native platform. This acquisition aligns with Akamai's strategy to expand its cloud computing capabilities and provide customers with more flexible and scalable solutions. The integration of Ondat's technology is expected to enhance Akamai's offerings in the cloud infrastructure and application delivery market.

-

In March 2023, Acalvio Technologies partnered with Carahsoft Technology Corp., a government IT solutions provider. Under this agreement, Carahsoft will serve as Acalvio's Master Government Aggregator, making Acalvio's Active Defense Platform and ShadowPlex Advanced Threat Defense available to the public sector. This partnership aims to enhance cybersecurity solutions for government agencies and organizations, addressing their unique security challenges.

-

In September 2022, Commvault released Metallic ThreatWise, a cybersecurity service that uses deception techniques to detect unknown threats and minimize data breaches. This early warning system sets up fake resources to lure attackers, allowing businesses to spot threats in their production environments and take proactive measures to safeguard their data. Metallic ThreatWise represents Commvault's commitment to providing innovative solutions to combat the evolving threat landscape.

-

In January 2022, Honeywell International Inc. collaborated with Acalvio Technologies to develop a new solution for detecting zero-day attacks in commercial building OT environments. The joint offering combines Acalvio's deception technology with Honeywell's expertise in operational technology, providing enhanced protection for critical infrastructure. This partnership demonstrates the growing importance of deception-based security solutions in safeguarding industrial and IoT systems.

Deception Technology Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.18 billion |

|

Revenue forecast in 2030 |

USD 4.59 billion |

|

Growth rate |

CAGR of 13.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

component, deception stack, deployment, organization size, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Acalvio Technologies; Allure Security Technology, Inc.; Attivo Networks, Inc.; Cymmetria, Inc.; Guardicore Ltd; Illusive Networks; Logrhythm, Inc.; Rapid7, Inc.; Smokescreen Technologies; Topspin Security; Trapx Security; Varmour |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Deception Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global deception technology market report based on component, deception stack, deployment, organization size, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Service

-

-

Deception Stack Outlook (Revenue, USD Million, 2017 - 2030)

-

Data Security

-

Application Security

-

Endpoint Security

-

Network Security

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On premise

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small and Medium Enterprises

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Energy and Utilities

-

Government

-

Healthcare

-

IT and Telecom

-

Manufacturing

-

Retail

-

Others (Education, Defense)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global deception technology market size was estimated at USD 1.98 billion in 2023 and is expected to reach USD 2.18 billion in 2024.

b. The global deception technology market is expected to grow at a compound annual growth rate of 13.2% from 2024 to 2030, reaching USD 4.59 billion by 2030.

b. North America dominated the deception technology market with a share of 35.3% in 2023. Enhancing incident response capabilities is a growing trend in North America using deception technology. Organizations deploy deception tools to improve their ability to detect, analyze, and respond to cybersecurity incidents in real time.

b. Some key players operating in the deception technology market include Acalvio Technologies, Allure Security Technology, Inc., Attivo Networks, Inc., Cymmetria, Inc., Guardicore Ltd, Illusive Networks, Logrhythm, Inc., Rapid7, Inc., Smokescreen Technologies, Topspin Security, Trapx Security, Varmour.

b. Key factors driving the market's growth include Integration with Security Orchestration, Automation, and Response (SOAR) and Extended Detection and Response (XDR) Convergence.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."