Decarbonization Market Size, Share & Trends Analysis Report By Technology (Renewable Energy Technologies, Energy Efficiency Solutions, Electric Vehicles (EVs)), By Services, By Deployment, By End-user, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-129-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Decarbonization Market Size & Trends

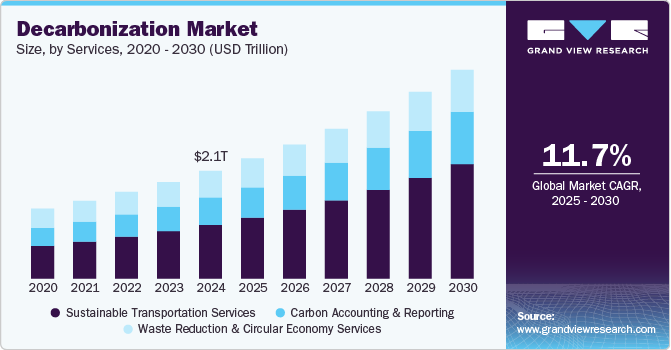

The global decarbonization market size was estimated at USD 2.09 trillion in 2024 and is anticipated to grow at a CAGR of 11.7% from 2025 to 2030. Climate change is a significant focus for firms in the context of ESG, and the demand for decarbonization-related solutions will grow. Instilling sustainability into digital transformation products will help customers transition to a green corporate approach, which includes considering ecology from both a commercial proposition and a risk aspect. As a result, raising awareness of the climate's impact, reaching consensus on the boundaries of climate goals, and building a strong and complete action plan will help the market advance.

Changing the supply of energy away from fossil fuels and toward zero-emissions electricity and other low-emissions fuels for energy, including modifying industrial and agricultural operations; hydrogen; managing energy demand and increasing energy efficiency; absorbing less emissions-intensive goods; utilizing the circular economy; deploying carbon capture & storage (CCS) technology; utilization, and improving sinks of both long-lived and short-lived pollutants.

Globally, many companies have made climate change mitigation commitments to chart a path towards decarbonization. Many companies are now going for public disclosure on their emissions and setting ambitious targets. Several initiatives, like science-based target initiatives, UN-Global impact business ambition for 1.5 degrees Celsius, and B-Corp’s commitment to reach net zero, have witnessed enhanced corporate participation in recent years.

Significant growth in renewable energy usage is fueling market growth. The transition to low-carbon fuels, as well as the presence of strong environmental regulations in most developed countries, has offered a significant boost to the renewable energy sector. The energy generating market has grown in terms of installed renewable capacity in recent years, owing to increased environmental concerns and pressure to decrease the detrimental impacts of Greenhouse Gases (GHG). This has played a significant role in the growth of the solar and wind energy sectors.

These factors, combined with the environmental concerns regarding the use of fossil fuels, are expected to drive decarbonization industry growth. Geothermal energy is renewable energy derived from the earth's heat and can be harnessed as a source of renewable electricity and for cooling & heating applications. With 3.7 GW of geothermal energy capacity, the United States tops the world. Furthermore, the world's largest geothermal plant is in California, and with widespread industry adoption, geothermal energy is predicted to supply 10% of US electricity demand in the near future. These factors are expected to drive the market demand over the forecast period.

Technology Insights

The renewable energy technologies segment led the market in 2024 accounting for 70.7% share of the global revenue. Renewable energy plants in regions have increased owing to the stringent government regulations regarding emissions. The power scenario in the country has been witnessing a change with the increased adoption of gas-based and renewable power sources as compared to coal-based power generation. The rising electricity distribution costs, power outages caused by faults in the main grid, and incentive programs introduced by the U.S. government are expected to propel end users to shift towards setting up hydropower systems. This is expected to boost renewable energy segment demand.

The electric vehicle segment is expected to register a significant CAGR growth during the forecast period. Stringent vehicle emissions regulations have led to the rise in demand for electric vehicles. For instance, the European Union set itself a net-zero greenhouse gas emissions target by 2050. Electric vehicles produce lower emissions as compared to conventional vehicles. This has led governments worldwide to increase awareness and promote the adoption of EVs to reduce oil consumption, air pollution, and related emissions. Some of the most comprehensive promotions are done in the Netherlands and Norway. Thus, the market will grow notably during the forecast period.

Service Insights

The sustainable transportation services segmentled the market in 2024 accounting for a significant share of the global revenue in 2024. Sustainable transportation refer to options and solutions that prioritize environmental sustainability, reduce carbon emissions, minimize resource consumption, and promote social and economic well-being. These services address the environmental and social challenges associated with traditional transportation methods while providing efficient and accessible mobility for people and goods. Using data and technology to optimize transportation services, reduce traffic congestion, and improve the efficiency of public transit is also a key aspect of sustainability in transportation.

The carbon accounting and reporting services segment will register a significant CAGR from 2025 to 2030. The process of computing, evaluating, measuring, and reporting a company's greenhouse gas emissions for auditing is carbon accounting services. Businesses can improve their management of carbon discharges by utilizing this service. Enhanced financial prospects for businesses are promising since investors are more inclined to fund a company that strives to reduce carbon emissions. This promotes greater transparency among interested parties and potential investors.

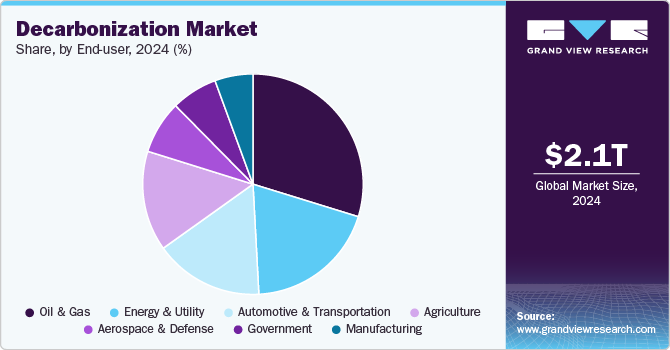

End-user Insights

Based on the end user, the oil & gas segment registered highest revenue in 2024. Decarbonization in the energy and utility sector refers to reducing or eliminating carbon dioxide (CO2) and other greenhouse gas emissions associated with the production and consumption of energy. This is crucial in addressing climate change and transitioning to a more sustainable and environmentally friendly energy system. One primary strategy for decarbonization is shifting from fossil fuels (such as coal, oil, and natural gas) to renewable energy sources like solar, wind, hydroelectric, and geothermal power. These sources produce electricity without emitting greenhouse gases.

The oil & gas segment is expected to register a CAGR of 13.8% over the forecast period. The oil and gas industry contributes significantly to global greenhouse gas emissions through the extraction, production, and use of fossil fuels. Decarbonization in the oil and gas sector refers to attempts to minimize the industry's carbon footprint and transition to a more sustainable and low-carbon energy future. One of the primary goals of decarbonization in the oil and gas industry is to reduce emissions associated with the extraction, processing, and transportation of oil and natural gas. This includes minimizing methane leaks, improving operation efficiency, and reducing flaring.

Deployment Insights

The on-premises segment led the market in 2024. The on-premises deployment in decarbonization refers to reducing or eliminating carbon emissions from various sources, such as industrial processes, energy production, transportation, and buildings, to combat climate change. Facilities can lessen their dependency on fossil fuels and reduce emissions related to power usage by installing on-site renewable energy sources, such as solar panels, wind turbines, or even small-scale hydroelectric units.

The cloud segment is expected to register the highest CAGR during the forecast period. Deploying decarburization over the cloud is cost-effective, highly scalable, and provides easier execution, maintenance, and upgradation. Additionally, it provides advantages like security, data control, speed, and 24/7 assistance, making it the top choice for clients. With pay-as-you-go pricing and variable processing capabilities on demand, cloud infrastructure, sometimes called public cloud solutions, significantly lowers the cost of commercial computing. Public cloud services are entirely managed by third parties, relieving IT teams of the need to purchase, install, maintain, and update technology locally.

Regional Insights

North America decarbonization market accounted for the highest share of the global revenue in 2024. This growth is driven by increasing initiatives by major players in the industry. For instance, in June 2023, the U.S. Department of Energy (DOE), under the leadership of the Biden-Harris Administration, announced an investment of around USD 30 million to accelerate the sustainability of federal buildings and clean energy technologies. In another instance, the North American Climate, Energy, and Environment Partnership has encouraged governments to adopt more sustainable policies and to purchase more renewable energy and electric vehicles as needed. Additionally, in partnership with the International Renewable Energy Agency, as part of a long-term global initiative, Mexico, Canada, and the U.S. are launching a Trilateral North American initiative to assist isolated, remote, and indigenous communities in transitioning to clean, renewable, and reliable energy sources

U.S. Decarbonization Market Trends

The U.S. decarbonization market held a dominant position in 2024. This expansion is driven by Stringent environmental regulations and ambitious government targets are stimulating investments in renewable energy and energy-efficient technologies, particularly through initiatives like the Bipartisan Infrastructure Law and the Inflation Reduction Act, which allocate substantial funding for decarbonization efforts.

Europe Decarbonization Market Trends

Europe’s decarbonization market is prominently growing across the globe. The EU's regulatory framework is crucial, as it fosters investor confidence and supports the development of low-carbon technologies across various sectors, including transport and buildings. The Green Deal Industrial Plan aims to enhance competitiveness while transitioning to net-zero technologies, highlighting the importance of energy efficiency as a common thread in recent policies.

Asia Pacific Decarbonization Market Trends

The Asia Pacific deep learning market is anticipated to grow at a significant CAGR from 2025 to 2030. The expanding installation of solar power projects in China and India is driving up demand for renewable energy solutions in the Asia Pacific. These countries are major global solar panel markets in Asia Pacific. Furthermore, nations in the region, such as Australia and Japan, offer strong market growth potential because they have been heavily investing in solar power generation in recent years.

Key Decarbonization Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players.

-

Deloitte is a global player in professional services, with a presence in over 150 countries and a workforce of approximately 457,000 people. The company is committed to making a significant impact by addressing complex challenges and delivering sustainable results for clients and communities. In the decarbonization sector, Deloitte offers comprehensive consulting services that help organizations transition to low-carbon operations. These services include climate risk assessments, sustainability strategy development, and carbon accounting solutions. By leveraging advanced analytics and industry expertise, Deloitte assists clients in achieving their decarbonization goals while fostering a more equitable and prosperous future. Their approach emphasizes collaboration and innovation, positioning them as trusted advisors in the pursuit of environmental sustainability.

-

Siemens is a global technology company that plays a pivotal role in the decarbonization industry through its innovative solutions and sustainable practices. The company focuses on enhancing energy efficiency, promoting renewable energy sources, and developing smart infrastructure to reduce carbon emissions across various sectors. Siemens offers a wide range of products and services, including digital solutions for optimizing energy consumption, advanced automation technologies, and electrification systems that support the transition to greener energy. Their commitment to sustainability is evident in initiatives aimed at achieving net-zero emissions in their operations and helping customers do the same. By leveraging cutting-edge technologies such as AI and robotics, Siemens is not only improving operational efficiency but also contributing significantly to the global effort of combating climate change.

Key Decarbonization Companies:

The following are the leading companies in the decarbonization market. These companies collectively hold the largest market share and dictate industry trends.

- Deloitte

- IBM

- Atos SE

- Accenture

- Siemens

- SAP SE

- EcoAct

- GE DIGITAL

- Dakota Software.

- EnergyCap.

- Isometrix

- Trinity Consultants

Recent Developments

-

In March 2023, Deloitte launched the GreenLight Solution, an innovative enterprise decarbonization software tool designed to guide organizations towards achieving net-zero emissions. This SaaS solution features a modular system that integrates advanced data analytics and a vast emissions database, helping businesses create actionable decarbonization roadmaps. With increasing pressure from stakeholders for ambitious carbon reduction targets, GreenLight Solution empowers companies to make informed decisions and prioritize sustainability initiatives effectively.

-

In September 2023, GE Vernova has unveiled its AI-driven carbon emissions management software, CERius, at the Azito power plant in Ivory Coast, marking a significant step towards enhancing emissions tracking in the energy sector. Designed to help organizations meet net-zero goals, CERius utilizes artificial intelligence and machine learning to automate greenhouse gas data collection and provide actionable insights for carbon reduction strategies. This deployment aligns with increasing global regulations on emissions reporting, positioning Azito as a leader in Africa's digital energy transition.

-

In January 2023, Cepsa began constructing three new solar power plants in Castilla-La Mancha, Spain. The three solar energy farms have a combined capacity of 400 MW. The initiatives were executed in Campo de Criptana and Arenales de San Gregorio communities with a total investment of EUR 280 million.

-

In September 2024, SAP SE announced a strategic partnership with Ambipar, a leader in environmental solutions, to launch Net Zero as a Service, aimed at assisting organizations in their journey towards carbon neutrality. This innovative service combines SAP's advanced cloud solutions with Ambipar's expertise in carbon credit generation and trading, providing customers with a comprehensive approach to managing and offsetting carbon emissions. Tercio Borlenghi Junior, CEO of Ambipar, emphasized the synergy between the two companies in promoting sustainability. Currently, Ambipar is piloting this service within its operations to meet its growth targets before it becomes available to SAP's global customer base.

Decarbonization Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.33 trillion |

|

Revenue forecast in 2030 |

USD 4.06 trillion |

|

Growth rate |

CAGR of 11.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD trillion/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Component, type, deployment, technology, end-user, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America;Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Deloitte, IBM, Atos SE, Accenture, Siemens, EcoAct, SAP SE, GE DIGITAL, Dakota Software., EnergyCap, Isometrix, Trinity Consultants |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Decarbonization Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global decarbonization market report based on services, technology, deployment, end-use, and region:

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Carbon Accounting and Reporting Services

-

Sustainable Transportation Services

-

Waste Reduction and Circular Economy Services

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Renewable Energy Technologies

-

Energy Efficiency Solutions

-

Electric Vehicles (EVs)

-

Carbon Removal Technologies

-

Carbon Capture and Storage (CCS)

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premises

-

Cloud

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Oil & Gas

-

Energy and Utility

-

Agriculture

-

Government

-

Automotive & Transportation

-

Aerospace & Defense

-

Manufacturing

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global decarbonization market size was estimated at USD 2.09 trillion in 2024 and is expected to reach USD 2.33 trillion in 2025.

b. The global decarbonization market is expected to grow at a compound annual growth rate of 11.9% from 2025 to 2030 to reach USD 4.06 trillion by 2030.

b. North America dominated the decarbonization market with a share of 32.2% in 2024. This is attributable to rising initiatives of the organization towards net-zero carbon emission in the forecast period.

b. Some key players operating in the decarbonization market include Deloitte, IBM, Atos SE, Accenture, Infosys, Siemens, EcoAct, SINAI Technologies, GE DIGITAL; among others.

b. Key factors that are driving the decarbonization market growth include significant growth in renewable energy usage across various industries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."