Decaffeinated Coffee Market Size, Share & Trends Analysis Report By Product (Roasted, Raw), By Bean Species (Arabica, Robusta, Others), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-410-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Decaffeinated Coffee Market Size & Trends

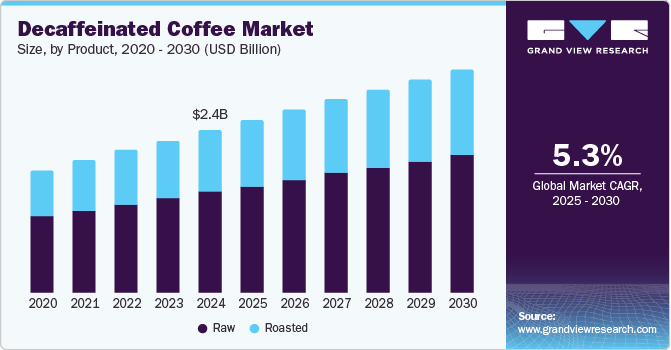

The global decaffeinated coffee market size was valued at USD 2.39 billion in 2024 and is projected to grow at a CAGR of 5.3% from 2025 to 2030. Increasing health awareness among consumers driven by the growing availability of information regarding the effects of a variety of food ingredients on human health, rising accessibility to decaffeinated coffee products offered by key companies, a large number of consumers shifting to healthier dietary consumptions, and preferred utilization by commercial buyers such as cafes, restaurants, coffee shops, eateries, and others.

The decaffeinated coffee is diligently made through various processes, including steaming green coffee beans, rinsing in methyl chloride, removing a liquid solution, caffeine extraction, drying and roasting decaffeinated beans, and more. Multiple methods and approaches, such as the Swiss water process, the supercritical CO2 method, ethyl acetate, the direct contact method, and others, are used for decaffeination.

In recent years, decaffeinated coffee, also referred to as young consumers, increasingly prefers decaf over regular coffee or other beverages, including sodas, carbonated drinks, flavored milk, etc. Rising awareness regarding the impact of caffeine on human health, including sleep loss, enhanced stimulation for jitteriness, anxiety, bone loss, increased levels of cholesterol level, heartburn, gastroesophageal reflux, and others, have changed consumer preference in recent years.

The increasing prevalence of chronic health issues such as hypertension, stress, and anxiety, changing lifestyles, the growing number of individuals participating in the workforce, rising awareness campaigns by government, health industry organizations, and welfare initiatives regarding the significance of food intake in human well-being, and enhanced availability of information have resulted in major shifts in consumer behavior.

Large groups of consumers have preferred food & beverage products formulated with ingredients that reduce or eliminate the ill effects. In addition, the availability of natural and organic products, enhanced formulation offerings, and company-oriented development strategies are projected to drive demand for this market in the coming years.

Product innovation and new launches by industry participants are also contributing to the growth of this market. For instance, in September 2024, Cheeky Cocktails, a juices and syrups producer, introduced a new addition to its portfolio: a Decaf Espresso Syrup. This innovation-based product is anticipated to offer enhanced convenience for commercial and individual users.

Product Insights

The raw decaffeinated coffee products dominated the global industry with a revenue share of 62.3% in 2024. Raw decaffeinated coffee is cost-efficient and less expensive than roasted decaf coffee. It’s characterized by a gentle or soft aroma, which holds significance in the customer’s purchase decision. In addition, availability and accessibility to technologically advanced home appliances such as home coffee roasters have driven the demand for raw decaffeinated coffee in recent years.

The roasted, decaffeinated coffee products segment is anticipated to experience the highest CAGR from 2025 to 2030. The roasting process turns beans into light and crunchy versions while enhancing the aroma through the evaporation of moisture. Availability, ease of accessibility, increasing inclusion by retail industry players, and growing demand from urban consumers are some of the key growth driving factors for this segment.

Bean Species Insights

The arabica beans segment held the largest revenue share of the global caffeinated coffee market in 2024. This is primarily attributed to Arabica beans' lesser caffeine content than Robusta beans. The product's sweet and smooth taste also contributes to its growing demand. It is marketed as a premium version of decaf coffee by industry participants. Increasing commercial utilization by the applauded coffee brands and major players in the ready-to-drink industry is projected to enhance the growth of this segment in the approaching years.

The robusta beans segment is projected to experience the fastest CAGR during the forecast period. Robusta beans are characterized by bold or extra flavor and aroma compared to Arabica beans. They also have thicker and harder outer layers than Arabica. The stronger flavor of Robusta beans also ensures a high-quality taste and smell even after the decaffeination process. Robusta beans are extensively used by commercial coffee vendors and quick-service restaurant businesses as they produce enhanced aroma and crema, a brown foam that often forms on top of fresh espresso coffee.

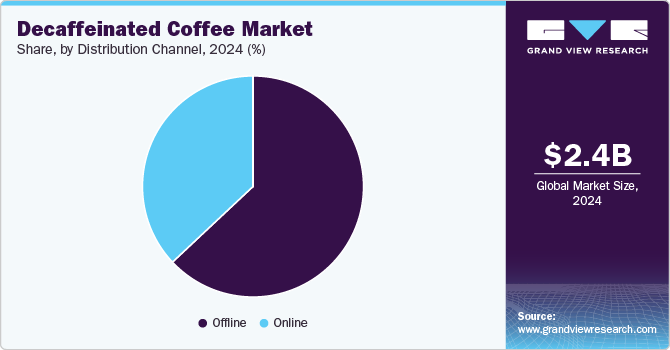

Distribution Channel Insights

The offline distribution segment dominated the global decaffeinated coffee industry in 2024. Growth of this segment is primarily influenced by factors such as ease of availability and accessibility, the large presence of supermarket and hypermarket networks across multiple countries worldwide, and the increasing inclusion of decaffeinated coffee products in portfolio offerings of local grocery stores, convenience stores, and other offline marketplaces, and more. The brands prefer effective offline distribution, offering enhanced brand visibility and improved customer engagement.

The online distribution segment is anticipated to experience the fastest CAGR from 2025 to 2030. This is attributed to factors such as consumers' increasing inclination to shop online, the growing penetration of quick commerce and e-commerce industries, a large number of key industry participants with an online presence through their own portals or e-commerce businesses, and enhanced services offered by online shopping platforms, such as improved customer assistance, doorstep delivery, and more.

Regional Insights

North America decaffeinated coffee market held a significant revenue share of the global industry in 2024. Enhanced product availability through online and offline points of sale, including large chains of supermarkets and e-commerce businesses with vast delivery networks, contributes to the growth of this market. In addition, increasing mindfulness regarding caffeine consumption, growing awareness regarding ill effects, and availability of strong alternatives that offer similar taste, aroma, and experience are also contributing to the growing demand for decaffeinated coffee in the region.

U.S. Decaffeinated Coffee Market Trends

The U.S. decaffeinated coffee market held the largest revenue share of the regional industry in 2024. This is attributed to multiple aspects, including numerous quick services restaurants and other commercial users, a large number of household users, increasing availability through enhanced retail industry and improved shopping experiences, growing awareness among customers regarding disadvantages associated with extra caffeine consumption, and more.

Europe Decaffeinated Coffee Market Trends

The decaffeinated coffee market in Europe dominated the global industry with a revenue share of 37.7% in 2024. This is attributed to factors such as the presence of many commercial users in the region, the traditional value of coffee and associated products, increasing awareness regarding the ill effects of caffeine, the growing availability of appliances such as home coffee roasting machines, and more. The presence of multiple key industry participants in the region, such as Nestle and others, also stimulates the growth.

Germany decaffeinated coffee market is projected held the largest revenue share of the regional market in 2024. A large amount of domestic consumption, the presence of multiple global brands from ready-to-drink coffee and quick service restaurant industry, increasing demand from household users owing to the availability of advanced technology-driven appliances, and growing awareness regarding the benefits of choosing decaffeinated coffee over regular are some of the key growth driving factors for this market.

Asia Pacific Decaffeinated Coffee Market Trends

Asia Pacific decaffeinated coffee industry is projected to experience the highest CAGR of 6.4% from 2025 to 2030. Increasing disposable income levels and growing penetration of quick commerce and e-commerce industry, a large number of retail industry players operating in the region, significant demand from the restaurants and ready-to-drink coffee serving businesses, and entry of multiple coffee and coffee product brands in the area is anticipated to generate growth in demand for this market in next few years.

China decaffeinated coffee market held the largest revenue share of the regional market in 2024. This market is primarily driven by growing demand from urban consumers, the entry of multiple global coffee brands in the country, a large number of commercial users, and increasing availability and accessibility of home appliances such as home coffee roasters and others. Significant penetration of e-commerce websites also adds to the growth of this market.

Key Decaffeinated Coffee Company Insights

Some of the key companies in the global decaffeinated coffee market are Don Pablo Coffee, Swiss Water Decaffeinated Coffee Inc., Volcanica Coffee Company, Swiss Water Decaffeinated Coffee Inc., Jo Coffee, Fresh Roasted Coffee, LLC, and others. To address growing competition and increasing demand from commercial buyers, the companies have adopted enhanced marketing, improved retail presence, effective distribution strategies, and more. Multiple key companies have also focused on strategies such as innovation, collaborations, partnerships, and offering attractive offers to retail customers and others.

-

Don Pablo Coffee specializes in specialty-grade coffee's growing and roasting process. Its decaf offerings include Subtle Earth Organic Swiss Water Decaf, Don Pablo Colombian Swiss Water Decaf, Don Pablo Bourbon Infused Decaf Coffee, and Don Pablo's Decaf Sampler Gift Box. It also offers a range of products, including organic whole bean, organic ground, organic low acid, cold brew, K cups, and more.

-

Volcanica Coffee Company offers multiple coffee products, such as flavored coffee, Costa Rican coffee, Columbian coffee, Ethiopian Coffee, Geisha Coffee, Guatemala Coffee, Sumatra Coffee, and more. It also provides its offerings to wholesale buyers. Its collection includes a variety of coffee offerings, such as estate, peaberry, decaf, organic, dark roast, low acid, and others.

Key Decaffeinated Coffee Companies:

The following are the leading companies in the decaffeinated coffee market. These companies collectively hold the largest market share and dictate industry trends.

- Swiss Water Decaffeinated Coffee Inc.

- Lifeboost Coffee LLC

- Don Pablo Coffee

- Jo Coffee

- Fresh Roasted Coffee, LLC

- Volcanica Coffee Company

- Kicking Horse Coffee Co. Ltd.

- Koffee Kult

- Koa Coffee

- The Eight O'Clock Coffee Company

View a comprehensive list of companies in the Decaffeinated Coffee Market

Recent Developments

-

In July 2024, Grind’s specialty coffee was selected to be served on short-haul flights by British Airways, specifically from Gatwick and Heathrow. The company has developed different product blends for High Life Café initiative by British Airways. Available brand products in British Airways’ short haul flights include Decaf Black, ready-to-drink Iced Caramel Latte Can and Long Black.

Decaffeinated Coffee Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.54 billion |

|

Revenue forecast in 2030 |

USD 3.28 billion |

|

Growth rate |

CAGR of 5.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, bean species, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, South Africa |

|

Key companies profiled |

Swiss Water Decaffeinated Coffee Inc.; Lifeboost Coffee LLC; Don Pablo Coffee; Jo Coffee; Fresh Roasted Coffee, LLC; Volcanica Coffee Company; Kicking Horse Coffee Co. Ltd.; Koffee Kult; Koa Coffee; The Eight O'Clock Coffee Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Decaffeinated Coffee Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand view research has segmented the global decaffeinated coffee market report based on product, bean species, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Roasted

-

Raw

-

-

Bean Species Outlook (Revenue, USD Million, 2018 - 2030)

-

Arabica

-

Robusta

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

UK

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

ANZ

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."