- Home

- »

- Next Generation Technologies

- »

-

Debt Collection Software Market Size & Share Report, 2030GVR Report cover

![Debt Collection Software Market Size, Share & Trends Report]()

Debt Collection Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment, By Enterprise Size, By End-User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-268-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Debt Collection Software Market Summary

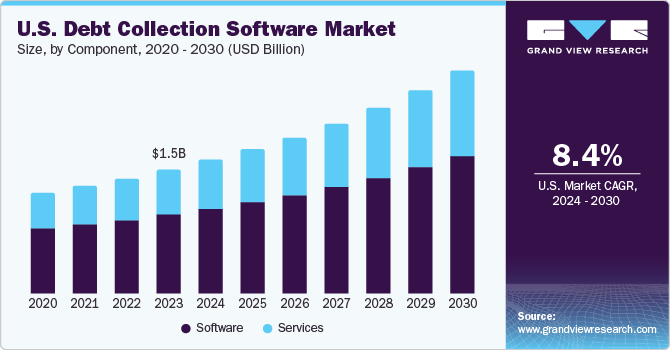

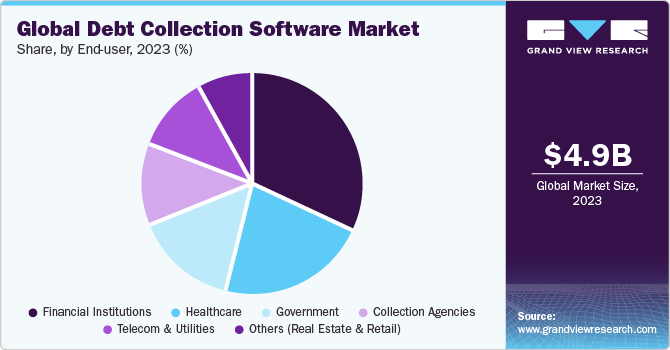

The global debt collection software market size was estimated at USD 4.92 billion in 2023 and is projected to reach USD 9.27 billion by 2030, growing at a CAGR of 9.6% from 2024 to 2030. The market growth is driven by the increasing demand for efficient debt recovery processes and the need to minimize bad debts while optimizing cash flow.

Key Market Trends & Insights

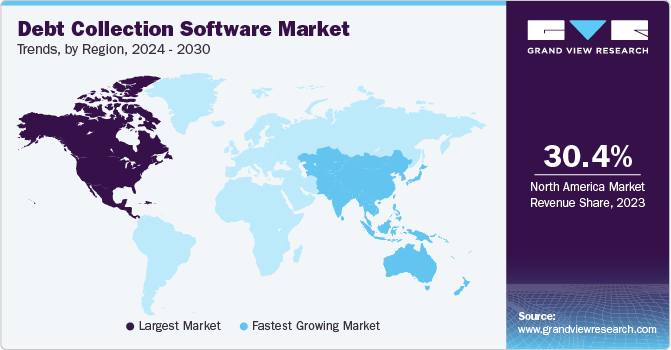

- North America dominated the global debt collection software market with a revenue share of 30.4% in 2023.

- Asia Pacific is anticipated to witness the fastest growth in the debt collection market over the forecast period.

- By component, the software segment dominated the market with a share of 65.5% in 2023.

- By enterprise size, the large enterprise segment dominated the market in 2023.

- By end-user, the financial institutions segment held the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.92 Billion

- 2030 Projected Market Size: USD 9.27 Billion

- CAGR (2024-2030): 9.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Companies can improve efficiency, reduce costs, and enhance the overall process by automating repetitive tasks such as sending reminders, generating reports, and managing communications with debtors.

Debts have been increasing globally due to lucrative loan schemes offered by banks and the simplification of the loan-taking process. According to the International Monetary Fund (IMF), private debts, loans, and debt securities were at 152.5% of GDP for the U.S., 215.9% for Canada, 150.8% for UK, and 195.0% for China.

With advancements in artificial intelligence, companies are observed integrating AI with debt collection software to offer a more sophisticated debt collection experience. For instance, in May 2023, GiniMachine launched AI-based GiniMachine Collection Edition to increase the efficiency and speed of fintech companies' debt collection operations. It features predictive model training and building to fulfill tasks such as identifying potential repayable and non-repayable debtors, enabling organizations to make informed decisions and tailor their collection strategies for better results.

Furthermore, the expansion of fintech companies is promoting market growth. According to the Inter-American Development Bank (IADB), the fintech industry doubled from 2018 to 2021 in Latin America and the Caribbean. About 22.6% of fintech companies globally originate in Latin America.

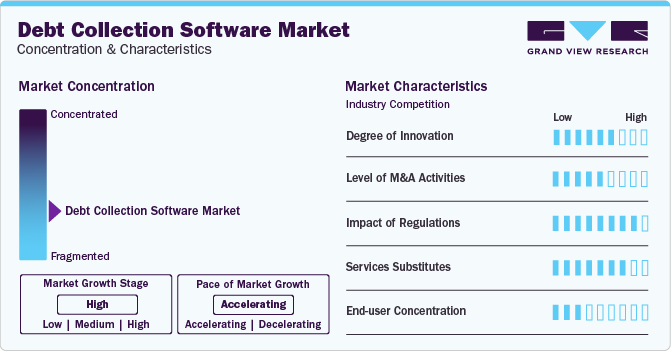

Market Concentration & Characteristics

The global debt collection software industry is fragmented and growing at a rapid rate. The industry is characterized by a high degree of innovation, owing to rapid technological advancements driven by factors such as advancements in machine learning algorithms, the availability of big data, and increasing computing power. Subsequently, advancements in this software are making it more reliable and robust.

Debt collection and automation are subject to significant government regulations worldwide to ensure the process is fairly and ethically conducted. Guidelines dictate how debtors' personal information can be collected, stored, used, and shared. Communication practices are also regulated to prevent harassment. Debt validation procedures ensure that the debts are legitimate and accurate and that debtors are not subjected to false claims. Hence, regulations prohibit harassment, abusive language, and misleading approaches to ensure that the collection process is properly carried out.

While debt collection software offers a streamlined and automated approach to recovering debts, several service substitutes exist, each with advantages and disadvantages depending on specific needs. Some of these substitutes include traditional manual collections, debt collection agencies, credit counseling and debt settlement services, peer-to-peer debt collection platforms, and legal action.

Component Insights

The software segment dominated the market with a share of 65.5% in 2023. The ongoing Industry 4.0 initiative worldwide is driving the segment growth. The software's core functionalities include case management, automated workflows, payment processing, reporting and analytics, and compliance management. It also includes supplementary features such as skip tracing, credit reporting, negotiation tools, chatbots, AI-powered communication, document management, team collaboration tools, and integrations with existing software, which support users with automation and debt recovery.

The service segment is expected to grow at the fastest CAGR over the forecast period owing to the rising demand for Software-as-a-Service (SaaS) models, reduced upfront cost, and high flexibility and scalability. Many companies are introducing advanced solutions to cater to this need. For instance, in October 2023, Mobicule Technologies, a mobile field force-based product developer, launched MCollect, a phygital debt recovery service, to provide cost-effective debt collection.

Deployment Insights

The cloud segment held the largest market share owing to the increasing need for data sharing and interconnectivity between the user and its client. Cloud-based solutions offer advantages such as collaborating in real-time and facilitating seamless communication and data integration. In addition, they provide remote access and mobility, enabling users to access data from any location at any time. Cloud deployment is cost-effective, scalable, and flexible, offering automatic updates, maintenance, and enhanced security. It ensures disaster recovery capabilities, which are crucial for unexpected system failure or data loss.

The on-premise segment is expected to grow at a significant CAGR over the forecast period. On-premise solutions provide organizations with maximum control, customization, and data privacy. They enable businesses to tailor the software to their specific collection processes, compliance requirements, and team structure. This approach allows businesses to maintain complete control over their sensitive data and implement their security protocols, providing higher security.

On-premise systems are inherently less prone to cybersecurity threats compared to cloud-based solutions. This added security measure provided by on-premise systems is essential for businesses that handle highly sensitive data. For instance, IBM reported that the global average cost of a data breach in 2023 reached USD 4.45 million, marking a 15% increase in expenses over three years.

Enterprise Size Insights

The large enterprise segment dominated the market in 2023 due to the increased data complexity and the rise of stringent regulations. Large enterprises operating in highly regulated industries and regions prioritize compliance as a key concern. To ensure adherence to legal requirements and mitigate risks, large enterprises require debt collection software equipped with robust compliance, which includes automated regulatory updates, audit trails, and secure data handling.

The SME segment is expected to witness significant growth, owing to the increasing focus on Customer Relationship Management (CRM). Software that incorporates CRM functionalities enables SMEs to effectively manage customer interactions, personalize communication, and maintain an affirmative customer experience throughout the debt collection process. Debt collection software is an effective tool that assists businesses in preserving their reputation and fostering customer loyalty, ultimately leading to long-term financial prosperity.

End-user Insights

The financial institutions segment held the largest market share in 2023. The rising need for fraud detection is driving the segment growth. Financial institutions are particularly vulnerable to fraudulent activities due to the sensitive financial information involved. Debt collection software plays a crucial role in safeguarding against fraudulent activities. It offers advanced features such as suspicious activity monitoring, multiple account correlations, and device and IP address checks. These features help identify unusual transactions, suspicious login attempts, and geographically inconsistent activity.

The telecom & utilities segment is expected to grow at a significant CAGR over the forecast period. This can be attributed to the rise in the number of fraudulent accounts, resulting in bad debts and revenue stream impacts. Debt collection software can be crucial in detecting and preventing these fraudulent accounts. It helps detect fraud, integrate with external databases, trigger alerts, implement verification procedures, and segment customer data based on risk profiles. These factors bode well for the segment growth.

Regional Insights

North America dominated the market with a revenue share of 30.4% in 2023. North America's robust adoption of technology has fostered an environment that favors the growth of the market for debt collection software. As a hub for technological innovation, the region drives the development of advanced software solutions. Companies in the region leverage technologies such as Artificial Intelligence (AI), machine learning, and data analytics to enhance collection strategies, improve debtor engagement, and optimize operational efficiency.

U.S. Debt Collection Software Market Trends

The U.S. debt collection software market dominated the global market with a share of 78.5% and a global share of 23.8% in 2023, owing to the stringent regulations in the country. The U.S. has a complex regulatory environment governing debt collection practices, including federal laws such as the Fair Debt Collection Practices Act (FDCPA), the Telephone Consumer Protection Act (TCPA), and state-level regulations. Debt collection software tailored to the U.S. market is designed to ensure compliance with these regulations, helping businesses avoid legal liabilities and penalties.

The debt collection software market in Canada is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the advent of digital transformation in Canada. Canadian government programs, such as the Strategic Innovation Fund, promote digitalization and technology adoption in various industries, offering financial support.

Europe Debt Collection Software Market Trends

Europe is considered a highly lucrative market owing to the emerging need for cross-border debt collection. Increasing cross-border trade necessitates software capable of handling complex international regulations and facilitating efficient debt recovery across borders.

The debt collection software market in Germany held a substantial market share. German companies prioritize innovations and heavily invest in Research and Development (R&D) to maintain technological leadership, resulting in better infrastructure for adopting debt collection software and, thus, driving the market.

The France debt collection software market is expected to grow at a significant rate over the forecast period. With the implementation of the General Data Protection Regulation (GDPR) in the European Union, including France, there is a heightened focus on data privacy and protection. Debt collection software providers in France invest in robust data security measures, encryption protocols, and compliance certifications to safeguard client data and ensure GDPR compliance.

Asia Pacific Debt Collection Software Market Trends

Asia Pacific is anticipated to witness the fastest growth in the debt collection market. This can be attributed to the region’s widespread technological adoption, driven by factors such as increasing internet penetration, smartphone usage, and digitalization initiatives. Debt collection software solutions leverage technologies such as Artificial Intelligence (AI), machine learning, and data analytics to optimize collection strategies, improve debtor engagement, and enhance operational efficiency in line with these trends, thus driving market growth.

The debt collection software market in China is expected to grow substantially over the forecast period. China has experienced rapid adoption of mobile payments and digital platforms, facilitated by the widespread use of smartphones and internet connectivity. Debt collection software solutions in China often integrate with popular mobile payment platforms and digital channels to facilitate convenient payment options, communication with debtors, and account management.

The India debt collection software market is expected to witness significant growth over the forecast period owing to the rise in digital transformation in the country. The Digital India initiative is one of the most prominent government initiatives that has increased the adoption of digitalization, encouraged technological development, and prompted local startups and established players to invest in innovative debt collection software solutions.

Middle East & Africa (MEA) Debt Collection Software Market Trends

The Middle East & Africa (MEA) region is expected to witness substantial growth over the forecast period owing to the rising economic growth, leading to increased access to credit and higher debt levels. As access to credit expands and debts rise, businesses in the MEA region face challenges in effectively managing delinquent accounts and recovering outstanding debts. Debt collection software offers a solution by providing advanced tools and functionalities that streamline the debt recovery process, enhance operational efficiency, and improve collection outcomes.

The debt collection software market in the UAE held a significant revenue share in the global market. The UAE is experiencing a diversified debts portfolio due to rising disposable income and credit access, leading to higher credit card usage and personal loan borrowing, resulting in market growth.

Key Debt Collection Software Company Insights

Some of the key players operating in the market include Experian, CGI, TransUnion, FIS, Pair Finance, Credgenics, and ZestMoney.

-

Fidelity National Information Services, also known as FIS, is a global financial technology company offering various solutions to financial institutions, businesses, and consumers. One of the key areas where FIS excels is debt collection software offerings. Debt collection software is essential for organizations seeking to streamline their debt recovery processes, improve efficiency, and ensure regulation compliance. Their offering includes FIS Getpaid, a debt collection software that aids businesses in collections and credit.

-

TransUnion is an insights and information company offering credit information and financial services to businesses and consumers. One of the key areas of focus for TransUnion is debt collection software solutions, which are designed to help businesses streamline their debt collection processes, improve efficiency, and increase recovery rates. The company offers TruLookup Investigative Solutions, TruContact Communications Solutions, and TruVision Risk Management Solutions.

-

Pair Finance is a leading debt collection company that provides innovative software solutions to streamline and optimize the debt collection process. The company leverages technology to offer efficient, data-driven, customer-centric debt collection services. It utilizes AI and behavioral science to improve communication and recovery rates, focusing on ethical debt collection practices.

Key Debt Collection Software Companies:

The following are the leading companies in the debt collection software market. These companies collectively hold the largest market share and dictate industry trends.

- Experian

- Fair Isaac Corporation

- Constellation Software Inc.

- CGI Group Inc.

- TransUnion

- Nucleus Software Exports Ltd.

- Chetu Inc.

- CDS Software

- Pegasystems Inc.

- Temenos Group AG

- AMEYO

- PAIR Finance

- Credgenics

Recent Developments

-

In May 2023, PAIR Finance, a German and Austrian developer in AI-based debt collection, expanded its services to the Netherlands, aligning with its European growth strategy. Leveraging advanced digital infrastructure and growing demand for socially responsible debt collection, PAIR Finance uses artificial intelligence to tailor collections, boosting recovery rates and maintaining customer relationships.

-

In June 2021, Exotel, a customer communication platform, and Ameyo merged to create Asia's largest customer engagement cloud platform, spanning 60 countries with a combined accounting rate of return of USD 40 million. The merger addresses the growing need for a comprehensive customer engagement solution in today's rapidly evolving work environment. It aims to unify customer data and leverage AI for enhanced customer experiences.

-

In June 2021, FICO and Constellation Software Inc. finalized the sale of FICO's Recovery and Collection business to Constellation Software Inc.’s. Jonas Software operating group. This acquisition provided Constellation Software Inc. access to the company’s debt collection software to integrate with its business management software platforms, further expanding its target market.

Debt Collection Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.34 billion

Revenue forecast in 2030

USD 9.27 billion

Growth rate

CAGR of 9.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Experian; Fair Isaac Corporation; Constellation Software Inc.; CGI Group Inc.; TransUnion; Nucleus Software Exports Ltd.; Chetu Inc.; CDS Software; Pegasystems Inc.; Temenos Group AG; AMEYO; PAIR Finance; Credgenics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Debt Collection Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global debt collection software market report based on component, deployment, enterprise size, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Services

-

Software

-

Consulting

-

Integration & Implementation

-

Training & Support

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

Financial Institutions

-

Collection Agencies

-

Government

-

Telecom & Utilities

-

Others (Real Estate & Retail)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

Australia

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global debt collection software market size was estimated at USD 4.92 billion in 2023 and is expected to reach USD 5.34 billion in 2024

b. The global debt collection software market is expected to grow at a compound annual growth rate of 9.6% from 2024 to 2030, reaching USD 9.27 billion by 2030

b. North America dominated the debt collection software market with a revenue share of 30.4% in 2023. North America's robust adoption of technology has fostered an environment that favors the growth of the debt collection software market.

b. Some key players operating in the debt collection software market include Experian; Fair Isaac Corporation; Constellation Software Inc.; CGI Group Inc.; TransUnion; Nucleus Software Exports Ltd.; Chetu Inc.; CDS Software; Pegasystems Inc.; Temenos Group AG; AMEYO; PAIR Finance; Credgenics

b. Factors such as the increasing need for efficient debt recovery processes and the need to minimize bad debt while optimizing cash flow are driving the growth of the debt collection software market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.