- Home

- »

- Electronic Devices

- »

-

DC Motor Control Devices Market Size & Share Report, 2030GVR Report cover

![DC Motor Control Devices Market Size, Share & Trends Report]()

DC Motor Control Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Consumer Electronics, Automotive & Transportation, Industrial, Medical Devices), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-763-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

DC Motor Control Devices Market Trends

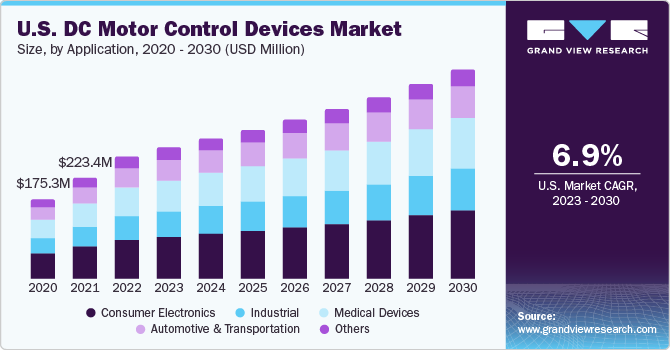

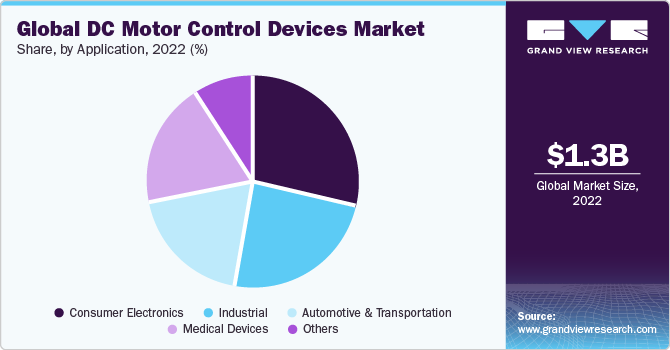

The global DC motor control devices market size was valued at USD 1.28 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. The primary trend expected to drive demand is increased competitiveness of markets incorporating electric motors, such as industrial, automotive, and aerospace. This factor also leads to considering new control strategies, the requirement for energy-efficient motors, and the need for cost-effective motor control devices. Numerous key players are developing integrated motor drive technology that offers several benefits, such as cost-effectiveness, increased efficiency, and compactness. These advancements are expected to drive product demand further. Additionally, rising demand for electric vehicles and the implementation of stringent government regulations about using energy-efficient products are expected to bolster market growth over the forecast period.

Brushless DC motors offer dynamic performance and are expected to replace stepper and conventional DC motors in various applications gradually. The growing adoption of these variants by end-use industries such as automotive, aerospace and defense, and healthcare is also expected to impact market growth positively. In addition, the ongoing trend of using direct-drive and servo motors in appliances, e-mobility applications, and Automated Guided Vehicles (AGVs) is expected to play a significant role in instigating product demand.

One of the challenges hindering growth prospects is an uptake of AC drives leveraging advancements in control and power conversion techniques and gradually gaining more prominence. However, this is a relatively moderate challenge as DC drives have been deployed across several industries, and their complete replacement by AC motors is expected to happen soon.

The COVID-19 pandemic had a mixed impact on the market for DC motor control devices. The global supply chains for these devices were significantly disrupted, leading to delays in production and distribution. The pandemic caused a slowdown in industrial activities, with many industries facing temporary shutdowns or reduced operations to comply with social distancing measures. It reduced the demand for DC motor control devices, particularly in sectors heavily impacted by the pandemic, such as automotive, aerospace, and construction. The economic uncertainties brought about by the pandemic have also led to a cautious approach to investment decisions, further affecting the demand for these devices. However, there was a notable shift toward automation during the pandemic.

Application Insights

The consumer electronics segment accounted for a major share of 29.3% in 2022. It can be attributed to increasing technological advancements and growing awareness regarding energy conservation among the population. Additionally, rising demand for compact and portable devices for vacuum cleaners and fans, HVAC, digital storage devices, and home appliances is expected to create additional revenue for market players over the forecast period.

The medical devices segment is expected to grow at the fastest CAGR of 9.8% over the forecast period. Unprecedented technological advances, coupled with baby boomers' retirement, have created growth potential for companies supplying components for medical applications. This marketplace is characterized by the production of various devices, ranging from breast pumps to fitness equipment, and is expected to provide high-growth avenues for market players.

Regional Insights

Asia Pacific accounted for the largest market share of 41.8% in 2022 and is expected to capture the largest CAGR of 7.8% during the forecast period. Increasing government investments in manufacturing electric vehicles and controlling fuel emissions are anticipated to boost market growth in the region over the forecast period. Moreover, the rising penetration of DC motor control devices in various applications, including consumer electronics, electric vehicles, and medical devices, is anticipated to drive the market in the Asia Pacific.

North America is projected to demonstrate growth at a CAGR of 6.5% over the forecast period. The region’s growth can be attributed to a shift in customer preference toward smart solutions, resulting in improved motor designs. Automation and an uptick in disposable medical devices also drive demand for affordable miniature motors in the U.S. and Canada. It is expected to catapult regional growth in the coming years.

Key Companies & Market Share Insights

The key players in the DC motor control devices market are aggressively investing in the research and development of DC-type controllers to introduce compact products. Efforts are also being made to develop electric DC motors with integrated speed controllers to cater to end-users requirements efficiently.

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in March 2022, Nidec Servo Corporation introduced a groundbreaking innovation: brushless DC motors equipped with Can-Bus, a communication function designed for vending machines' product pay-out mechanisms. These newly launched motors from Nidec Servo are the world's first to feature the Can-Bus communication function, enabling them to connect directly without needing a host computer.

Key DC Motor Control Devices Companies:

- ABB

- Eaton

- General Electric

- KB Electronics, Inc.

- OMRON Corporation

- Rockwell Automation

- Schneider Electric

- STMicroelectronics

- TOSHIBA CORPORATION

Recent Developments

-

In May 2023, ABB acquired Siemens' low-voltage NEMA motor business. This strategic move aligns with ABB's Motion business area's objective of achieving profitable growth. By integrating this business, ABB further solidifies its position as a premier manufacturer of industrial NEMA motors. The acquisition enhances ABB's capabilities and enables the company to provide improved services to its global customer base. Overall, this acquisition strengthens ABB's position in the industry and sets the stage for continued success

-

In May 2023, ABB Power Conversion introduced its newest high-efficiency rectifier, designed specifically for manufacturing applications. This advanced rectifier offers enhanced energy efficiency, significantly benefiting industrial operations. With this latest innovation, ABB Power Conversion continues to drive advancements in power conversion technology, delivering solutions that optimize performance and sustainability in manufacturing processes

-

In March 2023, GE Renewable Energy's Grid Solutions business secured three High-Voltage Direct Current contracts worth around 6 billion euros. These contracts are part of a consortium formed with Sembcorp Marine for TenneT's groundbreaking 2GW Program in the Netherlands. The agreements result from a five-year Framework Cooperation Agreement, with an option to extend for three years. This achievement solidifies GE's position in the renewable energy sector and demonstrates its commitment to innovative solutions for a sustainable future

-

In February 2023, Toshiba Electronic Devices & Storage Corporation commenced volume shipments of its latest gate-driver IC, "TB9083FTG," specifically designed for automotive brushless DC motors. This high-performance IC is intended for various applications, including electric brakes, shift-by-wire systems, and electric power steering (EPS). By launching this product, Toshiba aims to meet the increasing demand for advanced motor control solutions in the automotive industry

-

In October 2022, Rockwell acquired CUBIC, a private transportation and defense company. By integrating CUBIC's versatile and efficient modular systems with Rockwell's expertise and intelligent devices, customers will experience accelerated time to market and gain access to expanded plant-wide applications for intelligent motor control. Moreover, the collaboration will generate valuable smart data, enhancing sustainability and productivity. Rockwell also plans to leverage CUBIC's well-established partner model to extend its intelligent motor control offerings network in key regions such as Asia, Europe, and Latin America. This acquisition strengthens Rockwell's position in the market and reinforces its commitment to delivering innovative solutions to its customers worldwide

-

In April 2022, Exro Technologies Inc., a clean technology company specializing in advanced power control electronics for electric motors and batteries, has recently formed a strategic partnership with Wolong Electric Group Ltd, a supplier of automation solutions. This collaboration aligns with Exro's go-to-market strategy for its innovative Coil Drive inverter technology, which involves partnering with leading tier-1 automotive suppliers worldwide to enhance Exro's market reach and impact. The partnership signifies a significant milestone for Exro as it strengthens its market presence and accelerates the adoption of its patented technology in the global automotive industry

DC Motor Control Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.37 billion

Revenue forecast in 2030

USD 2.13 billion

Growth rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

ABB; Eaton; General Electric; KB Electronics, Inc.; OMRON Corporation; Rockwell Automation; Schneider Electric; STMicroelectronics; TOSHIBA CORPORATION

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

DC Motor Control Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global DC motor control devices market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer Electronics

-

Smart motorized devices

-

High-end toys

-

Social robots

-

Others

-

-

Automotive & Transportation

-

Marine outboard motors

-

Others

-

-

Industrial

-

ATM machines

-

Pan tilt zoom cameras

-

Water pump

-

Actuators & other robotic devices

-

Others

-

-

Medical Devices

-

CPAC machines

-

Oxygen concentrator machines

-

Breast pump

-

Electronic spoons

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global DC motor control devices market size was estimated at USD 1.28 billion in 2022 and is expected to reach USD 1.37 billion in 2022.

b. The global DC motor control devices market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 2.13 billion by 2030.

b. Asia Pacific dominated the DC motor control devices market with a share of 41.8% in 2022. This is attributable to increasing government investments in manufacturing electric vehicles and controlling fuel emissions.

b. Some key players operating in the DC motor control devices market include ABB, Eaton Corporation Plc, General Electric Company, KB Electronics, Inc., OMRON Corporation, Rockwell Automatic, Inc., Schneider Electric SE, STMicroelectronics, and Toshiba Corporation.

b. Key factors that are driving the market growth include increased use of electric motors in industrial, automotive, and aerospace applications and consequent need for underlying electronic controls.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.