DC-DC Converter Market Size, Share & Trends Analysis Report By Type (Isolated, Non-Isolated), By Input Voltage (Up to 40V, 40V to 100V), By Output Voltage (Up to 100V, 100V to 500V), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-396-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

DC-DC Converter Market Size & Trends

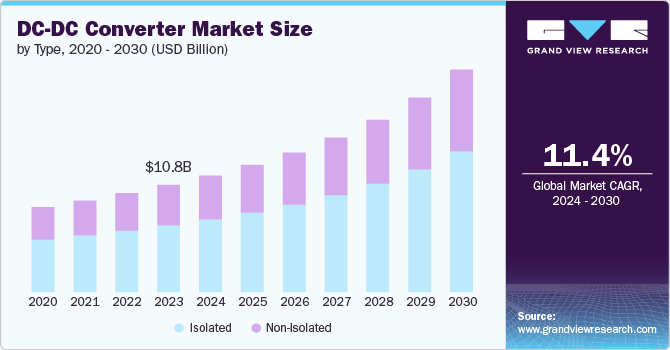

The global DC-DC converter market was estimated at USD 10.79 billion in 2023 and is expected to grow at a CAGR of 11.4% from 2024 to 2030. The primary market driver is the rising demand for energy-efficient power conversion solutions across various industries. The rapid expansion of renewable energy sources such as solar and wind power necessitates efficient DC-DC converters for power management and integration into the grid. Additionally, the increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) significantly boosts the market. These vehicles require reliable DC-DC converters to manage battery systems and power distribution, contributing to the market's expansion.

Other driver includes the growth in telecommunications infrastructure, especially with the global rollout of 5G technology. Advanced telecommunications equipment requires efficient power management, thereby driving the demand for high-performance DC-DC converters. The aerospace and defense sectors also play a crucial role, as DC-DC converters are essential for various applications, including avionics, satellite systems, and military equipment. The push towards miniaturization and increased power density in electronic devices further propels market growth, as modern converters need to be more compact and efficient.

In terms of market trends, there is a notable shift towards GaN (gallium nitride) and SiC (silicon carbide) technologies. These wide bandgap materials offer superior power efficiency, higher switching frequencies, and smaller footprints compared to conventional silicon-based devices. This trend is driven by the need for more efficient and compact power solutions, particularly in high-performance applications. The integration of IoT (Internet of Things) and AI (Artificial Intelligence) in industrial automation and consumer electronics also drives the demand for advanced DC-DC converters, which are essential for managing the power requirements of these smart devices.

There are abundant market opportunities, particularly in emerging markets and developing economies. The rapid industrialization and urbanization in regions such as Asia-Pacific and Latin America present significant growth potential. These regions are witnessing increased investments in renewable energy, telecommunications, and automotive industries, all of which require advanced DC-DC converters. Additionally, the continuous advancements in technology and increasing R&D investments open new avenues for innovative products with improved efficiency and performance.

Type Insights

The Isolated DC-DC converters segment dominated the market in 2023 and accounted for more than 62% share of global revenue. This dominance is due to the superior performance of these converters in providing electrical isolation between the input and output, which is crucial for safety and noise reduction in sensitive electronic applications. These converters are extensively used in applications where isolation is mandatory, such as medical devices, industrial control systems, and telecommunication equipment. The growing adoption of renewable energy systems, which often require isolation to prevent backflow of current, also contributes to the dominance of isolated converters. The robust demand from sectors like automotive, aerospace, and defense, where reliability and safety are paramount, further reinforces their leading position in the market. Innovations in materials and design are enhancing the efficiency and reliability of isolated DC-DC converters, making them even more attractive to industries with stringent performance standards. As technology advances and industries continue to prioritize safety and reliability, isolated DC-DC converters are expected to maintain their market dominance.

The non-isolated DC-DC converters segment, while essential for various low-power applications where isolation is not a concern, is growing at a stagnant rate. These converters are popular in consumer electronics, such as smartphones and portable devices, where efficiency, size, and cost are critical factors. However, the saturation of the consumer electronics market and the relatively low barriers to entry for manufacturers have led to intense competition and price pressures, limiting significant growth. Additionally, non-isolated converters are less suitable for applications requiring high safety standards and noise immunity, which restricts their adoption in high-growth industries like automotive and aerospace. While technological advancements and increasing power density may offer some growth opportunities, the overall market expansion for non-isolated DC-DC converters remains constrained compared to their isolated counterparts.

Input Voltage Insights

The 40V to 100V segment dominated the market in 2023 due to their widespread applicability across various industries, including automotive, industrial, and telecommunications. This voltage range is particularly suited for intermediate bus architectures in data centers, where power conversion efficiency and scalability are critical. The automotive sector, driven by the increasing adoption of EVs and advanced driver-assistance systems (ADAS), relies heavily on converters within this voltage range to manage battery systems and onboard electronics. Additionally, the telecom industry, with its growing infrastructure needs for 5G and IoT deployments, demands reliable power solutions within this voltage range. The versatility and reliability of 40V to 100V DC-DC converters make them indispensable in applications where power stability and efficiency are paramount, ensuring their leading position in the market.

The 500V to 1000V is the fastest-growing segment in the DC-DC converter market, driven by the expanding renewable energy sector and the increasing adoption of high-voltage industrial applications. These converters are crucial for managing power in solar photovoltaic systems, wind turbines, and energy storage solutions, where high voltage is essential for efficient energy transmission and conversion. The push towards electrification in transportation, including electric trains and heavy-duty electric vehicles, also boosts demand for high-voltage DC-DC converters. Moreover, advancements in semiconductor technologies, such as wide-bandgap materials like silicon carbide (SiC) and gallium nitride (GaN), enhance the performance and efficiency of high-voltage converters, making them more attractive for emerging applications. As industries continue to seek higher efficiency and power density, the 500V to 1000V DC-DC converter segment is poised for substantial growth.

Output Voltage Insights

The up to 100V segment dominated the market in 2023 due to the extensive use of these products in a wide range of applications, from consumer electronics to industrial equipment. These converters are integral in powering portable electronic devices, including smartphones, laptops, and wearable technology, where compact size and high efficiency are critical. In the industrial sector, up to 100V converters are used in automation systems, robotics, and instrumentation, providing reliable power for various control and monitoring functions. The rapid advancement in IoT devices, which often operate within this voltage range, further drives the demand for these converters. Additionally, the automotive industry utilizes up to 100V DC-DC converters for battery management systems and auxiliary power supplies in electric and hybrid vehicles. The broad applicability and continuous technological enhancements ensure the dominance of this segment in the market.

The output voltage segment is experiencing significant growth driven by the increasing need for high-power applications in renewable energy, transportation, and industrial automation. These converters are essential for efficient power management in solar inverters, wind energy systems, and large-scale energy storage solutions, where high output voltage is crucial for optimal performance. The shift towards electrification in the transportation sector, including electric buses, trucks, and railways, requires robust high-voltage converters to manage power distribution and battery systems. Industrial automation and smart grid applications also benefit from high-voltage DC-DC converters, enabling efficient power conversion and distribution in complex systems. The growing emphasis on energy efficiency and the adoption of advanced semiconductor technologies are accelerating the demand for 500V to 1000V DC-DC converters, making this segment the fastest-growing in the market.

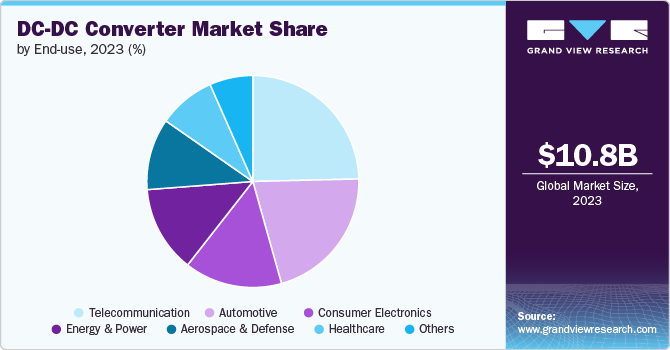

End Use Insights

The telecommunication segment dominated the market in 2023 due to the critical role of power conversion in maintaining and expanding communication networks. With the ongoing rollout of 5G technology and the increasing demand for high-speed internet and data services, telecommunication companies are investing heavily in infrastructure upgrades. DC-DC converters are vital components in base stations, data centers, and network equipment, ensuring reliable power delivery and efficient energy use. The proliferation of IoT devices and the need for constant connectivity further drive the demand for DC-DC converters in the telecom industry. The requirement for high reliability, efficiency, and compact design makes DC-DC converters indispensable in telecommunication applications, solidifying their dominant position in this market segment.

The automotive segment is experiencing significant growth in the market, driven by the rapid adoption of electric vehicles and the advancement of automotive electronics. The shift towards electrification and the integration of sophisticated electronic systems in vehicles necessitate efficient power management solutions. DC-DC converters are crucial in EVs for converting high-voltage battery power to lower voltages required by various electronic components, such as infotainment systems, ADAS, and lighting. The growing emphasis on vehicle electrification, driven by stringent emission regulations and consumer demand for eco-friendly transportation, is fueling the demand for advanced DC-DC converters. Additionally, the development of autonomous vehicles, which rely heavily on complex electronic systems, further accelerates the growth of this segment. The continuous innovation in automotive technology and the push towards sustainable transportation make the automotive sector the fastest-growing market for DC-DC converters.

Regional Insights

The market in North America is experiencing significant growth, driven by the region's strong emphasis on technological advancement and innovation. North America, particularly the U.S. and Canada, is home to numerous leading manufacturers and technology companies that are continuously developing advanced DC-DC converter solutions. The robust demand for DC-DC converters in sectors such as telecommunications, automotive, aerospace, and defense is a major driver. In the telecommunications sector, the rapid deployment of 5G infrastructure necessitates efficient power management solutions, boosting the demand for DC-DC converters. The automotive industry in North America is also a significant contributor, with the growing adoption of electric vehicles and hybrid electric vehicles that require reliable DC-DC converters for power distribution and battery management.

U.S. DC-DC Converter Market Trends

The market in the U.S. is a major segment within the North American region, characterized by high levels of innovation, technological advancement, and diverse application demands. The country's robust telecommunications sector, with ongoing investments in 5G infrastructure and advanced communication technologies, is a significant driver of the market. Efficient power management solutions are critical for the smooth operation of telecommunications equipment, driving the demand for advanced DC-DC converters. The automotive industry in the U.S. is also a major contributor to the market growth, with increasing adoption of electric and hybrid vehicles. Stringent emission regulations, government incentives, and the growing focus on sustainable transportation solutions accelerate the demand for DC-DC converters for power management and battery systems in electric vehicles. Additionally, the aerospace and defense sectors in the U.S. benefit from the high reliability and efficiency of DC-DC converters, which are essential for various applications, including avionics, satellite systems, and military equipment.

Asia Pacific DC-DC Converter Market Trends

The Asia Pacific region is the fastest-growing market for DC-DC converters driven by the region's burgeoning industrial sector, expanding telecommunications infrastructure, and increasing adoption of electric vehicles. Countries such as China, Japan, South Korea, and India are leading contributors to the market, with significant investments in technology development and infrastructure. The rapid expansion of telecommunications networks, particularly the deployment of 5G technology, is a major driver for DC-DC converters in the region. Efficient power management solutions are essential for the smooth operation of advanced telecommunications equipment, boosting the demand for DC-DC converters. The automotive industry in Asia Pacific is also a significant growth driver, with the region being a major hub for automotive manufacturing and innovation. The increasing production and adoption of electric and hybrid vehicles necessitate reliable DC-DC converters for power distribution and battery management systems.

Europe DC-DC Converter Market Trends

The market in Europe is poised for substantial growth, fueled by the region's strong focus on renewable energy, automotive electrification, and industrial automation. European countries are at the forefront of the global renewable energy transition, investing heavily in wind, solar, and other sustainable energy sources. DC-DC converters are essential components in renewable energy systems, facilitating efficient power conversion and integration into the grid. The automotive sector in Europe is also a major driver of the market, with leading automakers and suppliers headquartered in the region. The increasing adoption of electric and hybrid vehicles, supported by stringent emission regulations and government incentives, accelerates the demand for DC-DC converters for power management and battery systems.

Key DC-DC Converter Company Insights

Key players operating in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key DC-DC Converter Companies:

The following are the leading companies in the DC-DC converter market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Energy Industries, Inc.

- Delta Electronics, Inc.

- Flex Ltd

- Infineon Technologies AG

- Murata Manufacturing Co., Ltd.

- NXP Semiconductor

- Renesas Electronics Corporation

- Skyworks Solutions, Inc.

- STMicroelectronics

- TDK Corporation

- Analog Devices, Inc.

- ABB Ltd

- Crane Holdings, Co.

- Texas Instruments Incorporated

- Vicor Corporation.

Recent Developments

-

In June 2024, Renesas Electronics Corporation has announced the completion of its acquisition of Transphorm, Inc. With this acquisition finalized, Renesas will immediately begin offering GaN-based power products and related reference designs to address the increasing demand for wide bandgap (WBG) semiconductor products. WBG materials like GaN and silicon carbide (SiC) are regarded as critical technologies for new power semiconductors due to their higher switching frequencies, superior power efficiency, and smaller footprints compared to traditional silicon-based devices.

-

In January 2023, Micross Components, Inc., a prominent supplier of high-reliability microelectronic products and service solutions for space, defense, aerospace, medical, and industrial applications have announced the signing of a definitive agreement to acquire the DC-DC converter business of the Infineon Technologies AG, one of the global leaders in semiconductor power systems and IoT.

DC-DC Converter Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 11.72 billion |

|

Revenue forecast in 2030 |

USD 22.37 billion |

|

Growth rate |

CAGR of 11.4% from 2024 to 2030 |

|

Actual Data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, input voltage, output voltage, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa |

|

Key companies profiled |

Advanced Energy Industries, Inc.; Delta Electronics, Inc.; Flex Ltd; Infineon Technologies AG; Murata Manufacturing Co., Ltd.; NXP Semiconductor; Renesas Electronics Corporation; Skyworks Solutions, Inc.; STMicroelectronics; TDK Corporation; Analog Devices, Inc.; ABB Ltd; Crane Holdings, Co.; Texas Instruments Incorporated; Vicor Corporation |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scopes |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global DC-DC Converter Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global DC-DC converter market based on type, input voltage, output voltage, end use, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Isolated

-

Non-Isolated

-

-

Input Voltage Outlook (Revenue, USD Million, 2017 - 2030)

-

Up to 40V

-

40V to 100V

-

100V to 500V

-

500V to 1000V

-

-

Output Voltage Outlook (Revenue, USD Million, 2017 - 2030)

-

Up to 100V

-

100V to 500V

-

500V to 1000V

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecommunication

-

Automotive

-

Consumer Electronics

-

Energy & Power

-

Aerospace & Defense

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global DC-DC converter market size was estimated at USD 10.79 billion in 2023 and is expected to reach USD 11.72 billion in 2024.

b. The global DC-DC converter market is expected to grow at a compound annual growth rate of 11.4% from 2024 to 2030 to reach USD 22.37 billion by 2030.

b. Asia Pacific dominated the DC-DC converter market with a share of over 35.0% in 2023 due to the region's burgeoning industrial sector, expanding telecommunications infrastructure, and increasing adoption of electric vehicles. Countries such as China, Japan, South Korea, and India are leading contributors to the market, with significant investments in technology development and infrastructure.

b. Some key players operating in the DC-DC converter market include Advanced Energy Industries, Inc , Delta Electronics, Inc., Flex Ltd, Infineon Technologies AG, Murata Manufacturing Co., Ltd., NXP Semiconductor, Renesas Electronics Corporation, Skyworks Solutions, Inc., STMicroelectronics, TDK Corporation, Analog Devices, Inc., ABB Ltd, Crane Holdings, Co., Texas Instruments Incorporated, and Vicor Corporation.

b. Key factors driving market growth include the rising demand for energy-efficient power conversion solutions across various industries. The rapid expansion of renewable energy sources such as solar and wind power necessitates efficient DC-DC converters for power management and integration into the grid.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."