- Home

- »

- Semiconductors

- »

-

DC Circuit Breaker Market Size, Share, Growth Report, 2030GVR Report cover

![DC Circuit Breaker Market Size, Share & Trends Report]()

DC Circuit Breaker Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Solid State, Hybrid), By Insulation, By Voltage (Low Voltage, Medium Voltage, High Voltage), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-381-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

DC Circuit Breaker Market Size & Trends

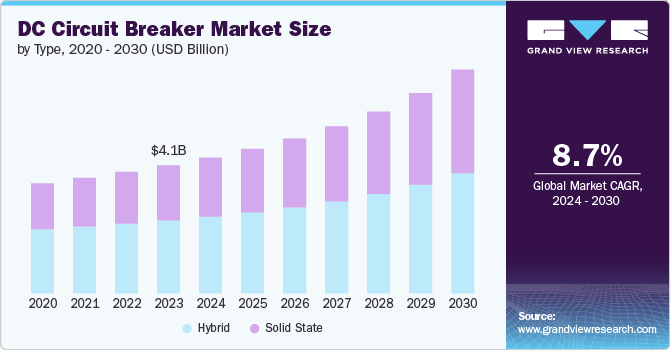

The global DC circuit breaker market size was estimated at USD 4.13 billion in 2023 and is expected to grow at a CAGR of 8.7% from 2024 to 2030. The market is experiencing significant growth driven by several key trends and drivers. One prominent trend is the increasing adoption of renewable energy sources, such as solar and wind power, which require efficient and reliable circuit protection. As countries worldwide strive to reduce carbon emissions and transition to sustainable energy systems, the deployment of DC circuit breakers is becoming crucial for integrating these renewable sources into the grid. Additionally, the rise of electric vehicles (EVs) and the expansion of EV charging infrastructure are creating a substantial demand for DC circuit breakers, which are essential for protecting charging stations and ensuring safe and efficient power distribution.

Market drivers include the ongoing modernization of aging power infrastructure and the implementation of smart grid technologies. These initiatives aim to enhance grid reliability, reduce transmission losses, and improve energy efficiency, thereby driving the demand for advanced DC circuit breakers. Moreover, the expansion of high voltage direct current (HVDC) transmission systems, which are essential for long-distance power transmission and integrating remote renewable energy sources, is significantly boosting the market. The increasing need for robust and efficient circuit protection in industrial applications and data centers further fuels market growth.

Market opportunities are abundant, particularly in emerging economies where rapid industrialization and urbanization are taking place. These regions are investing heavily in power infrastructure and renewable energy projects, creating a substantial demand for DC circuit breakers. Advancements in technology, such as the development of solid state and hybrid DC circuit breakers, are also opening new opportunities. These breakers offer superior performance, reliability, and efficiency, making them attractive for a wide range of applications. Furthermore, supportive government policies and incentives for renewable energy adoption and infrastructure development are expected to drive market growth.

Type Insights

The hybrid DC circuit breaker segment dominated the market in 2023 and accounted for a more than 56% share of global revenue. This is due to their balanced combination of mechanical robustness and electronic efficiency. These breakers incorporate both mechanical and solid-state elements, offering the best of both worlds: the high-speed interruption capabilities of solid-state devices and the durability and reliability of mechanical systems. This hybrid approach makes them ideal for a wide range of applications, including transportation, power distribution, and industrial systems, where both reliability and performance are critical.

The ongoing expansion of renewable energy projects and the modernization of power grids further boost the demand for hybrid DC circuit breakers. Their ability to handle high power levels and provide fast, reliable switching makes them essential for integrating renewable energy sources and ensuring grid stability. Moreover, advancements in hybrid technology are continually improving their performance, efficiency, and cost-effectiveness, reinforcing their dominance in the market. The versatility and adaptability of hybrid DC circuit breakers make them a preferred choice for many industries, ensuring their continued leadership in the market.

The solid-state DC circuit breaker segment is projected to witness high CAGR from 2024 to 2030. Solid state DC circuit breakers are witnessing rapid growth due to their superior efficiency, reliability, and quick switching capabilities. These breakers use semiconductor devices to interrupt the current flow, eliminating the mechanical wear and tear associated with traditional mechanical breakers. This characteristic makes them particularly suitable for applications requiring frequent switching and high-speed operation, such as renewable energy systems, data centers, and electric vehicles. The increasing deployment of smart grids and advanced power distribution networks also drives the demand for solid state DC circuit breakers.

As power systems become more complex and distributed, the need for precise and reliable control grows, further propelling the adoption of solid-state technology. Additionally, ongoing advancements in semiconductor materials and technology are expected to enhance the performance and reduce the costs of these breakers, making them more accessible for various applications. The trend towards electrification and digitalization in multiple sectors underscores the significant growth potential of solid-state DC circuit breakers, positioning them as a key component in the evolving energy landscape.

Insulation Insights

The vacuum-insulated DC circuit breakers segment dominated the market in 2023 due to their high reliability, efficiency, and ability to operate in harsh environments. These breakers use a vacuum as the insulating medium, which provides excellent arc-quenching capabilities and minimal maintenance requirements. Vacuum insulation is particularly advantageous in high-voltage applications, where the efficient interruption of high currents is critical. This makes vacuum-insulated DC circuit breakers a preferred choice for power generation, industrial applications, and transmission and distribution utilities.

The increasing adoption of renewable energy sources and the expansion of smart grid technologies further drive the demand for vacuum-insulated breakers. As power systems become more decentralized and complex, the need for reliable and efficient circuit protection grows, reinforcing the dominance of vacuum-insulated DC circuit breakers. Additionally, ongoing advancements in vacuum technology are enhancing the performance and reducing the costs of these breakers, making them more attractive for a wider range of applications.

The gas-insulated DC circuit breakers are the fastest-growing segment in the DC Circuit Breaker market driven by their compact size, high insulation properties, and suitability for urban and offshore installations. These breakers use gas, typically sulfur hexafluoride (SF6), as the insulating medium, providing excellent dielectric strength and arc-quenching capabilities. The compact design of gas-insulated breakers makes them ideal for applications where space is limited, such as in densely populated urban areas and offshore platforms.

The increasing focus on renewable energy projects and the modernization of power grids drive the demand for gas-insulated DC circuit breakers. As more renewable energy sources are integrated into the grid, the need for reliable and efficient circuit protection grows, boosting the adoption of gas-insulated technology. Moreover, advancements in gas insulation technology are enhancing the performance and environmental impact of these breakers, further supporting their growth. The trend towards urbanization and the expansion of offshore energy projects underscores the significant growth potential of gas-insulated DC circuit breakers.

Voltage Insights

The medium voltage DC circuit breakers segment dominated the market in 2023 due to their widespread use in power distribution and industrial applications. These breakers are essential for managing and protecting electrical systems in utilities, manufacturing plants, and large commercial facilities. The growth of smart grid technologies and the increasing deployment of renewable energy sources drive the demand for medium voltage DC circuit breakers. These breakers provide reliable and efficient interruption of current, ensuring the stability and safety of electrical systems.

The modernization of aging infrastructure and the expansion of power distribution networks further boost the adoption of medium voltage breakers. Additionally, advancements in medium voltage technology are enhancing the performance, efficiency, and cost-effectiveness of these breakers, making them more attractive for a wide range of applications. The critical role of medium voltage DC circuit breakers in ensuring reliable power distribution and protecting electrical systems underpins their dominant position in the market.

The high voltage DC circuit breakers segment is experiencing significant growth in the DC Circuit Breaker market due to the increasing deployment of high voltage direct current (HVDC) transmission systems. These breakers are essential for managing and protecting HVDC networks, which are crucial for long-distance power transmission and integrating renewable energy sources into the grid. The rapid expansion of renewable energy projects, such as offshore wind farms and large solar installations, drives the demand for high voltage DC circuit breakers.

These breakers provide reliable and efficient interruption of high currents, ensuring the stability and safety of HVDC systems. The ongoing investments in HVDC infrastructure and the modernization of power grids further boost the adoption of high voltage DC circuit breakers. Additionally, advancements in high voltage technology are enhancing the performance, efficiency, and cost-effectiveness of these breakers, making them more attractive for a wider range of applications. The critical role of high voltage DC circuit breakers in supporting the growth of renewable energy and ensuring the reliability of HVDC networks underscores their significant growth potential.

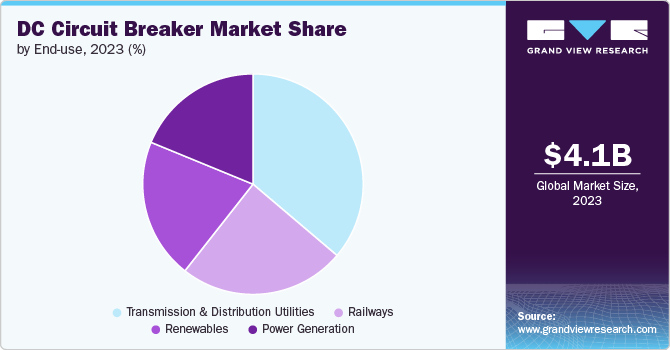

End-use Insights

The transmission and distribution utilities segment dominated the market in 2023 due to the critical need for reliable and efficient circuit protection in maintaining grid stability. These utilities rely on DC circuit breakers to manage and protect their power distribution networks, ensuring the continuous and safe delivery of electricity. The increasing adoption of renewable energy sources and the expansion of smart grid technologies drive the demand for DC circuit breakers in this segment.

As power systems become more complex and decentralized, the need for advanced circuit protection solutions grows, reinforcing the dominance of transmission and distribution utilities in the market. The modernization of aging infrastructure and ongoing investments in grid expansion further boost the adoption of DC circuit breakers. Additionally, advancements in DC circuit breaker technology are enhancing their performance, efficiency, and cost-effectiveness, making them more attractive for transmission and distribution utilities.

The renewables segment is experiencing significant growth due to the global push towards sustainable energy sources. The increasing deployment of solar, wind, and other renewable energy systems drives the demand for reliable and efficient circuit protection. DC circuit breakers play a crucial role in managing and protecting the electrical systems of renewable energy installations, ensuring the safe and stable integration of these sources into the grid.

The ongoing investments in renewable energy projects and the expansion of green energy infrastructure further boost the adoption of DC circuit breakers in this segment. Additionally, advancements in DC circuit breaker technology are enhancing their performance and cost-effectiveness, making them more attractive for renewable energy applications. The growing focus on sustainability and the transition towards a low-carbon energy system underscore the significant growth potential of the renewables segment.

Regional Insights

The DC Circuit Breaker market in North America is expected to hold a prominent position in the DC Circuit Breaker market driven by substantial investments in smart grid technologies and renewable energy projects. The region's focus on upgrading aging infrastructure and integrating advanced power distribution systems fuels market growth. The United States, in particular, plays a crucial role with its ongoing investments in HVDC transmission systems and renewable energy integration. The increasing adoption of electric vehicles and the expansion of data centers also drive the demand for DC circuit breakers in North America. Moreover, advancements in DC circuit breaker technology are enhancing the performance and cost-effectiveness of these solutions, making them more attractive for various applications. The region's commitment to sustainability and the transition towards a low-carbon energy system further support the market growth.

U.S. DC Circuit Breaker Market Trends

The DC circuit breaker market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030 and is characterized by substantial investments in upgrading the aging power infrastructure and expanding renewable energy projects. The country's focus on enhancing grid reliability and integrating more renewable energy sources drives the demand for advanced DC circuit breakers. The increasing adoption of electric vehicles and the expansion of EV charging infrastructure also contribute significantly to market growth. Moreover, the U.S. is investing heavily in smart grid technologies and HVDC transmission systems to improve the efficiency and reliability of its power distribution network. These factors, combined with ongoing technological advancements in DC circuit breakers, enhance their performance and cost-effectiveness, making them more attractive for a wide range of applications. The U.S. market's commitment to sustainability and reducing carbon emissions further supports the market growth.

Asia Pacific DC Circuit Breaker Market Trends

Asia Pacific stands as both the dominating and fastest-growing region in the DC circuit breakers market, driven by the rapid industrialization, urbanization, and significant investments in renewable energy and HVDC projects. Countries like China, India, and Japan are key contributors, with substantial investments in power infrastructure and renewable energy integration. The region's focus on expanding and modernizing its power grid to meet the growing energy demand fuels the adoption of DC circuit breakers. The increasing deployment of renewable energy systems and the expansion of electric vehicle charging infrastructure further boost market growth. Additionally, advancements in DC circuit breaker technology are enhancing their performance, efficiency, and cost-effectiveness, making them more attractive for a wide range of applications. The region's commitment to sustainability and the transition towards a low carbon energy system underscores the significant growth potential of the market in Asia Pacific.

Europe DC Circuit Breaker Market Trends

The DC circuit breaker market in Europe is characterized by stringent environmental regulations and a strong commitment to renewable energy. The region's extensive HVDC projects and smart grid initiatives drive the demand for DC circuit breakers. Countries like Germany, France, and the United Kingdom are key contributors, with significant investments in renewable energy and grid modernization. The increasing focus on integrating renewable energy sources into the grid and enhancing grid stability further boosts the adoption of DC circuit breakers. Additionally, advancements in DC circuit breaker technology are improving their performance, efficiency, and environmental impact, making them more attractive for various applications. The region's emphasis on sustainability and energy efficiency underscores the significant growth potential of the market in Europe.

Key DC Circuit Breaker Company Insights

Key players operating in the DC Circuit Breaker market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2023, Mitsubishi Electric Corporation has completed the acquisition of Scibreak AB, a Swedish company that provides direct current circuit breakers (DCCBs). This strategic acquisition is intended to boost the competitive advantage of both companies by jointly advancing DCCB technologies for high-voltage direct current (HVDC) systems, this collaboration aims to support the global shift towards renewable energy sources.

-

In September 2022, ABB has launched the SACE Infinitus, an advanced solid-state circuit breaker aimed at streamlining the integration, protection, and management of DC network architectures for a wide range of ships. According to ABB, SACE Infinitus is the first circuit breaker globally to be certified with IEC 60947-2 standards while incorporating semiconductor technology. Moreover, this innovative device will also come with DNV certification for low-voltage maritime applications.

Key DC Circuit Breaker Companies:

The following are the leading companies in the DC circuit breaker market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd

- Larsen & Toubro Limited

- Mitsubishi Electric Corporation

- GEYA Electrical Co.

- Entec Electric & Electronic Co Ltd

- Hyundai Electric & Energy Systems Company

- Rockwell Automation

- Eaton Corporation PLC

- Siemens AG

- Nader Electrical

- Fuji Electric Co Ltd

- Powell Industries, Inc.

- Schneider Electric SE

DC Circuit Breaker Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.38 billion

Revenue forecast in 2030

USD 7.22 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, insulation, voltage, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ABB Ltd; Larsen & Toubro Limited; Mitsubishi Electric Corporation; GEYA Electrical Co.; Entec Electric & Electronic Co Ltd; Hyundai Electric & Energy Systems Company; Rockwell Automation; Eaton Corporation PLC; Siemens AG; Nader Electrical; Fuji Electric Co Ltd; Powell Industries, Inc.; Schneider Electric SE

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scopes

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global DC Circuit Breaker Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global DC circuit breaker market report based on type, insulation, voltage, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid State

-

Hybrid

-

-

Insulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Vacuum

-

Gas

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Transmission & Distribution Utilities

-

Power Generation

-

Renewables

-

Railways

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global DC circuit breaker market size was estimated at USD 4.13 billion in 2023 and is expected to reach USD 4.38 billion in 2024.

b. The global DC circuit breaker market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 7.22 billion by 2030.

b. Asia Pacific dominated the DC circuit breaker market with a share of over 35% in 2023, driven by rapid industrialization, urbanization, and significant investments in renewable energy and HVDC projects. Countries like China, India, and Japan are key contributors, with substantial investments in power infrastructure and renewable energy integration.

b. Some key players operating in the DC circuit breaker market include ABB Ltd, Larsen & Toubro Limited, Mitsubishi Electric Corporation, GEYA Electrical Co., Entec Electric & Electronic Co Ltd, Hyundai Electric & Energy Systems Company, Rockwell Automation, Eaton Corporation PLC, Siemens AG, Nader Electrical, Fuji Electric Co Ltd, Powell Industries, Inc., and Schneider Electric SE.

b. Key factors driving market growth include the ongoing modernization of aging power infrastructure and the implementation of smart grid technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.