DataOps Platform Market Size, Share & Trends Analysis Report By Component (Platform, Services), By Deployment (Cloud, On Premise), By Type (Agile Development, DevOps), By Vertical (IT & Telecom), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-441-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

DataOps Platform Market Size & Trends

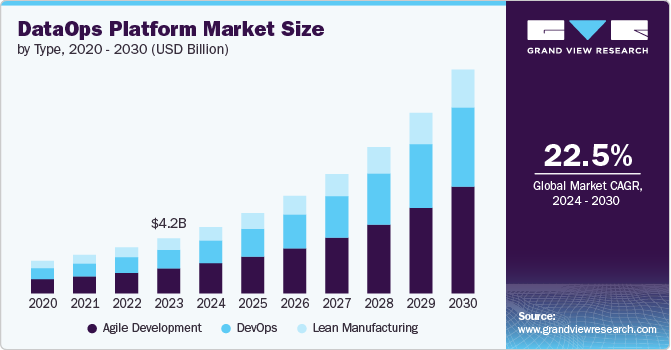

The global DataOps platform market size was estimated at USD 4.22 billion in 2023 and is expected to grow at a CAGR of 22.5% from 2024 to 2030. Numerous factors such as explosion of data, increasing demand for real-time analytics, data-driven decision-making, increasing complexity of data environments, and enhanced focus on data security are primarily contributing to the growth of the market. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into data analytics processes requires efficient data management and pipeline solutions provided by DataOps. The use of big data technologies and frameworks necessitates advanced DataOps practices for managing and processing large volumes of data.

Organizations leverage data for strategic insights, operational efficiency, and competitive advantage, leading to greater investment in DataOps to optimize data management and analytics processes. The complexity of managing data across various sources, formats, and platforms highlights the need for DataOps to ensure seamless integration, data quality, and governance. Increased emphasis on automation to streamline data workflows and reduce manual intervention drives the adoption of DataOps solutions. The shift towards cloud computing and digital transformation initiatives accelerates the need for DataOps to manage data across hybrid and multi-cloud environments efficiently.

Organizations need agile and scalable data operations to quickly adapt to market changes, innovate, and scale their data infrastructure in response to evolving business needs. Moreover, the rise of remote and hybrid work models increases the need for scalable and accessible data management solutions that support distributed teams and ensure data availability. Thus, there is high growth of the DataOps platform market. Furthermore, compliance with regulations such as General Data Protection Regulation (GDPR), Health Insurance Portability and Accountability Act (HIPAA), and California Consumer Privacy Act (CCPA) necessitates robust data governance and security practices, which are supported by DataOps frameworks.

Component Insights

The platform segment led the market and accounted for over 65.0% share of the global revenue in 2023. Organizations require real-time or near-real-time data processing and analytics to make timely decisions and gain competitive advantages, driving the need for DataOps platforms that support rapid data integration and analysis. Furthermore, ensuring data accuracy, consistency, and reliability is crucial for organizations, which fuels demand for DataOps solutions that address data quality issues. The integration of AI and machine learning technologies into data analytics requires efficient data management and pipeline solutions provided by DataOps platforms.

The services segment is anticipated to exhibit the highest CAGR from 2024 to 2030. Organizations require scalable DataOps services to support growth, adapt to changing business needs, and manage increasing data volumes effectively. The demand for customized DataOps solutions that address specific business needs and challenges drives growth in the services segment, as organizations seek expert guidance and tailored implementations. In addition, growing concerns about data breaches and security threats lead organizations to adopt DataOps services that offer robust security features and capabilities for protecting sensitive data.

Deployment Insights

The cloud systems segment accounted for the largest revenue share in 2023. Organizations are migrating their data infrastructure and applications to the cloud to benefit from scalability, flexibility, and cost-efficiency, driving the need for DataOps cloud solutions. In addition, the use of multiple cloud providers and hybrid cloud setups requires robust DataOps solutions to manage and integrate data across diverse environments. Cloud-based DataOps solutions facilitate the integration of data from various sources into a unified platform, improving data accessibility and usability.

The on-premises segment is anticipated to exhibit a significant CAGR from 2024 to 2030. Organizations with stringent data security and compliance needs, such as healthcare, finance, and government, often prefer on-premises solutions to maintain control over their data and meet regulatory standards. On-premises platforms help organizations ensure that data remains within their own infrastructure, which is crucial for compliance with data sovereignty laws. Furthermore, various organizations have significant investments in legacy systems and infrastructure. On-premises DataOps solutions are often required to integrate and optimize these existing systems without a complete overhaul.

Type Insights

The agile development segment accounted for the largest revenue share in 2023. Agile development practices emphasize rapid iteration and delivery of features, which aligns with the need for faster deployment of data management solutions and quicker insights from data. Moreover, the integration of DataOps with continuous integration and continuous deployment (CI/CD) pipelines in agile development environments promotes automation, efficiency, and consistency in data operations. These factors collectively contribute to the growth of the DataOps platform segment focused on agile development.

The DevOps segment is anticipated to exhibit a significant CAGR from 2024 to 2030. DevOps practices include automated testing and monitoring, which help maintain high data quality and reliability in DataOps platforms through continuous validation and quality assurance. Integrating DataOps with DevOps practices enables seamless management of data pipelines, supporting continuous delivery and integration of data-driven applications. Furthermore, the growth of cloud computing and microservices architectures drives the need for DataOps platforms that integrate seamlessly with DevOps practices to manage data across distributed and cloud environments.

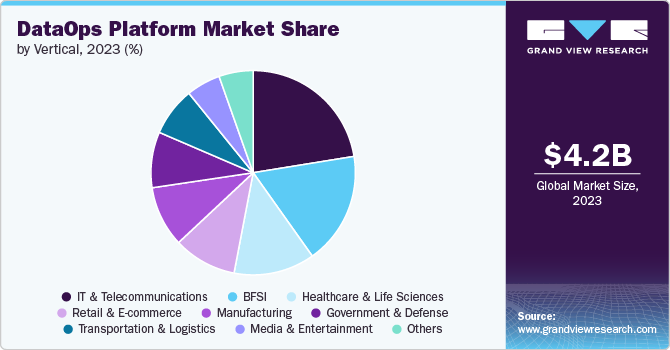

Vertical Insights

The IT & telecommunications segment accounted for the largest revenue share in 2023. The IT & telecommunications sector generates vast amounts of data from various sources, including network operations, customer interactions, and IoT devices. This massive data growth drives the need for DataOps platforms to efficiently manage, process, and analyze data. Moreover, telecommunications companies require real-time data processing to ensure the smooth operation of networks, improve customer service, and optimize network performance. DataOps platforms enable rapid data integration and real-time analytics, essential for these time-sensitive operations. These factors collectively contribute to the growth of the DataOps platform in the IT & telecommunications industry, as companies seek to enhance their data management capabilities, optimize operations, and stay competitive in a rapidly evolving technological landscape.

The healthcare & life sciences segment is anticipated to exhibit the highest CAGR of 26.2% over the forecast period. The widespread adoption of electronic health records (EHRs) has led to an explosion in the volume of patient data, necessitating robust DataOps platforms to manage, integrate, and analyze this information effectively. In addition, advances in genomics and personalized medicine generate vast amounts of data that require specialized DataOps solutions for processing and analysis. Furthermore, providing healthcare professionals with real-time access to patient data is crucial for delivering timely and effective care, driving the adoption of DataOps solutions that can manage real-time data streams.

Regional Insights

North America DataOps platform market dominated the market with a revenue share of over 40.0% in 2023. North America is a prominent region in AI and machine learning innovation. The integration of these technologies into data operations drives the demand for DataOps platforms that can efficiently manage and process large-scale data to support AI-driven applications. Furthermore, the widespread adoption of cloud computing in North America, driven by major cloud providers like Amazon Web Services, Microsoft, and Google accelerates the demand for cloud-native DataOps platforms that can manage data across hybrid and multi-cloud environments.

U.S. DataOps Platform Market Trends

The U.S. DataOps platform market is anticipated to exhibit a significant CAGR over the forecast period. The U.S. is home to various data-driven industries, including IT, healthcare, finance, and retail, leading to a massive generation of data. The need to efficiently manage, process, and analyze this data fuels the demand for DataOps platforms. Organizations across various industries in the U.S. are undergoing digital transformation, which involves the modernization of legacy systems, data infrastructure, and the adoption of advanced analytics. DataOps platforms are essential to these initiatives, enabling seamless data integration and real-time analytics.

Europe DataOps Platform Market Trends

The DataOps platform market in the Europe region is expected to witness significant growth over the forecast period. The growth of the DataOps platform market in Europe is influenced by a variety of factors specific to the region’s regulatory environment, technological landscape, and industry needs. Furthermore, various European countries emphasize data sovereignty, requiring data to be stored and processed within national borders. This drives the demand for DataOps platforms that can accommodate local data storage requirements while ensuring efficient data management and analytics.

Asia Pacific DataOps Platform Market Trends

The Asia Pacific DataOps platform market is anticipated to register the highest CAGR over the forecast period. Various countries in the APAC region, such as India, China, and Singapore, are rapidly digitalizing their economies. This transition is creating a massive demand for DataOps platforms to manage the growing volumes of data generated by digital initiatives. Furthermore, the APAC region is experiencing significant growth in cloud computing adoption, driven by both large enterprises and SMEs. The shift towards cloud-based infrastructures increases the need for DataOps platforms that can manage and integrate data across cloud environments.

Key DataOps Platform Company Insights

Key companies include Amazon Web Services, Cloud Software Group, Inc., and Cloudera, Inc. Companies active in the DataOps platform market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in June 2024, Cloudera, Inc. introduced Cloudera DataFlow, a cloud-native platform for data services that simplifies and streamlines the entire process of moving data, enabling universal data distribution. This platform makes use of the public cloud's scalability to rapidly construct and launch scalable data pipelines.

Key DataOps Platform Companies:

The following are the leading companies in the DataOps platform market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services

- Cloud Software Group, Inc.

- Cloudera, Inc.

- Databricks

- DataKitchen, Inc.

- Hitachi Vantara LLC

- IBM Corporation

- QlikTech International AB

- Software AG

- Talend, Inc.

Recent Developments

-

In August 2024, DataOps.live, a data products company, collaborated with Informatica to include new orchestration support for Informatica Cloud Data Governance and Catalog (CDGC). The new orchestrator tool for Informatica's Cloud Data Governance and Catalog, developed through a partnership with Projective Group, a financial services company, enhances the catalog by disseminating all metadata and lineage gathered through a DataOps pipeline. This expansion in accessible metadata fosters greater collaboration among data product managers, data stewards, and data engineering teams. By utilizing the most current metadata, clients are equipped to swiftly adapt to alterations throughout the development phase, thereby preventing unplanned modifications in the production environment.

-

In June 2024, IBM Corporation launched IBM Cloud Pak, a comprehensive suite consisting of interconnected software modules designed for analyzing data. Users can opt for self-hosting or choose to utilize it as a managed service through IBM Cloud. IBM Cloud Pak is designed to tackle several key challenges, including the automation of integration, governance of AI, and management of metadata, providing decisions derived from data and AI applications to end-users, as well as the storage and handling of various data sources.

-

In June 2024, TIBCO, a business unit of Cloud Software Group, Inc., launched the new TIBCO Platform, a composable, advanced data platform, integrates TIBCO solutions into a single, unified platform. This new platform significantly streamlines the process for users to construct, deploy, and oversee TIBCO solutions, thereby accelerating the realization of extensive and intricate digital projects. Accessibility to the platform will be provided under a newly streamlined TIBCO Platform subscription.

DataOps Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.09 billion |

|

Revenue forecast in 2030 |

USD 17.17 billion |

|

Growth rate |

CAGR of 22.5% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment type, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

Amazon Web Services; Cloud Software Group, Inc.; Cloudera, Inc.; Databricks; DataKitchen, Inc.; Hitachi Vantara LLC; IBM Corporation; QlikTech International AB; Software AG; and Talend, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global DataOps Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global DataOps platform market report based on the component, deployment, type, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Platform

-

Data Integration

-

Data Quality

-

Data Governance

-

Master Data Management

-

Data Analytics

-

Automation

-

Collaboration

-

Data Visualization

-

Others

-

-

Services

-

Consulting Services

-

Deployment & Integration

-

Training, Support & Maintenance Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

Public

-

Private

-

Hybrid

-

-

On-premises

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Agile Development

-

DevOps

-

Lean Manufacturing

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Healthcare & life sciences

-

Retail & E-commerce

-

Manufacturing

-

Government and Defence

-

Transportation and Logistics

-

IT & Telecommunications

-

Media and Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global DataOps market size was estimated at USD 4.22 billion in 2023 and is expected to reach USD 5.09 billion in 2024.

b. The global DataOps market is expected to grow at a compound annual growth rate of 22.5% from 2024 to 2030 to reach USD 17.17 billion by 2030.

b. North America dominated the DataOps market with a share of 40.3% in 2023. North America is a prominent region in AI and machine learning innovation. The integration of these technologies into data operations drives the demand for DataOps platforms that can efficiently manage and process large-scale data to support AI-driven applications.

b. Some key players operating in the DataOps market include Amazon Web Services; Cloud Software Group, Inc.; Cloudera, Inc.; Databricks; DataKitchen, Inc.; Hitachi Vantara LLC; IBM Corporation; QlikTech International AB; Software AG; and Talend, Inc.

b. Numerous factors such as, explosion of data, increasing demand for real-time analytics, data-driven decision-making, increasing complexity of data environments, and enhanced focus on data security are primarily contributing to the growth of the DataOps platform market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."