Database Management System Market Size, Share & Trends Analysis Report By Type, By Deployment, By Organization Size, By Vertical (BFSI, Manufacturing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-415-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

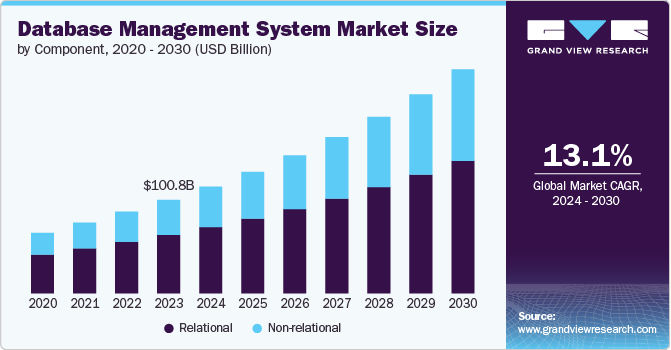

The global database management system market size was estimated at USD 100.79 billion in 2023 and is expected to grow at a CAGR of 13.1% from 2024 to 2030. Organizations across industries are undergoing digital transformation to enhance their operations, customer experiences, and business models. This transformation requires advanced DBMS solutions to manage complex data environments effectively. In addition, the exponential increase in data generation from various sources, including social media, IoT devices, and enterprise applications, necessitates robust database management system (DBMS) solutions to manage, store, and analyze this vast amount of data.

The increasing importance of big data analytics for decision-making and gaining competitive insights is driving the demand for the DBMS market. Advanced analytics and real-time data processing capabilities are essential for extracting value from big data. The shift towards cloud computing is a significant driver for the DBMS market. Cloud-based DBMS solutions offer scalability, flexibility, and cost-efficiency, making them efficient for businesses of all sizes. Furthermore, the integration of artificial intelligence and machine learning technologies in DBMS enhances data processing, management, and analysis capabilities. AI-powered DBMS can automate tasks, provide predictive insights, and improve overall efficiency.

The rise of NoSQL databases, which are designed for unstructured data and scalable, distributed systems, is driving market growth. These databases are particularly popular in various applications such as social media, e-commerce, and big data analytics. The adoption of microservices architecture in software development requires flexible and scalable DBMS solutions to manage data across distributed environments. Advancements in DBMS technology, such as in-memory databases and distributed databases, offer improved performance and scalability.

Type Insights

The relational segment led the market in 2023, accounting for over 62.0% share of the global revenue. Core enterprise applications such as ERP and CRM systems are built on relational database management system (RDBMS) platforms due to their need for transactional consistency and complex querying capabilities. The growth of these applications drives RDBMS adoption. Relational databases offer robust security features and compliance capabilities, which are critical for industries handling sensitive data, such as finance, healthcare, and government. Regulatory requirements such as GDPR and HIPAA drive investments in secure and compliant RDBMS solutions. The adoption of hybrid cloud environments, where organizations use a mix of on-premises and cloud resources, drives the need for RDBMS solutions that can operate seamlessly across these environments.

The non-relational segment is predicted to foresee the fastest growth in the coming years. The rise of big data has necessitated database systems that can handle large volumes of unstructured and semi-structured data. NoSQL databases are well-suited for big data analytics due to their ability to scale horizontally and manage diverse data types. The adoption of microservices architecture in application development requires databases that can handle distributed data and provide high availability and fault tolerance. NoSQL databases are often chosen for their ability to support microservices environments.

Deployment Insights

The cloud segment accounted for the largest revenue share in 2023. Cloud-based DBMS solutions offer dynamic scalability, allowing organizations to scale their database resources up or down based on demand. This flexibility is crucial for businesses with fluctuating workloads and data volumes. Cloud-based DBMS eliminates the need for significant upfront capital investment in hardware and infrastructure. Instead, organizations can adopt a pay-as-you-go model, paying only for the resources they use, which reduces overall IT costs. Cloud-based DBMS providers offer fully managed services, handling tasks such as database setup, maintenance, updates, backups, and security. This allows organizations to focus on their core business activities rather than database administration.

The on-premises segment is anticipated to exhibit a significant CAGR over the forecast period. On-premises DBMS solutions provide organizations with complete control over their database environment. This control allows for extensive customization to meet specific business needs and the ability to optimize performance for workloads. For applications requiring low latency and high performance, such as high-frequency trading platforms or real-time data processing systems, on-premises DBMS can offer superior performance by eliminating network-related delays. Numerous organizations have existing legacy systems and applications that rely on on-premises DBMS. Maintaining these systems on-premises can simplify integration and ensure continuity of operations without the need for extensive re-engineering.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share in 2023. Large enterprises generate and manage vast amounts of data from various sources, including transactional systems, customer interactions, and IoT devices. This complexity drives the need for robust DBMS solutions that can handle large-scale data processing, storage, and management. Large enterprises must adhere to stringent regulatory and compliance requirements, such as GDPR, HIPAA, and CCPA. Robust DBMS solutions with advanced security features and compliance capabilities are essential to meet these requirements and protect sensitive data.

The SMEs segment is anticipated to exhibit the fastest CAGR over the forecast period. SMEs often have limited IT budgets, so cost-effective DBMS solutions, including open-source options and pay-as-you-go cloud services, are highly preferable. These solutions allow SMEs to access advanced database capabilities without significant upfront investment. SMEs have smaller IT teams and less specialized expertise. DBMS solutions that are easy to deploy, manage, and use is critical for this market. User-friendly interfaces, simplified administration, and minimal maintenance requirements are important features.

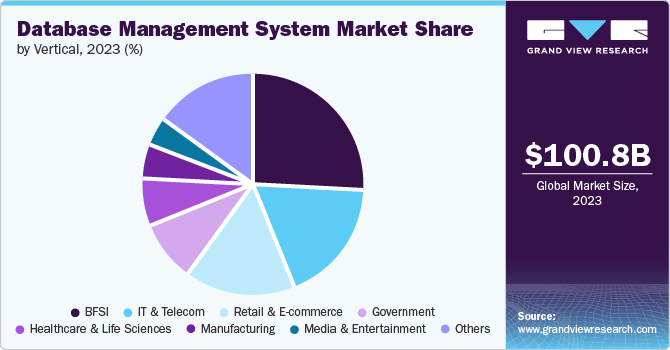

Vertical Insights

The BFSI segment accounted for the largest revenue share in 2023. The BFSI sector demands real-time data processing for various applications such as trading, fraud detection, and customer transactions. DBMS solutions that provide low-latency, high-throughput capabilities are essential for supporting these real-time operations. Effective risk management requires the ability to analyze large datasets to identify potential risks and make informed decisions. Advanced analytics and data processing capabilities of DBMS solutions support risk assessment and mitigation strategies. Enhancing customer experience through personalized services, faster transaction processing, and efficient customer support is a priority for BFSI institutions. dbms solutions enable better data management and analytics to provide insights for improving customer interactions.

The healthcare & life science segment is anticipated to exhibit the fastest CAGR over the forecast period. Healthcare and life sciences generate vast amounts of complex data from various sources, including electronic health records (EHRs), medical imaging, genomic sequencing, clinical trials, and IoT devices. Efficiently managing this data requires robust DBMS solutions capable of handling large volumes and diverse data types. Real-time data processing is essential for various healthcare applications, including monitoring patient vitals, managing emergency responses, and providing timely decision support. DBMS solutions that provide low-latency, high-throughput capabilities support these real-time operations.

Regional Insights

North America dominated with a revenue share of over 39.0% in 2023. The rapid evolution of database technologies, including cloud-based solutions and NoSQL databases, is driving market expansion in the region. Furthermore, the increasing adoption of big data analytics requires advanced DBMS solutions for handling and analyzing large volumes of data.

U.S. Database Management System Market Trends

The U.S. database management system market is anticipated to exhibit a significant CAGR over the forecast period. The integration of AI, machine learning, and IoT with database technologies is fueling demand for advanced DBMS solutions in the region. The growing need for business intelligence and data-driven decision-making is boosting the adoption of advanced DBMS solutions.

Europe Database Management System Market Trends

The database management system market in Europe is expected to witness significant growth over the forecast period. Increasing concerns about data security and privacy encourage businesses to implement advanced DBMS solutions for better data protection. Significant investments in IT infrastructure and the modernization of legacy systems by European enterprises contribute to market growth.

Asia Pacific Database Management System Market Trends

The database management system market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The accelerating digital transformation across various industries in Asia-Pacific drives demand for advanced DBMS solutions. Economic expansion and increasing investments in IT infrastructure by emerging economies in the region support market growth. The rising adoption of cloud computing and cloud-based DBMS solutions is a significant driver in the region.

Key Database Management System Company Insights

Key database management system companies include Amazon Web Services, Google Cloud, and International Business Machines Corporation. Companies active in the database management system market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in November 2023, Amazon Web Services collaborated with International Business Machines Corporation to launch a new cloud database service, helping customers enhance data management for AI tasks. Users of Amazon RDS for Db2 now have the flexibility to update their systems either on-site, on AWS, or by adopting a mixed cloud setup aimed at improving AI workloads.

Key Database Management System Companies:

The following are the leading companies in the database management system market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services

- Google Cloud

- International Business Machines Corporation

- Microsoft

- MongoDB, Inc.

- Oracle

- Redis

- SAP SE

- Snowflake Inc.

- Teradata

Recent Developments

-

In June 2024, International Business Machines Corporation introduced IBM Cloud Pak for Data 5.0, the latest version of the cloud-native insight platform, which consolidates necessary tools for data collection, organization, and analysis within a data fabric framework. With IBM Cloud Pak for Data 5.0, users' data strategies are elevated through new features like remote data planes and relationship explorer.

-

In March 2024, SAP SE introduced new features in the SAP Datasphere solution. The latest enhancements, featuring new generative AI functionalities, revolutionize enterprise planning by streamlining data environments and enabling more intuitive interactions with data.

-

In February 2024, Snowflake Inc. released Hybrid Tables. The hybrid table is specifically designed to efficiently support both transactional and operational workloads. It offers high throughput and low latency for quick, small-scale random reads and writes.

Database Management System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 114.99 billion |

|

Revenue forecast in 2030 |

USD 241.27 billion |

|

Growth rate |

CAGR of 13.1% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, deployment, organization size, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

Amazon Web Services; Google Cloud; International Business Machines Corporation; Microsoft; MongoDB, Inc.; Oracle; Redis; SAP SE; Snowflake Inc.; Teradata |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Database Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global database management system market report based on type, deployment, organization size, vertical, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Relational

-

Non-relational

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

IT & Telecom

-

Retail & E-commerce

-

Healthcare & Life Sciences

-

Government

-

Manufacturing

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global database management system market size was estimated at USD 100.79 billion in 2023 and is expected to reach USD 114.99 billion in 2024.

b. The global database management system market is expected to grow at a compound annual growth rate of 13.1% from 2024 to 2030 to reach USD 241.27 billion by 2030.

b. North America dominated the database management system market with a share of 39.6% in 2023. The rapid evolution of database technologies, including cloud-based solutions and NoSQL databases, is driving market expansion in the region. Furthermore, the increasing adoption of big data analytics requires advanced DBMS solutions for handling and analyzing large volumes of data.

b. Some key players operating in the database management system market include Amazon Web Services; Google Cloud; International Business Machines Corporation; Microsoft; MongoDB, Inc.; Oracle; Redis; SAP SE; Snowflake Inc.; and Teradata.

b. Organizations across industries are undergoing digital transformation to enhance their operations, customer experiences, and business models. This transformation requires advanced DBMS solutions to manage complex data environments effectively. In addition, the exponential increase in data generation from various sources, including social media, IoT devices, and enterprise applications, necessitates robust DBMS solutions to manage, store, and analyze this vast amount of data.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."