Data Storage Converter Market Size, Share & Trends Analysis Report By Type (Mobile Devices, Embedded Systems, Single-Board Computers), By Enterprise Size (SMEs, Large Enterprises), By Application (Consumer Electronics, Data Centers), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-458-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Data Storage Converter Market Trends

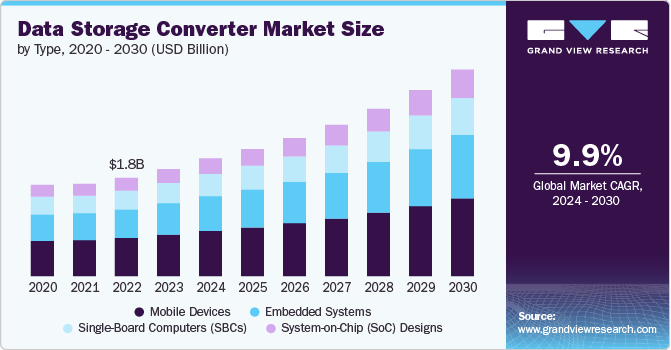

The global data storage converter market size was valued at USD 1.94 billion in 2023 and is anticipated to grow at a CAGR of 9.9% from 2024 to 2030. Several key factors are driving the growth of the market. The increasing demand for data centers, driven by the exponential growth of cloud computing, artificial intelligence, and big data, has created a significant need for advanced data storage solutions capable of efficiently handling vast amounts of information.

Additionally, the ongoing digital transformation across enterprises and the rising adoption of hybrid cloud solutions are propelling the need for high-performance data storage converters. The continued demand for portable devices such as smartphones, laptops, and tablets further fuel the consumer electronics market. Moreover, the automotive industry's shift toward autonomous driving and advanced infotainment systems contributes to the rising demand for data storage converters. These factors, along with advancements in storage technologies and increasing integration of IoT devices across industries, collectively drive the market's expansion.

The increasing demand for data centers is a major driver of the market, as modern data centers require advanced storage infrastructure to manage and process the ever-growing volume of data generated by cloud computing, big data analytics, artificial intelligence, and the Internet of Things (IoT). Data storage converters are critical in facilitating efficient and high-speed data transfer between various storage devices, ensuring optimal performance in these data-intensive environments. As enterprises continue to scale their operations and embrace cloud-based services, the need for scalable, reliable, high-performance data storage solutions becomes paramount. Consequently, data storage converters that support faster data access, better storage management, and enhanced compatibility across different systems are in high demand, further fueling the market’s growth.

The ongoing digital transformation across enterprises and the rising adoption of hybrid cloud solutions drive the demand for high-performance data storage converters. As businesses increasingly shift towards digitization, there is a growing need to manage, store, and process vast amounts of data securely and efficiently. Hybrid cloud solutions, which combine on-premises infrastructure with cloud storage, offer flexibility and scalability but require robust data storage systems seamlessly integrating different storage environments. High-performance data storage converters enable smooth data migration, interoperability, and real-time data access between diverse systems, ensuring that enterprises can meet digital transformation goals without compromising performance or security. This rising complexity and volume of enterprise data and the need for flexible and scalable storage solutions are key factors propelling the demand for advanced data storage converters.

Type Insights

The mobile devices segment accounted for the largest market share, over 38%, in the market in 2023. The growth of mobile devices in the market is driven by the increasing demand for smartphones, tablets, and other portable electronics that require efficient and compact data storage solutions. As mobile devices evolve with more advanced features such as higher-resolution cameras, faster processors, and enhanced multimedia capabilities, quicker data transfer, larger storage capacities, and efficient power management becomes crucial. Data storage converters designed for mobile devices address these requirements by enabling seamless data transmission and optimizing storage performance, thereby supporting the continued expansion of this segment.

The system-on-chip (SoC) designs segment is anticipated to grow at the fastest CAGR over the forecast period. The rise of system-on-chip (SoC) designs in the market is fueled by the growing integration of multiple functionalities-such as processing, memory, and connectivity-into a single chip. SoC designs are increasingly being adopted in various applications, from consumer electronics to automotive systems, due to their ability to enhance performance, reduce power consumption, and minimize space requirements. Data storage converters tailored for SoC designs are essential for ensuring high-speed data transfer between integrated types, supporting the efficient operation of complex systems. This integration of diverse functionalities within a compact form factor is a key driver of growth in the SoC segment of the market.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share in 2023. For large enterprises, the adoption of data storage converters is driven primarily by the need to manage vast volumes of data efficiently across complex IT infrastructures. These organizations often operate extensive data centers and utilize hybrid cloud solutions that require seamless integration and high-speed data transfer between various storage systems. Data storage converters facilitate this by enabling interoperability between different storage technologies and optimizing data access and management, thereby supporting the scalability and performance required by large enterprises. Additionally, the increasing focus on data-driven decision-making and analytics necessitates advanced storage solutions to effectively handle the growing data workload.

The SMEs segment is anticipated to expand at the fastest compound annual growth rate of over 10% during the forecast period. For small and medium-sized enterprises (SMEs), the adoption of data storage converters is largely influenced by the need for cost-effective and scalable storage solutions that can grow with their business. SMEs often face budget constraints and require versatile storage solutions that balance performance and cost. Data storage converters offer SMEs the flexibility to integrate various storage devices and technologies without significant capital investment, enhancing their data management capabilities while keeping expenses manageable. As SMEs increasingly embrace digital transformation and cloud-based services, efficiently handling and transferring data becomes crucial, further driving the adoption of data storage converters in this segment.

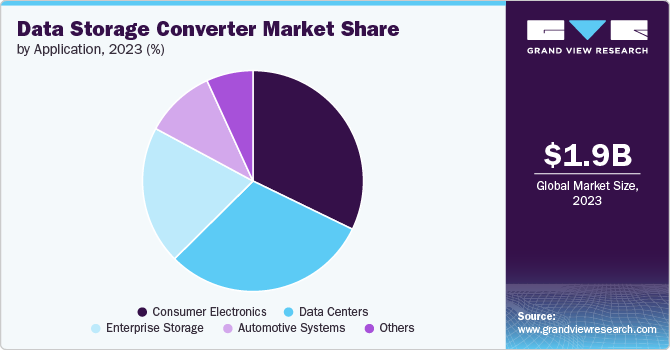

Application Insights

The consumer electronics segment accounted for the largest market share of over 32% in 2023 in the data storage converter market. For consumer electronics, the adoption of data storage converters is driven by the rapid advancement and diversification of electronic devices such as smartphones, tablets, and laptops. These devices require high-speed data transfer and efficient storage solutions to support increasingly demanding applications, including high-resolution media, gaming, and multitasking. Data storage converters enable compatibility and seamless integration between various storage formats and devices, facilitating faster data access and enhancing overall performance. The continual innovation in consumer electronics and rising consumer expectations for performance and storage capacity propel the demand for advanced data storage converters.

The data centers segment is anticipated to grow at the highest CAGR during the forecast period. In data centers, the adoption of data storage converters is primarily driven by the need to manage and optimize vast amounts of data generated by cloud computing, big data analytics, and enterprise applications. Data centers require high-performance storage solutions to ensure efficient data processing, rapid access, and reliable data transfer across diverse storage systems. Data storage converters enable interoperability between different storage technologies and support scalable and flexible storage architectures. As data centers continue to expand and evolve to meet the demands of modern digital operations, the need for sophisticated data storage converters to enhance efficiency and performance remains a key factor in their adoption.

Regional Insights

North America held the major share of over 35% of the market in 2023. In North America, the market is experiencing growth driven by the proliferation of data centers and the rapid adoption of cloud computing technologies. Enterprises in this region are increasingly deploying advanced data storage solutions to manage and process large volumes of data, supported by robust infrastructure investments. Additionally, the rise of artificial intelligence and big data analytics fuels the demand for high-performance data storage converters to ensure efficient data management and interoperability.

U.S. Data Storage Converter Market Trends

The data storage converter market in the U.S. is expected to grow significantly from 2024 to 2030. In the United States, the market is characterized by a strong emphasis on innovation and technology advancements. The rapid adoption of cloud computing and significant investments in data centers and big data analytics drive demand for high-performance data storage converters. The increasing need for efficient data management and integration across diverse storage systems is a key trend in this market.

Europe Data Storage Converter Market Trends

The data storage converter market in Europe is growing significantly at a CAGR of over 9% from 2024 to 2030. Europe is witnessing a rise in the market due to increasing digital transformation across various industries and stringent data protection regulations. The adoption of hybrid cloud solutions and the need for compliant data management drive demand for data storage converters that facilitate seamless integration and secure data transfer. Additionally, the growth of the IoT ecosystem and smart manufacturing contributes to the expanding market.

Asia Pacific Data Storage Converter Market Trends

The data storage converter market in Asia Pacific is growing significantly at a CAGR of over 10% from 2024 to 2030. In Asia Pacific, the market is growing rapidly, driven by the region's booming digital economy and significant investments in technology infrastructure. The rise of emerging markets, coupled with increasing adoption of cloud services and e-commerce, is creating a substantial demand for data storage converters. Additionally, the expansion of data centers and smart cities is further fueling market growth in this region.

Key Data Storage ConverterCompany Insights

Key players operating in the network emulator market include NXP Semiconductors, ATTO Technology, Broadcom Inc., Cypress Semiconductor, Intel Corporation, ADATA Technology, Apacer Technology, ON Semiconductor, Phison Electronics, and LSI Logic. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2024, ADATA Technology introduced a series of industrial-grade DDR5 5600 memory modules. The new products feature ECC U-DIMM/SO-DIMM, U-DIMM/SO-DIMM, and R-DIMM variants. DDR5 memory is already prevalent among leading server and PC manufacturers. ADATA Industrial’s DDR5 5600 memory modules have undergone rigorous environmental testing, including low temperatures, high temperatures, and thermal cycling assessments. These tests confirm that ADATA’s DDR5 products offer superior stability and reliability, facilitating the transition from DDR4 to DDR5 in the mainstream market.

-

In November 2022, ATTO Technology, Inc., a company in network and storage connectivity & infrastructure solutions for data-intensive computing environments, partnered with Western Digital Corp., a provider of storage technologies and solutions and Open-E, a prominent developer of innovative data storage software, to introduce a sophisticated high-capacity, high-availability HDD storage solution.

Key Data Storage Converter Companies:

The following are the leading companies in the data storage converter market. These companies collectively hold the largest market share and dictate industry trends.

- ADATA Technology

- Apacer Technology

- ATTO Technology

- Broadcom Inc.

- Cypress Semiconductor

- Intel Corporation

- LSI Logic

- NXP Semiconductors

- ON Semiconductor

- Phison Electronics

Data Storage Converter Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.12 billion |

|

Revenue forecast in 2030 |

USD 3.74 billion |

|

Growth rate |

CAGR of 9.9% from 2024 to 2030 |

|

Actual data |

2018 - 2022 |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, enterprise size, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, and South Africa |

|

Key companies profiled |

NXP Semiconductors, ATTO Technology, Broadcom Inc., Cypress Semiconductor, Intel Corporation, ADATA Technology, Apacer Technology, ON Semiconductor, Phison Electronics, and LSI Logic |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

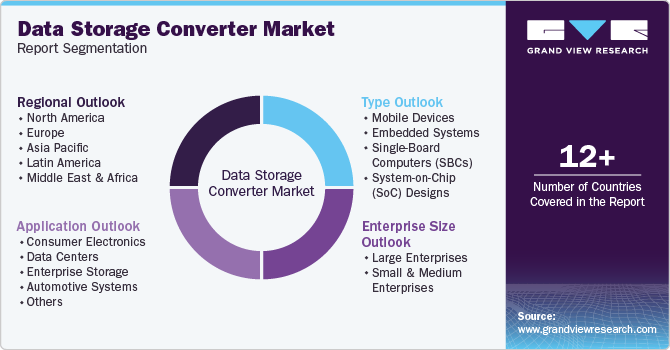

Global Data Storage Converter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data storage converter market report based on type, enterprise size, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mobile Devices

-

Embedded Systems

-

Single-Board Computers (SBCs)

-

System-on-Chip (SoC) Designs

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Data Centers

-

Enterprise Storage

-

Automotive Systems

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data storage converter market size was estimated at USD 1.94 billion in 2023 and is expected to reach USD 2.12 billion in 2024

b. The global data storage converter market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 3.74 billion by 2030

b. North America dominated the data storage converter market with a market share of 37.9% in 2023. In North America, the data storage converter market is experiencing growth driven by the proliferation of data centers and the rapid adoption of cloud computing technologies. Enterprises in this region are increasingly deploying advanced data storage solutions to manage and process large volumes of data, supported by robust infrastructure investments. Additionally, the rise of artificial intelligence and big data analytics fuels the demand for high-performance data storage converters to ensure efficient data management and interoperability.

b. Some key players operating in the data storage converter market include NXP Semiconductors, ATTO Technology, Broadcom Inc., Cypress Semiconductor, Intel Corporation, ADATA Technology, Apacer Technology, ON Semiconductor, Phison Electronics, and LSI Logic.

b. Several key factors are driving the growth of the data storage converter market. The increasing demand for data centers, driven by the exponential growth of cloud computing, artificial intelligence, and big data, has created a significant need for advanced data storage solutions capable of efficiently handling vast amounts of information. Additionally, the ongoing digital transformation across enterprises and the rising adoption of hybrid cloud solutions are propelling the need for high-performance data storage converters.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."