- Home

- »

- Network Security

- »

-

Data Protection And Recovery Solutions Market Report, 2030GVR Report cover

![Data Protection And Recovery Solutions Market Size, Share & Trends Report]()

Data Protection And Recovery Solutions Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (Email Protection, Endpoint Data Protection), By Deployment, By Enterprise Size, By End Use, By Region And Segment Forecasts

- Report ID: GVR-1-68038-941-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Protection And Recovery Solutions Market Summary

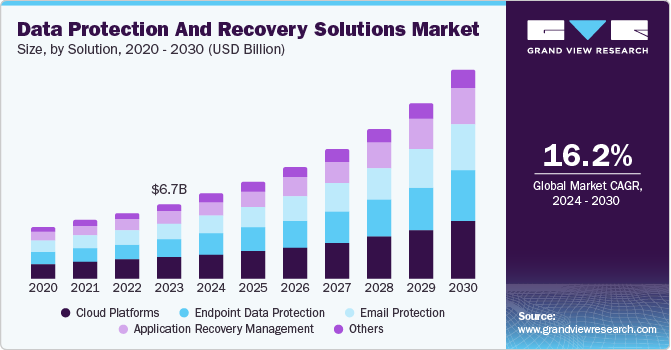

The global data protection and recovery solutions market size was valued at USD 6.73 billion in 2023 and is projected to reach USD 18.78 billion by 2030, growing at a CAGR of 16.2% from 2024 to 2030. Increasing dependency of businesses and industries on data sets and data availability, growing adoption of advanced technologies such as cloud computing, Internet of Things (IoT), Artificial Intelligence (AI), and machine learning, rising incidents of cyberattacks and increasing potential cyber threats have developed alarming need for effective data protection and recovery solutions in recent years.

Key Market Trends & Insights

- North America dominated the global data protection and recovery solutions market and accounted for a revenue share of 39.0% in 2023.

- The U.S. data protection and recovery solutions market held a significant revenue share of the regional market in 2023.

- Based on solution, the cloud platforms segment captured the largest market share of 29.0 % in 2023.

- Based on deployment, the on-premise deployment segment held the largest revenue share in 2023.

- Based on enterprise size, the large enterprise segment dominated the global market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.73 Billion

- 2030 Projected Market Size: USD 18.78 Billion

- CAGR (2024-2030): 16.2%

- North America: Largest Market in 2023

As businesses increasingly rely on data for multiple functions such as operations, decision-making, customer experiences, strategy development, strategy implementation, and more, the accessibility and availability of large datasets have become vital for growth. Unprecedented growth in cybercrime, data theft activities, data breach incidences, and targeted ransomware cyberattacks have driven the demand for data protection and recovery market. The U.S. Federal Investigation Bureau’s Internet Crime Complaint Center (IC3) received nearly 21.489 complaints of Business Email Compromise (BEC) cases, 2,825 complaints categorized as ransomware, and nearly 14,190 incident complaints of government impersonation.

The generation of personalized data through smartphones, connected devices, internet usage, and more has become one of the finest tools for businesses to identify customer behavior and changes. However, due to increased dependency on such data for daily operations, storage of key data sets related to areas such as financial services and banking has developed a requirement for robust data protection infrastructure. In addition, the reliability of critical infrastructure on technologies and data-driven systems has also generated demand for strong protection and recovery solutions.

Increasing digital transformations, a large number of data-driven online transactions, growing social media dialogue, and dependency on multiple critical infrastructure elements such as energy, water utilities, disaster management, transport, electricity grids, and others have developed growing demand for the innovative data protection solutions, as traditional data protection methods have become prone to attack and threats. For instance, from November 2023 to 2024, the U.S. infrastructure experienced cyber-attacks and unauthorized access incidents related to industrial control systems (ICS) operating in multiple industries, such as food and agriculture, healthcare, and water and wastewater management.

Solution Insights

The cloud platforms segment captured the largest market share of 29.0 % in 2023. Cloud platforms offer scalability and flexibility, enabling organizations to seamlessly adjust their data protection and recovery needs in response to fluctuating data volumes and evolving business requirements. This dynamic capability is particularly advantageous for businesses experiencing rapid growth or seasonal data spikes, as it allows them to scale their resources up or down quickly without substantial investments in physical infrastructure. By leveraging cloud platforms, organizations can accommodate sudden increases in data without facing the limitations and costs associated with traditional on-premises solutions. This scalability ensures that businesses can maintain optimal performance and reliability of their data protection and recovery systems, adapting swiftly to changes in demand and maintaining continuous protection.

The application recovery management segment is projected to expand at the fastest CAGR of 17.6 % over the forecast period. The increasing frequency of cyberattacks necessitates robust application recovery plans for businesses to safeguard their operations. These attacks can severely disrupt business processes and result in significant data loss if not adequately addressed. In this context, application recovery management solutions are essential, providing the tools and methods to restore critical applications and minimize downtime swiftly. These solutions help mitigate cyber incidents' financial and operational impacts by ensuring rapid recovery, maintaining business continuity, and protecting sensitive data.

Deployment Insights

The on-premise deployment segment held the largest revenue share in 2023. The growth of this segment is attributed to increased demand for improved management, flexibility, and data accessibility. Various organizations belonging to the BFSI, energy and utilities, manufacturing, government, healthcare, and retail industries are investing significantly in developing security offerings. This is attributed to the increasing large-scale cyber-attacks on enterprise web-based or on-premises applications. On premise, deployment is often preferred by the organizations for customized approach and complete control over data protection infrastructure.

The hosted deployment segment is expected to experience the fastest CAGR over the forecast period. Hosted solutions typically operate on a subscription or pay-as-you-go model, significantly reducing the need for large capital expenditures on hardware and software. This cost-efficient approach allows businesses to allocate resources more effectively, avoiding the hefty initial investments required for on-premises solutions. Such financial flexibility is desirable for small and medium-sized enterprises (SMEs) requiring robust data protection but with limited budgets. By opting for hosted solutions, SMEs can achieve high data security and recovery capabilities without incurring substantial costs and maintenance demands for traditional in-house systems.

Enterprise Size Insights

Based on enterprise size, the large enterprise segment dominated the global market in 2023. Large enterprises generate and manage vast amounts of data daily, including sensitive customer information, financial records, and critical operational data. The volume and significance of this data require effective data protection solutions to prevent loss, breaches, and thefts. These solutions identify potential threats and protect data storage from unauthorized access. Data recovery plays a vital role in a cyber-attack resulting in data theft, especially in government agencies and critical infrastructure management systems. Therefore, companies and governments worldwide are continuously seeking technology-driven, advanced data protection and recovery solutions for such precise requirements. The large enterprise segment is expected to experience increasing adoption owing to the availability of necessary infrastructure and investment, higher dependency on data compared to SMEs, and global scale of operations managed by multiple businesses from different industries.

The SME segment is expected to experience the fastest CAGR over the forecast period. Budget constraints are a significant concern for SMEs, making cost-effective data protection and recovery solutions essential. Hosted solutions that operate on subscription-based or pay-as-you-go models alleviate the financial burden by eliminating the need for significant upfront infrastructure investments. This approach enables SMEs to access advanced data protection technologies that were previously out of reach due to cost barriers. By adopting these flexible payment models, SMEs can ensure robust data security and recovery capabilities while maintaining financial stability. The unavailability of in-house cybersecurity experts and growing online activity, including financial transactions, data transfer, and more by SMEs, are expected to generate greater demand for this segment in the coming years.

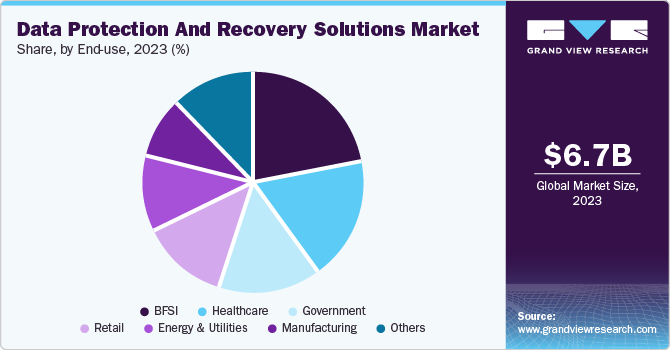

End Use Insights

The BFSI segment held the largest revenue share in 2023. This is attributed to the dependence of banking operations on computerized systems, and the large data volumes generated through daily operations of the banking and financial services industry. In addition, emergence of digital payment platforms used by large groups of customers through smartphones, and growing penetration of online platforms managed by baking organizations for enhanced customer experience require effective protection and recovery shield. Security of data generated through all these dynamics of the modern BFSI industry plays a crucial role in flawless operations and uninterrupted availability of services.

The manufacturing segment is anticipated to experience the fastest CAGR during the forecast period. The growth of this segment is attributed to the rising dependability of the manufacturing industry on data-driven technologies such as artificial intelligence and Internet of Things (IoT), increasing automation of multiple processes involved in manufacturing, and more. Companies have been transforming manufacturing activities into advanced assisted processes and relying on technologies for predictive maintenance, enhanced productivity, reduced wastage, inventory management, fleet management, worker safety, remote monitoring, quality control, and more.

Regional Insights

North America dominated the global data protection and recovery solutions market and accounted for a revenue share of 39.0% in 2023. This is attributed to multiple factors, such as the presence of numerous major market participants from the information & technology industry, the robust manufacturing sector, higher adoption of advanced technologies, growing dependency on data-driven technology-based systems, and increasing new incidents of cyberattacks targeted at businesses and networks in the region. The critical infrastructure in the area is linked with multiple computing systems and remote monitoring networks, which makes it prone to cyber threats. The emergence of advanced automation systems, the growing adoption of automation in manufacturing businesses, and the unceasing growth of the e-commerce industry in recent years are expected to influence the further development of this regional industry.

U.S. Data Protection And Recovery Solutions Market Trends

The U.S. data protection and recovery solutions market held a significant revenue share of the regional market in 2023. This market is primarily driven by factors such as the early adoption trend of advanced technology, many businesses preferring digital transformations over other investments, increasing cyber threats identified by federal agencies, growing online activities fueled by the digital footprint of multiple business-customer transactions, and the need for robust data protection and recovery solutions. The presence of various IT businesses, technology-driven manufacturing units, global scale operations of numerous industries, and dependence of critical infrastructure services on computing technology is anticipated to generate higher demand for this market during the forecast period.

Europe Data Protection And Recovery Solutions Market Trends

Europe is identified as one of the lucrative regions for the global data protection and recovery solutions market in 2023. The growth of this regional industry is driven by factors such as the regulatory landscape, cybersecurity challenges, and technological advancements adopted by the domestic and global companies operating in Europe. The stringent requirements of the General Data Protection Regulation (GDPR) compel organizations to adopt robust data protection and recovery solutions to ensure compliance and avoid substantial fines. The rise in sophisticated cyberattacks, such as ransomware, necessitates advanced security measures to safeguard sensitive data and maintain business continuity. Additionally, the exponential growth of data due to digital transformation initiatives and increasing adoption of cloud services across Europe has amplified the need for scalable and flexible data protection solutions.

Germany data protection and recovery solutions market is expected to experience significant growth during forecast period. Industry-specific finance, healthcare, and manufacturing technology advancements drive the demand for tailored data management strategies. In addition, the growing dependence on data-driven technology tools utilized by the country's robust manufacturing sector is expected to increase demand for data protection and recovery solutions. The technological innovations, including AI-driven automation and machine learning, enhance the efficiency of data recovery processes, making them attractive to businesses seeking to improve their cybersecurity posture.

Asia Pacific Data Protection And Recovery Solutions Market Trends

Asia Pacific regional market is anticipated to grow at the fastest CAGR of 17.8 % from 2024 to 2030. This is attributed to the increasing adoption of data protection and recovery systems in developing nations such as India and in other countries with higher industrial activity such as China. The rising number of technology-based businesses, the banking sector, and the need for government institutions has developed higher dependency of data, which has resulted in growing requirement for data protection. Increasing financial activities and transactions through digital modes, rising use of smartphones in the region, and unprecedented growth in accessibility and availability of internet is expected to fuel growth of this regional industry during 2024 to 2030.

India data protection and recovery market held significant revenue share of regional market in 2023. It is mainly driven by the ongoing digital transformation activities in India, substantial investments in cloud computing, big data, and the Internet of Things (IoT). This increase in technological adoption has led to a dramatic increase in the volume of data generated and stored across industries. As businesses and government agencies digitize their operations and services, robust data protection and recovery solutions are critical. Effective measures are required to safeguard this vast amount of data against cyber threats such as data breaches and ransomware attacks, which have become more sophisticated and frequent. Comprehensive data protection strategies are essential to ensure data security and compliance with regulatory frameworks and maintain operational continuity and trust among consumers and stakeholders amidst this accelerating digital transformation in India.

Key Data Protection And Recovery Solutions Company Insights

Some of the key companies operating in the data protection and recovery solutions market include Acronis International GmbH, Actifio Inc., Arcserve, LLC, Axcient, Cohesity, Inc., and Commvault. To address the growing competition in the industry, companies have adopted strategies such as an enhanced product portfolio, inclusion of innovation, a growing focus on research and development activities, and collaborations with other organizations.

-

Cohesity Inc., one of the key companies in data security and management industry, offers range of solutions associated with data protection, data security, data mobility, data access, data insights, and more. It serves multiple industries including financial services, healthcare, life sciences, federal government, retail & hospitality, legal, energy, telecom, technology, media, entertainment and others.

-

NinjaOne, a prominent IT solutions and services provider, offers its solutions to more than 17,000 customers in nearly 80 countries. The company offers various solutions including security, helpdesk, operations, infrastructure and more.

Key Data Protection and Recovery Solutions Companies:

The following are the leading companies in the data protection and recovery solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Acronis International GmbH

- Actifio Inc.

- Arcserve, LLC

- Axcient

- Cohesity, Inc.

- Commvault

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- IBM

- Microsoft

- NinjaOne

- Rubrik

- Unitrends

- Veeam Software

Recent Developments:

-

In February 2024, Cohesity, Inc. announced the agreement to acquire data protection unit of Veritas Technologies LLC, to expand the customer base to deliver reliable data protection services.

-

In June 2024, Veeam Software, a key player in data protection and recovery industry, launched Veeam Data Cloud Vault. This newly developed cloud-based enhanced security storage service ensures secure storage of backup data in encrypted forms which adds extra layer of protection for critical business information and data sets.

Data Protection And Recovery Solutions Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.73 billion

Revenue forecast in 2030

USD 18.78 billion

Growth rate

CAGR of 16.2 % from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size,end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico , Germany, UK, Germany, France, Japan, China, , India, Australia, South Korea, Brazil, Argentina, South Africa, And UAE,

Key companies profiled

Acronis International GmbH; Actifio Inc.; Arcserve, LLC; Axcient; Cohesity, Inc.; Commvault; Dell Inc.; Hewlett Packard Enterprise Development LP; IBM; Microsoft; NinjaOne; Rubrik; Unitrends; Veeam Software

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Protection And Recovery Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the data protection and recovery solutions market report based on solution, deployment, enterprise size, end use, and region

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Email Protection

-

Endpoint Data Protection

-

Application Recovery Management

-

Cloud Platforms

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Energy & Utilities

-

Government

-

Healthcare

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.