Data Observability Market Size, Share & Trend Analysis Report By Component, By Deployment, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-375-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Data Observability Market Size & Trends

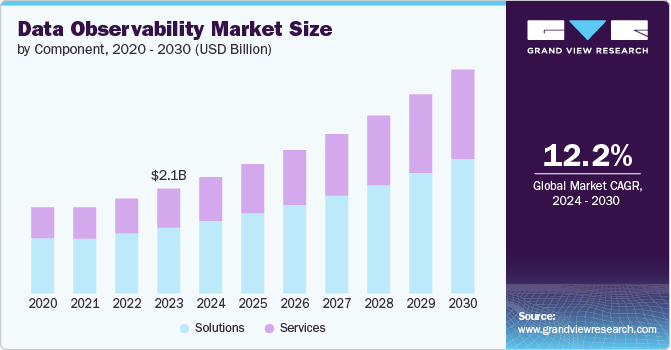

The global data observability market size was estimated at USD 2.14 billion in 2023 and is projected to grow at a CAGR of 12.2% from 2024 to 2030. The market is experiencing significant growth, driven by several key factors. As organizations increasingly rely on data-driven decision-making, they face challenges from growing data complexity and volume. This complexity, coupled with the rising costs associated with poor data quality, has heightened the need for robust observability solutions. Additionally, stringent regulatory compliance requirements across various industries necessitate better data governance and monitoring. The shift towards cloud-based and distributed data architectures has further accelerated the demand for comprehensive data observability tools that can provide visibility across diverse and often disparate data environments.

Organizations increasingly rely on data-driven strategies for decision-making, operational optimization, and customer experience enhancement. This dependence underscores the need for high-quality, reliable data, as poor data quality can lead to costly mistakes. Data observability solutions provide critical visibility into data quality, flows, and lineage, enabling quick anomaly detection and resolution. These tools ensure analytics systems work with accurate, current data, leading to more reliable insights and better business outcomes. As data volumes and complexity grow, maintaining data integrity becomes crucial, driving demand for data observability solutions.

One prominent trend is the democratization of data quality management through self-service tools. These solutions empower non-technical users to monitor and maintain data quality, reducing the burden on IT departments and fostering a culture of data responsibility across organizations. The adoption of DataOps and DataSecOps practices is gaining momentum, integrating data observability into broader data management and security frameworks. This holistic approach ensures that data observability is not treated as a standalone function but is seamlessly incorporated into the entire data lifecycle, from ingestion to analysis and beyond.

Stringent data privacy regulations like GDPR and CCPA require robust data management mechanisms. Data observability tools are essential for compliance, offering the visibility needed to monitor data flows and ensure legal adherence. They help detect and mitigate issues before they lead to regulatory breaches, reducing risks of fines and reputational damage. By providing detailed insights into data management, these solutions support the creation of transparent compliance reports, crucial for regulatory demonstration and stakeholder trust. As regulations evolve, the demand for advanced data observability solutions is expected to increase significantly.

Component Insights

The solutions segment led the market and accounted for 62.1% of the global revenue in 2023. The solution segment dominates the market due to the increasing demand for robust software tools that provide comprehensive visibility into data health and quality. Organizations seek advanced solutions that offer real-time monitoring, anomaly detection, and automated troubleshooting to ensure data integrity across complex systems. These solutions integrate seamlessly with existing data infrastructures, providing scalable and customizable capabilities that address specific business requirements. As a result, the extensive adoption of such feature-rich tools drives the growth and prominence of the solution segment in the data observability market.

The services segment is projected to grow significantly over the forecast period. The service segment provides essential support for implementing and optimizing complex observability tools. Many organizations prefer managed services and professional consulting to navigate the intricacies of data observability solutions, ensuring these systems are customized to their specific needs. Moreover, ongoing monitoring and maintenance services help businesses maintain the performance and reliability of their data environments without needing in-house expertise. This reliance on external services for customization, integration, and continuous management drives the strong demand for the service segment.

Deployment Insights

The public cloud segment accounted for the largest revenue share in 2023. The public cloud offers a scalable and cost-effective infrastructure that can handle the growing volume and complexity of data. Cloud platforms provide flexible, on-demand resources and integrated observability tools, enabling businesses to efficiently monitor and manage their data pipelines without significant upfront investments. Moreover, the widespread adoption of cloud services by organizations for their data storage and processing needs amplifies the necessity for robust observability solutions tailored for cloud environments. This combination of scalability, flexibility, and increasing cloud adoption fuels the dominance of the public cloud segment.

The private cloud segment is predicted to foresee significant growth in the forecast period. The private cloud segment is witnessing growth due to the need for enhanced data security and control within organizations handling sensitive information. Companies with strict regulatory and compliance requirements prefer private cloud environments to maintain higher levels of data privacy and governance. Private clouds offer customizable infrastructure and dedicated resources, allowing businesses to customize observability solutions to their specific operational and security needs. As concerns about data breaches and compliance intensify, the adoption of private cloud solutions for secure and controlled data observability is accelerating.

End-use Insights

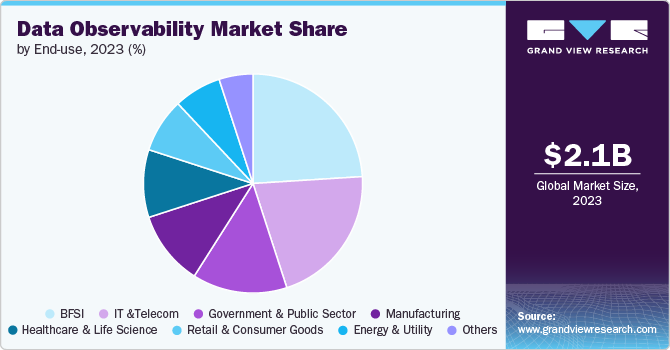

The BFSI segment accounted for the largest revenue share in 2023. The BFSI segment dominates the market due to stringent regulatory requirements, critical reliance on real-time data integrity, and the need for robust risk management. Ensuring the accuracy, consistency, and security of financial data is crucial for financial institutions to meet compliance requirements of regulations such as PCI-DSS, GDPR, and Basel III. Data observability tools provide these organizations with comprehensive monitoring and auditing capabilities, enabling proactive detection of anomalies and ensuring compliance with regulatory standards. Moreover, in a highly competitive industry where timely and accurate data insights drive strategic decision-making, BFSI firms prioritize investments in data observability to maintain operational efficiency and enhance customer trust.

The IT & telecom segment is witnessing significant growth from 2024 to 2030, due to its inherent complexities and rapid technological advancements. These industries manage extensive networks, diverse data streams, and mission-critical systems that require continuous monitoring and optimization. Data observability tools help in providing real-time insights into network performance, service availability, and customer interactions. With the shift towards cloud computing and digital transformation, IT & Telecom companies prioritize scalable and agile solutions that can seamlessly integrate with their evolving infrastructures. Furthermore, the emphasis on enhancing customer experience through personalized services and predictive analytics further drives the adoption of data observability tools.

Regional Insights

North America dominated the market and accounted for 41.6% share in 2023. North America benefits from a highly developed IT infrastructure, advanced technological expertise, and significant investments in digital transformation initiatives across various industries. The presence of a large number of technology companies, including major cloud service providers and data analytics firms, which continuously innovate and offer robust data observability solutions, propels the market forward. These solutions address the diverse needs of enterprises ranging from financial services to healthcare & life science, utilizing sophisticated technologies such as artificial intelligence, machine learning, and big data analytics.

U.S. Data Observability Market Trends

The data observability market in the U.S. is expected to grow significantly over the forecast period.The The U.S. market is poised for significant expansion driven by escalating demand for real-time data insights, the rapid pace of digital transformation initiatives across industries, and the integration of advanced technologies such as IoT, edge computing, and AI/ML. These factors underscore a growing necessity for robust observability solutions that can ensure data accuracy, support agile practices, and enhance cybersecurity measures amidst evolving business sector.

Europe Data Observability Market Trends

Stringent data privacy regulations such as the General Data Protection Regulation (GDPR) in the European Union mandate strict controls over how data is collected, stored, and managed. Organizations are thus investing in observability solutions to maintain compliance with these regulations, safeguarding customer data and avoiding hefty fines. Furthermore, the adoption of cloud computing, artificial intelligence (AI), and machine learning (ML) technologies is on the rise in Europe. These technologies enable businesses to leverage vast amounts of data for predictive analytics, personalized customer experiences, and enhanced decision-making.

Asia Pacific Data Observability Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. Asia Pacific boasts a large and tech-savvy population with high mobile penetration rates. This societal trend fuels the demand for real-time data insights and personalized digital experiences, driving the need for advanced observability capabilities. The rapid growth of e-commerce platforms, digital payment systems, and online services in Asia Pacific creates vast amounts of transactional and customer data. Observability tools are essential for monitoring and optimizing these digital operations to ensure reliability, security, and efficiency.

Key Data Observability Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in May 2023, Red Hat, Inc., an American software company and Dynatrace LLC. partnered to integrate their platforms, enabling automated problem remediation through advanced AI and automation technologies. This collaboration simplifies incident management, reduces downtime, and enhances operational efficiency by utilizing precise insights and orchestration capabilities across environments.

Key Data Observability Companies:

The following are the leading companies in the data observability market. These companies collectively hold the largest market share and dictate industry trends.

- Acceldata

- AppDynamics

- Datadog

- Dynatrace LLC.

- Hound Technology, Inc.

- International Business Machines Corporation

- Microsoft

- Monte Carlo

- New Relic, Inc.

- Splunk Inc.

Recent Developments

-

In July 2024, International Business Machines Corporation, an American multinational technology company acquired StreamSets to expand its data integration capabilities, enabling real-time data pipelines and enhancing IBM Data Fabric's support for AI-driven insights. This acquisition aims to provide robust tools that empower organizations to utilize data effectively in hybrid multi-cloud environments.

-

In June 2024, Splunk Inc. introduced new data management innovations to provide customers with unified visibility across their enterprise. This includes preprocessing data through a centralized pipeline to optimize data economics and enhance digital resilience, addressing the complexities of managing data growth across diverse IT environments.

-

In April 2024, the Microsoft Azure Container Networking team introduced Retina, an open-source container networking observability platform designed to provide comprehensive visualization and analysis of workload traffic across diverse environments. Retina utilizes eBPF technology to achieve kernel-level monitoring without requiring container agents, ensuring efficient and scalable network monitoring across Linux and Windows environments.

-

In April 2024, Tech Mahindra Limited, an Indian multinational information technology services and consulting company, collaborated with Microsoft to launch a unified workbench on Microsoft Fabric. The collaboration focuses on streamlining data workflows, enhancing analytics capabilities, and accelerating business transformation.

-

In November 2023, Monte Carlo introduced integrations with vector databases and Apache Kafka, enhancing their data observability capabilities to ensure data quality and reliability across complex pipelines, including those supporting generative AI models. These advancements, showcased at Impact 2023, include Performance Monitoring and Data Product Dashboard tools to optimize data pipeline efficiency and monitor data product reliability.

Data Observability Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.37 billion |

|

Revenue forecast in 2030 |

USD 4.73 billion |

|

Growth rate |

CAGR of 12.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Acceldata; AppDynamics; Datadog; Dynatrace LLC; Hound Technology, Inc.; International Business Machines Corporation; Microsoft; Monte Carlo; New Relic, Inc.; Splunk Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Observability Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data observability market report based on component, deployment, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Government & Public Sector

-

Energy & Utility

-

Manufacturing

-

Healthcare & Life Science

-

Retail & Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data observability market size was estimated at USD 2.14 billion in 2023 and is expected to reach USD 2.37 billion in 2024.

b. The global data observability market is expected to grow at a compound annual growth rate of 12.2% from 2024 to 2030 to reach USD 4.73 billion by 2030.

b. North America dominated the data observability market with a share of 41.6% in 2023. This is attributable to the region's advanced technological infrastructure, high adoption rate of data-driven decision-making across industries, and significant investments in data analytics and monitoring tools.

b. Some key players operating in the data observability market include Acceldata, AppDynamics, Datadog, Dynatrace LLC., Hound Technology, Inc., International Business Machines Corporation, Microsoft, Monte Carlo, New Relic, Inc., and Splunk Inc.

b. Key factors driving market growth include increasing data volume, rising adoption of cloud technologies, demand for real-time analytics, emphasis on data quality and governance, growth of AI and machine learning, and focus on enhancing customer experience.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."