- Home

- »

- Next Generation Technologies

- »

-

Data Lake Market Size, Share, Trends & Growth Report 2030GVR Report cover

![Data Lake Market Size, Share & Trends Report]()

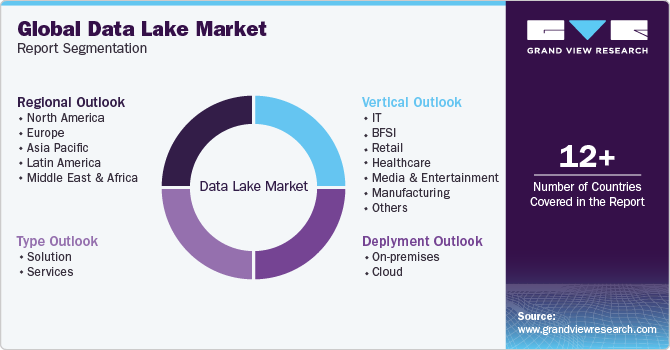

Data Lake Market Size, Share & Trends Analysis Report By Type (Solution, Services), By Deployment (On-Premises, Cloud), By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-244-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Data Lake Market Size & Trends

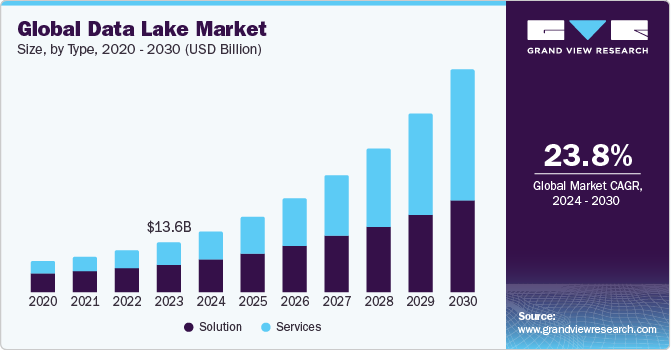

The global data lake market size was estimated at USD 13.62 billion in 2023 and is projected to grow at a CAGR of 23.8% from 2024 to 2030. The growing importance of AI and machine learning in data analytics has led to a surge in the adoption of data lakes. Data lakes provide the necessary infrastructure to store and process the vast amounts of data required for advanced analytics and machine learning models.

Organizations are leveraging data lakes to ingest, store, and prepare data for training these models, leading to more accurate predictions, personalized recommendations, and enhanced decision-making. As AI and machine learning technologies continue to evolve, the demand for data lakes capable of supporting these capabilities will only increase.

The demand for real-time insights has led to the integration of real-time data processing and streaming capabilities in data lakes. Organizations are leveraging technologies like Apache Kafka, Apache Spark Streaming, and Amazon Kinesis to ingest, process, and analyze data in near real-time. This enables them to make timely, data-driven decisions and respond quickly to changing market conditions or customer needs. The ability to combine batch and real-time data processing within a data lake environment has become a key differentiator for organizations seeking to stay competitive.

The rise in the number of digital payments is increasing the amount of transactional data in banks across the globe. Several banks are investing in developing data lakes to improve their analytical abilities to provide on-the-go solutions to their customers. Banks, including Australia and New Zealand Banking Group and State Bank of India, have already started developing data lakes to integrate data across domains and create a central database. Thus, data lakes allow banks to aggregate data from all the data ponds across the domains into a central database that can be accessed by any individual in real time.

A rise in the adoption of IoT devices is expected to positively impact the market growth. The proliferation of data with increasing adoption of IoT is expected to drive the market growth. Also, various government initiatives, such as the development of smart cities, and implementation of intelligent utility meters, amongst others, would impact the market positively. For instance, Singapore, Tokyo, New York, and London are anticipated to be among the top investors in smart city initiatives for the year 2020.

Market Concentration & Characteristics

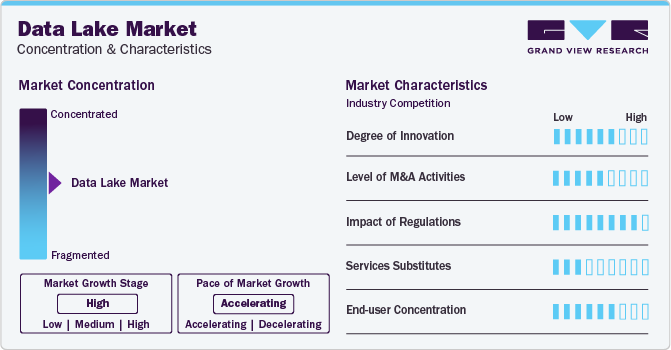

The market is characterized by a high degree of innovation as vendors continuously introduce new features and capabilities to stay ahead of the competition. Some key areas showcasing a significant level of innovation include improved data management, enhanced analytics, and AI/ML integration, cloud-based data lake solutions, real-time data processing, and advancements in data lake security and compliance. These innovative developments are aimed at helping organizations better understand, control, and derive valuable insights from their data assets, while also addressing the growing concerns around data privacy and regulatory requirements.

Data lake vendors are acquiring companies with advanced analytics, machine learning, and artificial intelligence capabilities to enhance their data lake platforms and deliver more sophisticated insights and automation to their customers. This trend reflects the increasing importance of integrating cutting-edge analytics and AI/ML functionalities within data lake solutions, as organizations seek to derive greater value from their data assets through enhanced decision-making and business optimization.

Regulatory mandates are driving organizations to implement robust data governance frameworks within their data lake environments. This includes the adoption of comprehensive data management policies, data stewardship roles, and lifecycle management processes to ensure the quality, security, and retention of data throughout its lifecycle. Improved data governance helps organizations meet regulatory requirements, maintain data integrity, and leverage their data assets more effectively.

The market is not only influenced by the technological innovations and regulatory landscape, but also by the availability of service-based alternatives that can potentially substitute or complement traditional data lake solutions. These service-based offerings provide organizations with more flexible, cost-effective, and specialized options to address their data management and analytics needs, enabling them to focus on driving business value rather than managing the underlying infrastructure.

End-user concentration in the global market is steadily rising as businesses recognize the strategic importance of data-driven insights. Established players with proven track records in data management and analytics are attracting a larger share of end-users seeking reliable solutions. This concentration is driven by factors such as trust, reputation, and the ability to scale to meet growing data demands. As a result, smaller vendors may find it challenging to compete effectively unless they can offer unique value propositions or niche solutions.

Type Insights

Based on type, the solution segment led the market with the largest revenue share of 56.15% in 2023. Data lakes are increasingly seen as the foundation for successful artificial intelligence (AI) and machine learning (ML) initiatives. To address this growing need, data lake solutions are evolving to seamlessly connect with AI/ML platforms. This integration enables powerful features like data preparation specifically tailored for machine learning models. Real-time data analysis capabilities empower AI applications to react to insights as they emerge. In addition, the vast datasets housed within the data lake can be leveraged to train complex and highly accurate machine learning models.

As the adoption of data lakes increases, there is a growing need for specialized skills and expertise in managing and utilizing these technologies. Data lake training and skill development services have emerged to address this demand. These services provide comprehensive training programs, workshops, and certifications to help organizations upskill their IT teams, data engineers, and data analysts in areas such as data lake architecture, data ingestion, data transformation, data governance, and data analytics. By investing in these services, organizations can build internal capabilities and foster a data-driven culture, enabling them to fully leverage the potential of their data lake investments.

Deployment Insights

Based on deployment, the on-premises segment led the market with the largest revenue share of 45.62% in 2023. The on-premises segment is witnessing a growing trend towards hybrid architectures, where organizations combine on-premises data lakes with cloud-based storage and processing capabilities. This approach allows businesses to leverage the scalability and cost-effectiveness of cloud infrastructure while still maintaining control and security over their sensitive data on-premises. By adopting a hybrid model, organizations can enjoy the best of both worlds, optimizing their data management strategies to meet their specific requirements. This trend is particularly prevalent among enterprises that need to balance regulatory compliance, data sovereignty, and the desire to harness the benefits of cloud-based data analytics and machine learning services.

The cloud segment is witnessing a growing trend towards the adoption of highly scalable and elastic cloud infrastructure. Enterprises are increasingly leveraging cloud-based data lake platforms that can dynamically allocate, and scale computing and storage resources based on their evolving data processing and analytics requirements. This enables organizations to cost-effectively handle surges in data volumes and processing needs without having to invest in costly on-premises infrastructure. Cloud data lakes offer the flexibility to easily scale up or down, allowing businesses to match their resource utilization with their actual usage patterns. This trend empowers organizations to achieve greater agility, efficiency, and cost optimization in their data management strategies.

Vertical Insights

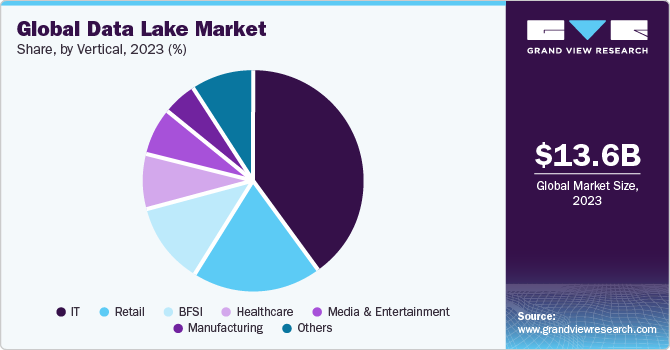

Based on vertical, the IT segment led the market with the largest revenue share of 40.11% in 2023. The IT vertical in the global market is witnessing a trend towards the adoption of unified data management platforms that combine the functionalities of traditional data lakes, data warehouses, and various analytics tools. These integrated platforms enable organizations to consolidate their disparate data sources, streamline data ingestion, and provide a centralized hub for data processing, analysis, and insights generation. By leveraging a unified platform, IT teams can eliminate data silos, improve data governance, and enable seamless collaboration across different business units. This trend is driven by the need to simplify data management, enhance data accessibility, and accelerate the delivery of data-driven insights within the IT organization.

The retail segment is witnessing the integration of Internet of Things (IoT) data to generate enhanced retail insights. Retailers are incorporating data from various IoT devices, such as in-store sensors, smart shelves, and connected inventory management systems, into their data lakes. By analyzing this real-time IoT data, retailers can gain valuable insights into store operations, customer traffic patterns, product availability, and resource utilization. This trend enables retailers to make more informed decisions about store layout, product placement, staffing, and inventory replenishment, ultimately improving operational efficiency and enhancing the customer experience. The ability to leverage IoT data within a data lake environment has become a crucial strategy for retail organizations to stay competitive and responsive to evolving market dynamics.

Regional Insights

North America dominated the data lake market with the revenue share of 36.32% in 2023. The North American market is witnessing a significant trend towards the adoption of hybrid data lake architectures. Enterprises in the region are combining on-premises data lakes with cloud-based storage and processing capabilities to leverage the benefits of both approaches. This hybrid model allows organizations to maintain control and security over sensitive data while tapping into the scalability, cost-effectiveness, and advanced analytics capabilities offered by cloud-based data lake services. The flexibility to seamlessly move and process data between on-premises and cloud environments has become a key priority for North American organizations, enabling them to optimize their data management strategies and derive maximum value from their data assets.

U.S. Data Lake Market Trends

The data lake market in U.S. is witnessing a significant surge in the adoption of cloud-based data lake solutions. American enterprises are increasingly migrating their data lake infrastructure to the cloud, leveraging the scalability, elasticity, and cost-efficiency offered by cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. This trend is driven by the need to overcome the challenges associated with on-premises data lake deployments, including complex infrastructure management, limited scalability, and high upfront costs. By embracing cloud-based data lakes, U.S. organizations can focus on their core business activities while offloading the operational and maintenance responsibilities to their cloud service providers.

Europe Data Lake Market Trends

The data lake market in Europe is anticipated to grow at a fastest CAGR during the forecast period. The implementation of regulations like GDPR, European organizations are placing greater emphasis on data governance, security, and compliance within their data lake architectures. There is a growing demand for data lake solutions that offer robust data management, access controls, and audit capabilities to ensure regulatory compliance.

The UK data lake market is aspecialized data lake solution tailored to the needs of specific industries, such as financial services, healthcare, and manufacturing that are gaining traction in the UK market. These industry-specific data lakes incorporate pre-built connectors, data models, and analytics functionalities to address the unique data management and analysis requirements of each sector.

The data lake market in France has an implementation of the EU's General Data Protection Regulation (GDPR), and French companies, which are placing a strong emphasis on data governance, security, and compliance within their data lake environments.

The Germany data lake market organizations are exploring the use of artificial intelligence (AI) and machine learning (ML) within their data lake environments to enable advanced analytics, predictive modeling, and intelligent data processing. Data lake platforms are being enhanced with AI/ML capabilities, such as natural language processing, computer vision, and predictive analytics, to unlock new insights and business value.

Asia Pacific Data Lake Trends

The data lake market in Asia Pacific is anticipated to register at the fastest CAGR over the forecast period. The dominance of on-premises data lakes is waning as businesses in the Asia Pacific region increasingly embrace cloud-based solutions. Cloud data lakes offered by major players like AWS, Microsoft Azure, and Google Cloud provide superior scalability and elasticity. This is crucial for handling the ever-growing volume of data generated across the region's booming industries. In addition, cloud solutions offer greater reliability, ensuring data availability and accessibility for critical analytics tasks.

The China data lake market has data security and privacy regulations, like the Data Security Law and Personal Information Protection Law. They are driving a focus on secure data storage within the country's borders. This trend is accelerating the adoption of cloud data lakes offered by domestic providers who can ensure compliance with these regulations.

The data lake market in India is expected to grow at a substantial CAGR over the forecast period. The market growth can be ascribed to increasing investments made by major technology companies in China, India, Australia, and Japan. Also, several other factors, including growing digitization and rising penetration of advanced big data analytics technology, are anticipated to drive the Asia Pacific market. Further, government initiatives and regulations are amongst the key catalysts for market growth in the region.

The Japan data lake market is expected to grow at a significant CAGR over the forecast period. Japanese organizations are placing a strong emphasis on data governance, security, and regulatory compliance within their data lake architectures. There is a growing demand for data lake solutions that offer robust data management capabilities, access controls, and audit trails to ensure compliance with Japan's data protection regulations, such as the Act on the Protection of Personal Information (APPI).

Middle East & Africa Data Lake Trends

The data lake market in Middle East & Africa is anticipated to grow at the robust CAGR during the forecast period. With the implementation of data protection regulations, such as the Dubai International Financial Centre (DIFC) Data Protection Law, organizations in the MEA region are placing a strong emphasis on data governance, security, and compliance within their data lake architectures. There is a rising demand for data lake solutions that provide robust data management capabilities, access controls, and audit trails to ensure regulatory compliance.

Key Data Lake Company Insights

Major corporations have utilized a combination of expansions, product launches, agreements, mergers and acquisitions, partnerships, contracts, and collaborations as their key business approach to expand their market presence. These firms have employed diverse tactics to improve market penetration and strengthen their standing within the competitive sector. For instance, in August 2022, Cloudera introduced a comprehensive Software-as-a-Service (SaaS) solution called Cloudera Data Platform (CDP), integrating built-in security measures and machine learning capabilities with the objective of providing valuable insights.

Key Data Lake Companies:

The following are the leading companies in the data lake market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc

- Cloudera, Inc.

- Dremio Corporation

- Informatica Corporation

- Microsoft Corporation

- Oracle Corporation

- SAS Institute Inc.

- Snowflake Inc.

- Teradata Corporation

- Zaloni, Inc.

Recent Developments

-

In May 2023, Amazon Web Services, Inc. (AWS) introduced Amazon Security Lake, a service designed to seamlessly gather security information from various sources including AWS environments, on-premises setups, leading SaaS providers, and other cloud platforms, consolidating it into a single unified data repository

-

In October 2022, Oracle unveiled a comprehensive suite of cloud applications and platform services meticulously integrated with artificial intelligence models spanning various industries, aiming to enrich customer experiences. To empower organizations across diverse sectors in crafting more precise customer interactions, Oracle has incorporated 15 foundational artificial intelligence models into its Oracle Unity platform

-

In August 2022, Teradata, a prominent U.S.-based software firm specializing in cloud database and analytics solutions, introduced VantageCloud Lake. This marks Teradata's launch product built on an entirely new, cutting-edge, cloud-native architecture, signaling a significant advancement in its product offerings

Data Lake Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.61 billion

Revenue forecast in 2030

USD 59.89 billion

Growth rate

CAGR of 23.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; UAE; Saudi Arabia (KSA); South Africa

Key companies profiled

Amazon Web Services, Inc; Cloudera, Inc.; Dremio Corporation; Informatica Corporation; Microsoft Corporation; Oracle Corporation; SAS Institute Inc.; Snowflake Inc.; Teradata Corporation; Zaloni, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Lake Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the data lake market report based on type, application, vertical and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

IT

-

BFSI

-

Retail

-

Healthcare

-

Media and Entertainment

-

Manufacturing

-

Others (government, hospitality, education, others)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data lake market size was estimated at USD 13.62 billion in 2023 and is expected to reach USD 16.61 billion in 2024.

b. The global data lake market is expected to grow at a compound annual growth rate of 23.8% from 2024 to 2030 to reach USD 59.89 billion by 2030.

b. North America dominated the data lake market with a share of 36.32% in 2023. The North American data lake market is witnessing a significant trend towards the adoption of hybrid data lake architectures. Enterprises in the region are combining on-premises data lakes with cloud-based storage and processing capabilities to leverage the benefits of both approaches.

b. Some key players operating in the data lake market include Amazon Web Services, Inc., Cloudera, Inc., Dremio Corporation, Informatica Corporation, Microsoft Corporation, Oracle Corporation, SAS Institute Inc., Snowflake Inc., Teradata Corporation, and Zaloni, Inc.

b. Key factors driving market growth include the increasing need to extract insights from huge volumes of data and the rapid growth of advanced analytics technologies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."