Data Labeling Solution And Services Market Size, Share & Trends Analysis Report By Sourcing Type (In-house, Outsourced), By Type (Text, Image/Video, Audio), By Labeling Type, By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-912-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

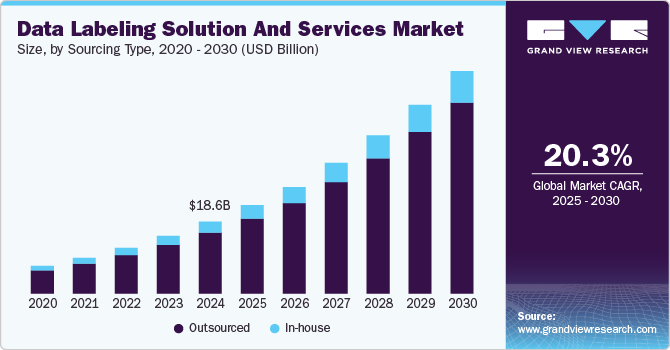

The global data labeling solution and services market size was valued at USD 18.63 billion in 2024 and is projected to grow at a CAGR of 20.3% from 2025 to 2030. The market is growing due to the increasing demand for AI and ML across industries. As more sectors rely on AI-driven insights to streamline operations and make data-driven decisions, high-quality labeled data becomes crucial. Accurate data labeling enables models to process information correctly, directly impacting the effectiveness of AI applications. This demand is especially high in sectors such as healthcare, automotive, and finance, where precise AI models are essential for operational accuracy. Moreover, the rise of autonomous technologies and predictive analytics in various industries has made labeled data a necessary component for AI models. Companies are investing in data labeling to ensure their AI algorithms are well-trained, efficient, and capable of delivering accurate results.

The shift toward automation in data labeling processes has contributed to market growth. Advanced tools now offer semi-automated and fully automated labeling solutions, reducing human intervention and improving efficiency. This automation enhances accuracy by reducing human error, leading to better outcomes in AI and ML model training. Consequently, businesses can expedite model Sourcing Type and benefit from faster returns on investment in AI projects. In addition, the increasing adoption of cloud-based data labeling platforms is allowing companies to access scalable solutions, further driving market expansion. Cloud solutions provide greater flexibility and adaptability, which is especially valuable for enterprises dealing with large data volumes. Thus, technological advancements in labeling services are reinforcing the market's growth trajectory.

Many Labeling Types prefer to rely on outsourced data labeling services rather than develop in-house capabilities, given the labor-intensive nature and technical expertise required for accurate labeling. By partnering with dedicated labeling vendors, businesses can access high-quality labeled data without diverting internal resources. This trend is especially prevalent in regions with high labor costs, where outsourcing offers a cost-effective alternative. Moreover, outsourced providers are often equipped with domain-specific expertise, ensuring labeling accuracy and reducing the time needed to prepare data for AI models. As companies strive for efficiency and cost control, this shift toward outsourcing further accelerates market growth. Third-party vendors are increasingly expanding their offerings to provide specialized labeling services, strengthening their position in a competitive market.

Sourcing Type Insights

The outsourced segment accounted for the dominant share of 84.6% in 2024. The outsourced segment is dominated by providers with specialized expertise and advanced technologies, which enable them to deliver high-quality, scalable labeling solutions efficiently. Many organizations prefer outsourcing due to the reduced costs associated with external vendors, especially in regions with high labor expenses. Moreover, outsourced vendors often have established quality assurance processes, ensuring accurate and consistent data labeling that benefits AI model performance. These providers typically support various industries, offering tailored services that meet sector-specific requirements, further strengthening their market position. Consequently, the outsourced segment holds a significant market share as businesses seek cost-effective, dependable solutions for their data labeling needs.

In-house data labeling supports this market by allowing companies to retain greater control over sensitive data and customize labeling processes to meet specific project requirements. Companies with in-house capabilities can fine-tune their labeling tasks, which enhances data security and ensures alignment with internal standards. This segment appeals to organizations with ongoing, large-scale data labeling needs, as they can invest in dedicated teams and tools to manage continuous labeling demands. In-house labeling also enables faster iteration and refinement of data, as companies can promptly adjust processes based on model performance. Thus, in-house data labeling supports companies aiming for long-term efficiency and direct oversight in their AI projects, adding value to the overall data labeling market.

Type Insights

The image/video segment accounted for the dominant share in 2024 due to the exponential growth of visual content generated across platforms such as social media, e-commerce, and entertainment. As businesses increasingly rely on visual data for applications like computer vision, facial recognition, and autonomous driving, the demand for accurately labeled images and videos has surged. Advanced labeling techniques, including bounding box annotations and segmentation, are essential for training AI models effectively, leading to a growing focus on this segment. Furthermore, the rise of augmented reality (AR) and virtual reality (VR) applications is amplifying the need for labeled visual content, making it a critical area for investment. This strong demand for accurate visual data continues to solidify the image and video segment as a leader in the data labeling market.

The audio segment is gaining traction as the need for speech recognition and natural language processing (NLP) applications expands. As companies seek to enhance user experiences through voice-activated systems and virtual assistants, accurately labeled audio data becomes crucial for effective model training. The rise of podcasts, audiobooks, and other audio content formats has further increased the demand for transcription and annotation services. Labeling audio data allows organizations to improve their algorithms for tasks like sentiment analysis and language translation, thereby enhancing the functionality of AI-driven applications. As a result, the audio segment is emerging as a significant contributor to the overall growth of the data labeling market.

Labeling Type Insights

The manual segment accounted for the dominant share in 2024 due to its high accuracy and adaptability in handling complex labeling tasks that require human judgment. For industries where precision is crucial, such as healthcare and autonomous vehicles, manual labeling provides the detailed annotations needed for effective AI training. This segment is further strengthened by the flexibility of human labelers, who can adapt to unique project requirements and improve data quality through ongoing quality checks. Many companies continue to rely on manual labeling to ensure their models produce reliable outcomes, especially when dealing with nuanced data. Consequently, manual labeling remains a preferred choice for tasks where accuracy is essential, reinforcing its dominant position in the market.

The automatic segment is rapidly growing as advancements in AI and machine learning streamline data labeling processes. Automated labeling tools enable companies to process large volumes of data efficiently, significantly reducing time and costs compared to manual methods. This approach is particularly useful for repetitive and high-volume tasks, where automation can quickly generate basic labels with minimal human intervention. Improvements in AI algorithms also enhance the accuracy of automatic labeling, making it a viable option for less complex projects. As organizations aim to optimize their data operations, the automatic segment is gaining traction, contributing to its steady expansion within the data labeling market.

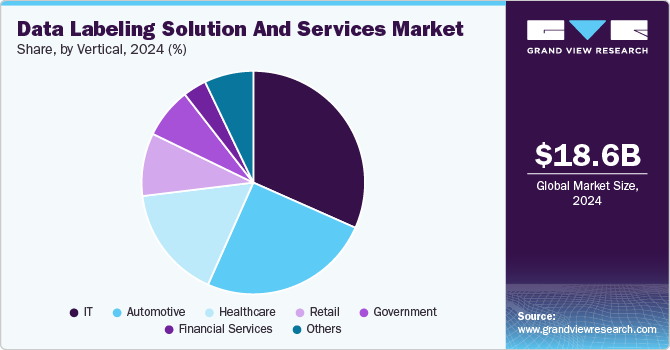

Vertical Insights

The IT segment accounted for the dominant share in 2024 as it is a central driver of AI and machine learning innovations across industries. It requires extensive labeled data for applications in areas like cybersecurity, virtual assistance, and cloud-based AI services. With large volumes of digital data generated in IT environments, accurate data labeling is crucial for training and fine-tuning algorithms that improve automation, user experience, and security. IT companies also have the resources and expertise to utilize both in-house and outsourced labeling services effectively, further strengthening their position. As IT continues to evolve with emerging technologies like edge computing and (IoT), the demand for high-quality data labeling grows to support these advancements. Thus, the IT sector remains dominant, heavily investing in labeled data to fuel the next generation of AI-driven solutions and services.

The automotive vertical is experiencing notable growth, driven by the increasing integration of AI in autonomous driving, advanced driver-assistance systems (ADAS), and in-car user experiences. Automotive companies require precisely labeled visual, audio, and sensor data to train algorithms for real-time decision-making and object recognition in self-driving technologies. As the industry moves toward higher levels of vehicle automation, the need for accurate and diverse data labeling intensifies, especially for handling complex environments and improving safety features. Moreover, data labeling plays a critical role in developing predictive maintenance and vehicle diagnostics, adding to the sector's data requirements. This growth trajectory in the automotive vertical highlights the industry's commitment to AI advancements, propelling demand for specialized data labeling solutions.

Regional Insights

North America data labeling solution and services market led the global industry accounting for a 33.9% share in 2024.In North America, the data labeling market is thriving, driven by the region's high concentration of technology companies and AI research centers. The demand for labeled data is significant, especially in sectors like healthcare, finance, and e-commerce, which rely heavily on AI for data-driven insights. North America’s emphasis on data privacy regulations has also contributed to the demand for reliable and secure labeling solutions. The presence of large cloud service providers enhances the accessibility of scalable data labeling platforms, supporting the needs of both large enterprises and small businesses.

U.S. Data Labeling Solution And Services Market Trends

The U.S. data labeling solution and services market is expanding rapidly due to the country's strong investment in AI and machine learning research. With advancements in autonomous systems, including self-driving vehicles and drone technologies, there is a substantial need for high-quality labeled data to improve model accuracy. The tech industry’s competitive landscape has prompted companies to adopt data labeling solutions that accelerate the development and deployment of AI-driven applications.

Europe Data Labeling Solution And Services Market Trends

The Europe data labeling solution and services market is growing steadily, supported by the region's commitment to ethical AI and stringent data privacy regulations, such as GDPR. European industries, especially in healthcare, automotive, and finance, require highly accurate and secure data labeling solutions to comply with regulatory standards. Countries in the region are also investing in AI innovation hubs and collaborative research projects, which amplify demand for labeled data to support diverse AI applications. Moreover, the market benefits from strong governmental support for AI, driving initiatives that encourage the development of localized data labeling solutions.

Asia Pacific Data Labeling Solution And Services Market Trends

The data labeling solution and services market in Asia Pacific is witnessing rapid growth, driven by the proliferation of digital platforms and significant investments in AI across industries. Countries in this region are focusing on sectors like e-commerce, social media, and telecommunications, which require vast amounts of labeled data for personalized user experiences and predictive analytics. The region benefits from a large and skilled workforce that supports cost-effective manual labeling, enhancing market competitiveness. Moreover, government-backed AI programs in countries such as China and Japan further propel the adoption of data labeling, particularly for advancements in smart cities and autonomous vehicles.

Key Data Labeling Solution And Services Company Insights

Some of the key companies in the market include Amazon Mechanical Turk, Inc., Appen Limited, Clickworker GmbH, CloudApp, CloudFactory Limited, and others. Labeling Types focus on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Appen Limited has advanced data labeling by utilizing a global workforce and integrating automation to handle large-scale labeling tasks across diverse data types, including images, text, and audio. The company’s platform combines human-in-the-loop labeling with machine learning to improve accuracy and efficiency, catering to industries with high data demands. Appen has also prioritized data security and compliance, making it appealing to regulated sectors like healthcare and finance.

-

Amazon Mechanical Turk, Inc. offers a data labeling platform that enables businesses to tap into a vast crowd of workers for flexible, on-demand labeling tasks. This platform is particularly advantageous for companies seeking cost-effective, scalable solutions, as it provides access to a large pool of human workers for tasks like image and text annotation, sentiment analysis, and content moderation. While it allows companies to label data quickly, the crowd-sourced nature of Mechanical Turk can sometimes lead to variability in quality, making it ideal for less complex tasks or when high volume is prioritized over precision.

Key Data Labeling Solution And Services Companies:

The following are the leading companies in the data labeling solution and services market. These companies collectively hold the largest market share and dictate industry trends.

- Alegion

- Amazon Mechanical Turk, Inc.

- Appen Limited

- Clickworker GmbH

- CloudApp

- CloudFactory Limited

- Cogito Tech LLC

- Deep Systems, LLC

- edgecase.ai

- Explosion AI GmbH

- Heex Technologies

- Labelbox, Inc.

- Lotus Quality Assurance

- Mighty AI, Inc.

- Playment Inc.

- Scale AI

- Shaip

- Steldia Services Ltd.

- Tagtog Sp. z o.o.

- Trilldata Technologies Pvt Ltd

- Yandez LLC

Recent Developments

-

In September 2023, Labelbox's LLM solution utilized advanced data labeling processes to improve model alignment with human preferences, which is essential for creating high-quality, business-specific AI applications. By integrating human feedback through data labeling and reinforcement learning techniques, Labelbox allows enterprises to refine LLM outputs to ensure contextually accurate and reliable responses, making it easier for ML teams to validate and optimize AI model performance across diverse industries.

-

In May 2023, Appen Limited collaborated with NVIDIA Corporation to integrate its data services with the NVIDIA AI Enterprise platform, providing enterprises with a comprehensive solution for creating and customizing real-time AI capabilities. This collaboration enhances Appen’s data sourcing, annotation, and labeling expertise, enabling businesses to effectively use their data for tailored AI applications while maintaining brand integrity.

-

In February 2023, Appen Limited introduced three new products-Reinforcement Learning with Human Feedback, Document Intelligence, and Automated NLP Labeling-to advance generative AI capabilities and enhance customer experiences. This expansion positions Appen as an AI platform company, addressing key challenges in data preparation and pipeline efficiency for clients building AI-driven solutions.

Data Labeling Solution And Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 22.90 billion |

|

Revenue forecast in 2030 |

USD 57.63 billion |

|

Growth rate |

CAGR of 20.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Sourcing type, type, labeling type, vertical, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil ,KSA, UAE and South Africa |

|

Key companies profiled |

Alegion, Amazon Mechanical Turk, Inc., Appen Limited, Clickworker GmbH, CloudApp, CloudFactory Limited, Cogito Tech LLC, Deep Systems, LLC, edgecase.ai, Explosion AI GmbH, Heex Technologies, Labelbox, Inc, Lotus Quality Assurance, Mighty AI, Inc., Playment Inc., Scale AI, Shaip, Steldia Services Ltd., Tagtog Sp. z o.o., Trilldata Technologies Pvt Ltd, Yandez LLC. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Labeling Solution And Services Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data labeling solution and services market report based on sourcing type, type, labeling type, vertical, and region:

-

Sourcing Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-House

-

Outsourced

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Text

-

Image/Video

-

Audio

-

-

Labeling Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Semi-Supervised

-

Automatic

-

-

Vertical (Revenue, USD Million, 2018 - 2030)

-

IT

-

Automotive

-

Government

-

Healthcare

-

Financial Services

-

Retails

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the data labeling solution and services market include Alegion; Amazon Mechanical Turk, Inc.; Appen Limited; Clickworker GmbH; CloudApp; CloudFactory Limited; Cogito Tech LLC; Deep Systems, LLC; edgecase.ai; Explosion AI GmbH; Heex Technologies; Labelbox, Inc; Lotus Quality Assurance; Mighty AI, Inc.; Playment Inc.; Scale AI; Shaip; Steldia Services Ltd.; Tagtog Sp. z o.o.; Trilldata Technologies Pvt Ltd.;Yandez LLC.

b. Key factors that are driving the data labeling solution and services market growth include the emergence of data labeling tools and workflow trends, the increasing prominence of AI and machine learning, and accelerated medical data labeling for diagnostic AI.

b. The global data labeling solution and services market size was estimated at USD 18.63 billion in 2024 and is expected to reach USD 22.90 billion in 2025.

b. The global data labeling solution and services market is expected to grow at a compound annual growth rate of 20.3 % from 2025 to 2030 to reach USD 57.63 billion by 2030.

b. North America dominated the data labeling solution and services market with a share of 33.9 % in 2024. This is attributable to the mass adoption of digital devices, and increasing investments in North American companies for AI solutions and services.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."