- Home

- »

- Next Generation Technologies

- »

-

Data Integration Market Size & Share, Industry Report, 2030GVR Report cover

![Data Integration Market Size, Share & Trend Report]()

Data Integration Market (2025 - 2030) Size, Share & Trend Analysis Report By Component, By Deployment, By Organization Size, By Business Application (Marketing, Sales), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-976-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Integration Market Summary

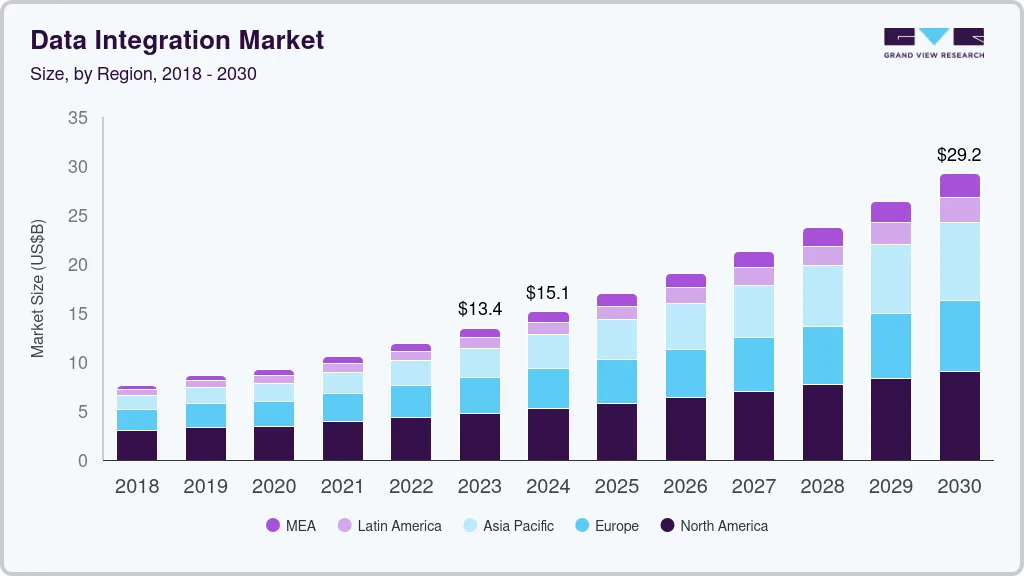

The global data integration market size was estimated at USD 15.18 billion in 2024 and is projected to reach USD 30.27 billion by 2030, growing at a CAGR of 12.1% from 2025 to 2030. Data integration is the process of bringing data together from various sources into a single, comprehensive view.

Key Market Trends & Insights

- North America data integration market dominated the market in 2024, accounting for over 36% share of the global revenue.

- The data integration market in the U.S. is expected to grow substantially over the forecast period due to several key factors.

- By component, the tool segment led the market and accounted for over 68% of the global revenue in 2024.

- By deployment, the on-premises segment accounted for the largest market revenue share in 2024.

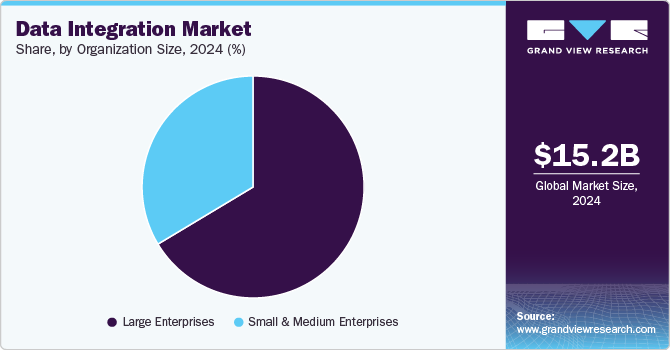

- By organization size, the large enterprises segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.18 Billion

- 2030 Projected Market Size: USD 30.27 Billion

- CAGR (2025-2030): 12.1%

- North America: Largest market in 2024

Transformation, cleansing, extract, transform, and load (ETL) mapping are a few processes involved in data integration. Analytics tools can provide valuable, actionable business intelligence with the help of data integration. Data integration creates a unified, single view of an organization's data that a business intelligence application can access to deliver actionable insights based on the organization's data assets, regardless of the source or format. Generally, a data warehouse is created from the pool of information generated by the integration process.

Businesses have realized that integrating data is the only practical approach to maximizing its potential. When they have all the necessary information in one location, enterprises can locate and apply the most pertinent and accurate insights. Their ability to strategically integrate these insights into their business operations offers them an advantage over competitors. These vast datasets range from consumer data analytics and business intelligence to real-time information delivery, data enrichment, and integration support queries. Managing company and consumer data is a critical use case for data integration products and services.

Business intelligence, enterprise reporting, and advanced enterprise analytics are supported by data integration, which delivers integrated data into data warehouses. Moreover, this growth is also driven by initiatives from major organizations to improve data integration capabilities. For instance, in April 2025, the Pentagon's Chief Data and AI Office initiated a series of experiments aimed at enhancing data integration. These experiments are designed to enable operators to more effectively utilize advanced command-and-control capabilities by addressing specific technical and systems integration challenges, reflecting the broader trend of investing in data integration to enhance operational efficiency and decision-making across various sectors.

Integration of customer data gives business managers and data analysts a comprehensive picture of key performance indicators (KPIs), operations in the manufacturing, financial risks, clients, and supply chain, efforts to comply with regulations, and other elements of business processes. For organizations to compete in the modern economy, integrated data unlocks a layer of connectivity. Organizations can achieve data consistency and smooth knowledge transfer by linking and integrating systems that store vital data across departments and locations. It benefits the firm rather than simply a team or an individual, encouraging intersystem cooperation for a full view of the company.

Component Insights

The tool segment led the market and accounted for over 68% of the global revenue in 2024. The high share can be attributed due to software tools, as they aid in deploying tools in various industries to extract, transform, and load data in a significant amount of time. Tools provide a central location for processing and storing multiple data sets in one database from different sources. These tools help in mapping, designing, cleansing, transforming, and storing data in the cloud and on-premises. The software tools provide a common platform for the organization and support the functional aspects of work in every field.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. Services offer the skills and knowledge required to combine data from many sources into a single database. Further, they reduce the chances of human error and fraud, enhance efficiency, and quickly process large volumes of data. Professional service providers offer consulting, training, and technical support, whereas managed service providers handle infrastructure maintenance and solve complex operations, allowing enterprises to utilize technology fully.

Deployment Insights

The on-premises segment accounted for the largest market revenue share in 2024. The segment’s high share can be attributed to on-premises data integration software capabilities to combine data regardless of its structure, type, and volume from numerous on-premises sources that handle integrations using in-house software. The software includes a data replication tool that keeps track of the data consistency across the cloud and local network. The data from various on-premises software systems could be unified with the aid of on-premises data integration tools. The location for an on-premises data integration system is one of the company's physical offices.

The cloud segment is anticipated to grow at the fastest CAGR over the forecast period. The cloud platforms' main goal is to create unified data stores that all applications and users can access transparently and efficiently. Cloud data integration refers to technology and tools connecting various systems, IT environments, repositories, and applications for real-time data exchange. It includes consolidating different data from multiple systems where the endpoint is a cloud source, such as Google Cloud, Oracle Cloud, Azure SQL, and Amazon RDS. The cloud deployment of data integration software helps transform, consolidate, and clean the data to give the users a view of all essential interactions. Further, integrated cloud services can be accessed by multiple devices through the internet.

Organization Size Insights

The large enterprises segment dominated the market in 2024. The growth is attributed to large enterprises' high adoption rate of data integration software to meet new demands, scale their infrastructure, and maintain support for their products and services. In large enterprises, it's challenging to bring all the data together and gain a competitive advantage, but data integration benefits the enterprises in various ways, such as increasing productivity, greater visibility, reducing the burden of IT, and helping them gain more opportunities. Additionally, large enterprises often have complex data ecosystems, necessitating advanced data integration solutions to manage diverse data sources effectively.

The small and medium enterprises segment is expected to grow at the fastest CAGR during the forecast period. This growth is due to increased demand for cloud-based software spending, which helps improve efficiency and reduce infrastructure costs. Small & medium enterprises can consolidate data from several sources in an organized way using the data integration process. Furthermore, cloud-based data integration solutions offer scalability and flexibility, making them particularly appealing to SMEs looking to expand their operations without significant upfront investments.

Business Application Insights

The marketing segment accounted for the largest market revenue share in 2024. The segment's rise can be attributed to various factors, including studying consumer behavior, comprehending consumer wants and preferences, and personalizing customer interactions. Marketers utilize data integration to segment their target market based on age, gender, and product likes and dislikes, allowing them to make smarter marketing decisions, such as creating campaigns targeted at particular demographics. Moreover, data integration enables marketers to track campaign effectiveness in real time, facilitating data-driven adjustments to marketing strategies.

The HR segment is anticipated to grow at the fastest CAGR during the forecast period. HR data integration refers to automatically sharing candidate, employee, or job-related data among various HR applications or centralizing data from many sources into one database. Instead of wasting time manually entering the same information twice into different HR programs, data integration allows HR professionals to focus on strategic issues that help a company thrive. Additionally, integrated HR data systems can provide insights into workforce trends and talent management, supporting strategic human capital decisions.

End Use Insights

The IT & telecom segment accounted for the largest market revenue share in 2024. With the help of data integration, IT & telecom sectors could quickly bring together data from internal databases, customer records, and third-party systems. This sector generates vast amounts of data from various sources, including network traffic, customer interactions, and service performance metrics. To manage and leverage this data effectively, IT & telecom companies invest heavily in data integration solutions to ensure seamless data flow, enhance operational efficiency, and support strategic decision-making. Additionally, the need for real-time analytics and insights in this sector drives the adoption of advanced data integration tools.

The retail & e-commerce is expected to represent prominent growth over the forecast period. Data integration in this segment enables real-time visibility into inventory, sales, and demand across multiple retail channels, allowing businesses to streamline supply chain operations and enhance decision-making accuracy. By integrating data from various sources, such as e-commerce platforms, retailers, and distributors, companies can respond more effectively to shifting consumer demands and market conditions. For instance, in February 2025, Alloy.ai, one of the leading retail analytics and data integration platform, partnered with CloudPaths, an SAP’s partner, to offer real-time, end-to-end visibility across the retail value chain, improving demand sensing, forecasting precision, and operational agility for consumer brands.

Regional Insights

North America data integration market dominated the market in 2024, accounting for over 36% share of the global revenue. Developed countries like Canada and the U.S. drive the market's growth. With the increased adoption of digital strategies, the region is moving towards upgraded and innovative technologies. Growing technological advancements in the area are essential factors promoting market expansion in North America. The rising number of global data integration businesses will aid the expanding market.

U.S. Data Integration Market Trends

The data integration market in the U.S. is expected to grow substantially over the forecast period due to several key factors. The increasing volume of data generated by businesses necessitates efficient data management solutions, driving demand for advanced data integration tools. Additionally, stringent data privacy regulations and the presence of numerous enterprises across various industries further boost the market. The U.S. features a mature technology ecosystem with a high adoption rate of data integration solutions, which supports ongoing market expansion.

Europe Data Integration Market Trends

The data integration industry in Europe is expected to witness significant growth over the forecast period, driven by the adoption of hybrid data integration solutions, which connect applications, data files, and business partners across cloud and on-premises systems. This trend is particularly prevalent in countries like the U.K., where hybrid integration is increasingly used to meet data compliance requirements. Moreover, evolving industry-specific needs and regulatory considerations, such as data privacy regulations, contribute to the market's expansion. As European businesses continue to invest in digital transformation initiatives, the demand for data integration solutions to optimize data usage and improve business agility is likely to increase.

Asia Pacific Data Integration Market Trends

The data integration industry in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period. The leading players in the APAC data integration market are focusing on growing their product portfolios, rising investments, and strategic partnerships to create easy and robust functionality. Several initiatives were implemented, and it is anticipated that the industry will expand as e-commerce trade in the region continues to rise.

Key Data Integration Company Insights

Some key companies in the data integration industry Informatica Inc., International Business Machines Corporation, Oracle, and Talend

-

Informatica specializes in enterprise cloud data management and data integration, offering a comprehensive platform known as the Intelligent Data Management Cloud (IDMC). This platform supports various data integration patterns, including ETL and ELT, and is designed to manage data across cloud and hybrid environments. Informatica's solutions focus on ensuring data quality, governance, and security, making it a key player in helping organizations optimize their data management strategies.

-

IBM is a global technology company that provides a wide range of data integration solutions, including IBM DataStage, which is a leading ETL tool. IBM's data integration offerings are designed to help businesses connect, transform, and deliver data across various systems and environments. IBM's solutions support complex data integration tasks, enabling organizations to leverage their data assets effectively and make informed decisions. IBM's data integration tools are part of a broader suite of data management solutions that cater to diverse industry needs.

Key Data Integration Companies:

The following are the leading companies in the data integration market. These companies collectively hold the largest market share and dictate industry trends.

- Informatica Inc.

- International Business Machines Corporation

- Microsoft

- SAP

- Oracle

- Talend

- SAS Institute Inc.

- TIBCO Software Inc.

- Denodo Technologies

- QlikTech International AB

Recent Developments

-

In April 2025, archTIS Limited achieved a notable milestone by securing its first contract in Japan for the Trusted Data Integration (TDI) platform. This contract, valued at approximately USD 244,000 annually, involves a trial by a Japanese multinational corporation to enhance secure data services, particularly in highly regulated sectors such as the Japanese Ministry of Defence. The TDI platform integrates attribute-based access control with orchestration capabilities, offering a scalable solution for data integration, governance, and security.

-

In March 2025, Precisely introduced the Data Link program, a pioneering initiative designed to streamline the integration of its data portfolio with datasets from trusted partners through pre-linked connections. This innovative approach addresses the long-standing challenges organizations face when merging disparate third-party datasets, which typically involve navigating complex integrations and coordinating multiple vendors. By leveraging unique identifier systems, Data Link simplifies dataset integration, enhances cost efficiency, and accelerates the time-to-value for businesses, enabling them to achieve faster results in critical use cases.

-

In January 2025, ServiceNow announced a strategic integration with Oracle to enhance its Workflow Data Fabric capabilities. This collaboration enables real-time, bi-directional data exchange and zero-copy data sharing between Oracle's data sources, including the Autonomous Database and Database 23ai, and the ServiceNow platform. The integration aims to facilitate intelligent decision-making and operational efficiency for enterprises by connecting various data types, including transactional, analytical, and unstructured data, across the organization.

Data Integration Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.10 billion

Revenue forecast in 2030

USD 30.27 billion

Growth rate

CAGR of 12.1% from 2025 to 2030

Historical data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization size, business application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil,

Key companies profiled

Informatica Inc.; International Business Machines Corporation; Microsoft; SAP; Oracle; Talend; SAS Institute Inc.; TIBCO Software Inc.; Denodo Technologies; QlikTech International AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Integration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global security and vulnerability market report based on the component, deployment, organization size, business application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Tools

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Business Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Marketing

-

Sales

-

Operations & Supply Chain

-

Finance

-

HR

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

IT & Telecom

-

BFSI

-

Healthcare

-

Manufacturing

-

Retail & E-commerce

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global data integration market size was estimated at USD 15.19 billion in 2024 and is expected to reach USD 17.10 billion in 2025.

b. The global data integration market is expected to grow at a compound annual growth rate of 12.1% from 2025 to 2030 to reach USD 30.27 billion by 2030.

b. North America dominated the data integration market with a share of 36% in 2024. This is attributable to the increased adoption of digital strategies, and the region is moving towards upgraded and innovative technologies.

b. Some key players operating in the data integration market include Informatica Inc., International Business Machines Corporation, Microsoft, SAP, Oracle, Talend, SAS Institute Inc., TIBCO Software Inc., Denodo Technologies, QlikTech International AB.

b. Key factors that are driving the data integration market growth include increasing demand for data integration tools and software and technology advancements in cloud computing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.