Data Historian Market Size, Share & Trend Analysis Report By Type (Software, Services), By Deployment (Cloud, On-premises), By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-364-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Data Historian Market Size & Trends

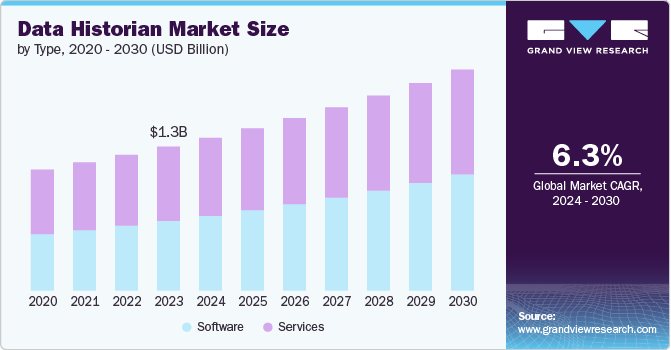

The global data historian market size was estimated at USD 1.32 billion in 2023 and is estimated to grow at a CAGR of 6.3% from 2024 to 2030. The increasing amount of data generated by various sources, such as IoT devices, cloud applications, and social media, is driving demand for data historians. Many industries are subject to regulations and compliance requirements that require storing historical data. Data historians provide a way to meet these requirements while enabling organizations to extract insights from the data. This is particularly important in the industries such as financial services. Thus, demand from such sectors is contributing to the market.

The expansion of data centers supports the growth of data historians by providing the essential infrastructure for storing, processing, and analyzing vast amounts of data. Additionally, data centers often offer advanced processing capabilities, such as high-performance computing and data analytics tools, which help organizations derive valuable insights and trends from their data. With the emergence of Industry 4.0, along with smart plants and factories, there is a global shift towards utilizing large volumes of data across various process layers. This shift is driving the demand for data historian solutions to ensure effective management, stable and efficient plant operations, and robust analysis. However, data historian market growth is hindered by increasing data capabilities and complexities, high deployment costs, and limited development.

Type Insights

The services segment led the market and accounted for 51.6% of the global revenue in 2023. Data historian is a specialized software service designed to efficiently collect, store, and retrieve vast amounts of time-series data from industrial equipment and processes. Primarily used in sectors like manufacturing, energy, and utilities, a data historian captures real-time data from sensors, control systems, and other data-generating sources. This service ensures high-speed data acquisition and is optimized for handling the large volume of data typical in industrial environments. It enables organizations to perform trend analysis, monitor equipment performance, and ensure regulatory compliance through accurate record-keeping. Additionally, modern data historians often integrate with advanced analytics and IoT platforms, facilitating predictive maintenance and operational optimization. This enhances decision-making processes by providing actionable insights derived from historical and real-time data, ultimately leading to improved efficiency, reduced downtime, and cost savings.

The software segment is estimated to grow significantly over the forecast period. Software in a data historian system is engineered to handle the intricate demands of time-series data management in industrial settings. It comprises modules for data collection, storage, and retrieval, optimized for high-frequency data input from various sensors and control systems. This software ensures data integrity and accuracy, even under conditions of network instability, through robust buffering and redundancy mechanisms. It features powerful compression algorithms to efficiently store massive datasets while maintaining quick access for analysis and reporting. Integration capabilities are a hallmark, allowing seamless connectivity with enterprise systems, SCADA, IoT platforms, and advanced analytics tools. User-friendly interfaces provide operators and engineers with real-time dashboards, historical trends, and alarm management, facilitating proactive maintenance and operational excellence.

Deployment Insights

The cloud segment accounted for the largest share of the global revenue in 2023. The rise of cloud development has resulted in scalable and flexible cloud infrastructure capable of managing vast amounts of data, making it perfect for data historians. Additionally, cloud development has facilitated the integration of data historians with other cloud-based tools and services, such as data analysis and visualization, driving demand for data historians. The adoption of cloud services for storing and managing consumer data has also surged due to the expansion of cloud deployment. In the BFSI industry, services such as payment gateways, online fund transfers, digital wallets, and unified customer experiences are significantly contributing to the overall transition to cloud deployment.

The On-premises segment is estimated to grow significantly over the forecast period. On-premises deployment for data historians offers organizations significant control and security benefits. By keeping data within their own infrastructure, companies maintain full ownership and can better protect sensitive information from external threats. This approach is particularly advantageous for industries with strict compliance requirements or those dealing with proprietary data. On-premises historians often provide enhanced performance and reliability for local operations, which is crucial for real-time monitoring and alarming systems. They can also be more easily integrated with existing industrial control systems and may offer a lower total cost of ownership compared to cloud-based alternatives

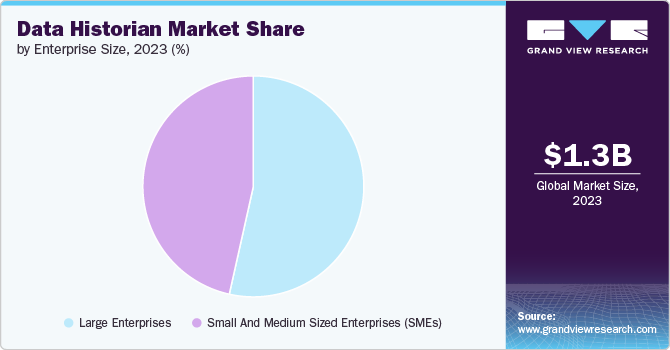

Enterprise Size Insights

The large enterprises segment dominated the market accounting for the highest revenue share in 2023. Large enterprises in the market benefit from centralized data management systems that store and organize historical data from various industrial sources. These systems, often cloud-based, offer scalable, cost-effective, and secure solutions for handling large volumes of historical and real-time data. By leveraging cloud technology, enterprises can perform trend analysis, identify patterns, and uncover insights to optimize processes, improve product quality, and enhance operational efficiency. Real-time monitoring and analytics capabilities allow for proactive decision-making and reduced downtime. Additionally, cloud-based data historians can detect anomalies or deviations from normal operational patterns, enabling early detection of potential equipment failures or process inefficiencies. The scalability of these systems eliminates the need for significant upfront capital investments in hardware, reducing costs and allowing for efficient resource allocation.

The Small and Medium Sized Enterprises (SMEs) segment is projected to grow significantly over the forecast period. Small and medium-sized enterprises (SMEs) can significantly benefit from implementing data historians, especially with the advent of open technology and the Automation Revolution, which have made these systems more affordable. Data historians allow SMEs to collect, store, and analyze vast amounts of historical and real-time data from various industrial processes, providing insights that were previously only accessible to large corporations. These systems enhance operational efficiency by enabling trend analysis, pinpointing energy consumption, and identifying areas for cost reduction and yield improvement.

End-use Insights

The oil & gas segment accounted for the largest market revenue share in 2023. Data historians play a crucial role in the oil and gas industry, providing a comprehensive solution for capturing, storing, and analyzing vast amounts of operational data from exploration to production and distribution. These systems enable real-time monitoring of critical parameters such as well pressure, flow rates, and equipment performance, allowing for optimized production and early detection of potential issues. In the upstream sector, historians help in reservoir management and production optimization, while in midstream and downstream operations, they assist in monitoring pipeline integrity, refinery processes, and supply chain logistics. By leveraging advanced analytics and machine learning algorithms on historical data, oil and gas companies can predict equipment failures, optimize maintenance schedules, and improve overall operational efficiency.

The power & utility segment is predicted to foresee significant growth in the forecast period. Data historians play a crucial role in the Power & Utility sector, offering significant benefits for operational efficiency and decision-making. In this industry, which is valued at billions of dollars, there is a constant need for process optimization. Data historians enable the collection and analysis of vast amounts of data generated by modern technology, providing valuable insights to enhance process and asset performance monitoring, ultimately boosting revenue. Data historians assist in monitoring energy consumption, identifying inefficiencies, and enabling cost savings. They can also track equipment status in real-time, predict potential outages, and facilitate rapid response to issues. These capabilities are particularly valuable in an industry where even minor equipment malfunctions can result in significant financial losses.

Regional Insights

North America accounted for a 31.7% share in 2023. North America is projected to hold the largest market share due to significant investments in research and development driving innovation in the market. The region is home to major industry vendors who are continuously investing in this sector. The demand for data historians is steadily growing, driven by a rising need for industrial automation data to enhance performance, the increasing use of Big Data analytics across various economic sectors, and the expanding IoT infrastructure that generates vast amounts of data for collection and analysis, along with other technological trends.

U.S. Data Historian Market Trends

The U.S. is a significant market within the global data historian industry, accounting for a substantial portion of the market share. The U.S. market benefits from the presence of major industry players and a strong focus on technological advancements in sectors such as oil and gas, manufacturing, and utilities. The adoption of data historian solutions in the U.S. is driven by the need for improved operational efficiency, regulatory compliance, and the increasing importance of data-driven decision-making in various industries.

Europe Data Historian Market Trends

The adoption of data historian solutions in Europe is particularly strong in sectors such as manufacturing, energy, and utilities, where there is a growing emphasis on process optimization and regulatory compliance. Furthermore, European companies are increasingly leveraging data historian technologies to improve operational efficiency, reduce downtime, and enhance decision-making processes

Asia Pacific Data Historian Market Trends

The region is experiencing rapid digitalization, particularly in countries like Australia, New Zealand, China, Japan, and Singapore, resulting in the production of large volumes of unstructured data. This has created a substantial demand for enterprise data management solutions, including data historians. The adoption of data historian technologies in Asia Pacific is being fueled by the region's strong focus on technological advancements, the implementation of Industry 4.0 initiatives, and the growing emphasis on data-driven decision-making across various industries.

Key Data Historian Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, partnerships, and collaborations contracts, agreements, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in May 2023, TrendMiner, a Software AG company, and Siemens AG announced a strategic partnership designed to assist industrial companies in achieving their digitalization goals while maintaining a competitive edge. This collaboration with Siemens promises significant value for industrial customers seeking a turnkey solution to transform into data-driven organizations.

Similarly in October 2022, Uptake Technologies Inc. partnered with the ADX team to develop an industrial data historian using Azure Data Explorer (ADX). Following Microsoft's decision to cease development of Time Series Insights (TSI), Uptake has been transitioning its flagship OT cloud data historian, Fusion, to the ADX platform.

Key Data Historian Companies:

The following are the leading companies in the data historian market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Emerson Electric Co.

- Siemens

- AVEVA (Schneider Electric)

- Honeywell International Inc.

- Rockwell Automation

- IBM

- Yokogawa Electric Corporation

- Inductive Automation, LLC.

- InfluxData Inc.

- SORBA.ai

Recent Developments

-

In June 2024, Honeywell unveiled Honeywell Batch Historian, a digital software solution that offers manufacturers contextualized data history for reporting and analytics, enhancing operational efficiency and cost-effectiveness. This move towards digitalizing manufacturing operations aligns with Honeywell’s emphasis on the automation megatrend.

-

In October 2023, IBM introduced the IBM Storage Scale System, a cutting-edge global data platform tailored for handling data-intensive tasks and AI workloads. This new system expands IBM Storage's offerings in the Data and AI sector.

Data Historian Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.40 billion |

|

Revenue forecast in 2030 |

USD 2.02 billion |

|

Growth rate |

CAGR of 6.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, deployment, enterprise size, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

ABB; Emerson Electric Co.; Siemens; AVEVA (Schneider Electric); Honeywell International Inc.; Rockwell Automation; IBM; Yokogawa Electric Corporation; Inductive Automation; LLC.; InfluxData Inc.; SORBA.ai |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Historian Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data historian market report based on type, deployment, enterprise size, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small And Medium Sized Enterprises (SMEs)

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Marine

-

Chemicals And Petrochemicals

-

Metal and Mining

-

Power & Utility

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data historian market size was estimated at USD 1.32 billion in 2023 and is expected to reach USD 1.40 billion in 2024.

b. The global data historian market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 2.02 billion by 2030.

b. North America dominated the data historian market with a share of 31.7% in 2023. North America is projected to hold the largest market share due to significant investments in research and development driving innovation in the data historian market.

b. Some key players operating in the data historian market include ABB; Emerson Electric Co.; Siemens; AVEVA (Schneider Electric); Honeywell International Inc.; Rockwell Automation; IBM; Yokogawa Electric Corporation; Inductive Automation, LLC.; InfluxData Inc.; SORBA.ai

b. Key factors that are driving the market growth include the expansion of data centers supports the growth of data historians by providing the essential infrastructure for storing, processing, and analyzing vast amounts of data.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."