Data Exfiltration Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Type, By End-use (BFSI, Healthcare), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-353-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Data Exfiltration Market Size & Share

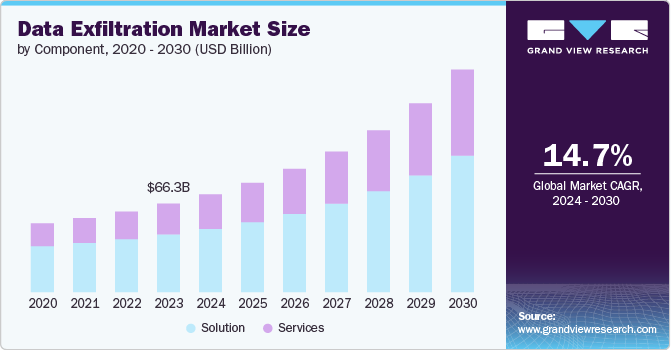

The global data exfiltration market size was valued at USD 66.29 billion in 2023 and is estimated grow at a CAGR of 14.7% from 2024 to 2030. The market is being driven by several key factors that have emerged in recent years. The increasing frequency and sophistication of cybersecurity threats have compelled organizations to bolster their defenses against data breaches. Simultaneously, the growing value of data assets has made them prime targets for cybercriminals, further fueling the need for robust protection measures.

The widespread adoption of remote work models and cloud services has expanded the attack surface, creating new vulnerabilities that malicious actors can exploit. Additionally, the evolving regulatory landscape, with stricter data protection laws and severe penalties for non-compliance, has pushed companies to invest heavily in data security and exfiltration prevention tools.

Several trends are shaping the data exfiltration landscape, reflecting the ongoing battle between attackers and defenders. Artificial intelligence and machine learning are being leveraged by both sides: attackers use these technologies to develop more sophisticated exfiltration methods, while defenders employ them to detect and prevent such attempts. There's an increasing focus on insider threats, leading to a greater emphasis on user behavior analytics and privileged access management. Encrypted data exfiltration is on the rise, with attackers using encryption to hide stolen data within seemingly innocent traffic, prompting the development of more advanced traffic analysis tools. Social engineering tactics have also become more refined, with cybercriminals manipulating employees through advanced phishing attacks and business email compromise schemes.

The adoption of Zero Trust Architecture is gaining momentum as organizations move away from traditional perimeter-based security models. This approach, which assumes no user or system is trustworthy by default, helps prevent data exfiltration by requiring continuous authentication and authorization for all data access. The proliferation of Internet of Things (IoT) devices has created new vectors for data exfiltration, with attackers exploiting vulnerabilities in these often less-secure devices. Ransomware attacks are increasingly being combined with data exfiltration, allowing attackers to threaten victims with data exposure if ransom demands are not met. Lastly, supply chain attacks have become more prevalent, with cybercriminals targeting vulnerabilities in the supply chain to gain access to multiple organizations' data, emphasizing the critical importance of third-party risk management and secure software supply chains in preventing data exfiltration.

Component Insights

The solution segment dominated the market accounting for 65.3% of the revenue share in 2023. This indicates a strong preference for software and technological tools designed to prevent, detect, and respond to data exfiltration attempts. Further, the dominance can also be attributed to the growing demand for comprehensive data protection tools, advanced threat detection systems, and robust data loss prevention software. Organizations are increasingly recognizing the critical importance of implementing cutting-edge technological solutions to safeguard their sensitive information against sophisticated cyber threats and potential insider risks.

The services segment is poised for remarkable growth, projected to expand at the highest CAGR from 2024 to 2030. This surge in the services sector reflects the increasing complexity of data security landscapes and the growing need for specialized expertise. As organizations grapple with evolving threats, stringent regulatory requirements, and the challenges of securing distributed work environments, they are turning to managed security services, consulting, and training programs to enhance their data exfiltration and protection strategies. The rapid growth in this segment underscores the shift towards holistic, service-oriented approaches to data security, combining technological solutions with human expertise to create more resilient and adaptive security postures.

Type Insights

The active data exfiltration segment emerged as the commanding force in 2023, holding a substantial revenue share of the market. The leading share reflects the growing prevalence and sophistication of proactive data theft techniques. Active exfiltration methods, which involve deliberate actions to extract data from target systems, have gained traction due to their effectiveness in bypassing traditional security measures. This segment's prominence is driven by the increasing use of advanced persistent threats (APTs), social engineering tactics, and malware-driven exfiltration attempts. Organizations are increasingly investing in solutions that can detect and prevent these active exfiltration attempts, contributing to the increased market demand.

The rapid advancement of active exfiltration techniques, including AI-powered attacks and sophisticated phishing schemes, is driving organizations to continuously update and enhance their defense mechanisms. This trend is expected to fuel further innovation in active threat detection and prevention technologies, including real-time monitoring systems, behavioral analytics, and adaptive security architectures. Meanwhile, the passive data exfiltration segment also remains a critical area of concern. It focuses on unauthorized data access through covert means, often exploiting existing vulnerabilities or misconfigurations. With the evolving nature of cyber threats and the persistent challenge they pose to data security, passive exfiltration prevention continues to be an essential component of comprehensive data security strategies.

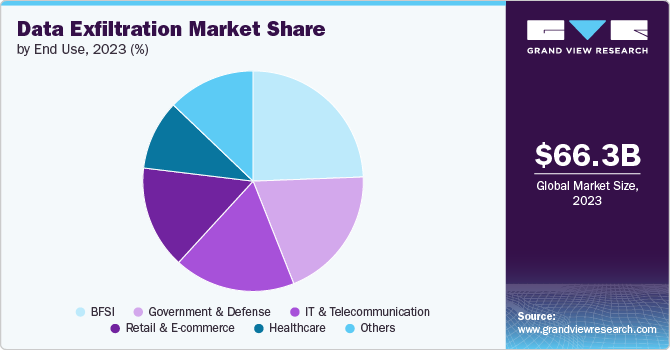

End-use Insights

The BFSI segment led the market, capturing a substantial revenue share in 2023. The leading share is credited to the critical nature of data protection in the financial sector, where the potential risks are exceptionally high due to the sensitive nature of financial information and the strict regulatory environment. Banks, insurance companies, and other financial institutions have been at the forefront of adopting advanced data exfiltration prevention solutions to safeguard against cyber threats, protect customer data, and maintain compliance with stringent financial regulations such as GDPR, PSD2, and various national banking standards.

The Healthcare segment is projected to expand at the highest CAGR from 2024 to 2030. This rapid growth in the healthcare sector can be attributed to various factors. The increasing digitization of health records, the growing adoption of telemedicine and connected medical devices, and the high value of personal health information on the black market have made healthcare organizations prime targets for data exfiltration attempts. Additionally, stringent data protection regulations specific to healthcare, such as HIPAA in the United States, are driving increased investment in robust data security solutions. The COVID-19 pandemic has further accelerated this trend, highlighting the critical importance of securing health data in an increasingly digital healthcare landscape. As a result, healthcare providers, pharmaceutical companies, and medical technology firms are rapidly adopting advanced data exfiltration prevention tools, driving the segment's rapid growth and positioning it as a key focus area in the data security market for the coming years.

Regional Insights

North America accounted for the leading share in the market capturing a 35.4% share of global revenue in 2023. The North American market is characterized by its technological leadership and early adoption of advanced security solutions. The region is home to many leading cybersecurity firms and is often at the forefront of developing cutting-edge data protection technologies. Stringent data protection regulations are driving increased investment in data security across industries. The region is seeing a significant shift towards cloud-based security solutions and AI-powered threat detection systems. The healthcare and financial sectors are particularly active in adopting robust data exfiltration prevention measures.

U.S. Data Exfiltration Market Trends

As the largest market within North America, the U.S. data exfiltration market accounted for a 14.52 billion in 2023. The country is experiencing a surge in demand for comprehensive cybersecurity solutions, driven by high-profile data breaches and increasing regulatory pressures. There's a notable trend toward the adoption of Zero Trust architectures and advanced endpoint detection and response (EDR) solutions. The U.S. market is also seeing increased integration of AI and ML in security tools to combat sophisticated cyber threats. Government initiatives, such as the Cybersecurity Maturity Model Certification (CMMC) for defense contractors, are further propelling the market growth.

Europe Data Exfiltration Market Trends

The data exfiltration market in Europe is heavily influenced by the General Data Protection Regulation (GDPR) and other stringent data protection laws. This regulatory environment has led to increased investment in data loss prevention technologies and privacy-enhancing tools. There's a strong focus on data sovereignty and localization, driving demand for region-specific cloud security solutions. There's also a growing trend towards open-source security solutions and collaborative cybersecurity initiatives across EU member states. The financial services and manufacturing sectors are particularly active in adopting advanced data exfiltration prevention measures.

Asia Pacific Data Exfiltration Market Trends

The Asia Pacific region is experiencing rapid growth in the data exfiltration market, driven by increasing digitalization, expanding cloud adoption, and growing awareness of cybersecurity threats. Countries like Japan, South Korea, and Singapore are leading in the adoption of advanced security technologies while emerging economies are rapidly catching up. There's a significant focus on securing digital payment systems and e-commerce platforms, reflecting the region's booming digital economy. The Asia Pacific market is seeing increased demand for mobile security solutions, given the high smartphone penetration rates. There's also a growing trend towards developing indigenous cybersecurity solutions to address region-specific threats and comply with data localization requirements.

Key Data Exfiltration Company Insights

The competitive landscape of the market is characterized by a mix of established players, tech giants, and innovative startups. The market is seeing a trend towards consolidation, with larger companies acquiring smaller, innovative firms to expand their capabilities and market share. There's also a growing presence of AI-focused cybersecurity companies that are leveraging machine learning to detect and prevent sophisticated exfiltration attempts. The competitive dynamics are further influenced by regional players who cater to local regulatory requirements and specific market needs.

Key Data Exfiltration Companies:

The following are the leading companies in the data exfiltration market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom Inc.

- Crowdstrike Holdings, Inc.

- McAfee, LLC

- Cisco Systems Inc.

- Trend Micro Inc.

- GTB Technologies

- Palo Alto Networks,

- Fortinet Inc.

- Zscaler Inc.

- Check Point Software Technologies

- Juniper Networks

- Forcepoint

Recent Developments

-

In May 2024, Palo Alto Networks and IBM Corporation announced a strategic partnership aimed at delivering AI-powered security solutions to their customers. The partnership's core objective is to provide a comprehensive, AI-driven approach to cybersecurity, enabling organizations to more effectively combat evolving threats, including data exfiltration attempts, at scale.

-

In May 2024, Palo Alto Networks unveiled a comprehensive suite of security solutions designed to combat AI-generated threats and safeguard AI-by-design systems. At the core of these new offerings is the company's proprietary Precision AI technology, which integrates advanced machine learning and deep learning capabilities with the flexibility of generative AI. This approach enables real-time, AI-driven security measures that can anticipate and outmaneuver cyber adversaries.

-

In April 2024, Cisco completed the acquisition of Isovalent, an open source cloud native networking and security solutions provider. This strategic move positions Isovalent's innovative technologies as a key component of Cisco's Security Cloud vision. The Cisco Security Cloud is conceived as an AI-powered, cloud-delivered security platform that aims to provide comprehensive protection against threats in multi cloud environments. It offers advanced security measures that leverage artificial intelligence to defend against evolving cyber threats.

-

In March 2024, CrowdStrike and HCLTech announced a strategic partnership aimed at enhancing cybersecurity offerings. This collaboration integrates CrowdStrike's advanced AI-powered Falcon XDR platform into HCLTech's managed detection and response (MDR) solutions. The partnership allows HCLTech to offer the full capabilities of the Falcon platform to its clients, providing comprehensive cybersecurity coverage across multiple domains including devices, identity management, cloud environments, and data protection as well as next-generation SIEM.

Data Exfiltration Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 73.35 billion |

|

Revenue forecast in 2030 |

USD 166.84 billion |

|

Growth rate |

CAGR of 14.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Broadcom Inc; Crowdstrike Holdings, Inc.; McAfee, LLC; Cisco Systems Inc.; Trend Micro Inc.; GTB Technologies; Palo Alto Networks; Fortinet Inc.; Zscaler Inc.; Check Point Software Technologies; Juniper Networks, Forcepoint |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Exfiltration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data exfiltration market report based on component, type, end use, and region.

-

By Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

By Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Active Data Exfiltration

-

Passive Data Exfiltration

-

-

By End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government & Defense

-

Retail & Ecommerce

-

IT & Telecommunication

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data exfiltration market size was estimated at USD 66.29 billion in 2023 and is expected to reach USD 73.35 billion in 2024.

b. The global data exfiltration market is expected to grow at a compound annual growth rate of 14.7% from 2024 to 2030 to reach USD 166.84 billion by 2030.

b. North America dominated the data exfiltration market with a share of 35.4% in 2023. This is attributable to the region's technological leadership and early adoption of advanced security solutions coupled with a significant shift towards cloud-based security solutions and AI-powered threat detection systems

b. Some key players operating in the data exfiltration market include Broadcom Inc, Crowdstrike Holdings, Inc.; McAfee, LLC; Cisco Systems Inc.; Trend Micro Inc.; GTB Technologies; Palo Alto Networks; Fortinet Inc.; Zscaler Inc.; Check Point Software Technologies; Juniper Networks, Forcepoint

b. Key factors that are driving the market growth include increasing cybersecurity threats, growing value of data assets, rise in remote work and cloud adoption, and evolving regulatory landscape

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."