Data Center Support Infrastructure Market Size, Share & Trends Analysis Report By Infrastructure (Power Distribution Systems, Cooling Systems), By Enterprise Size, By Tier Level (Tier 1, Tier 2), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-496-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

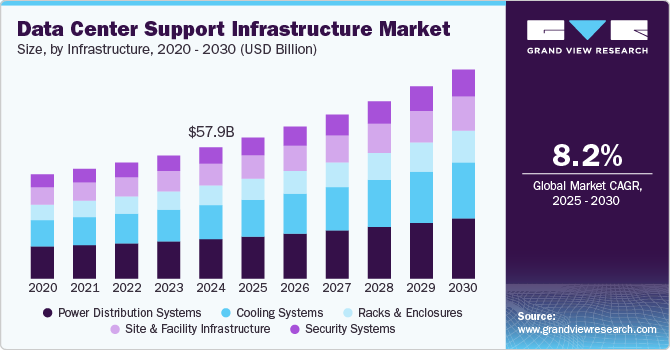

The global data center support infrastructure market size was valued at USD 57.94 billion in 2024 and is anticipated to grow at a CAGR of 8.2% from 2025 to 2030. The industry encompasses critical components such as power systems (UPS, generators), cooling systems, racks, monitoring systems, and Racks and Enclosures solutions. These elements ensure the operational reliability, efficiency, and Racks and Enclosures of data centers.

The rapid adoption of cloud services, big data analytics, internet of things (IoT), and AI-driven Tier Levels is transforming the technology landscape. Organizations across industries are migrating their workloads to the cloud, leveraging its scalability, cost efficiency, and flexibility. This surge in demand for cloud computing fuels the need for robust data centers capable of handling massive volumes of data and ensuring uninterrupted services. To support these operations, data centers require advanced support infrastructure, including efficient cooling systems to manage heat from high-density servers, reliable power backup systems to prevent downtime, and intelligent management solutions for optimal performance and energy utilization. This trend drives continuous innovation and investment in Tier 3, enabling businesses to meet growing digital demands and ensure seamless operations in an increasingly data-driven world.

Hyperscale data centers cater to large-scale cloud operations, offering extensive Power Distribution Systems and computational capabilities, while edge data centers provide localized, low-latency services for real-time Tier Levels like IoT and 5G. The rise of these facilities has created a need for scalable and modular infrastructure to accommodate rapid growth and evolving technology demands. Hyperscale data centers require optimized cooling and power systems to manage high-density workloads, ensuring efficiency and reliability. Edge data centers, on the other hand, emphasize compact and flexible solutions to support deployment in remote or distributed locations. Together, these developments are transforming the data center landscape, driving innovation in infrastructure to meet the diverse and growing demands of modern digital ecosystems.

The integration of artificial intelligence (AI) and machine learning in monitoring and management systems is expected to revolutionize operational efficiency and predictive maintenance capabilities. Liquid cooling solutions, driven by increasing server densities and energy efficiency requirements, are anticipated to gain substantial traction. The shift toward renewable energy sources and the adoption of battery energy Power Distribution Systems highlights the market's focus on sustainability. The growing demand for edge data centers, coupled with the rise of Industry 4.0 Tier Levels, presents new growth opportunities. Furthermore, the adoption of modular data centers and flexible infrastructure solutions will enable faster deployment and scalability. Emerging markets, particularly in Asia Pacific and MEA, are likely to play a pivotal role in market expansion, supported by digital transformation initiatives and economic development.

Despite strong growth prospects, the market faces notable restraints. High initial capital expenditures for deploying advanced support infrastructure pose challenges, particularly for small and medium-sized enterprises (SMEs). Additionally, the complex integration of modern solutions such as AI-driven monitoring systems and liquid cooling technologies with existing infrastructure can deter adoption. Rising energy costs and ongoing operational expenses for managing power and cooling systems are also significant concerns for operators aiming to maintain profitability.

Infrastructure Insights

The power distribution systems segment dominated the market in 2024 and accounted for a market share of over 29%. The increasing power demand from high-density servers is driven by the growth of data-intensive Tier Levels such as AI, machine learning, and big data analytics. These Tier Levels require significant computational resources, which in turn lead to higher power consumption. As servers become more powerful and data centers become more densely packed to accommodate these workloads, the need for efficient power distribution systems becomes critical. These systems must be capable of managing increased electrical loads, ensuring that each server and component receives a stable power supply. Efficient power distribution systems help optimize energy usage, reduce waste, and ensure reliable performance, making them essential for modern data centers.

The cooling systems segment is expected to grow at a significant rate during the forecast period. Data centers are prioritizing energy-efficient cooling systems to reduce costs and meet sustainability goals due to rising energy prices and environmental concerns. Solutions like free cooling, economizers, and energy-efficient units help minimize energy consumption and lower the carbon footprint. These technologies optimize cooling performance, reduce operational costs, and support green initiatives, making them essential in addressing the growing demand for both efficiency and environmental responsibility in data center operations.

Tier Level Insights

The Tier 3 segment accounted for a market share of over 59% in 2024. Tier 3 data centers offer a balance between cost-efficiency and reliability, providing uptime with minimal downtime, making them ideal for organizations needing dependable operations without the high costs of Tier 4 facilities. Their design supports critical but not ultra-critical workloads, appealing to a wide range of businesses. Additionally, the rising number of mid-sized enterprises and regional cloud service providers drives demand for Tier 3 facilities. These organizations value the scalability, flexibility, and reliability that Tier 3 infrastructure provides, enabling them to efficiently manage their growing IT needs while maintaining operational stability. This combination of attributes makes Tier 3 data centers a popular choice in diverse markets.

The Tier 4 segment is anticipated to grow at a significant CAGR of 8.9% during the forecast period. The rise in hyperscale data centers, fueled by global cloud providers and enterprises, is driving demand for Tier 4 infrastructure. These facilities prioritize robust support systems to ensure redundancy, fault tolerance, and maximum operational efficiency. Tier 4 data centers meet the stringent reliability and performance standards required for hyperscale operations, enabling seamless management of massive data volumes, and ensuring uninterrupted services for critical Tier Levels across industries.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of over 82% in 2024. As large enterprises expand their IT infrastructures to handle growing data processing and power distribution system’s needs, the demand for more powerful and reliable data centers increases. This expansion drives the need for advanced support infrastructure, including efficient power distribution, cooling systems, and high-performance networking solutions. Furthermore, many enterprises are embracing hybrid and multi-cloud strategies, combining on-premises data centers with cloud-based services. This shift requires robust and scalable support infrastructure that can seamlessly integrate with both local and cloud environments, handling diverse workloads effectively. The combination of growing IT infrastructure demand and the adoption of hybrid cloud models propels the need for adaptable and resilient data center support systems.

The small & medium-sized enterprises segment is expected to grow at the fastest CAGR during the forecast period. SMEs are rapidly adopting cloud-based services to improve efficiency, reduce costs, and scale operations. As they migrate to the cloud, there is a rising need for reliable data center support infrastructure to ensure seamless integration and ongoing support. This infrastructure, including power distribution, cooling, and network solutions, is crucial for managing the growing digital requirements of SMEs, ensuring they can operate efficiently while scaling their cloud environments.

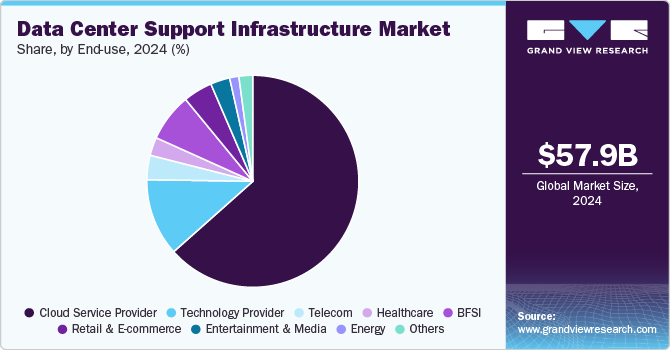

End Use Insights

The cloud service provider segment accounted for the largest market share of over 63% in 2024. Cloud service providers are expanding their global reach to tap into new markets and support a growing customer base. This expansion necessitates the establishment of new data centers in various regions, each equipped with robust support infrastructure to ensure scalability and deliver localized services. Additionally, the rise in demand for Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS) offerings is driving the need for cloud providers to maintain large-scale, high-performance data centers. These services require scalable, high-capacity infrastructure capable of managing vast amounts of customer data and complex workloads, pushing cloud service providers to invest in advanced, efficient data center support systems to meet these growing demands.

The technology provider segment is expected to grow at the fastest CAGR during the forecast period. As businesses and cloud service providers expand their data centers, the demand for advanced infrastructure solutions in power distribution, cooling, networking, and Racks and Enclosures systems rises. Technology providers are well-positioned to meet these needs by delivering innovative and reliable solutions that improve the performance and efficiency of data center operations. Their offerings help optimize resource usage, reduce costs, and ensure the high availability and Racks and Enclosures, supporting the growth of modern data centers.

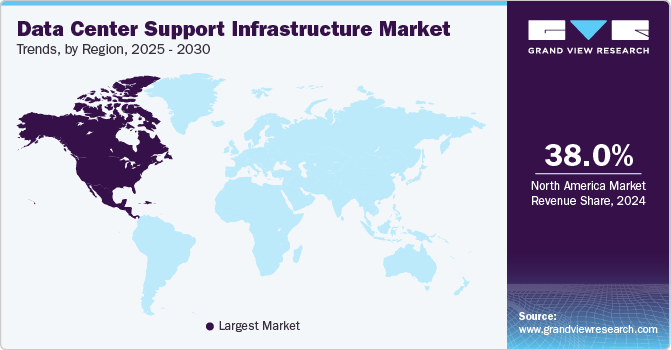

Regional Insights

North America data center support infrastructure industry held the major share of over 38% in 2024. The increasing digitalization of industries such as healthcare, finance, retail, and manufacturing is pushing the need for robust Tier 3. Organizations are adopting cloud-based services and enterprise resource planning (ERP) systems, creating demand for highly efficient data center support infrastructure to handle increased workloads, ensuring business continuity, and meeting Racks and Enclosures requirements. North American companies, particularly in the tech sector, are focusing on sustainability by adopting energy-efficient data center solutions. There is a rising demand for green data center solutions, such as advanced cooling technologies, renewable energy integrations, and energy-efficient power distribution systems, to help meet both regulatory requirements and environmental goals.

U.S. Data Center Support Infrastructure Market Trends

The data center support infrastructure industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. is a leader in cloud computing services, with major providers like AWS, Microsoft Azure, and Google Cloud expanding rapidly. This growth drives increased demand for data center support infrastructure, including power distribution, cooling, and Racks and Enclosures systems. As these providers scale their operations to meet growing customer needs, they require advanced infrastructure solutions to ensure efficient, reliable, and secure data center performance across regions.

Europe Data Center Support Infrastructure Market Trends

The data center support infrastructure market in Europe is expected to grow significantly at a CAGR of over 7.1% from 2025 to 2030. Europe is a global leader in sustainability efforts, with many countries setting ambitious goals to reduce carbon footprints. Data center operators in the region are adopting energy-efficient and eco-friendly solutions, such as advanced cooling systems and renewable energy sources. This focus on sustainability drives demand for energy-efficient infrastructure and green technologies within data centers.

The U.K. data center support infrastructure industry is expected to grow rapidly in the coming years. The rollout of 5G networks across the UK is a major factor boosting the demand for data center support infrastructure. As 5G requires low-latency processing and high-speed data transfer, there is an increased need for data centers that can handle these requirements. Telecommunications companies are investing in new infrastructure to support 5G, thereby driving demand for high-performance support systems.

The data center support infrastructure market in Germany held a substantial share in 2024. Germany is a leader in industrial automation and Industry 4.0, where smart factories, robotics, and data-driven manufacturing processes require robust IT infrastructures. These technologies generate vast amounts of data that need to be processed, stored, and analyzed in real time. The demand for data centers that can support these high-performance workloads, and the associated power and cooling needs is growing rapidly.

Asia Pacific Data Center Support Infrastructure Market Trends

The data center support infrastructure market in Asia Pacific is expected to grow significantly at a CAGR of over 10.1% from 2025 to 2030. The growth of e-commerce platforms and digital services in countries like China, India, Japan, and Southeast Asia is driving demand for robust data center support infrastructure. As these businesses expand their online presence and enhance their digital offerings, there is a need for data centers to manage web traffic, transaction processing, and customer data. This drives the need for advanced infrastructure solutions, including high-capacity power and cooling systems.

China data center support infrastructure industry held a substantial market share in 2024. China’s accelerated adoption of cloud computing across various industries such as finance, manufacturing, healthcare, and e-commerce is a key driver for the data center support infrastructure market. Major cloud service providers like Alibaba Cloud, Tencent Cloud, and Baidu are expanding their infrastructure to meet the growing demand for cloud-based services. This shift to cloud computing increases the need for advanced power distribution, cooling, and Racks and Enclosures systems in data centers.

The data center support infrastructure industry in Japan held a substantial share in 2024. Japan is making significant strides in AI research and the development of high-performance computing (HPC) solutions. These technologies require large-scale data processing and Power Distribution Systems capabilities, which increases the demand for specialized Tier 3. As HPC, AI, and big data analytics continue to gain prominence across industries like automotive, robotics, and healthcare, data centers equipped with high-density power distribution and advanced cooling solutions are essential to meet the growing computational needs.

India data center support infrastructure industry is growing rapidly. India is a global hub for information technology (IT) services and business process outsourcing (BPO). As demand for IT services and outsourcing continues to grow, businesses are expanding their infrastructure to support their operations. This expansion requires modern, reliable data centers that can provide scalable solutions for data Power Distribution Systems, processing, and management, further driving demand for advanced data center support infrastructure.

Key Data Center Support Infrastructure Company Insights

Key players operating in the industry include Corning, Schneider Electric, Leviton, Legrand, Eaton, ABB, Motivair, Panduit, Rittal, Chatsworth Products, APC by Schneider Electric, Raritan, Hubbell, Vertiv, and Emerson Network Power. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2025, Panduit partnered with Hyperview to offer modern Data Center Infrastructure Management (DCIM) software tools to enhance clients' capabilities in security, environment responsiveness, and operational efficiency. By integrating Hyperview’s cloud-based platform with Panduit's critical power solutions, the collaboration aims to provide comprehensive insights, optimize operations, and promote sustainability. This move ensures seamless service continuity for existing clients while leveraging the advanced capabilities of Azure-based infrastructure for scalability and privacy

-

In April 2024, Eaton partnered with Red Dot Analytics (RDA) to enhance data center operations with AI-focused solutions. This collaboration aims to improve predictive maintenance, anomaly detection, and energy optimization in data centers. By integrating RDA’s Cognitive Digital Twin technology with Eaton’s expertise in power management, the partnership seeks to boost sustainability, resilience, and efficiency in handling the growing demand for AI and high-density computing workloads.

Key Data Center Support Infrastructure Companies:

The following are the leading companies in the data center support infrastructure market. These companies collectively hold the largest market share and dictate industry trends:

- Corning

- Schneider Electric

- Leviton

- Legrand

- Eaton

- ABB

- Motivair

- Panduit

- Rittal

- Chatsworth Products

- APC by Schneider Electric

- Raritan

- Hubbell

- Vertiv

- Emerson Network Power.

Data Center Support Infrastructure Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 62.24 billion |

|

Revenue forecast in 2030 |

USD 92.22 billion |

|

Growth Rate |

CAGR of 8.2% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Infrastructure, tier level, enterprise size, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico U.K., Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, and South Africa |

|

Key companies profiled |

Corning, Schneider Electric, Leviton, Legrand, Eaton, ABB, Motivair, Panduit, Rittal, Chatsworth Products, APC by Schneider Electric, Raritan, Hubbell, Vertiv, Emerson Network Power |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center Support Infrastructure Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center support infrastructure market report based on Infrastructure, tier level, enterprise size, end use and region.

-

Infrastructure Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Distribution Systems

-

Cooling Systems

-

Racks and Enclosures

-

Site and Facility Infrastructure

-

Security Systems

-

-

Tier Level Outlook (Revenue, USD Million, 2018 - 2030)

-

Tier 1

-

Tier 2

-

Tier 3

-

Tier 4

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Sized Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud Service Provider

-

Technology Provider

-

Telecom

-

Healthcare

-

BFSI

-

Retail & E-commerce

-

Entertainment & Media

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center support infrastructure market size was estimated at USD 57.94 billion in 2024 and is expected to reach USD 62.24 billion in 2025.

b. The global data center support infrastructure market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2030 to reach USD 92.22 billion by 2030.

b. The large enterprise segment accounted for the largest market share of over 82% in 2024. As large enterprises expand their IT infrastructures to handle growing data processing and Power Distribution Systems needs, the demand for more powerful and reliable data centers increases. This expansion drives the need for advanced support infrastructure, including efficient power distribution, cooling systems, and high-performance networking solutions.

b. Key players operating in the data center support infrastructure industry include Corning, Schneider Electric, Leviton, Legrand, Eaton, ABB, Motivair, Panduit, Rittal, Chatsworth Products, APC by Schneider Electric, Raritan, Hubbell, Vertiv, and Emerson Network Power.

b. Organizations across industries are migrating their workloads to the cloud, leveraging its scalability, cost efficiency, and flexibility. This surge in demand for cloud computing fuels the need for robust data centers capable of handling massive volumes of data and ensuring uninterrupted services. To support these operations, data centers require advanced support infrastructure, including efficient cooling systems to manage heat from high-density servers, reliable power backup systems to prevent downtime, and intelligent management solutions for optimal performance and energy utilization.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."