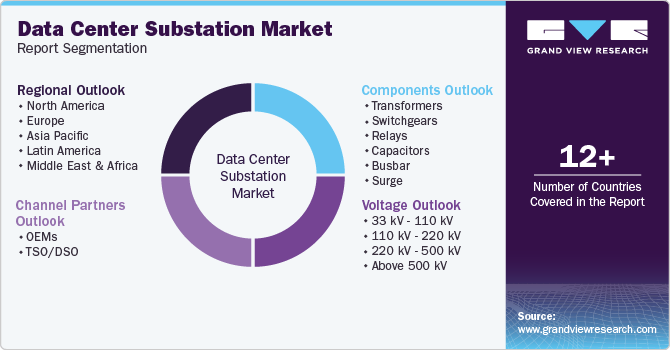

Data Center Substation Market Size, Share & Trends Analysis Report By Component, By Voltage (33kV - 110kV, 110kV - 220kV, 220 kV - 500 kV, Above 500 kV), By Channel Partners, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-632-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Data Center Substation Market Size & Trends

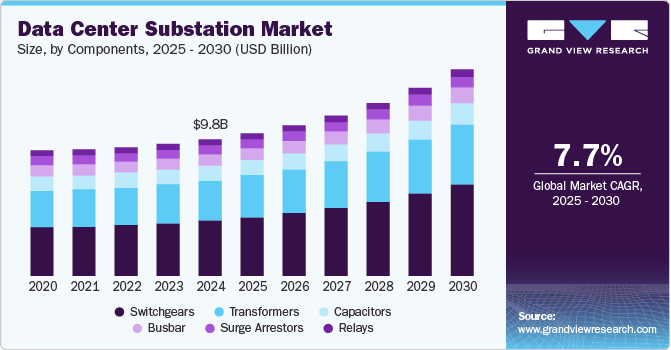

The global data center substation market size was valued at USD 9.79 billion in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030. The exponential increase in data generation and consumption is driving the market. As businesses and individuals increasingly rely on digital platforms for communication, entertainment, and commerce, the volume of structured and unstructured data continues to rise. This surge necessitates the establishment of more data centers to handle the influx of information.

With organizations transitioning to cloud-based services for their operational needs, their dependence on data centers is increasing. These facilities require robust electrical infrastructure to support their operations, making substations critical components in managing power distribution effectively. In addition, the trend toward edge computing, which involves processing data closer to its source to reduce latency and improve performance, further amplifies the need for strategically located substations that can facilitate efficient energy transmission.

Moreover, the modernization of existing electrical infrastructure plays a crucial role in market growth. Many regions are replacing outdated substations with advanced digital and modular systems that enhance operational efficiency and reliability. The integration of smart technologies into substations allows for better monitoring and management of power flows. For instance, Iberdrola, in Spain, is developing a secondary substation platform (SSP). This platform would enable the implementation of technologies such as Edge computing and virtualization in secondary substations. This initiative aims to enhance the flexibility and efficiency of distribution grids, showcasing how modernization can lead to improved operational reliability and responsiveness.

As companies strive to reduce their carbon footprints and meet regulatory requirements, there is a heightened focus on implementing energy-efficient technologies and practices. Data center operators are investing in substations that provide reliable power and incorporate advanced energy management systems, enabling better load balancing and reducing energy waste. This shift toward sustainable practices is further supported by governmental policies and incentives aimed at promoting green technologies. For instance, the European Union has set ambitious targets for carbon neutrality by 2050, which include significant investments in renewable energy infrastructure.

Components Insights

The switchgears segment dominated the market with a revenue share of 40.8% in 2024, owing to its reliable power distribution. This segment accounted for a substantial portion of the market, underscoring its importance in managing fluctuating operational voltages and maintaining safety in electrical systems. The use of both air-insulated and gas-insulated switchgear is prevalent, optimizing space and improving safety in high-density environments. For instance, Eaton Corporation has been at the forefront of developing advanced switchgear solutions tailored for data centers. Its Xiria medium-voltage switchgear is designed specifically for high-density environments, providing enhanced safety and reliability while optimizing space.

The capacitors segment is projected to grow at a significant CAGR during the forecast period, as it plays a vital role in enhancing the efficiency of power systems within data centers. Capacitors are integral for power factor correction, voltage stabilization, and improving overall system reliability. By optimizing energy consumption and reducing operational costs through effective capacitor systems, data centers can minimize energy losses and enhance system performance.

Voltage Insights

The above 500 kV segment dominated the market with the highest share in 2024, reflecting the increasing need for high capacity substations to support critical operations. High voltage substations are specifically designed to meet the power requirements of data centers, ensuring they receive a stable and quality power supply. This investment not only enhances reliability but also allows for the efficient transmission of electricity over long distances, which is crucial given the scale at which these facilities operate. As data centers continue to expand globally, the demand for such high capacity infrastructure will only grow.

The 220 kV - 500 kV segment is expected to grow at a significant CAGR over the forecast period. This voltage range is essential for efficiently stepping down high transmission voltages to levels suitable for distribution within data centers, ensuring a stable and reliable power supply. As data centers expand to accommodate the growing demand for digital services and cloud computing, having robust infrastructure capable of handling significant power loads becomes critical. This segment facilitates optimal power transmission and distribution, which is vital for maintaining the operational continuity of mission critical facilities.

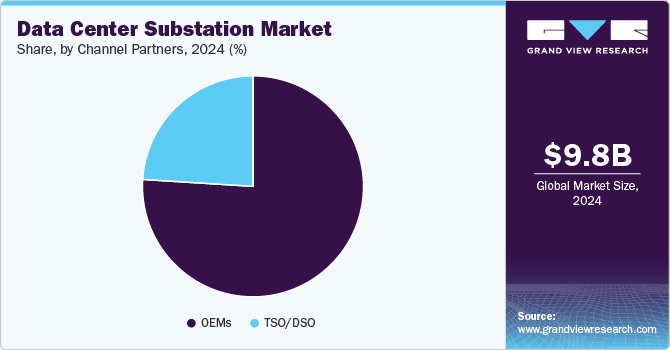

Channel Partners Insights

The OEMs segment dominated the market with the highest revenue share in 2024, reflecting a strong preference for integrated solutions that ensure compatibility and performance within data center infrastructures. Original Equipment Manufacturers (OEMs) provide tailored equipment that meets specific operational requirements, which is crucial for maintaining optimal performance in energy-intensive environments such as data centers. As the industry continues to evolve, the role of OEMs will be pivotal in delivering innovative solutions that cater to the unique challenges faced by data centers today.

The TSO/DSO segment is expected to grow at a significant CAGR over the forecast period. Their involvement is essential for ensuring that data centers receive uninterrupted power supply while adhering to regulatory standards. As demand for reliable electricity continues to rise with the expansion of digital services and cloud computing, Transmission System Operators (TSOs) and Distribution System Operators (DSOs) will increasingly focus on enhancing grid resilience and efficiency to support this growing sector. This collaborative approach ensures reliable service and promotes sustainability within energy consumption practices across data centers. For example, in 2012, Microsoft committed to becoming carbon negative by 2030 and is working closely with Enchanted Rock to enhance the sustainability of its data centers with backup power sourced from California’s upcoming largest microgrid supported by RNG. This partnership aims to leverage microgrid technology that utilizes clean energy sources, thereby reducing reliance on fossil fuels and enhancing the overall resilience of the power supply.

Regional Insights

The North America data center substation market dominated the global market with a revenue share of 37.9% in 2024, driven by a combination of robust infrastructure and increasing demand for reliable power solutions. This region's dominance can be attributed to its well-developed IT ecosystem, which supports a high concentration of data centers that require efficient power management systems. For instance, companies such as Amazon Web Services (AWS) and Microsoft Azure have invested heavily in their data center operations across North America, driving the need for advanced substations that can handle significant power loads while ensuring uninterrupted service.

U.S. Data Center Substation Market Trends

The U.S. dominated the regional data center substation market in 2024 and is expected to maintain its dominance over the forecast period. In the U.S., the market is thriving due to a well-established IT infrastructure and a high demand for cloud-based solutions. The presence of major technology companies and a surge in data-driven industries, such as finance and healthcare, are driving the construction of new data centers. This has led to significant investments in advanced substation technologies that support high-capacity power requirements, ensuring reliable service for critical operations. For instance, Amazon Web Services (AWS) has been actively constructing its own data centers across various locations, including a significant investment of USD 10 billion in new facilities in Mississippi.

Europe Data Center Substation Market Trends

In Europe, the data center substation market is witnessing significant growth driven by the need for modernization and increased energy efficiency. As many European countries aim to transition to greener energy solutions, there is a strong focus on replacing aging electrical infrastructure with advanced digital substations that utilize fiber optic technology for improved connectivity and reduced installation costs.

Germany is emerging as a key player in the European data center substation market, supported by its strong digital economy and high levels of industrial digitalization. The country’s commitment to renewable energy, particularly wind and solar power, is fostering the development of sustainable data centers. As companies increasingly adopt green technologies, the demand for efficient substations that can integrate renewable energy sources is rising, positioning Germany as a leader in sustainable data center infrastructure.

Asia Pacific Data Center Substation Market Trends

The Asia Pacific region as a whole is witnessing rapid growth in the data center substation market, with countries such as China and India leading the charge. The increasing penetration of smartphones and internet services is fueling the demand for data storage and cloud computing services. In China, substantial investments in smart grid technologies are enhancing the efficiency of power distribution networks. These developments are collectively driving the need for modern substations equipped to handle the evolving energy demands of data centers.

China is experiencing growth in its energy landscape, primarily driven by substantial investments in smart grid technologies and infrastructure upgrades. For instance, the National Development and Reform Commission has outlined a plan to increase investments in key energy sectors by 25% by 2027, focusing on modernizing thermal power, electricity transmission, and distribution systems. This includes renovating old substations and replacing outdated transformers, which is essential for enhancing grid safety and efficiency as the country integrates a growing share of renewable energy sources like wind and solar power.

Key Data Center Substation Company Insights

The data center substation market is characterized by the presence of several key players that significantly influence its dynamics. Major companies include Eaton Corporation, General Electric, ABB Ltd., and Siemens AG, which are known for their innovative technologies and extensive product offerings. These firms are actively involved in developing advanced substation solutions that cater to the growing demand for reliable power distribution in data centers.

-

Eaton Corporation is a global power management company that specializes in providing energy-efficient solutions across various sectors, including electrical, hydraulic, and mechanical power. The company focuses on developing innovative technologies and services that help customers manage power in a reliable and sustainable manner. Eaton serves a diverse range of industries, including utilities, aerospace, automotive, and renewable energy, with a commitment to improving quality of life and environmental sustainability.

-

Siemens AG is a multinational conglomerate based in Germany, primarily focused on industrial manufacturing and technology. The company operates in various sectors, including automation, digitalization, smart infrastructure, mobility, and healthcare. Siemens is recognized for its commitment to innovation and sustainability, leveraging advanced technologies such as artificial intelligence and the Internet of Things (IoT) to enhance efficiency and productivity across industries.

Key Data Center Substation Companies:

The following are the leading companies in the data center substation market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Bharat Heavy Electricals Limited (BHEL)

- CG Power and Industrial Solutions Limited

- Eaton Corporation

- Fuji Electric Co., Ltd.

- General Electric

- Hitachi Energy

- Hyundai Electric & Energy Systems Co., Ltd.

- Mitsubishi Electric Corporation

- NARI Technology Co., Ltd.

- Schneider Electric SE

- Siemens AG

- Sterling & Wilson Pvt Ltd

- Toshiba Corporation

- Vertiv Holdings Co.

Recent Development

-

In May 2023, Mapletree Investments made a significant move by acquiring a new facility in Osaka for over USD 372 million. This acquisition reflects the growing interest of international investors in Japan's data center sector as they seek to capitalize on the rising demand for colocation services and robust digital infrastructure.

-

In July 2022, Eaton completed the acquisition of a 50% stake in Jiangsu Huineng Electric Co., Ltd., a Chinese manufacturer specializing in low-voltage circuit breakers. This strategic partnership aims to enhance Eaton's growth strategy by combining tailored products with its global distribution channels, allowing the company to tap into markets such as renewable energy and grid modernization.

Data Center Substation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 10.22 billion |

|

Revenue forecast in 2030 |

USD 14.80 billion |

|

Growth rate |

CAGR of 7.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Components, voltage, channel partners, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; Ireland; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia. |

|

Key companies profiled |

ABB Ltd.; Bharat Heavy Electricals Limited (BHEL); CG Power and Industrial Solutions Limited; Eaton Corporation; Fuji Electric Co., Ltd.; General Electric; Hitachi Energy; Hyundai Electric & Energy Systems Co., Ltd.; Mitsubishi Electric Corporation; NARI Technology Co., Ltd.; Schneider Electric SE; Siemens AG; Sterling & Wilson Pvt Ltd; Toshiba Corporation; Vertiv Holdings Co. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center Substation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center substation market report based on components, voltage, channel partners, and region.

-

Components Outlook (Revenue, USD Million, 2018 - 2030)

-

Transformers

-

Switchgears

-

Air Insulated

-

Circuit

-

Others

-

-

Gas Insulated

-

-

Relays

-

Capacitors

-

Busbar

-

Surge

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

33 kV - 110 kV

-

110 kV - 220 kV

-

220 kV - 500 kV

-

Above 500 kV

-

-

Channel Partners Outlook (Revenue, USD Million, 2018 - 2030)

-

OEMs

-

TSO/DSO

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Ireland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."