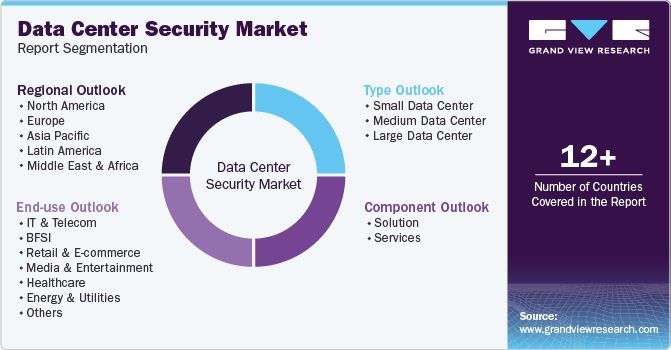

Data Center Security Market Size, Share & Trends Analysis Report By Component, By Type (Small Data Center, Medium Data Center, Large Data Center), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-034-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Data Center Security Market Size & Trends

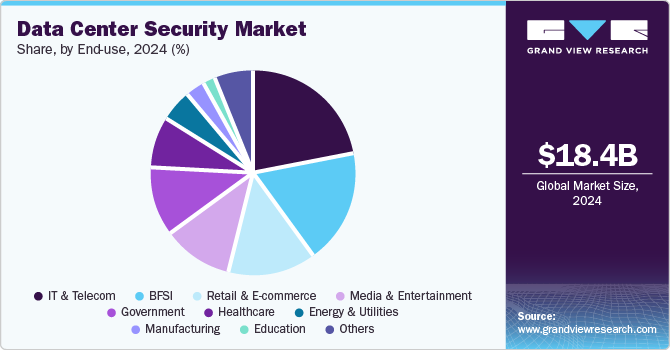

The global data center security market was valued at USD 18.42 billion in 2024 and is projected to grow at a CAGR of 16.8% from 2025 to 2030. The growth of this market is primarily driven by growing concerns regarding data thefts, cyber-attacks, and unauthorized access, which can result in sensitive data leaks and compromised data integrity. The increasing use of data-driven strategies, the generation of data in large volumes, and the growing dependability of industries such as healthcare, retail, banking, and financial services on data availability have developed an alarming need for effective data center security solutions and services.

The data centers comprise switches, routers, storage systems, firewalls, application delivery controllers, and servers, which are physical facilities businesses, governments, and other organizations use to store data and critical applications. Data centers' presence and seamless operations play a vital role in multiple business activities of modern industry related to emails, file sharing, applications, customer relationship management platforms, Enterprise resource planning (ERP), and advanced technologies such as big data, AI, and others.

However, in recent years, owing to the growth in the use of network-based infrastructure in multiple industries, a noteworthy rise in internet-based crimes, security breaches, and data thefts has raised critical issues. Loss of data, ransomware attacks, and leaks of private customer information have resulted in regulatory consequences for numerous organizations. According to Internet Crime Report 2023 by the U.S. Federal Bureau of Investigation, Department of Justice, the Internet Crime Complaint Center (IC3) received 55,851 complaints of personal data breach, 298,878 complaints of Phishing/Spoofing, and nearly 14,190 complaints related to Internet crime committed through government impersonation.

The rising concerns regarding data integrity and data center security has encouraged multiple organizations to introduce data center security solutions related with physical security, network security, endpoint security, application security, data security, Security Information and Event Management (SIEM), Identity and Access Management (IAM) and others. Ease of availability, increasing adoption of data-driven technologies and systems, and rising threats to data center facilities are expected to drive demand for these solutions in the approaching years.

Component Insights

Based on components, the solutions segment dominated the global industry and accounted for a revenue share of 79.8% in 2024. Increase in remote work culture backed by the use of advanced technologies and enhanced network connectivity, emergence and higher industry penetration of artificial intelligence and machine learning, increasing awareness in customers regarding data privacy, stringent regulation associated with data security, storage and protection, and unceasing growth in use of internet leading to generation of data in large volumes are some of the key growth driving factors for this segment. Solutions such as multi-factor authentication, biometric access technology, high-definition video surveillance, and others are extensively used by organizations and data centers to ensure data integrity.

The services segment is expected to experience the fastest CAGR during the forecast period. Some of the data centers provide security as part of their offerings to businesses by adopting measures such as intrusion detection systems, intrusion prevention systems, firewalls, next-generation firewalls (NGFWs), unauthorized access preventions, and more. Increasing dependency on data-driven business processes and growth in cyber threats are expected to generate an upsurge in demand for the services segment in the approaching years.

Type Insights

The large data centers segment accounted for the largest revenue share of the global market in 2024. Growth of this segment is mainly driven by factors such as energy efficiency, large-scale operations, multiple layers of power supply and cooling systems to ensure continuous operation, strict and strong implementation of security protocols, and more. Often known as hyper-scale data centers, they are usually located on the outskirts of large cities where land and power supply costs are favorable for such facilities. Global cloud service provider companies primarily use large data centers.

The medium data centers segment is expected to experience the noteworthy CAGR during the forecast period. This is attributed to factors such as cost-effective solutions and services provided by the centers, growing subscriptions by small and medium-scale organizations, reduced latency due to closer proximity location, and flexibility offered to reduce or expand capacities according to timely requirements.

End-use Insights

Based on end-use, the IT & telecom segment accounted for the largest revenue share in 2024. This segment is mainly influenced by factors such as increasing data generation by customers of the telecom industry through the use of internet and internet-based applications, rising adoption of data-driven technologies by multiple industries leading to demand for effective enterprise IT solutions, and dependency on numerous businesses such as e-commerce, retail, banking and others on customer data. Businesses operating in the IT & telecom industry continuously rely on data centers for multiple functions such as hosting applications, database management, cloud service provisions, disaster recovery, etc. These aspects are expected to drive the growth of this segment in the approaching years.

Government segment is anticipated to experience the fastest CAGR of 18.5% during the forecast period. Governments’ growing adoption of advanced technologies to store sensitive data regarding multiple stakeholders, including the public, businesses, military personnel, intelligence network assets deployed on foreign soils, critical infrastructure management systems, etc. To ensure the security and protection of this data, the government, local municipal corporations, and organizations operating with government control store inefficient data centers. Increasing digital transformation activities embraced by governments worldwide are expected to generate an upsurge in demand for this segment from 2024 to 2030.

Regional Insights

North America data center security market dominated the global industry and accounted for the revenue share of 36.2 % in 2024. This is attributed to factors such as client organizations' increasing demand for effective data center security services, the rapid pace of digital transformation, which is leading to rising dependency on data, large-scale operations accomplished through modern technologies such as cloud computing, and the presence of a robust IT and telecom industry.

U.S. Data Center Security Market Trends

The U.S. data center security market held the largest revenue share of the regional industry and accounted for the revenue share of 77.0% in 2024. This is attributed to the large number of data center facilities present in the country, the increasing adoption of modern technologies in multiple businesses, which leads to the generation of large volumes of data, the increasing number of cyber-attacks on critical infrastructure management systems and organizational infrastructures, and more.

Europe Data Center Security Market Trends

Europe data center security market was identified as a lucrative region in 2024. The region imposes stringent regulations, such as the General Data Protection Regulation (GDPR), to ensure data privacy. These rules and regulations require businesses to adhere to strict data security measures, compelling investments in data center security. Additionally, technological advancements are leading to the adoption of cloud services, which require robust data center security.

The UK data center security market is expected to grow rapidly in the approaching years. This is primarily attributed to the increasing number of businesses shifting from traditional IT structures to cloud platforms. Data centers in the region deploy advanced security solutions to protect existing data center infrastructure from imminent cyber threats. The increasing expansion of 5G networks and the growing use of internet-based platforms, e-commerce websites, social media, and online services applications also contribute to the ever-increasing demand for the data center security market.

Asia Pacific Data Center Security Market Trends

Asia Pacific data center security market is anticipated to witness the fastest CAGR of 18.3% during the forecast period. The rising use of cloud computing services by multiple industries and businesses to ensure smooth operational workflows is influencing the growth of this market. A rise in cyberattacks, increasing dependability on data, development of new data centers in the region, and stringent regulator scenarios regarding data security and protection are expected to drive demand for this regional industry from 2025 to 2030. In March 2024 and May 2024, the Indian government, aerospace & defense, and energy sector agencies were targeted by cyber-attacks.

India data center security market is expected to experience significant growth during forecast period. This is attributed to the rapid pace of digital transformation activities, the increasing number of organizations shifting to cloud computing platforms for hosting, storage, and other business functions, growing data-driven business processes, and rising dependability on data in multiple industries, including e-commerce, banking, financial services, and others.

Key Data Center Security Company Insights

Some of the key companies in the data center security market include Cisco Systems, Inc., IBM, Fortinet, Inc., Honeywell International Inc., and others. The major market participants are adopting strategies such as increasing collaborations with other organizations, innovation, and serviced delivery enhancements to ensure improved customer engagement.

-

Cisco Systems, Inc., one of the prominent companies in the technology & innovation market, offer secure data center solutions. Some of its products include Application Centric Infrastructure (ACI), Firepower Next Generation Firewall, Stealthwatch, Tetration, and more. Its data centers are equipped with capabilities such as segmentation to reduce attack surfaces, threat detection, protection and others.

-

Fortinet, Inc., a major industry participant in cybersecurity, offersFortiGate Next-Generation Firewalls (NGFWs), automated AI/ML-powered FortiGuard services and more. Company offers portfolio of more than 50 enterprise security products.

Key Data Center Security Companies:

The following are the leading companies in the data center security market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- IBM

- Palo Alto Networks

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Hewlett Packard Enterprise Development LP

- Honeywell International Inc.

- Juniper Networks, Inc.

- McAfee, LLC

- Trend Micro Incorporated

Recent Developments

-

In April 2024, Cisco Systems Inc., announced its latest innovation, Cisco Hypershield, new security architecture, which aims to restructure and reimagine the security for clouds and data centers, especially with the growing penetration of artificial intelligence technology.

Data Center Security Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 21.25 billion |

|

Revenue forecast in 2030 |

USD 46.11 billion |

|

Growth Rate |

CAGR of 16.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, type, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Germany, China, Japan, India, South Korea, Australia, Brazil, South Arabia, UAE, South Africa |

|

Key companies profiled |

Cisco Systems, Inc.; IBM; Palo Alto Networks; Fortinet, Inc.; Check Point Software Technologies Ltd.; Hewlett Packard Enterprise Development LP; Honeywell International Inc.; Juniper Networks, Inc.; McAfee, LLC; Trend Micro Incorporated |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the data center security market report based on component, type, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Physical Security

-

Network Security

-

Endpoint Security

-

Application Security

-

Data Security

-

Security Information and Event Management (SIEM)

-

Identity and Access Management (IAM)

-

-

Services

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Small Data Center

-

Medium Data Center

-

Large Data Center

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

IT & Telecom

-

BFSI

-

Retail & E-commerce

-

Media & Entertainment

-

Healthcare

-

Energy & Utilities

-

Government

-

Manufacturing

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."