Data Center Robotics Market Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By Robot Type, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-124-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global data center robotics market size was valued at USD 8.73 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 22.1% from 2023 to 2030. Data center operators are actively searching for solutions to automate routine procedures and operations in order to boost productivity and eliminate human error. Robots can undertake chores like equipment installation, cable management, and regular maintenance, freeing up human workers for more strategic work. As data centers become increasingly tightly packed with computers and equipment, the space available for human technicians to walk around becomes limited. Robots can navigate these confined spaces more successfully.

Remote monitoring and diagnostics can be provided by robots equipped with sensors and cameras, allowing data center personnel to examine conditions in difficult-to-reach places without personally being present. Data center robotics can help with energy saving by managing cooling, monitoring power use, and ensuring equipment is operating at peak performance. Robotics can be used to do predictive maintenance activities, detecting possible problems before they cause downtime or interruptions.

Moreover, there has been a growing concern for energy usage of the data centers because of its rising environmental and operating expenses. Sensor-equipped robots can monitor temperature differences in various regions of the data center and modify cooling systems as needed. This guarantees that cooling resources are accurately distributed where they are required, reducing energy waste. Individual server and device power usage can be monitored by robots. They can optimize power distribution and help achieve greater energy efficiency by detecting and fixing energy-intensive equipment. Robots in data centers can assist in the analysis of server workloads and the identification of opportunities for virtualization and server consolidation, which can reduce the number of active servers and save energy.

In data centers, robots help in the setup, installation, and configuration of servers, networking hardware, and other pieces of technology. This helps to eliminate human mistake and streamline the initial deployment procedure. Robots using sensors and cameras can evaluate equipment on a regular basis to look for potential problems like overheating, weak connections, or wear and tear. This proactive technique would potentially prevent expensive breakdowns and disruptions.

However, the complexity of data center environments and high initial investments of data centers is anticipated to hamper the market's growth. Data centers are complex, cluttered spaces with a wide range of gear, cables, and systems. It is difficult to create robots that can move through and perform well in such settings without causing harm or interruptions. Additionally, there is a significant upfront investment required for the development, testing, integration, and deployment of both hardware and software for the use of robotic systems in data centers.

Component Insights

The hardware segment held the highest revenue share of 43.2% for the data center robotics market in 2022. The growth of the hardware segment in the data center robotics market is a result of increasing data center demand, technological advancements, customization capabilities, scalability, safety improvements, and the need for operational efficiency. As data centers continue to evolve and optimize their operations, hardware components play a critical role in enabling effective automation and enhancing overall performance.

The software segment is expected to register the fastest growth at a CAGR of 22.8% over the forecast period. The development of sophisticated software solutions enhances the efficiency and effectiveness of robotic systems, ultimately driving the adoption of robotics in data center environments. The development of such software solutions is a key catalyst for enabling efficient and effective robotic systems. Sophisticated software enables the programming and control of robotic systems. It allows data center operators to define tasks, sequences, and behaviors that the robots should perform. This level of automation ensures that robots can execute tasks consistently and accurately, reducing the need for manual intervention.

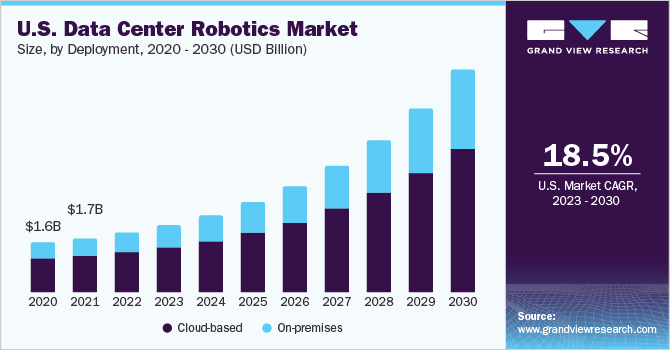

Deployment Insights

The on-premise segment held the highest revenue share of 52.2% for the data center robotics market in 2022. The growth of the on-premise segment in the data center robotics market is driven by its ability to offer customized solutions, low latency, operational control, data security, and task versatility. As data centers continue to prioritize efficiency, automation, and responsiveness, the on-premise deployment model becomes an attractive option for integrating robotics directly into their operational workflows. It offers the benefits of customized solutions, low latency, operational control, data security, and task versatility, contributing to the growth of the on-premise segment in the data center robotics market.

The cloud segment is expected to register growth at a CAGR of 20.8% over the forecast period. The cloud-based deployment segment is experiencing rapid growth in the data center robotics market due to several advantages it offers. These advantages include scalability, remote management, rapid deployment, access to advanced technologies, cost efficiency, and integration with analytics. These benefits make cloud-based deployment an attractive option for data center operators seeking to optimize operations, enhance efficiency, and leverage cutting-edge technologies. The growth of the on-premise segment is also driven by its ability to offer customized solutions, low latency, operational control, data security, and task versatility. As data centers continue to prioritize efficiency, automation, and responsiveness, both on-premise and cloud-based deployment models become compelling options for integrating robotics directly into operational workflows.

Enterprise Size Insights

The large enterprise segment held the highest revenue share of 62.3% for the Data Center Robotics market in 2022. Large enterprises play a pivotal role in shaping the data center robotics market due to their significant influence in terms of investment, innovation, scalability, and trend-setting within the industry. Their adoption of robotics technology brings about a range of benefits that extend beyond their own operational improvements, contributing to the overall growth and advancement of robotics technology and its applications within the data center ecosystem. These enterprises promote collaboration, foster innovation, and drive the industry forward, ultimately shaping the future of data center robotics.

The Small and Medium Enterprises (SMEs) is expected to register a CAGR of 23.5% through 2030. The fast growth of the SME segment in the data center robotics market is driven by the convergence of affordability, operational efficiency, scalability, remote management capabilities, competitive advantages, and the alignment of robotics with the specific needs of smaller businesses. As robotics continue to evolve and adapt, SMEs are well-positioned to leverage these technologies to enhance their data center operations and navigate the dynamic business landscape.

Robot Type Insights

The industrial robots segment accounted for the largest revenue share in 2022, contributing 36.7% of the overall revenue in the data center robotics market. The industrial robotics market growth is attributed to the automation of various tasks such as maintenance and repair, equipment installation, increased efficiency, and reduced downtime. Data usage continues to propel by adopting robotic technologies to enhance the growing capabilities and meet business demands, facilitating high-speed and reliable data processing. The evolving robotics in the industrial data center setup enhances the security of monitoring and patrolling for unauthorized access and anomalies.

The collaborative robots segment is expected to register a CAGR of 23.4% through 2030. The collaborative robotic data center market growth is attributed to its diverse IT expertise. The growing diversity has prompted knowledge sharing and fostered collaboration and innovation in a business setup. The collaborative robotic data center prioritizes investing in sustainability and energy-efficient technologies. Moreover, collaborative robotic data centers facilitate manufacturing and production-related tasks such as material handling, machine tending, and product quality control.

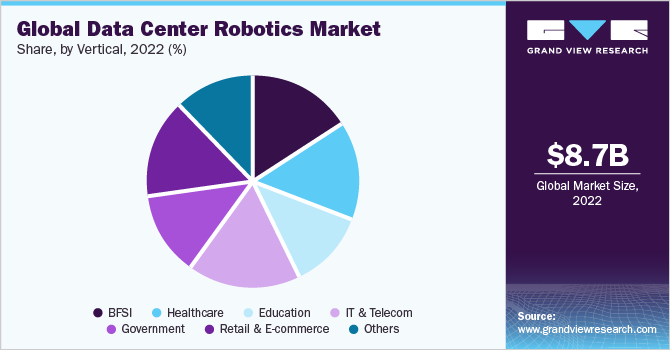

Vertical Insights

The IT and telecom segment accounted for the largest revenue share in 2022, contributing 17.1% of the overall revenue in the data center robotics market. The IT and telecom sectors are expected to dominate the data center market in the upcoming years. This is due to the wide acceptance of enhanced technologies like IoT, cloud computing, and AI, which are generating huge amounts of data. The impact of emerging trends like AI, IoT, and cloud computing on the data center industry is unquestionable, including increased performance demands, potential security risks, and the need for more efficient and flexible data center infrastructure.

The Retail & E-commerce segment is anticipated to grow at a CAGR of 26.7% during the forecast period. The use of robots in the retail and e-commerce sector can provide several advantages, including improved inventory management, increased efficiency and accuracy, cost savings, and improved customer experience which is the major factor anticipating the fastest growth of the segment in the market. Robots can be used to quickly identify and retrieve items from inventory, reducing the time customers need to wait for their orders. Moreover, can perform a variety of functions, from material handling and cleaning to order and returns processing. Furthermore, integrating robots with chatbots can help retailers attend to customers more efficiently, improving customer personalization.

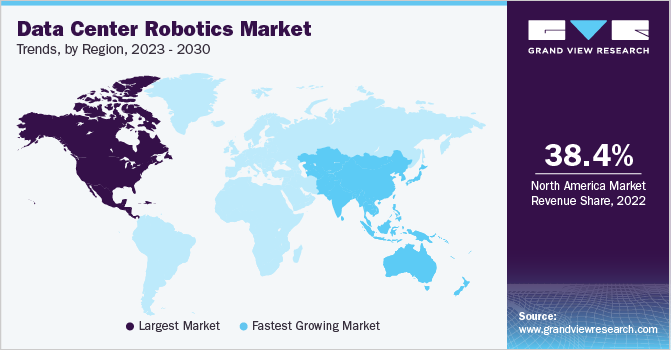

Regional Insights

North America held the largest market share of 38.42% in 2022. North America has played a significant role in the data center industry, including data center robotics. The region's robust IT infrastructure, large number of data centers, and innovative advancements have contributed to its prominence in this field. Many of the world's largest tech companies and cloud service providers are based in North America, and they often invest heavily in optimizing their data center operations. The growth of the on-premise segment in the data center robotics market is driven by its ability to offer customized solutions, low latency, operational control, data security, and task versatility. On the other hand, the cloud-based deployment segment's rapid growth is driven by its ability to provide scalability, remote management, rapid deployment, access to advanced technologies, cost efficiency, and integration with analytics. As data centers continue to prioritize efficiency, automation, and responsiveness, both on-premise and cloud-based deployment models become compelling options for integrating robotics directly into operational workflows.

Asia Pacific is expected to register the fastest growth, at a CAGR of 22.2%, over the forecast period. The Asia-Pacific (APAC) region is undergoing a rapid digital transition, with rising usage of big data, cloud, artificial intelligence, and the Internet of Things (IoT). Data centers need to become more scalable, efficient, and capable of managing complex workloads as data volumes increase. Robotics can assist in meeting these demands. Many APAC countries are facing skilled labor shortages, specifically in technical and engineering positions. By automating routine operations and freeing up trained workers for higher-value work, robotic solutions could potentially relieve these shortages. The competitive nature of the APAC technology sector leads companies to seek creative methods to distinguish themselves. Robotic data centers can be a unique selling factor and assist in developing a company's reputation.

Key Companies & Market Share Insights

The key market players in the global market in 2022 include ABB Ltd., Delta Electronics, Inc., Digital Realty Trust, and Cisco Systems, Inc. Intense competition among leading players for introducing advanced and innovative products is encouraging companies to invest in research and development of energy-efficient data centers. Furthermore, several Verticals are adopting data center robotics solutions, making it easier for data centers to adopt green practices without compromising performance.

Companies are adopting strategies to leverage new opportunities in the market and target new customers by developing sustainable products. For instance, in June 2023, Siemens AG and Intrinsic, a web-based developed and provider of robotic solutions, collaborated to investigate connectivity and interfaces between Intrinsic's robotics software, which is intended to facilitate the usage of AI-built abilities, along with Siemens Digital Industries' accessible and interconnected portfolio for mechanizing and managing industrial production. Some prominent players in the Data Center Robotics market include:

-

365 Data Centers

-

ABB

-

Amazon Web Services

-

BMC Software, Inc

-

China Telecom

-

Cisco Systems, Inc.

-

ConnectWise LLC

-

Digital Realty

-

Equinix

-

Hewlett Packard Enterprise Development LP

-

Huawei Technologies Co., Ltd.

-

Microsoft Corporation

-

NTT Communications

-

Rockwell Automation Inc.

-

Siemens AG

-

Verizon

Data Center Robotics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 10.11 billion |

|

Revenue Forecast in 2030 |

USD 40.90 billion |

|

Growth rate |

CAGR of 22.1% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, robot type, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

365 Data Centers; ABB; Amazon Web Services; BMC Software, Inc; China Telecom; Cisco Systems, Inc.; ConnectWise LLC; Digital Realty; Equinix; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; Microsoft Corporation; NTT Communications; Rockwell Automation Inc.; Siemens AG; Verizon |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center Robotics Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 - 2030. For the purpose of this study, Grand View Research has segmented the data center robotics market report on the basis of component, deployment, enterprise size, robot type, vertical, and region:

-

Component Outlook (Revenue, USD Billion; 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion; 2018 - 2030)

-

Cloud-based

-

On-Premises

-

-

Enterprise Size Outlook (Revenue, USD Billion; 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Robot Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Collaborative Robots

-

Industrial Robots

-

Service Robots

-

-

Vertical Outlook (Revenue, USD Billion; 2018 - 2030)

-

BFSI

-

Healthcare

-

Education

-

IT & Telecom

-

Government

-

Retail & E-commerce

-

Others

-

-

Region Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center robotics market size was estimated at USD 8.73 billion in 2022 and is expected to reach USD 10.11 billion by 2023.

b. The global data center robotics market is expected to grow at a compound annual growth rate of 22.1% from 2023 to 2030 to reach USD 40.9 billion by 2030.

b. The hardware segment dominated the data center robotics market with a share of 43.2% in 2022. This is attributable to the increase in data center demand, technological advancements, customization capabilities, scalability, safety improvements, and the need for operational efficiency.

b. Some key players operating in the data center robotics market include ABB Ltd.; Asetek, Inc.; Delta Electronics, Inc.; Digital Realty Trust; Cisco Systems, Inc.; Dell Technologies, Inc.; Equinix, Inc.; Fujitsu Ltd.; General Electric; Hewlett Packard Enterprise Company; International Business Machines Corporation; Huawei Technologies Co., Ltd.; Hitachi, Ltd.; Schneider Electric; and Siemens AG among others.

b. Key factors driving the data center robotics market growth operators are actively searching for solutions to automate routine procedures and operations to boost productivity and eliminate human error.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."