- Home

- »

- Communications Infrastructure

- »

-

Data Center RFID Market Size, Share & Growth Report, 2030GVR Report cover

![Data Center RFID Market Size, Share & Trends Report]()

Data Center RFID Market Size, Share & Trends Analysis Report, By Component (Hardware, Software, and Services), By Hardware, By Tags, By Tag Frequency, By Reader, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-179-6

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Data Center RFID Market Size & Trends

The global data center RFID market size was estimated at USD 1,270.3 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 24.8% from 2024 to 2030. Data centers are growing larger and more complicated due to a spike in demand for data processing and storage, which makes effective and dependable asset management systems essential. This need is met by data center RFID technology, which offers real-time asset tracking and visibility, maximizes asset usage, and boosts overall operational effectiveness. Data centers house critical infrastructure and sensitive information. Data breaches and unauthorized access can have devastating consequences. Data center RFID plays a crucial role in enhancing security by facilitating access control and monitoring the movement of assets within the data center. This real-time visibility allows for swift detection and response to potential security threats, minimizing risks and safeguarding valuable data.

The advantages of RFID technology are becoming more and more apparent to data center operators. In the sector, the capacity to automate processes, boost productivity, and strengthen security is becoming increasingly popular. A booming market is being created for RFID technology vendors by the rising usage of data center RFID solutions brought about by this expanding awareness. Technological advancements are constantly improving RFID technology, making it more affordable, reliable, and versatile for data center applications. Longer read ranges allow for wider coverage, higher data capacity facilitates richer data collection, and seamless integration with other systems allows for comprehensive data center management solutions. These advancements are driving market growth by making data center RFID a more compelling solution.

Data center RFID is no longer limited to asset tracking and security. Its applications are expanding to encompass diverse areas like data center audits, environmental monitoring, predictive maintenance, and lifecycle management. This diversification opens up new market opportunities and drives further growth by offering comprehensive data center management solutions that cater to specific needs.The integration of AI and ML with data center RFID is unlocking new possibilities for data analysis and predictive maintenance. AI algorithms can analyze RFID data to identify patterns, predict asset failures, and optimize maintenance schedules. This proactive approach minimizes downtime, reduces costs, and ensures the optimal performance of data center equipment.

Present-day data center management systems, such as building management systems (BMS) and data center infrastructure management (DCIM), easily interface with modern data center RFID solutions. Real-time data analysis and visualization made possible by this integration promote proactive management and better decision-making. Additionally, by doing away with the requirement for manual data gathering and reconciliation, this integration lowers errors and boosts operational effectiveness.

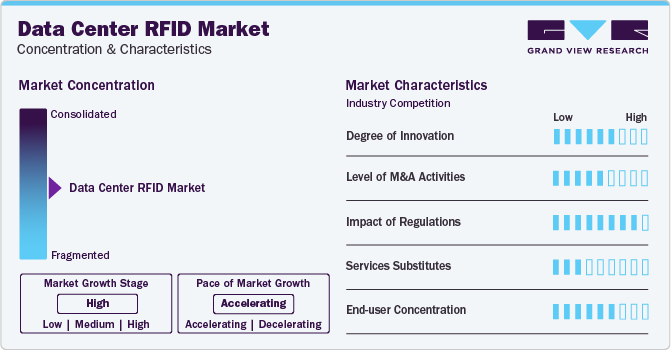

Market Characteristics

The market growth stage is high, and pace of the market growth is accelerating. The data center RFID market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in machine learning algorithms, enhanced security and visibility among others. Increasing demand for data storage and processing, increasing applications of data center RFID into areas data center audits, predictive maintenance, and environmental monitoring.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new AI technologies and talent, need to consolidate in a rapidly growing market, and increasing strategic importance of data center and cloud computing.

The market is subject to regulations that majorly deal with data security. Regulations like GDPR and HIPAA require organizations to protect sensitive data. RFID helps ensure the physical security of data storage devices and tracks access attempts to comply with these regulations. Regulations like Energy Star and LEED promote sustainable data center operations. RFID helps track energy consumption and optimize data center operations for compliance and environmental benefits.

There are a significant number of substitutes available for data center RFID in the market, some of which include Barcodes and QR codes, Wi-Fi and Bluetooth Low Energy (BLE) tags, Ultra-wideband (UWB) technology, and Building Management Systems (BMS), among others. The prioritization of data center RFID or any of its substitutes depends upon factors such as budget, technological infrastructure, and integration with existing systems, among others.

One important aspect influencing the data center RFID market is the concentration of end users. The market for data center RFID solutions is being driven by end-user organizations such as SMBs, CSPs, and colocation providers. Universities and big businesses use data center RFID due to its asset management, efficiency, and security features. Strong security measures are increasingly necessary in data centers that store extremely sensitive information, which makes RFID a more alluring choice.

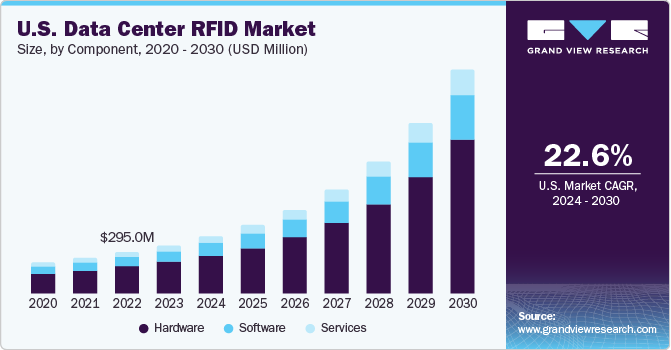

Component Insights

Hardware component led the market and accounted for 73% of the global revenue in 2023. The growing demand for data storage and processing necessitates the construction and expansion of data centers, creating a substantial market for hardware components. Hardware components are becoming more sophisticated, offering features like longer read ranges, higher data capacity, and improved environmental resistance. These advancements enhance the effectiveness and value proposition of data center RFID, driving further adoption. Beyond asset tracking and security, data center RFID is used for data center audits, environmental monitoring, predictive maintenance, and lifecycle management. This diversification necessitates specialized hardware components, creating new opportunities for manufacturers.

The services segment is expected to register the fastest CAGR over the forecast period 2024 to 2030. As data centers grow and become complex, managing, and optimizing operations becomes increasingly challenging. Services providers offer expertise and solutions to overcome these challenges, ensuring data center operators can leverage the full potential of their RFID investments. Implementing and maintaining a data center RFID system requires specialized knowledge and technical expertise. Many organizations need more resources internally, driving demand for expert services from experienced providers.

Hardware Insights

The reader segment accounted for the largest market revenue share of around 35% in 2023. This is attributable to Data center operators increasingly recognizing the benefits of RFID technology. Its ability to automate tasks, improve efficiency, and enhance security is driving widespread adoption within the industry. Continuous advancements in RFID technology are making it more affordable, reliable, versatile, and feature rich. Longer read ranges, higher data capacity, improved environmental resistance, and seamless integration with existing systems enhance the effectiveness and value proposition of data center RFID.

The antenna segment is expected to witness the fastest CAGR over the forecast period. Advancements in antenna design, including polarization diversity and multi-beam antennas, enhance tag detection accuracy and improve data transmission efficiency. These advanced features enable data center operators to optimize their RFID systems and maximize the effectiveness of their asset tracking and management processes. Modern data center antennas are designed for seamless integration with existing data centers infrastructure, such as cable trays and ceilings; this eliminates the need for extensive rewiring or modification to existing structures, simplifying installation, and reducing deployment costs.

Tags Insights

Passive tags dominated the market share in 2023, occupying more than 71%. Passive tags have a lifespan of up to 10 years, while active tags typically last only 2-5 years; this means that passive tags require less frequent replacement, further reducing costs. Passive tags are much smaller and lighter than active tags; this makes them easier to attach to assets and less likely to be damaged or lost. Passive tags are capable of providing accurate and reliable data for most data center applications, including asset tracking, access control, and environmental monitoring. Passive tags are less susceptible to interference from other electronic devices in the data center environment; this ensures reliable communication between tags and readers.

Active tags are expected to witness the fastest CAGR over the forecast period of 2024 to 2030. Active tags boast significantly longer read ranges than passive tags, often reaching up to 100 meters or more; this is particularly advantageous for large data centers where assets are spread over a wide area or for tracking assets in difficult-to-reach locations. Active tags transmit data continuously, providing real-time visibility into asset location and movement; this allows for immediate response to events like unauthorized asset movement or equipment failure, minimizing downtime and security risks. Active tags can be equipped with features like encryption and tamper detection, enhancing security and protecting sensitive data from unauthorized access; this is crucial for data centers storing valuable assets or sensitive information.

Tags Frequency Insights

UHF segment occupied the largest market share of around 70% in 2023. UHF tags transmit data at a much faster rate compared to HF and LF tags; this allows for quicker identification and processing of information, which is crucial for real-time monitoring and efficient data center operations. UHF tags offer significantly longer read ranges than HF and LF tags, typically reaching several meters to tens of meters; this is crucial for data centers where assets are spread over a wide area, ensuring reliable data capture and efficient asset tracking. UHF tags offer significantly larger memory capacity than HF and LF tags; this allows them to store more data, including asset identification information, sensor readings, and other relevant details.

The HF segment is expected to have the fastest CAGR over the forecast period. The smaller size of HF tags makes them ideal for attaching to smaller or delicate assets that cannot accommodate larger UHF tags; this allows for wider application and easier implementation in data centers with diverse asset types. The shorter read range of HF tags, typically only a few centimeters to meters, can be advantageous in situations where precise asset location tracking is critical; this allows for more accurate identification of assets in proximity, such as within server racks or cabinets. HF tags can offer superior read sensitivity compared to UHF tags in certain situations, such as when tags are obscured by materials or located in challenging environments.

Reader Insights

The handheld reader type is expected to occupy the largest market share of around 60% in 2023. Handheld readers provide immediate access to data, enabling real-time identification and tracking of assets; this allows for instant confirmation of asset location and identification of missing or misplaced items, minimizing downtime and ensuring efficient inventory control. Handheld readers can be easily scaled to accommodate the size and complexity of the data center. Additional readers can be added to cover larger areas or increase data collection efficiency. This scalability ensures the system adapts to the evolving needs of the data center. Modern handheld readers offer a range of functionalities beyond basic RFID tag reading. They can capture additional information like barcodes, temperature readings, and sensor data, providing a more comprehensive overview of asset status and environmental conditions.

The fixed reader type is expected to witness the fastest CAGR over the forecast period. Fixed readers automate data collection, eliminating manual tasks and ensuring consistent and reliable data capture; this improves data accuracy and reduces the risk of errors associated with manual processes. While the initial investment for fixed readers can be higher than for handheld readers, their automated data collection and larger coverage area reduce the need for manual labor and additional hardware, which leads to lower operational costs in the long run. Fixed readers facilitate accurate and efficient inventory management by providing continuous updates on asset location and status; this helps avoid stockouts and ensures readily available assets for maintenance and repair activities.

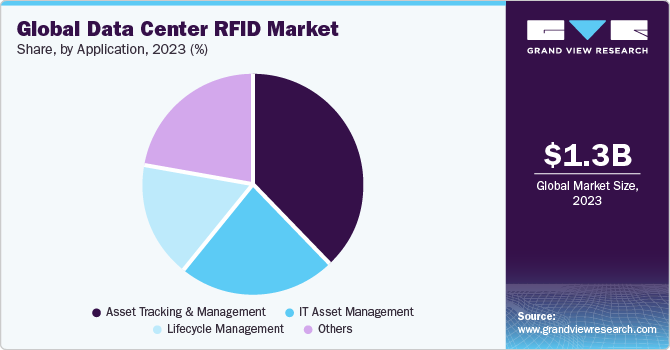

Application Insights

The asset tracking and management segment is estimated to occupy around 38% in 2023, which is the highest. RFID-based AT&M systems can help organizations quickly locate and identify assets, even in large and complex data centers; this can significantly reduce the time and resources required to troubleshoot problems and perform maintenance tasks, improving overall data center efficiency. RFID-based AT&M systems can help organizations extend the lifecycles of their assets by providing predictive maintenance and failure analysis capabilities. This can reduce asset replacement costs and improve overall data center profitability.

Lifecycle Management (LCM) plays a pivotal role in the market, enabling data center operators to optimize the entire life cycle of their assets, from acquisition and deployment to maintenance, repair, and end-of-life management. Through real-time data and insights gleaned from RFID technology, LCM systems empower organizations to streamline operations, maximize asset utilization, and enhance data center performance. By proactively addressing maintenance needs, optimizing resource allocation, and ensuring responsible end-of-life management, LCM systems deliver significant cost reductions, improved data security, and a more sustainable data center environment.

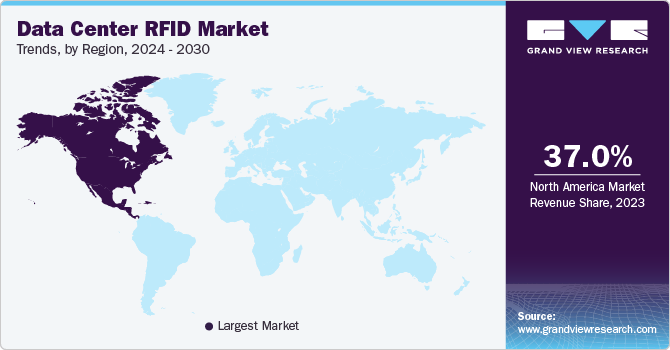

Regional Insights

North America dominated the market and accounted nearly for 37% share in 2023. North America houses the largest concentration of data centers globally, driven by its high internet penetration, cloud computing adoption, and technological advancements. This extensive data center footprint creates a substantial demand for RFID solutions to manage and optimize operations. The US is home to leading technology companies like Google, Amazon, and Microsoft, which operate vast data centers and heavily invest in cutting-edge technologies like RFID. This high concentration of tech giants drives the demand for advanced data center solutions and accelerates technology adoption.

Asia Pacific is anticipated to witness significant growth in the market. The APAC region is witnessing a surge in data center construction, driven by factors like rising internet penetration, booming e-commerce, and expanding cloud computing services. This rapid growth in data center infrastructure creates a substantial demand for efficient management solutions, including RFID technology. The Indian government actively supports data center development through policies and initiatives promoting technology adoption. Schemes like "Make in India" encourage local production of data center equipment, including RFID solutions, fostering a self-sufficient market.

Key Companies & Market Share Insights

Some of the key players operating in the market include Impinj, Inc., Zebra Technologies Corporation, Alien Technology, LLC, ThingMagic, Inc., and AVERY DENNISON CORPORATION.

-

Impinj, Inc. offers a comprehensive portfolio of RAIN RFID tags, readers, antennas, software, and services. Their solutions provide real-time visibility and management of data center assets, improving operational efficiency, security, and compliance

-

Zebra Technologies Corporation offers a diverse range of RFID tags, high-performance readers, printers, antennas, and Zebra VisibilityIQ software. Committed to continuous innovation, Zebra focuses on automation, AI integration, security, and expansion into emerging markets

Detego, MOJIX, and Confidex are some of the emerging market participants in the data center RFID market.

-

Detego has been growing rampantly in the data center RFID market; its Perception Platform is a cloud-based platform that provides real-time visibility and management of all data center assets tagged with RFID. This platform integrates seamlessly with existing data center systems and infrastructure, offering a flexible solution for data integration, visualization, and analysis

-

MOJIX’s whole line of solutions combines RFID and RTLS technologies to provide a single platform for data visualization, analytics, and automation. Integrating MOJIX with existing data center software and systems is easy since it offers an open API

Key Data Center RFID Companies:

- Alien Technology

- AVERY DENNISON CORPORATION

- Confidex

- Detego

- GAO Group

- HID Global

- Honeywell International Inc.

- Impinj, Inc.

- MOJIX

- Nedap

- NXP Semiconductors

- SATO Holdings Corporation

- Semiconductor Components Industries, LLC

- ThingMagic

- Zebra Technologies Corp.

Recent Developments

-

In September 2023, Hyperview announced a strategic partnership with Digitalor. Hyperview will integrate Digitalor’s technologies which include environmental sensors and asset tracking hardware that enables customers to easily monitor an asset’s entire life cycle, from receipt to decommissioning.

-

In March 2023, MASS Group announced its integration with Zebra Technologies for the addition of FX9600 and FX7500 fixed readers. The ability to integrate both handheld and fixed hardware solutions will enable MASS Group to increase its offering and provide clients with a wide range of solutions.

-

In May 2022, HID Global acquired Vizinex RFID; the purchase enhances HID Global's standing in the rapidly expanding RFID tag industry. High-quality standard and bespoke tags from Vizinex RFID enable customers to increase tracking, security, and authentication while also saving money and generating new efficiencies. The specialty of Vizinex is providing customized RFID tags that are both fully integrated into and compatible with various product designs.

Data Center RFID Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,489.0 million

Revenue forecast in 2030

USD 5,627.0 million

Growth rate

CAGR of 24.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, hardware, tags, tag frequency, reader, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Alien Technology; AVERY DENNISON CORPORATION; Confidex, Detego; GAO Group; HID Global; Honeywell International Inc.; Impinj, Inc.; MOJIX; Nedap; NXP Semiconductors; SATO Holdings Corporation; Semiconductor Components Industries; LLC; ThingMagic, and Zebra Technologies Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center RFID Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the data center RFID market report based on component, hardware, tags, tag frequency, reader, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Hardware Outlook (Revenue, USD Million, 2018 - 2030)

-

Tags

-

Reader

-

Printer

-

Antenna

-

Others

-

-

Tags Outlook (Revenue, USD Million, 2018 - 2030)

-

Active

-

Passive

-

-

Tag Frequency Outlook (Revenue, USD Million, 2018 - 2030)

-

LHF

-

HF

-

UHF

-

-

Reader Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Handheld

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Asset Tracking and Management

-

IT Asset Management

-

Lifecycle Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center RFID market size was estimated at USD 1,270.3 million in 2023 and is expected to reach USD 1,489.0 million in 2024.

b. The global data center RFID market is expected to grow at a compound annual growth rate of 24.8% from 2024 to 2030 to reach USD 5,627.0 million by 2030.

b. North America dominated the global data center RFID market with a share of 36.57% in 2023, which is attributable to factors such as a high number of data centers, increasing demand for data centers with lower PUE, stringent energy regulations, presence of major data center RFID solution providers, home to major tech companies such as Google, Apple Inc., Microsoft among others.

b. Some key players operating in the global data center RFID market include Alien Technology, AVERY DENNISON CORPORATION, Confidex, Detego, GAO Group, HID Global, Honeywell International Inc., Impinj, Inc., MOJIX, Nedap, NXP Semiconductors, SATO Holdings Corporation, Semiconductor Components Industries, LLC, ThingMagic, and Zebra Technologies Corp.

b. Key factors driving the growth of the global data center RFID market include increasing digitalization, rising e-commerce sales, increasing demand for digital contents, increasing data requirements, among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."