Data Center Physical Security Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Data Center Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-409-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Data Center Physical Security Market Trends

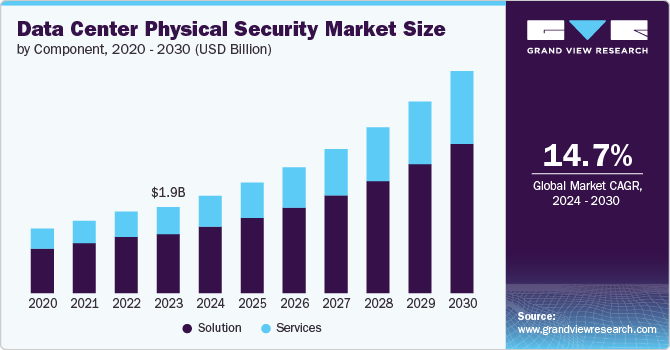

The global data center physical security market size was estimated at USD 1.87 billion in 2023 and is anticipated to grow at a CAGR of 14.7% from 2024 to 2030. The market is primarily driven by the increasing prevalence of data breaches and cyberattacks, necessitating robust security measures to safeguard sensitive information. Regulatory compliance requirements, such as GDPR and HIPAA, mandate stringent security protocols, further propelling the demand for advanced physical security solutions.

Additionally, the rapid expansion of data center infrastructure to accommodate the growing demand for cloud services and big data analytics is a significant driver. Technological advancements in surveillance and access control systems, along with integrated security solutions, are also enhancing the effectiveness and appeal of physical security measures. As a result, organizations are increasingly investing in comprehensive physical security strategies to ensure the protection and resilience of their data centers.

The increasing prevalence of data breaches and cyberattacks significantly drives the data center physical security market by underscoring the critical need for enhanced protective measures. As cyber threats become more sophisticated and frequent, the potential for severe financial and reputational damage rises, prompting organizations to prioritize the security of their data centers.

Robust physical security solutions, including advanced access control systems, video surveillance, and monitoring and detection technologies, are essential to prevent unauthorized access and mitigate risks. These measures ensure the integrity, confidentiality, and availability of sensitive data and critical infrastructure. Consequently, the heightened awareness of these threats compels enterprises to invest heavily in physical security solutions to safeguard their assets and comply with stringent regulatory requirements.

The rapid expansion of data center infrastructure is a crucial driver of the data center physical security market. As the demand for cloud services, big data analytics, and digital transformation initiatives grows, organizations are increasingly investing in developing and expanding data centers to handle the escalating volume of data. This expansion necessitates robust physical security measures to protect these facilities' sensitive information and critical systems.

Modern data centers' increased scale and complexity require advanced access control, video surveillance, and monitoring and detection solutions to ensure comprehensive security coverage. Consequently, the need to secure these more extensive and more complex infrastructures fuels the demand for sophisticated physical security technologies, driving market growth.

Technological advancements in surveillance and access control systems, coupled with integrated security solutions, significantly enhance the effectiveness and appeal of physical security measures. High-definition and IP-based cameras provide superior image quality and remote monitoring capabilities, while advanced biometric access systems offer robust authentication methods, reducing the risk of unauthorized access. Integrated security solutions, which combine video surveillance, access control, and intrusion detection into a cohesive system, streamline security management and improve response times. These innovations increase the reliability and efficiency of physical security and offer scalable and flexible solutions that can adapt to the evolving needs of modern data centers, thereby elevating their overall security posture.

Component Insights

The solution segment accounted for the largest market share, over 68%, in the data center physical security market in 2023. This dominance is attributed to its comprehensive range of products, including advanced access control systems, sophisticated video surveillance technologies, and effective monitoring and detection mechanisms. These solutions are fundamental to ensuring the physical security of data centers and addressing various vulnerabilities and threats. The demand for cutting-edge security technologies, such as biometric access systems and high-definition video surveillance, remains robust as organizations seek to protect their critical infrastructure from unauthorized access and breaches. Consequently, the solutions segment commands a substantial market share due to its essential role in safeguarding data center environments.

The services segment is anticipated to grow at the fastest CAGR from 2024 to 2030. This rapid growth is driven by the increasing complexity of security requirements and the need for specialized expertise in implementing and maintaining advanced security systems. Consulting, system integration, and ongoing maintenance and support are increasingly critical as organizations strive to optimize their security postures. The shift towards comprehensive security strategies that include regular assessments, updates, and managed services is fueling the expansion of the services segment. As data centers evolve and grow in complexity, the demand for professional services to ensure the seamless operation and effectiveness of security solutions is accelerating, making this the fastest-growing segment in the market.

Data Center Size Insights

The large data center segment accounted for the largest market share in 2023. Large data center facilities typically house vast amounts of critical and sensitive data, necessitating comprehensive and advanced security measures. Due to their size and the high value of their assets, large data centers require robust physical security solutions, including sophisticated access control, extensive video surveillance, and comprehensive monitoring and detection systems. The significant investments made by large enterprises and cloud service providers in securing these facilities contribute to the dominance of this segment. As a result, the large data centers segment holds the largest share of the market, driven by the need to protect extensive infrastructure and valuable data assets.

The medium data center segment is anticipated to expand at a compound annual growth rate of over 15% during the forecast period. The expansion of mid-sized enterprises and the increasing adoption of digital transformation initiatives are driving the growth of this segment. Medium data centers are rapidly expanding their capacity to meet the rising demand for data processing and storage. This growth necessitates the implementation of advanced physical security measures to ensure the protection of sensitive data and critical infrastructure. Additionally, the cost-effectiveness and scalability of security solutions tailored to medium data centers appeal to businesses aiming to enhance their security postures. Consequently, the medium data centers segment is experiencing the fastest growth rate in the market.

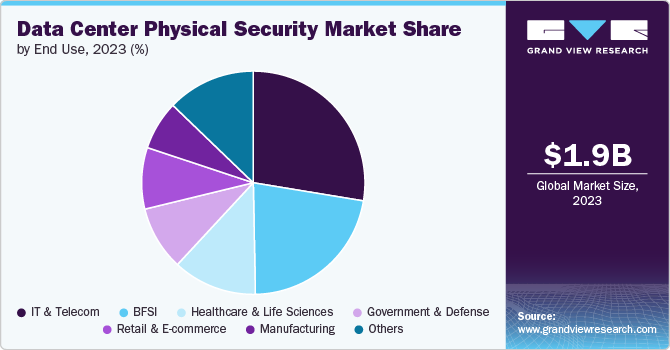

End-use Insights

The IT & telecom segment accounted for the largest revenue share of over 27% in 2023. This dominance is driven by the critical nature of data centers in supporting the core operations of IT and telecommunications companies, which rely heavily on secure, reliable data storage and processing facilities. These organizations manage vast amounts of sensitive and proprietary data, making robust physical security measures imperative to prevent unauthorized access and breaches. The high value and volume of data handled by IT and telecom companies necessitate comprehensive security solutions, including advanced access control, video surveillance, and continuous monitoring systems. As a result, the IT and Telecom sector maintains a significant share of the data center physical security market.

The healthcare segment is anticipated to grow at the highest CAGR from 2024 to 2030. This rapid growth is fueled by the increasing digitalization of healthcare records and the adoption of electronic health records (EHRs), which necessitate stringent security measures to protect sensitive patient information. Regulatory requirements, such as the Health Insurance Portability and Accountability Act (HIPAA), mandate rigorous security protocols to safeguard healthcare data, driving the demand for advanced physical security solutions.

Additionally, the growing use of telemedicine and connected medical devices further amplifies the healthcare sector's need for secure data centers. Consequently, the healthcare segment is experiencing accelerated growth as organizations invest heavily in physical security to ensure the protection and confidentiality of patient data.

Regional Insights

North America held the major share of over 42% of the market in 2023. In North America, the data center physical security market is experiencing robust growth, fueled mainly by the increasing reliance on cloud computing and the expanding digital infrastructure. The region is seeing a surge in adopting advanced security measures such as biometric access controls, integrated surveillance systems, and sophisticated fire suppression technologies. This growth is further supported by heightened awareness of cybersecurity threats and the need for comprehensive physical security to protect sensitive data and critical infrastructure.

U.S. Data Center Physical Security Market Trends

The data center physical security market in the U.S. is expected to grow significantly from 2024 to 2030. The data center physical security market in the U.S. is driven by the proliferation of hyperscale data centers and stringent regulatory requirements. The U.S. market is characterized by significant investments in state-of-the-art security solutions, including advanced intrusion detection systems and automated security management platforms. The emphasis on compliance with regulations and standards is compelling data center operators to enhance their physical security measures to protect valuable data assets and maintain operational integrity.

Europe Data Center Physical Security Market Trends

The Europe data center physical security market is growing significantly at a CAGR of over 13% from 2024 to 2030. The European market is characterized by a strong emphasis on data privacy and compliance with regulations such as the General Data Protection Regulation (GDPR). This regulatory landscape is fostering the adoption of comprehensive physical security measures to safeguard sensitive information, with a notable increase in the deployment of integrated security systems and physical intrusion detection technologies.

Asia Pacific Data Center Physical Security Market Trends

The data center physical security market in Asia Pacific is growing significantly at a CAGR of over 15% from 2024 to 2030. The Asia Pacific region is witnessing rapid expansion in the data center physical security market due to the burgeoning IT infrastructure and the growing number of data centers supporting digital transformation initiatives. Countries like China and India are leading this growth, driven by substantial investments in data center construction and cutting-edge security solutions to mitigate potential risks and ensure operational continuity.

Key Data Center Physical Security Company Insights

Key players operating in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Data Center Physical Security Companies:

The following are the leading companies in the data center physical security market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Axis Communications AB

- Bosch Sicherheitssysteme GmbH

- Cisco Systems, Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Johnson Controls

- Pelco

- Schneider Electric SE

- Siemens AG

Recent Developments

-

In June 2024, Honeywell International Inc. announced the completion of its acquisition of Carrier Global Corporation's Global Access Solutions business for the sum of USD 4.95 billion. This strategic acquisition positions Honeywell as a premier provider of security solutions for the digital age, creating substantial opportunities for accelerated innovation in the rapidly expanding cloud-based services and solutions sector.

-

In May 2024, ASPEED Technology, a provider of immersive 360-degree imaging products, in partnership with its subsidiary company Cupola360 Inc., announced a collaboration with Millitronic and Schneider Electric SE to introduce an industry-first smart panoramic visual remote management solution designed for data centers. This pioneering solution integrates Schneider Electric's data center sensors and gateways with Cupola360's visual AI management platform and immersive panoramic cameras, as well as Millitronic's wireless infrastructure integration.

Data Center Physical Security Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.12 billion |

|

Revenue forecast in 2030 |

USD 4.83 billion |

|

Growth rate |

CAGR of 14.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, data center size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

ABB; Axis Communications AB; Bosch Sicherheitssysteme GmbH; Cisco Systems, Inc.; Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International Inc.; Johnson Controls; Pelco; Schneider Electric SE; Siemens AG. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center Physical Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center physical security market report based on component, data center size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Access Control

-

Video Surveillance

-

Monitoring and Detection

-

Others

-

-

Services

-

Consulting

-

System Integration

-

Maintenance and Support

-

-

-

Data Center Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small Data Centers

-

Medium Data Centers

-

Large Data Centers

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government & Defense

-

IT & Telecom

-

Healthcare & Life Sciences

-

Retail & Ecommerce

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center physical security market size was estimated at USD 1.87 billion in 2023 and is expected to reach USD 2.12 billion in 2024

b. The global data center physical security market is expected to grow at a compound annual growth rate of 14.7% from 2024 to 2030 to reach USD 4.83 billion by 2030

b. North America dominated the data center physical security market with a market share of 42.8% in 2023. In North America, the data center physical security market is experiencing robust growth, fueled mainly by the increasing reliance on cloud computing and the expanding digital infrastructure. The region is seeing a surge in adopting advanced security measures such as biometric access controls, integrated surveillance systems, and sophisticated fire suppression technologies.

b. Some key players operating in the data center physical security market include ABB, Axis Communications AB, Bosch Sicherheitssysteme GmbH, Cisco Systems, Inc., Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Johnson Controls, Pelco, Schneider Electric SE, and Siemens AG.

b. Several key factors are driving the growth of the data center physical security market. The data center physical security market is primarily driven by the increasing prevalence of data breaches and cyberattacks, necessitating robust security measures to safeguard sensitive information. Regulatory compliance requirements, such as GDPR and HIPAA, mandate stringent security protocols, further propelling the demand for advanced physical security solutions. Additionally, the rapid expansion of data center infrastructure to accommodate the growing demand for cloud services and big data analytics is a significant driver.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."