Data Center Market Size, Share, & Trends Analysis Report By Component (Hardware, Software), By Type (On-premise), By Server Rack Density, By Redundancy, By PUE, By Design, By Tier Level, By Enterprise Size, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-116-0

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Data Center Market Size & Trends

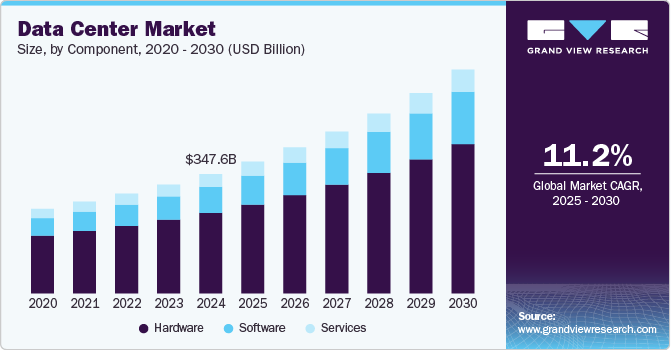

The global data center market size was estimated at USD 347.60 billion in 2024 and is anticipated to grow at a CAGR of 11.2% from 2025 to 2030, driven primarily by the exponential rise in data generation across industries. The rapid adoption of digital transformation initiatives, cloud computing, and emerging technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) have substantially increased data processing and storage requirements. This has necessitated the expansion of data center infrastructure to accommodate the growing demand for scalable and efficient data management solutions.

The increasing reliance on hyperscale and colocation data centers. Hyperscale operators such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are continuously expanding their data center footprints to cater to global enterprises' cloud computing and storage needs leading to growth of the market. Additionally, the demand for colocation services is rising as businesses seek cost-effective alternatives to building and maintaining their own data centers. Colocation facilities offer scalable infrastructure, improved connectivity, and enhanced security, making them attractive for companies seeking to optimize their IT operations.

Moreover, the proliferation of edge computing is significantly contributing to growth on data center industry. As the volume of data generated by IoT devices and real-time applications increases, there is a growing need for low-latency processing. Edge data centers located closer to the source of data generation help reduce latency and improve application performance. This trend is particularly prominent in sectors such as autonomous vehicles, healthcare, and smart cities, where real-time data processing is critical.

Sustainability initiatives are also playing a pivotal role in driving data center market growth. Data center operators are increasingly focusing on energy-efficient solutions, renewable energy integration, and advanced cooling technologies to reduce carbon footprints. Governments and regulatory bodies are encouraging the adoption of green data center practices, further accelerating investments in sustainable infrastructure. In addition, the ongoing advancements in data center technologies, including liquid cooling systems, artificial intelligence-powered management platforms, and modular data center designs, are enhancing operational efficiency and reducing costs. These innovations are attracting enterprises to modernize their data infrastructure, driving further market expansion.

Component Insights

The hardware segment accounted for the largest market share of over 67.0% in 2024 in the data center market. The rapid growth of social media, digital transactions, and the Internet of Things (IoT) has increased the demand for expanded data storage and processing capabilities. This surge necessitates the upgrading of hardware technologies, including CPUs, servers, storage devices, GPUs, and memory, prompting data centers to refresh their hardware installations. Therefore, there is a growing need for optimized hardware solutions to support complex tasks and accelerate model training processes, driving growth in the hardware segment of the market.

The software segment is anticipated to grow at a CAGR of 12.5% during the forecast period. The increasing demand for virtualization and cloud computing is set to drive the growth of the software segment. Advanced software solutions play a crucial role in enhancing data center security with features like robust encryption, intrusion detection, access controls, and continuous monitoring. Additionally, the rise in demand for energy-efficient, green data centers further emphasizes the need for advanced software to optimize operations, monitor cooling systems, and manage power consumption, ensuring sustainable and efficient data center performance.

Hardware Insights

The server segment dominated the market and accounted for the revenue share of over 34.0% in 2024. Modern servers are becoming more powerful and energy-efficient due to the continuous advancements in processor technology, memory, and storage solutions. For example, the integration of ARM-based processors into server designs has been gaining traction, offering a more energy-efficient and cost-effective alternative to traditional x86-based servers.

The Uninterruptible Power Supply (UPS) segment is expected to grow at a significant CAGR over the forecast period. As data processing and storage needs continue to grow, the expansion of data centers and cloud computing capabilities has become essential. The increasing reliance on digital technology, data centers, and cloud services has heightened the demand for sustainable power protection to ensure continuous operations and prevent data loss. In this context, Uninterruptible Power Supply (UPS) systems have become crucial for preventing downtime and data corruption, driving the growing demand in the market.

Software Insights

The virtualization segment dominated the market and accounted for the revenue share of nearly 18.0% in 2024. Virtualization enables data centers to maximize the use of physical hardware by running multiple virtual machines (VMs) on a single physical server. This consolidation reduces hardware maintenance and procurement costs. Additionally, virtualization enables efficient resource management, allowing IT administrators to dynamically allocate CPU, memory, and storage to VMs based on demand. This flexibility not only enhances overall performance but also improves the management of resources, optimizing the efficiency of data center operations.

The DCIM segment is expected to grow at a significant CAGR over the forecast period. The need for real-time monitoring and predictive maintenance is significant driver for the DCIM segment. As data centers become more mission-critical, ensuring up time and preventing failures is paramount. DCIM solutions provide real-time alerts and monitoring of critical infrastructure components, such as power systems, cooling units, and network devices, helping operators identify potential issues before they lead to system failures or downtime

Services Insights

The professional services segment dominated the market and accounted for the revenue share of nearly 49.0% in 2024. Traditional data centers are increasingly struggling to accommodate the rising demands of modern workloads. As a result, professional services are essential for upgrading, designing, and implementing solutions that improve data center performance, capacity, and efficiency. Organizations' growing reliance on digital operations and infrastructure for the construction, design, and commissioning of new data centers is driving the demand for these professional services.

The support services segment is expected to grow at a significant CAGR over the forecast period. Support services play a crucial role in helping organizations implement, design, and maintain data centers that can meet the demands of modern operations. As data centers become more complex due to the integration of advanced hardware, networking, software, and storage components, these services are essential for optimizing and managing these tasks efficiently. This growing complexity is driving the increasing demand for support services in the market.

Type Insights

The on-premises segment dominated the market and accounted for the revenue share of over 39.0% in 2024, driven bythe increasing focus on data security and privacy. Many organizations, particularly in regulated industries such as finance, healthcare, and government, prefer to maintain complete control over their data to ensure compliance with stringent data protection laws and industry standards. By managing their own data centers, these organizations can implement tailored security protocols and ensure their data is stored and processed in-house, minimizing exposure to external threats.

The hyperscale segment is expected to grow at a significant CAGR over the forecast period, driven the increasing demand for cloud services. Major cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are heavily investing in building and upgrading large-scale data centers to support the growing need for cloud storage, computing power, and data processing capabilities. This surge in cloud adoption by businesses of all sizes, particularly with the rise of remote work and digital transformation, has significantly boosted the demand for hyperscale facilities.

Server Rack Density Insights

The <10kW segment dominated the market and accounted for the revenue share of over 36.0% in 2024. Businesses looking for on-premise or colocation-based infrastructure solutions prefer lower-density racks due to their affordability and ease of management. Lower-density server racks consume less power and generate less heat, reducing the need for expensive cooling solutions. Colocation providers also benefit from offering <10kW racks as they cater to a broader range of customers, from startups to enterprises with moderate computing requirements.

The 20-29kW segment is expected to grow at a significant CAGR over the forecast period, driven by the increasing demand for mid-to-large-scale IT infrastructure that can handle more significant workloads without requiring the extensive resources of hyperscale facilities. One of the main growth drivers for this segment is the demand from businesses and organizations that are scaling up their digital transformation initiatives. As companies expand their digital capabilities, they require more robust data processing, storage, and computing power to support growing customer bases, more complex data analytics, and the implementation of technologies like artificial intelligence, machine learning, and big data analytics.

Redundancy Insights

The N+1 segment dominated the market and accounted for the revenue share of nearly 70.0% in 2024 due to the increasing need for reliability and uptime in data center operations. As businesses rely more heavily on data-driven technologies and digital transformation, the demand for 24/7 availability of critical applications and services is growing. Any downtime, even for short periods, can result in significant financial losses and damage to reputation.

The N+2 segment is expected to grow at a significant CAGR over the forecast period due to the growing need for more robust disaster recovery and business continuity capabilities. Industries such as finance, healthcare, government, and telecommunications, which rely on continuous access to critical data and applications, are increasingly demanding data center infrastructures that can guarantee near-zero downtime. In these industries, even brief service interruptions can lead to significant financial losses, regulatory penalties, or damage to reputation.

PUE Insights

The 1.2-1.5 segment dominated the market and accounted for the revenue share of over 47.0% in 2024, driven by the gradual adoption of advanced cooling and power systems that are energy-efficient but not necessarily cutting-edge. Technologies such as hot and cold aisle containment, in-row cooling, and efficient HVAC (heating, ventilation, and air conditioning) systems can all help lower energy consumption for cooling while still maintaining a balance between efficiency and cost.

The less than 1.2 segment is expected to grow at a significant CAGR over the forecast period. As climate change concerns and environmental regulations intensify, businesses and organizations are increasingly focused on reducing their carbon footprint. Data centers are among the largest consumers of energy in the IT ecosystem, and lowering PUE is one of the most effective ways to minimize energy consumption and reduce greenhouse gas emissions.

Design Insights

The traditional segment dominated the market and accounted for the revenue share of over 75.0% in 2024. Traditional data center designs typically have lower upfront capital expenditures compared to newer, more advanced designs such as modular, containerized, or hyper-scale facilities. For small to medium-sized businesses or organizations that do not have large-scale IT needs, traditional data centers offer a more budget-friendly option for maintaining their operations. These facilities are often designed with a focus on maximizing available space and basic operational requirements, making them appealing to organizations looking for a relatively low-cost and straightforward infrastructure solution

The modular segment is expected to grow at a significant CAGR over the forecast period. As businesses and cloud service providers expand their digital operations, the demand for data center capacity is growing rapidly. Modular designs offer a significant advantage because they allow for incremental expansion. Rather than investing in a large, fixed facility, businesses can deploy smaller modules that can be added or removed based on demand, reducing the risk of over-investment or underutilization. This scalability is important for organizations experiencing rapid growth or those operating in dynamic industries where demand can fluctuate.

Tier Level Insights

The tier 3 segment dominated the market and accounted for the revenue share of over 58.0% in 2024, driven by the rise of edge computing. Edge computing requires a distributed network of data centers located closer to end users, ensuring faster processing and lower latency. Many edge data centers are designed to meet Tier 3 standards, as they require high availability and redundancy to support real-time applications, such as IoT, autonomous vehicles, and smart cities.

The tier 4 segment is expected to grow at a significant CAGR over the forecast period. Digital transformation and the increasing reliance on big data and real-time analytics are driving the need for Tier 4 data centers. With businesses increasingly using data-driven insights to guide decision-making, applications requiring high-performance computing and large-scale data processing cannot afford any disruptions.

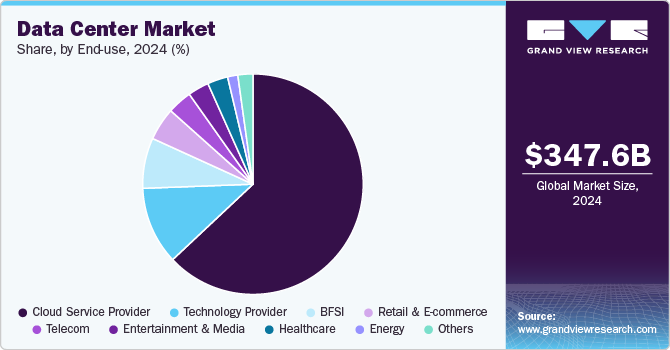

End Use Insights

The cloud service provider segment dominated the market and accounted for the revenue share of over 63.0% in 2024. The increasing demand for high-performance computing (HPC) and big data processing is significant growth driver for the cloud service provider (CSP) end-use segment. Cloud service providers are increasingly offering specialized services such as AI, machine learning (ML), and big data analytics to help businesses process and analyze large volumes of data. These services require data centers with advanced infrastructure capable of handling high workloads and providing low-latency processing.

The technology provider segment is expected to grow at a significant CAGR over the forecast period, driven the increasing demand for cloud-based solutions. As more businesses shift to cloud computing, technology providers need robust data center infrastructure to host applications and services that support digital transformation. Whether it is providing software-as-a-service (SaaS), platform-as-a-service (PaaS), or infrastructure-as-a-service (IaaS) offerings, technology providers rely on data centers to deliver reliable, scalable, and cost-effective cloud services.

Enterprise Size Insights

The large enterprise segment dominated the market and accounted for the revenue share of over 83.0% in 2024. The growth of hybrid and multi-cloud environments is influencing the data center requirements of large enterprises. Many large organizations adopt hybrid or multi-cloud strategies, where they use a combination of private data centers and public cloud services from providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Therefore, large enterprises are looking for data center providers that can seamlessly integrate with cloud platforms, support hybrid infrastructure, and offer the flexibility to shift workloads between on-premises data centers and cloud environments.

The small & medium enterprises segment is expected to grow at a significant CAGR over the forecast period. Local and regional data center options are particularly important for SMEs that need to comply with data sovereignty regulations or require low-latency services. Many SMEs operate within specific geographic regions and need data centers that can meet local regulatory requirements and provide high-speed access to customers. Regional data centers are often more affordable and accessible for SMEs than larger, global data center facilities.

Regional Insights

The data center market in North America held a significant share of over 40.0% in 2024, driven by the increasing adoption of cloud computing, artificial intelligence (AI), and big data analytics. Enterprises across the region are rapidly transitioning to hybrid and multi-cloud environments to enhance operational efficiency and scalability. Major cloud service providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, are significantly expanding their data center footprints to meet the growing demand for data storage and processing.

U.S. Data Center Market Trends

The data center market in the U.S. is expected to grow significantly at a CAGR of 10.7% from 2025 to 2030 due to the rapid adoption of cloud computing, artificial intelligence (AI), and big data analytics. Hyperscale cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are expanding their data center footprints to meet rising demands for cloud storage and processing.

Europe Data Center Market Trends

The data center market in Europe is anticipated to register a considerable growth from 2025 to 2030. The demand for cloud-based solutions, remote working environments, and AI-powered applications is contributing to the need for reliable data storage and processing. Countries such as the Netherlands, Ireland, and Denmark are emerging as data center hubs due to favorable tax policies, robust connectivity, and renewable energy availability. Additionally, stringent data protection regulations such as the General Data Protection Regulation (GDPR) are encouraging companies to build regional data centers for compliance purposes.

The Germany data center market held a substantial market share in 2024. The increasing demand for edge computing solutions to support Industry 4.0 initiatives and real-time data processing in sectors like automotive, manufacturing, and logistics is driving market growth. The emphasis on sustainability is also notable, with operators investing in renewable energy sources to reduce carbon emissions.

Asia Pacific Data Center Market Trends

Asia Pacific is expected to register the highest CAGR of 13.3% from 2025 to 2030, due to the accelerated adoption of cloud computing, e-commerce expansion, and digital transformation across industries. Countries such as China, Japan, India, and Singapore are leading the market with substantial investments in hyperscale and colocation data centers. The proliferation of 5G technology and IoT devices is driving demand for edge data centers to ensure low latency and seamless connectivity.

The Japan data center market is expected to grow rapidly in the coming years, driven by the increasing adoption of cloud services, AI applications, and digital business solutions. Major global cloud providers, along with domestic players such as NTT Communications and KDDI, are investing in expanding their data center infrastructure. The country’s advanced 5G network and extensive fiber-optic connectivity further enhance its appeal as a data center hub.

The China data center market held a substantial market share in 2024, driven by the rapid expansion of cloud services, e-commerce, and digital payment systems. Leading Chinese tech giants such as Alibaba, Tencent, and Huawei are heavily investing in hyperscale data centers to support their cloud platforms and AI-driven applications. The Chinese government’s emphasis on data sovereignty and strict regulations mandating local data storage are further driving the construction of regional data centers.

Key Data Center Company Insights

Key players operating in the data center industry are Amazon Web Services (AWS), Inc. Microsoft, Google Cloud, Alibaba Cloud, and Equinix, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2025, Alibaba Cloud, the digital technology arm of Alibaba Group, opened its second data center in Thailand to meet the growing demand for cloud computing services, particularly for generative AI applications. The new facility enhances local capacity and aligns with the Thai government's efforts to promote digital innovation and sustainable technology. Offering a range of services including elastic computing, storage, databases, security, networking, data analytics, and AI solutions, the data center aims to address industry-specific challenges.

-

In December 2024, Amazon Web Services (AWS) introduced redesigned data center infrastructure to accommodate the growing demands of artificial intelligence (AI) and sustainability. The updates features advancements in liquid cooling, power distribution, and rack design, enabling a sixfold increase in rack power density over the next two years. AWS stated that these enhancements aims to deliver a 12% boost in compute power per site, improve energy efficiency, and enhance system availability.

-

In May 2024, Equinix, Inc. launched its first two data centers in Malaysia, with the International Business Exchange (IBX) facilities now operational in Johor and Kuala Lumpur. The facilities are intended to cater to Equinix Inc.'s customers in Malaysia while enhancing regional connectivity.

Key Data Center Companies:

The following are the leading companies in the data center market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Cloud

- Amazon Web Services, Inc.

- AT&T Intellectual Property

- Lumen Technologies (CenturyLink)

- China Telecom Americas, Inc.

- CoreSite

- CyrusOne

- Digital Realty

- Equinix, Inc.

- Google Cloud

- IBM Corporation

- Microsoft

- NTT Communications Corporation

- Oracle

- Tencent Cloud

Data Center Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 383.82 billion |

|

Revenue forecast in 2030 |

USD 652.01 billion |

|

Growth Rate |

CAGR of 11.2% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report vertical |

Revenue forecast, company share, competitive landscape, growth factors, trends |

|

Segments covered |

Component, Type, Server Rack Density, Redundancy, PUE, Design, Tier Level, Enterprise Size, End Use, Region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

ABB, Acer Inc.; Ascenty, Cisco Systems, Inc.; Dell Inc.; Equinix, Inc.; Fujitsu; Gensler; Hewlett Packard Enterprise Development LP; Hitachi, Ltd.; HostDime Global Corp.; Huawei Technologies Co., Ltd.; IBM; INSPUR Co., Ltd.; IPXON Networks; KIO; Lenovo; Oracle; Schneider Electric; Vertiv Group Corp. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the data center construction market report based on component, type, server rack density, redundancy, PUE, design, tier level, enterprise size, end use, and region.

-

Component Outlook (Revenue; USD Billion; 2018 - 2030)

-

Hardware

-

Servers

-

Enterprise network equipment

-

PDU

-

UPS

-

-

Software

-

DCIM

-

Virtualization

-

Others

-

-

Services

-

Managed Infrastructure Services

-

Hosting Services

-

Support Services

-

Professional services

-

-

-

Type Outlook (Revenue; USD Billion; 2018 - 2030)

-

On-premise

-

hyperscale

-

HPC

-

Colocation

-

Edge

-

-

Server Rack Density Outlook (Revenue; USD Billion; 2018 - 2030)

-

<10kW

-

10-19kW

-

20-29kW

-

30-39kW

-

40-49kW

-

>50kW

-

-

Data Center Redundancy Outlook (Revenue; USD Billion; 2018 - 2030)

-

N+1

-

2N

-

N+2

-

N

-

-

PUE Outlook (Revenue; USD Billion; 2018 - 2030)

-

Less than 1.2

-

1.2 - 1.5

-

1.5 - 2.0

-

Greater than 2.0

-

-

Design Outlook (Revenue; USD Billion; 2018 - 2030)

-

Traditional

-

Containerized

-

Modular

-

-

Tier Level Outlook (Revenue; USD Billion; 2018 - 2030)

-

Tier 1

-

Tier 2

-

Tier 3

-

Tier 4

-

-

Enterprise Size Outlook (Revenue; USD Billion; 2018 - 2030)

-

Large Enterprise

-

Small & Medium enterprises

-

-

End-use Outlook (Revenue; USD Billion; 2018 - 2030)

-

Cloud Service Provider

-

Technology Provider

-

Telecom

-

Healthcare

-

BFSI

-

Retail & E-commerce

-

Entertainment & Media

-

Energy

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center market size was estimated at USD 347.60 billion in 2024 and is expected to reach USD 383.82 billion in 2025.

b. The global data center market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2030 to reach USD 652.01 billion by 2030.

b. North America dominated the data center market with a share of over 40.0% in 2024, driven by the increasing adoption of cloud computing, artificial intelligence (AI), and big data analytics. Enterprises across the region are rapidly transitioning to hybrid and multi-cloud environments to enhance operational efficiency and scalability.

b. Some key players operating in the data center market include Alibaba Cloud, Amazon Web Services, Inc., AT&T Intellectual Property, Lumen Technologies (CenturyLink), China Telecom Americas, Inc., CoreSite, CyrusOne, Digital Realty, Equinix, Inc., Google Cloud, IBM Corporation, Microsoft, NTT Communications Corporation, Oracle, Tencent Cloud

b. Key factors driving the growth of the data center market include the rapid adoption of digital transformation initiatives, cloud computing, and emerging technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), which have substantially increased data processing and storage requirements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."