Data Center Infrastructure Management Market Size, Share, & Trends Analysis Report By Component, By Data Center, By Deployment, By Enterprise Size, By Application, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-011-2

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

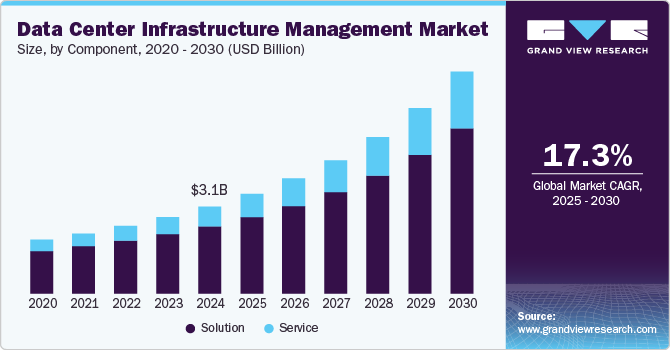

The data center infrastructure management market size was estimated at USD 3.06 billion in 2024 and is anticipated to grow at a CAGR of 17.3% from 2025 to 2030. The complexity of managing IT infrastructure has grown with businesses increasingly migrating to cloud-based solutions, particularly in hybrid and multicloud environments. This shift has created an increasing demand for effective data center management to ensure optimal performance and efficiency. Data center infrastructure management (DCIM) solutions play a crucial role in this context by providing tools to oversee and integrate various cloud and on-premises resources.

The exponential growth in digital data, fueled by trends such as cloud computing, big data analytics, artificial intelligence (AI), and the Internet of Things (IoT), is driving the demand for more data centers. Organizations across industries, from financial services to healthcare, are expanding their data storage and processing capabilities. As data centers grow in scale and complexity, there is a pressing need for solutions such as DCIM that provide real-time monitoring, infrastructure visibility, and better management of IT and facilities assets. DCIM plays a key role in ensuring uptime, scalability, and efficiency, all of which are crucial as digital transformation continues to accelerate globally.

Modern data centers are no longer simple server rooms but vast facilities filled with complex networks of servers, storage devices, cooling systems, and security layers. Managing these resources effectively requires continuous monitoring and coordination across different systems. DCIM provides a unified interface for managing both IT and facility infrastructures, which are traditionally managed in silos. This integration enables data center operators to optimize equipment performance, improve capacity planning, and prevent issues before they occur, all of which are crucial for maintaining uptime in complex, mission-critical environments.

The rise of edge computing, where data is processed closer to the source rather than in centralized data centers, is driving demand for DCIM solutions. Edge data centers are typically smaller and more distributed but need the same level of monitoring and control as larger facilities. Managing multiple, smaller data centers across different locations requires DCIM platforms that can handle decentralized infrastructure. These tools enable seamless monitoring of performance, power, and cooling across different sites, ensuring that edge facilities run as efficiently as central data centers. The expansion of edge computing makes DCIM essential for companies scaling their IT operations.

Component Insights

The solution segment accounted for the largest revenue share of over 77.0% in 2024. As organizations adopt hybrid and multi-cloud strategies, the complexity of managing infrastructure increases. DCIM solutions offer tools for managing these diverse environments by providing unified dashboards that give operators visibility into both cloud and on-premises infrastructure. This cross-environment view allows organizations to balance workloads more efficiently, monitor resource utilization, and avoid over-provisioning. With the growth of cloud adoption, the need for integrated DCIM solutions is becoming more pronounced.

The service segment is expected to grow at a CAGR of 19.4% over the forecast period. As the complexity of data centers grows, many organizations are opting for managed services to oversee the installation, monitoring, and maintenance of their DCIM platforms. Managed service providers (MSPs) offer expertise in optimizing the performance of data centers, allowing companies to focus on their core business activities. The outsourcing trend is driven by a shortage of skilled professionals and the need for continuous 24/7 monitoring, especially in large and complex data center environments. Managed DCIM services help companies ensure operational efficiency, improve uptime, and reduce the risk of system failures.

Data Center Insights

The enterprise data center segment accounted for the largest revenue share of over 32.0% in 2024. As organizations generate and process vast amounts of data from diverse sources, the infrastructure required to manage this data becomes more intricate. Enterprise data centers handle large-scale data storage, processing, and analysis, all while maintaining high performance and reliability.

The cloud and edge data center segment is expected to grow at a significant CAGR over the forecast period. As cloud and edge data centers grow in terms of complexity and scale, DCIM solutions are expected to play a potent role in optimizing resource utilization and enhancing operational efficiency. Resource optimization involves the efficient allocation of computing, storage, and network resources to maximize performance and minimize wastage, which is crucial in the wake of the intricate nature of modern data center environments.

Deployment Insights

The on-premises segment accounted for the largest revenue share of over 52.0% in 2024. With on-premises deployment, companies have the flexibility to tailor the DCIM software to align with their specific operational requirements, such as configuring the system to meet particular performance standards, integrating it with existing tools, or adapting it to fit their internal processes.

The cloud segment is expected to grow at a significant CAGR over the forecast period. The global shift towards cloud-based services is one of the primary drivers for the growth of the cloud deployment segment in the DCIM market. Enterprises are migrating their workloads to public, private, and hybrid clouds to leverage scalability, flexibility, and cost-efficiency. As these cloud environments grow, DCIM solutions are needed to monitor and manage the infrastructure that supports these cloud platforms, ensuring optimal performance, resource allocation, and uptime.

Enterprise Size Insights

The large enterprise segment accounted for the largest revenue share of over 69.0% in 2024. Large enterprises operate extensive and complex IT infrastructures that span multiple data centers, often located in different regions. Managing this vast network of systems, applications, and hardware requires advanced DCIM solutions. DCIM solutions help monitor performance, manage capacity, and optimize resource allocation across diverse locations, allowing large enterprises to streamline operations, reduce downtime, and improve overall data center performance.

The SMEs segment is expected to grow at a significant CAGR over the forecast period. DCIM solutions help SMEs optimize their data center resources by providing insights into power consumption, equipment utilization, and cooling efficiency. It helps avoid over-provisioning, reduce unnecessary operational costs, and extend the life of their equipment. The ability to monitor and control energy usage is particularly important for SMEs seeking to lower overhead while maintaining reliable IT infrastructure. DCIM tools can significantly reduce operational expenses, allowing SMEs to allocate their resources more effectively.

Application Insights

The asset management segment accounted for the largest revenue share of 30.0% in 2024. As organizations embrace automation and digital transformation, there is an increasing need for advanced tools to streamline asset management processes. DCIM solutions offer automation features like asset tracking, inventory management, and maintenance scheduling, which reduce manual effort and enhance accuracy in managing data center assets.

The BI and analysis segment is expected to grow at a significant CAGR over the forecast period. Advanced BI and analytics tools in DCIM platforms are increasingly integrating artificial intelligence (AI) and machine learning (ML) capabilities. This integration allows businesses to automate many aspects of data center management, including anomaly detection, fault prediction, and workload optimization. AI-powered analytics help businesses predict future resource demands, adjust cooling or power distribution, and fine-tune performance based on data patterns. This level of automation improves operational efficiency and also reduces human intervention, making data center management more streamlined and cost-effective.

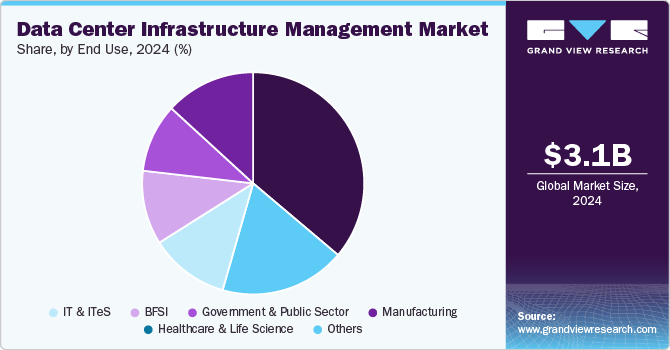

End Use Insights

The IT and ITeS segment accounted for the largest revenue share of over 36.0% in 2024. As IT and ITeS companies expand their offerings of cloud-based solutions, they face the challenge of managing increasingly complex infrastructure environments that often include a mix of private, public, and multicloud setups. To address this complexity, they need advanced DCIM tools. DCIM solutions provide critical functionalities such as monitoring, capacity planning, and resource optimization, which are essential for maintaining the reliability and efficiency of cloud services.

The government and public sector segment is expected to grow at a significant CAGR over the forecast period. The government sector is a frequent target of cyberattacks, given the sensitive nature of the data they handle. DCIM solutions play a crucial role in augmenting data security by offering continuous monitoring of data center environments, identifying vulnerabilities, and ensuring compliance with stringent security standards. Additionally, DCIM tools provide real-time insights into any anomalies, unauthorized access attempts, or operational disruptions, helping government agencies maintain robust security protocols.

Regional Insights

The data center infrastructure management market in North America held a share of over 40.0% in 2024, driven by the rising demand for scalable data centers across various industries. The volume of data generated and processed has expanded significantly as businesses increasingly rely on digital technologies. Industries such as healthcare, finance, e-commerce, telecommunications, and entertainment are now handling vast amounts of information, prompting the need for robust and flexible data storage solutions.

U.S. Data Center Infrastructure Management Trends

The data center infrastructure management market in the U.S. is expected to grow significantly at a CAGR of 17.2% from 2025 to 2030. The exponential growth of data, fueled by the rapid adoption of cloud computing, IoT devices, and Artificial Intelligence (AI), compelled organizations to expand their data center capacities. DCIM solutions help data centers manage this growing demand by optimizing resource allocation, monitoring infrastructure health, and enhancing overall efficiency.

Europe Data Center Infrastructure Management Trends

The data center infrastructure management market in Europe is growing with a significant CAGR from 2025 to 2030. Sustainability is a significant concern in Europe, and data centers are obliged to minimize their environmental impact. The European Union's stringent environmental regulations and energy efficiency directives have made energy management and carbon footprint reduction critical for data centers. DCIM solutions play a vital role in addressing these challenges by optimizing power usage, cooling systems, and overall resource management.

The UK data center infrastructure management market is expected to grow rapidly in the coming years. The UK is witnessing a transition toward cloud services and hybrid IT infrastructures as businesses seek scalability and flexibility in their IT environments. Cloud service providers are expanding their data centers to cater to increasing cloud storage and computing needs. The need to manage these complex environments spanning both on-premises and cloud platforms boosts the demand for DCIM solutions to optimize resource utilization and monitor infrastructure performance in real time.

The data center infrastructure management market in Germany held a substantial market share in 2024. Germany is experiencing increased demand for managing decentralized data center infrastructures with the advent of edge computing and Internet of Things (IoT) applications. DCIM solutions are being implemented to ensure smooth operations across these distributed environments. Germany's growing adoption of Industry 4.0 initiatives and smart manufacturing is driving the need for edge data centers, where DCIM tools play a critical role in maintaining operational efficiency, monitoring equipment health, and preventing downtime.

Asia Pacific Data Center Infrastructure Management Trends

Asia Pacific is growing significantly at a CAGR of 19.4% from 2025 to 2030. Government initiatives and investments in digital infrastructure across various Asia Pacific countries contribute to the DCIM market's expansion. Governments are increasingly focusing on developing smart cities and enhancing digital connectivity, which involves building and upgrading data centers to support these advanced technological frameworks. This has led to an increased adoption of DCIM solutions to ensure these data centers are managed effectively, reducing operational costs and improving overall efficiency.

The Japan data center infrastructure management market is expected to grow rapidly in the coming years. Japan's focus on energy efficiency and sustainability is propelling the DCIM market forward. Data centers are obliged to optimize their energy consumption and reduce their carbon footprint amidst stringent regulations and growing awareness about environmental impact.

The China data center infrastructure management market held a substantial market share in 2024. China DCIM market has experienced robust growth in recent years, driven by several key factors. The accelerated digital transformation across various sectors in China is a significant growth driver of the DCIM market. Businesses and government entities are increasingly adopting digital technologies, and the demand for efficient and scalable data center solutions has surged. This digital transformation includes the widespread adoption of cloud computing, big data analytics, and Internet of Things (IoT) applications, all of which necessitate advanced data center infrastructure to support their operations and data storage needs.

Key Data Center Infrastructure Management Company Insights

Some of the key companies in the market include ABB, Cisco Systems, Inc., Device42, Inc., IBM, Schneider Electric, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

In June 2024, Cisco Systems, Inc. introduced Nexus HyperFabric AI Clusters in collaboration with NVIDIA, a multinational corporation and technology company based in the U.S., for a new data center infrastructure solution designed to streamline the deployment of generative AI applications. The innovative solution integrated Cisco Systems, Inc.’s and NVIDIA’s technologies to simplify the setup and management of AI infrastructure, offering comprehensive IT visibility and analytics. Nexus HyperFabric AI Clusters enable enterprise customers to deploy and manage generative AI models and applications without requiring extensive IT expertise. The platform provides exclusive cloud management features that facilitate the design, deployment, monitoring, and assurance of AI pods and data center workloads from a single interface. It supports large-scale fabric deployment across data centers, colocation facilities, and edge sites, ensuring efficient and scalable AI infrastructure management.

-

In March 2024, Schneider Electric collaborated with NVIDIA, a technology company based in the U.S., to improve data center infrastructure and advance edge AI and digital twin technologies. Schneider Electric is expected to leverage NVIDIA's cutting-edge AI technologies to create AI data center reference designs that can potentially establish new standards for AI deployment and operations in data center environments.

Key Data Center Infrastructure Management Companies:

The following are the leading companies in the data center infrastructure management market. These companies collectively hold the largest market share and dictate industry trends:

- ABB

- Cisco Systems, Inc.

- Device42, Inc.

- Eaton

- FNT GmbH

- Huawei Technologies Co., Ltd

- IBM

- Schneider Electric

- Siemens

- Sunbird Inc.

Data Center Infrastructure Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.50 billion |

|

Revenue forecast in 2030 |

USD 7.79 billion |

|

Growth rate |

CAGR of 17.3% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report component |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, data center, deployment, enterprise size, application, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Kingdom of Saudi Arabia, and South Africa |

|

Key companies profiled |

ABB; Cisco Systems, Inc.; Device42, Inc.; Eaton; FNT GmbH; Huawei Technologies Co., Ltd; IBM; Schneider Electric; Siemens; Sunbird Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center Infrastructure Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the data center infrastructure management market report based on component, data center, deployment, enterprise size, application, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Service

-

-

Data Center Outlook (Revenue, USD Billion, 2018 - 2030)

-

Enterprise Data Center

-

Managed Data Center

-

Colocation Edge Data Center

-

Cloud and Edge Data Center

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-Premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asset Management

-

Capacity Management

-

Power Monitoring

-

Environmental Monitoring

-

BI and Analysis

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT and Telecommunications

-

BFSI

-

Healthcare

-

Retail and E-commerce

-

Aerospace & Defense

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center infrastructure management market size was estimated at 3.06 billion in 2024 and is expected to reach USD 3.50 billion in 2025.

b. The global data center infrastructure management market is expected to grow at a compound annual growth rate of 17.3% from 2025 to 2030 to reach USD 7.79 billion by 2030.

b. The data center infrastructure management market in North America held a share of over 40.0% in 2024, driven by the rising demand for scalable data centers across various industries. The volume of data generated and processed has expanded significantly as businesses increasingly rely on digital technologies.

b. Some key players operating in the data center infrastructure management market include ABB, Cisco Systems, Inc., Device42, Inc., Eaton, FNT GmbH, Huawei Technologies Co., Ltd, IBM, Schneider Electric, Siemens, and Sunbird Inc.

b. Key factors driving the market growth include the complexity of managing IT infrastructure, which has grown as businesses increasingly migrate to cloud-based solutions, particularly in hybrid and multi-cloud environments. This shift has increased the demand for effective data center management to ensure optimal performance and efficiency.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."