Data Center GPU Market Size, Share & Trends Analysis Report By Deployment (On-premises, Cloud), By Function, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-450-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Data Center GPU Market Size & Trends

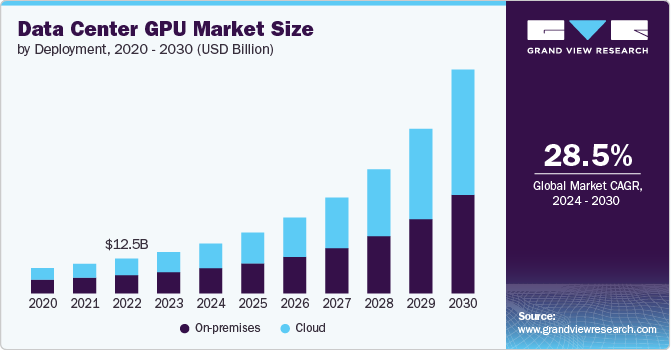

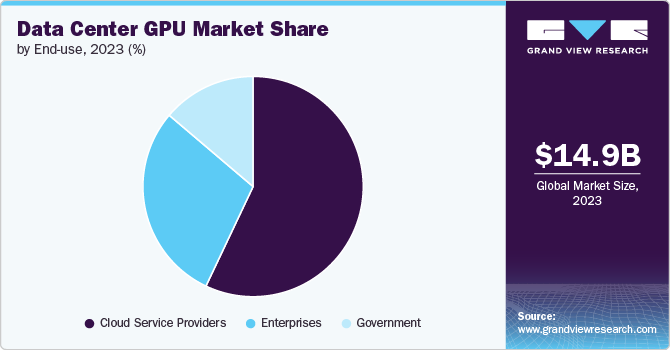

The global data center GPU market size was estimated at USD 14.87 billion in 2023 and is projected to grow at a CAGR of 28.5% from 2024 to 2030. The market has been experiencing significant growth, driven by the increasing demand for advanced computing power across various sectors. A key trend is the widespread adoption of artificial intelligence (AI), machine learning (ML), and deep learning applications, which require powerful GPUs to handle complex computations efficiently.

Data centers are investing in GPUs to optimize AI workloads, particularly in sectors such as healthcare, finance, and autonomous driving, where real-time data processing is critical. This trend is further amplified by advancements in high-performance computing (HPC), driving the need for scalable and efficient GPU solutions.

One of the main factors driving the market growth is the surge in cloud computing services. Leading cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are leveraging GPU-powered infrastructures to enhance their service offerings. The increasing shift toward hybrid cloud and multi-cloud environments is also spurring demand for GPU-enabled data centers, allowing enterprises to scale their operations while optimizing performance. Furthermore, the rise of 5G and edge computing is intensifying the demand for GPUs in edge data centers, enabling faster processing of data closer to the source.

The growing opportunity in the market lies in the gaming and entertainment industry, which is witnessing a surge in demand for cloud gaming and virtual reality (VR) experiences. As these industries require high-performance graphical processing, data centers are increasingly adopting GPUs to deliver low-latency gaming and immersive entertainment experiences. In addition, the rise of metaverse applications, which rely heavily on GPU acceleration, is expected to further drive demand in this segment, creating new avenues for growth in the coming years.

The global supply chain dynamics play a crucial role in shaping the market. The shortage of semiconductors and geopolitical tensions surrounding technology trade are influencing the availability and pricing of GPUs. However, companies are increasingly localizing their supply chains and investing in chip manufacturing capacity, which presents long-term opportunities for market stabilization. In addition, as more countries invest in their own data center infrastructures to support digital transformation, the demand for GPUs is set to rise, fostering global market expansion.

Deployment Insights

Based on deployment, the on premise segment led the market with the largest revenue share of 51.6% in 2023. The increasing demand for high-performance computing (HPC) within industries such as defense, finance, and healthcare, is driving the demand for on premise deployments in global market. Many organizations in these sectors prefer on-premise deployment to maintain direct control over their data and mitigate security risks, especially when dealing with sensitive or proprietary information. For example, financial institutions dealing with real-time analytics and algorithmic trading heavily rely on on-premise GPUs to ensure ultra-low latency and secure transaction processing. This has led to steady investments in GPU-powered private data centers that can handle the heavy computational requirements of AI and deep learning applications.

The cloud segment is expected to grow at a significant CAGR during the forecast period. In the cloud segment, the ongoing migration toward cloud-native applications and AI-as-a-service (AIaaS) is a major driver of GPU adoption. Cloud providers like AWS, Microsoft Azure, and Google Cloud are heavily investing in GPU infrastructure to meet the growing demand for AI and machine learning services offered through the cloud. This shift allows businesses to leverage high-performance GPU capabilities without having to invest in expensive in-house infrastructure. The pay-as-you-go model of cloud services provides an attractive solution for SMEs and startups looking to access cutting-edge AI technology with minimal upfront investment, further accelerating the growth of the cloud segment.

Function Insights

Based on service provider, the inference segment led the market with the largest revenue share of 54.6% in 2023. The inference segment is gaining momentum as enterprises seek real-time decision-making capabilities from their AI models. Once trained, AI models require efficient inference engines to deliver results rapidly in live applications, such as chatbots, recommendation engines, and autonomous systems. GPUs, with their parallel processing capabilities, are ideally suited to power these inference workloads, especially as edge computing and IoT devices proliferate across industries. A key trend driving growth in this segment is the increasing implementation of AI at the edge, where real-time data processing is critical. This presents significant opportunities for GPU manufacturers to deliver compact, high-performance inference solutions tailored for edge environments.

The training segment is expected to grow at a significant CAGR over the forecast period. The training segment of the global market is gaining traction due to the increasing demand for deep learning models and complex AI training processes. Training AI models requires immense computational resources, and GPUs are uniquely suited for these tasks due to their ability to process parallel computations efficiently. Key trends include the growing use of transformer models in natural language processing and advancements in reinforcement learning for autonomous systems. These developments are accelerating the adoption of GPUs in data centers specifically designed for training tasks, with industries such as healthcare, autonomous driving, and e-commerce pushing the demand for advanced AI models that rely on extensive training datasets.

End-use Insights

Based on end use, the cloud service providers segment led the market with the largest revenue share of 57.1% in 2023. In the cloud service providers (CSPs) segment of the market, a key trend driving growth is the increasing demand for AI and machine learning workloads. As cloud services evolve, major CSPs like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are offering GPU-accelerated services to meet the computational needs of AI-driven applications. These GPUs enable faster data processing and deep learning capabilities, which are crucial for industries ranging from healthcare to finance. As enterprises continue to embrace cloud-based AI models to enhance decision-making and automate processes, the demand for GPU-powered data centers is accelerating.

The government segment is expected to grow at a significant CAGR during the forecast period. In the Government segment, the key trend driving GPU adoption is the need for real-time data analytics and high-performance computing to support various public sector initiatives. Governments worldwide are increasingly investing in smart cities, surveillance systems, and defense applications that require GPUs for processing large volumes of data quickly and accurately. For instance, in the defense and intelligence sectors, GPUs are critical for real-time image recognition, satellite data processing, and advanced simulations. As governments aim to enhance their decision-making processes through the use of AI and machine learning, the demand for GPU-enabled data centers is expected to rise.

Regional Insights

North America dominated the data center GPU market with the largest market share of 36.0% in 2023. In In North America, the key trend driving the market growth is the rapid adoption of AI and deep learning technologies across sectors such as healthcare, finance, and autonomous vehicles. The region is home to leading technology companies and cloud service providers like NVIDIA, Amazon, and Google, which are at the forefront of GPU innovation. The demand for high-performance computing (HPC) in both private and public sectors is driving significant investments in GPU infrastructure.

U.S. Data Center GPU Market Trends

The data center GPU market in the U.S. is anticipated to grow at a significant CAGR of 26.7% from 2024 to 2030. In the US, the market growth is being driven by cloud computing giants and the expansion of AI-driven services across industries. With significant investments in autonomous systems, healthcare AI, and financial analytics, the US is a key driver in advancing GPU technologies. The country's leadership in hyperscale data centers and large-scale AI projects, coupled with growing demand from defense and national security sectors, is creating a robust market for GPU deployment.

Asia Pacific Data Center GPU Market Trends

The data center GPU market in Asia Pacific is expected to grow at a significant CAGR of 30.3% from 2024 to 2030. In Asia Pacific, the rise of smart cities and 5G rollouts, particularly in China, Japan, and South Korea, is significantly boosting the demand for GPU-powered data centers. Countries in this region are rapidly adopting AI technologies in sectors like retail, manufacturing, and public infrastructure. China’s growing leadership in AI development and the expansion of local cloud providers are driving the need for large-scale GPU deployment. Opportunities abound in the region’s focus on digital transformation and the integration of AI in governance, offering substantial growth potential for the market as governments and enterprises invest in advanced computational infrastructure.

Europe Data Center GPU Market Trends

The data center GPU market in Europe is anticipated to grow at a significant CAGR of 28.1% from 2024 to 2030. In Europe, the growth is driven by increasing investments in sustainable data centers and energy-efficient GPU solutions, particularly in countries like Germany, France, and the UK. The European Green Deal and stringent regulations around carbon emissions are pushing data centers to adopt GPU technologies that offer both performance and reduced energy consumption. In addition, the rise of AI in industrial automation and autonomous transportation is fueling the demand for GPU-powered infrastructures.

Key Data Center GPU Company Insights

Some of the key players operating in the market include NVIDIA Corporation, Intel Corporation, Advanced Micro Devices, Inc., Micron Technology, Inc., IBM Corporation, Samsung SDS, Qualcomm Technologies, Inc., Google Cloud, Imagination Technologies, and Huawei Cloud Computing Technologies Co., Ltd. among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Data Center GPU Companies:

The following are the leading companies in the data center GPU market. These companies collectively hold the largest market share and dictate industry trends.

- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices, Inc.

- Micron Technology, Inc.

- IBM

- Samsung SDS

- Qualcomm Technologies, Inc.

- Google Cloud

- Imagination Technologies

- Huawei Cloud Computing Technologies Co., Ltd.

Recent Developments

-

In February 2024, Iris Energy, a top provider of renewable energy-powered data centers, revealed its plans to offer GPU cloud services to the AI firm Poolside. This collaboration follows the successful completion of extensive testing and will feature the integration of 248 NVIDIA H100 GPUs to support Poolside's operations

-

In November 2023, AMD introduced its Ryzen Embedded 7000 Series processor family today at Smart Production Solutions 2023, designed to meet the high-performance needs of the industrial sector. Built on the advanced "Zen 4" architecture and featuring integrated Radeon graphics, the Ryzen Embedded 7000 Series delivers unprecedented performance and capabilities for the embedded market, setting a new standard for functionality and efficiency

Data Center GPU Market Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 17.92 billion |

|

Revenue forecast in 2030 |

USD 80.69 billion |

|

Growth rate |

CAGR of 28.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, function, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa. |

|

Key companies profiled |

NVIDIA Corporation; Intel Corporation; Advanced Micro Devices, Inc.; Micron Technology; Inc.; IBM Corporation; Samsung SDS; Qualcomm Technologies, Inc.; Google Cloud; Imagination Technologies; Huawei Cloud Computing Technologies Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center GPU Market Report Segmentation

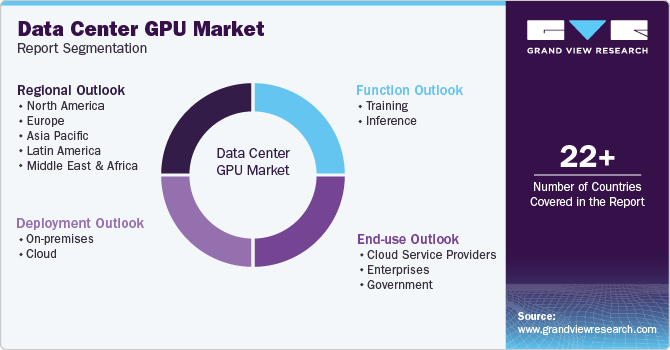

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global data center GPU market report based on deployment, function, end-use, and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Function Outlook (Revenue; USD Billion, 2018 - 2030)

-

Training

-

Inference

-

-

End-use Outlook (Revenue; USD Billion, 2018 - 2030)

-

Cloud Service Providers

-

Enterprises

-

Government

-

-

Regional Outlook (Revenue: USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center GPU market was valued at USD 14.87 billion in 2023 and is expected to reach USD 17.92 billion in 2024.

b. The global data center GPU market is expected to grow at a compound annual growth rate of 28.5% from 2024 to 2030 to reach USD 80.69 billion by 2030.

b. The cloud segment is expected to grow at a significant rate during the forecast period. In the cloud segment, the ongoing migration toward cloud-native applications and AI-as-a-service (AIaaS) is a major driver of GPU adoption. Cloud providers like AWS, Microsoft Azure, and Google Cloud are heavily investing in GPU infrastructure to meet the growing demand for AI and machine learning services offered through the cloud.

b. Key players in the cloud workflow market include NVIDIA Corporation, Intel Corporation, Advanced Micro Devices, Inc., Micron Technology, Inc., IBM Corporation, Samsung SDS, Qualcomm Technologies, Inc., Google Cloud, Imagination Technologies, and Huawei Cloud Computing Technologies Co., Ltd.

b. The data center GPU market has been experiencing significant growth, driven by the increasing demand for advanced computing power across various sectors. A key trend is the widespread adoption of artificial intelligence (AI), machine learning (ML), and deep learning applications, which require powerful GPUs to handle complex computations efficiently. Data centers are investing in GPUs to optimize AI workloads, particularly in sectors such as healthcare, finance, and autonomous driving, where real-time data processing is critical.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."