Data Center Generator Market Size, Share & Trends Analysis Report By Product Type (Diesel, Gas), By Capacity (<1 MW, 1-2MW, >2MW), By Tier Standards (Tier I & II, Tier III, Tier IV), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-235-8

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Data Center Generator Market Size & Trends

The global data center generator market size was valued at USD 7.49 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030.Generators are the backup power supply source for data centers during a power interruption. A full power cut-off from a data center might require a total restart for the system, leading to start-up issues, system downtime, and the loss of current/ongoing information. Thus, data centers are always supported by a backup power supply through the generators to avoid anomalies and errors.

A key driving factor for the market is that these generators do not require an existing power supply to function. In addition, major manufacturers are developing generators with customized capacity due to changing customer requirements. Such systems are equipped with a feature to scale up and down as per the power required by the data center. This flexibility is also expected to escalate the demand, thereby augmenting market growth.

The increasing importance of overcoming the reliability on power for the functioning of the data centers is also expected to drive market growth. In addition, the advent of edge computing is contributing to facility developments in the market of secondary data centers. These secondary data centers have low power reliability; thus, the significance of power backup equipment is high. This is expected to have a positive impact on the adoption of data center generators.

Several colocation service providers have increased the production of data centers, owing to the rising demand for edge data centers globally. For instance, in 2019, Google announced that it was investing USD 3.3 billion to expand its data center presence in Europe. Moreover, the growing construction of hyperscale facilities and increasing adoption of Diesel Rotary Uninterruptible Power Supply (DRUPS) is expected to boost the market.

However, increasing power costs are projected to have a negative impact on market expansion over the coming years. The rising trend of using fuel cells as a power backup due to the high costs of generators might also cause hindrance to the market growth. For instance, in 2019, the Adani Group announced an investment of USD 9.8 billion to set up solar-powered data parks in India.

Data centers are mission-critical infrastructures that handle and process a large volume of data across multiple industries, and hence become significant contributors to the global economy. Thus, reliable power backup to prevent data loss during power outages is of prime importance for data center facilities. Generators provide a secure and cost-effective solution to provide backup and avoid downtimes incurred in restarting the entire system. They do not require any external power supply to operate and can suffice a data center's massive electrical power demands, resulting in increased adoption of power backup.

Data center generator manufacturers are focused on equipping their products with technologically advanced features to cater to the varying demands of data center facilities. Cummins, Inc. and Himoinsa have introduced features such as remote monitoring to generator sets. Thus, the data center operator can observe the load levels, power system status, and alternator data while controlling it remotely. Such features result in low maintenance costs and higher operating efficiencies for data center facilities. All these factors are expected to spur the adoption of DC generators globally.

Power generators operate on fuel sources such as diesel, natural gas, liquid petroleum, and gasoline. Of these, natural gas generators are witnessing significant growth opportunities in the data center generator market. Natural gas generators also comply with stringent government regulations on greenhouse gas emissions from data centers. Moreover, natural gas generators provide high efficiency and power output performance. The high reliability of natural gas grids in developed regions avoids the risk of limited run times and refueling compared to other types of generators.

Natural gas generators can lower a data center’s emissions. Compared to diesel-operated generators, natural gas generators can reduce NOx emissions by 80-90% and CO2 emissions by up to 25%. Moreover, relatively high prices of diesel and gasoline-operated generators, coupled with changing government policies and regulations, are anticipated to generate demand for natural gas generator systems, which bodes well for market growth.

The integration of battery technologies such as fuel cells and Li-ion batteries has led to the emergence of fuel cell power systems, which is expected to hinder market growth. Fuel-powered generators used in data center facilities produce nitrogen oxide, carbon dioxide, particulate matter, and other dangerous exhausts that are then released into the atmosphere. Thus, while installing such generators, data centers need to consider various government regulations pertaining to environmental sustainability.

Moreover, ample space and large, on-site fuel tanks are required to install these generators. A dedicated UPS is also required for the smooth functioning of the generators. Owing to the factors mentioned above, data center companies are looking at newer technologies that can replace fuel-powered generators.

Product Type Insights

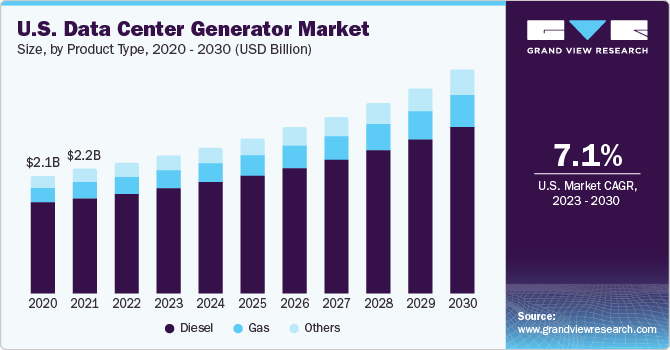

The product type segment is categorized into diesel, gas, and others. The diesel product type segment held the dominant market share of 73.0% in 2022. The segment is anticipated to expand steadily due to the high adoption of these products and the flywheel UPS topology and battery used to provide a backup power supply.

On the other hand, the gas segment is projected to register the fastest CAGR of 8.9% over the forecast period in the data center generators market. Gas is highly preferred by customers owing to its long-term usage. Although the initial investment cost of gas-based systems is high, they are eco-friendly and offer long-term benefits.

Tier Standards Insights

The tier standards segment is divided into tier I & II, tier III, and tier IV. The tier I & II segment dominated the market with the highest revenue share of 53.6% in 2022. Tier I & II provide improved UPS to filter power spikes, IT systems, and momentary outages. Moreover, the tier I and II types also have dedicated cooling equipment and offer on-site power production. It increases the safety margin against IT systems, resulting in market growth.

The tier IV segment is expected to advance at a significant CAGR of 8.9% over the forecast period. Introducing fault tolerance technology into the infrastructure topology is expected to bolster its adoption in the coming years. Tier IV adoption is observed to have a significant growth rate in Europe, as 25% of all tier IV verified data centers are situated in Luxembourg.

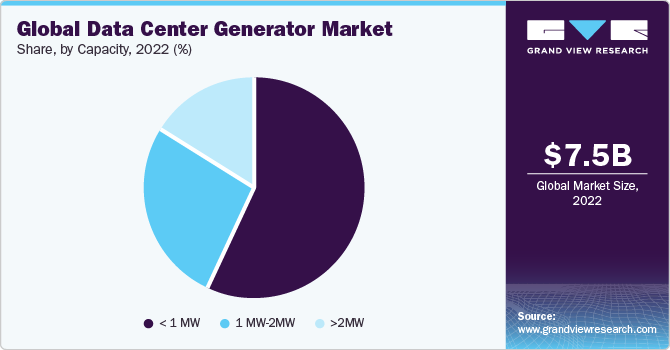

Capacity Insights

The <1 MW segment dominated the market with the highest revenue share of 57.3% in 2022. This strong demand is attributable to the extensive usage of edge data centers across the globe. Moreover, the wide usage of on-premise data centers in developing countries, which generally require less than 500 kW capacity generators, is also expected to support segment growth.

The 1MW-2MW segment is expected to expand at a significant CAGR of 7.0% over the forecast period. The extensive presence of Tier I and II data centers in developing regions such as Asia Pacific and Latin America has contributed to the segment’s growth. The 1 MW capacity segment is likely to witness steady growth. It is normally adopted along with N+1 redundant configuration systems in large data centers. These systems are designed to provide 48+ hours of runtime. Growing investments in the construction of mega data centers and backup capabilities for long hours are anticipated to drive segment growth.

Regional Insights

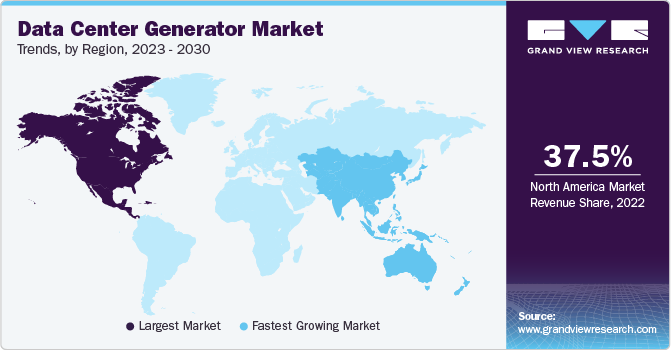

North America dominated the market with the largest revenue share of 37.5% in 2022. Major companies such as Cummins, Inc.; Caterpillar, Inc.; and Generac Holdings, Inc. have positively affected the regional market's growth. Factors such as advanced technology development and awareness about the same are also expected to impact the market positively.

The high revenue share of North America can be attributed to aggressive investments in hyperscale projects. The U.S. is a developed economy with an established sophisticated network infrastructure. It is also home to major cloud service providers like Amazon.com, Google, Inc., and Facebook. These companies are investing in constructing mega facilities for additional data storage and processing capabilities, opening market growth opportunities.

The Asia Pacific region is expected to expand at the fastest CAGR of 9.7% during the forecast period. Investments by market leaders in developing countries like China and India are expected to drive regional market expansion. For instance, Atlas Copco is focused on generating revenue from the Asia Pacific region. According to industry experts, in 2018, Asia Pacific contributed to 35% of the company’s total revenue.

Countries such as India and China generate a large volume of data owing to rising internet usage and high smartphone penetration. There has been an increase in investments and the construction of hyper-scale data centers across the region. For instance, in 2018, Facebook announced an investment of USD 1.4 billion to develop a hyper-scale data center in Singapore.

Similarly, in 2019, Alibaba Cloud, a subsidiary of Alibaba Group, announced the opening of its second data center in Indonesia. Thus, the increasing number of data center constructions, coupled with a high rate of power outages in Asia Pacific, is expected to increase the adoption of generators, thereby contributing to market growth.

During the forecast period, Latin America is expected to have considerable growth opportunities, as several key companies are focusing on M&A to expand and mark their presence in the region. For instance, in June 2018, Generac Power Systems announced the acquisition of Selmec Equipos Industriales, S.A. de C.V., to expand its business of industrial generators in Latin America.

Key Companies & Market Share Insights

Product launches, investments in R&D, and expansion of product portfolios are strategies undertaken by key players to strengthen their market position. Other strategies companies undertake include developing new products and service lines. For instance, in March 2019, Caterpillar announced the launch of a Cat G3512 natural gas generator. The generator is designed to perform maximum operations on a low-pressure energy supply. This newly launched generator would be suitable for data centers, schools, retail complexes, universities, government offices, and research facilities.

Key Data Center Generator Companies:

- Caterpillar

- Atlas Copco

- Cummins, Inc.

- Eurodiesel Services

- Generac Power Systems, Inc.

- HIMOINSA

- KOHLER

- MITSUBISHI MOTORS CORPORATION

- Piller (Langley Holdings plc)

- Rolls Royce plc

Recent Developments

-

In January 2023, EdgeCloudLink (ECL), a startup offering data center-as-a-service, announced its off-grid modular data centers powered by hydrogen. These data centers will be constructed using 3D printing technology in 1MW units. ECL has initiated its first data center project at its headquarters in Mountain View, California, collaborating with a local building services company and utilizing a construction 3D printer. The innovative design will rely on hydrogen from a local source and incorporate a proprietary liquid cooling system. ECL has assured that these hydrogen-powered data centers will operate without diesel generators, further enhancing their sustainability and efficiency

-

In May 2023, Kohler Power Systems introduced a web-based version to replace its widely used Power Solutions Center desktop app, which is utilized for generator sizing and KOHLER North American industrial product specifications. The newly developed web-based platform, the Power Solutions Center (PSC), offers users convenient access to technical data directly through KohlerPower.com. Users can retrieve product guide specifications, building information modeling (BIM) files, product drawings, and genset performance information through the free PSC software, enhancing their experience and streamlining the process of accessing essential information

-

In October 2022, LCL, a Belgian data center company, used hydrotreated vegetable oil (HVO) to replace diesel in its backup generators. The company announced that LCL Brussels-West in Aalst, which invested in six new 2.25 MVA generators, would be the first site to adopt this biodiesel. The facility comprises eight backup generators, including two older 1MW units and six new HVO-powered generators. This transition from diesel to renewable fuel sources demonstrates LCL's commitment to sustainability. It paves the way for DC generator manufacturers to innovate and develop advanced products in line with renewable energy requirements

-

In November 2022, Kohler Power Systems inaugurated the production expansion at its existing generator manufacturing facility in Wisconsin, U.S. This expansion aims to enhance Kohler's manufacturing capabilities in North America, specifically to cater to critical strategic industries such as data centers. By increasing its production capacity, Kohler Power Systems is well-positioned to meet the growing demands of these industries

Data Center Generator Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 7.92 billion |

|

Revenue forecast 2030 |

USD 12.98 billion |

|

Growth rate |

CAGR of 7.3% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017- 2021 |

|

Forecast period |

2023- 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, capacity, tier standards, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Caterpillar; Atlas Copco; Cummins, Inc.; Eurodiesel Services; Generac Power Systems, Inc.; HIMOINSA; KOHLER; MITSUBISHI MOTORS CORPORATION; Piller (Langley Holdings plc); Rolls Royce plc |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center Generator Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global data center generator marketreport on the basis of product type, capacity, tier standards, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Diesel

-

Gas

-

Others

-

-

Capacity Outlook (Revenue, USD Million, 2017 - 2030)

-

< 1 MW

-

1 MW-2MW

-

>2MW

-

-

Tier Standards Outlook (Revenue, USD Million, 2017 - 2030)

-

Tier I & II

-

Tier III

-

Tier IV

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global data center generator market size was estimated at USD 7.49 billion in 2022 and is expected to reach USD 7.92 billion in 2023.

b. The global data center generator market is expected to grow at a compound annual growth rate of 7.3% from 2023 to 2030 to reach USD 12.98 billion by 2030.

b. North America region dominated the data center generator market with a share of 37.5% in 2023. Factors such as advanced technology development and awareness about the same are also expected to impact the market positively.

b. Some key players operating in the data center generator market include Caterpillar, Atlas Copco, Cummins, Inc., Eurodiesel Services, Generac Power System, Inc., HIMOINSA, KOHLER, MITSUBISHI MOTORS CORPORATION, Piller (Langley Holdings plc), Rolls Royce plc.

b. A key driving factor for the market is that these generators do not require an existing power supply to function. In addition, major manufacturers are developing generators with customized capacity due to changing customer requirements. Such systems are equipped with a feature to scale up and down as per the power required by the data center.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."