Data Center Cooling Market Size, Share & Trends Analysis Report By Component (Solutions, Services), By Type, By Containment, By Structure, By Application, By Solution, By Service, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-652-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Data Center Cooling Market Size & Trends

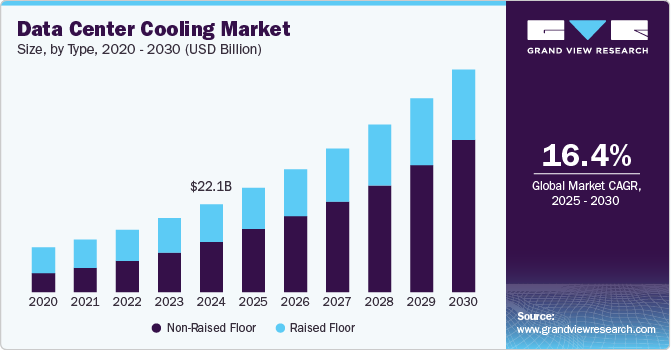

The global data center cooling market size was estimated at USD 22.13 billion in 2024 and is anticipated to grow at a CAGR of 16.4% from 2025 to 2030. The growing need for energy-efficient data centers is expected to present significant growth opportunities for the data center cooling industry. Many leading companies are planning expansions in response to this demand. Additionally, the positive growth outlook is driven by the rapid surge in data generation, which in turn fuels the increasing demand for data centers worldwide. Given that data centers consume substantial amounts of energy, they also generate a considerable amount of heat, which increases the necessity for advanced and efficient cooling solutions.

Several prominent companies are acquiring data center cooling providers to broaden their market presence in untapped regions. For instance, in October 2024, Schneider Electric announced an agreement to acquire a majority stake in Motivair Corporation, a U.S.-based company specializing in liquid cooling and advanced thermal management solutions for high-performance computing systems. Additionally, these companies are adopting innovations within the data center cooling sector, such as integrating artificial intelligence and automation to monitor and analyze trends, which is fueling growth in this segment.

The data center cooling industry is directed by various regulations, with governments across different regions emphasizing the importance of efficient data center incident response and recovery protocols. Cooling systems play a crucial role in preventing equipment overheating and ensuring the continued operation of data centers during and after emergencies.

The threat of substitutes remains moderate. As energy costs rise and data centers continue to expand to meet increasing demand, mechanical cooling becomes an increasingly expensive operational burden. In response, virtual containment technology has emerged as an energy-efficient alternative. For instance, in March 2025, Chemours Company, a U.S.-based company in performance chemistry, launched a full-scale product trial with NTT DATA and Hibiya Engineering, Ltd. to test two-phase immersion cooling for data centers using Chemours' Opteon 2P50 dielectric fluid. This trial follows successful lab tests and is a key step in the product’s commercialization.

Buyers are increasingly looking for systems that can scale with shifting workloads and changing infrastructure needs. Solutions with modular components are preferred, enabling adjustments and expansions to meet specific requirements. Additionally, with growing concerns over the environmental impact of data centers, buyers are increasingly interested in cooling solutions that align with sustainability goals. Energy-efficient cooling not only reduces operational costs but also supports more sustainable and eco-friendly data center operations.

Component Insights

The solution segment dominated the data center cooling industry in 2024 driven by the surge in data traffic due to the rise of AI, big data, and cloud computing. This surge has increased the heat output of data center infrastructure, necessitating advanced cooling technologies that can maintain optimal operating temperatures while minimizing energy consumption.

The services segment is expected to register a significant CAGR over the forecast period due to the growing complexity of data center operations. The increasing need for high-performance computing (such as AI and machine learning workloads), has heightened the demand for ongoing optimization services.

Solution Insights

The air conditioners segment dominated the market in 2024 due to the growth in data center densities. As more computing power is packed into smaller spaces, cooling demands have intensified, making air conditioners a crucial component of maintaining optimal temperature levels. As more computing power is packed into smaller spaces, cooling demands have intensified, making air conditioners a crucial component of maintaining optimal temperature levels.

The precision air conditioners segment is expected to grow at a significant CAGR over the forecast period. The growing trend of modular and micro data centers, particularly in edge computing, is increasing the demand for precision air conditioners. These smaller-scale, distributed data centers often face space and cooling challenges, requiring compact yet highly effective cooling solutions. Precision air conditioners are well-suited for these applications as they can be designed to fit into smaller footprints while maintaining a high level of cooling efficiency.

Services Insights

The installation & deployment segment dominated the market in 2024. The increasing focus on improving operational efficiency and reducing downtime is fueling demand for high-quality installation and deployment services. Therefore, operators are seeking experienced service providers who can ensure that cooling systems are installed and deployed with precision and minimal disruption to ongoing operations.

The maintenance service segment is expected to grow at a significant CAGR over the forecast period. The growth of remote monitoring and IoT-enabled devices is enhancing the role of maintenance services in the data center cooling market. With the advent of IoT and remote monitoring technologies, data centers can track the performance of cooling systems in real time, identifying potential issues before they become critical.

Type Insights

The non-raised floor dominated the market and accounted for the revenue share of over 57.0% in 2024, driven by evolving data center designs and the increasing demand for efficient, space-saving cooling solutions. Traditionally, raised floors have been used to house cooling infrastructure, such as air conditioning units and chilled water pipes, in data centers. However, as the data center industry progresses, there is a growing trend towards non-raised floor designs, which are reshaping how cooling systems are integrated into these facilities.

The raised floor segment is expected to grow at a significant CAGR over the forecast period due to the longevity and cost-effectiveness of raised floor systems. These systems are durable, easy to maintain, and can accommodate various cooling equipment, making them a preferred choice for both new and retrofitted data centers. The flexibility of raised floors also supports future expansions and upgrades, allowing data centers to scale their infrastructure without major disruptions

Containment Insights

The containment segment is further segregated into raised floor with containment and raised floor without containment. The raised floor with containment segment is further segregated into Hot Aisle Containment (HAC) and Cold Aisle Containment (CAC). The segment captured a considerable share of over 57.0% in 2024 owing to the increased adoption of hot and cold aisle containment methods.

The raised floor without containment segment is expected to grow at a significant CAGR from 2025 to 2030. In a raised floor setup without containment, cold air is delivered through perforated tiles located under the floor, and the air rises naturally to cool the IT equipment. This type of cooling system is often preferred in environments where flexibility and ease of maintenance are prioritized over strict containment strategies.

Structure Insights

The room based cooling dominated the market and accounted for the revenue share of over 47.0% in 2024. As organizations migrate to the cloud and deploy more complex IT infrastructures, the need for efficient and reliable cooling solutions for high-density computing environments becomes even more critical. Room-based cooling structures are well-suited to handle these higher heat loads, ensuring that the servers remain at optimal operating temperatures and reducing the risk of equipment failure or downtime.

The row-based cooling segment is expected to grow at a significant CAGR over the forecast period. Growing trend toward high-density server configurations in data centers is contributing to the rise of row-based cooling structures. As data centers evolve to support more powerful computing systems and handle larger volumes of data, the heat generated by these high-performance servers increases, making traditional cooling methods less effective.

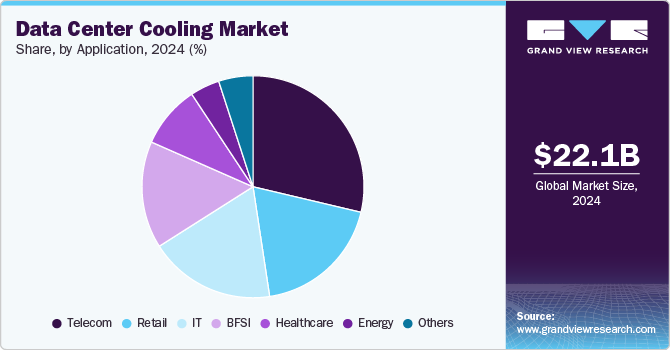

Application Insights

The telecom segment dominated the market and accounted for the revenue share of over 28.0% in 2024. As telecom operators continue to expand their networks, especially with the rollout of 5G technologies, the need for more advanced and energy-efficient data centers to support telecom infrastructure becomes increasingly critical. Telecom companies are investing heavily in data centers to store and process massive amounts of data generated by mobile networks, IoT devices, and customer interactions. This surge in data traffic and the growing complexity of telecom services are driving the demand for sophisticated cooling solutions that can ensure the efficient operation of telecom-related data centers.

The retail segment is expected to grow at a significant CAGR over the forecast period, driven by the increasing demand for e-commerce and the digitalization of retail operations. As the retail sector continues to shift towards online platforms, businesses are relying heavily on data centers to handle vast amounts of data, from customer transactions to inventory management and personalized shopping experiences.

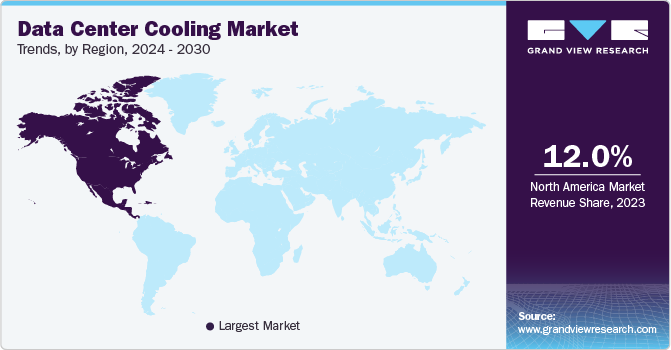

Regional Insights

The data center cooling industry in North America held a significant share of over 34.0% in 2024 due to the increasing demand for data processing and storage solutions. This expansion is largely fueled by the rising adoption of high-performance computing (HPC) and the escalating need for efficient cooling solutions to support advanced technologies such as artificial intelligence (AI).

U.S. Data Center Cooling Market Trends

The data center cooling industry in the U.S. is expected to grow significantly at a CAGR of 10.8% from 2025 to 2030. The U.S. market is witnessing a surge in investments in green data centers. Companies are adopting eco-friendly cooling technologies like free cooling, which utilizes ambient air, and more sustainable refrigerants to reduce their carbon footprints. As the need for high-performance computing (HPC) grows, especially in sectors like AI, gaming, and cloud services, data center cooling technologies are expected to evolve to support these power-intensive applications while maintaining cost-effective and energy-efficient operations.

Europe Data Center Cooling Market Trends

The Europe data center cooling industry is anticipated to register a considerable growth from 2025 to 2030. This growth is driven by factors such as the increasing adoption of cloud computing among small and medium-sized enterprises (SMEs), stringent government regulations concerning local data security, and substantial investments by domestic players in data center infrastructure.

The UK data center cooling market is expected to grow rapidly in the coming years. To meet the cooling demands of these advanced technologies, there is a notable shift towards innovative cooling solutions, including liquid cooling systems. For instance, in July 2024, Iceotope, in collaboration with Efficiency IT, launched the first liquid cooling lab and data center facility in Sheffield, U.K., specifically designed to support AI and high-performance computing workloads.

The data center cooling market in Germany held a substantial market share in 2024. The increasing number of internet users in Germany has heightened the demand for data centers, prompting operators to adopt renewable energy to manage rising electricity costs and enhance competitiveness through sustainable energy pricing

Asia Pacific Data Center Cooling Market Trends

Asia Pacific is expected to register the fastest CAGR of 20.6% from 2025 to 2030, driven by the rapid expansion of digital infrastructure and data storage needs in the region. As more businesses embrace cloud computing, e-commerce, big data, and artificial intelligence, the demand for data centers is increasing exponentially. Countries like China, India, Japan, and South Korea are at the forefront of this digital transformation, investing heavily in building data centers to support their growing economies and technology ecosystems.

The Japan data center cooling market is expected to grow rapidly in the coming years. Japan’s government policies and initiatives that encourage the development of green technologies and environmental sustainability are creating a favorable regulatory environment for market growth. These factors, combined with Japan's leading role in the global technology sector, are expected to continue driving the demand for advanced and efficient data center cooling solutions in the country.

The data center cooling market in China held a substantial market share in 2024. The rapid deployment of 5G technology in China has created a massive increase in the amount of data that needs to be processed and stored. As 5G networks require higher-density data centers to manage the large volumes of data, there is an increased need for efficient and effective cooling systems to prevent overheating in high-performance servers and equipment.

Key Data Center Cooling Company Insights

Key players operating in the data center cooling industry are Vertiv Group Corp. and Schneider Electric, Fujitsu, Mitsubishi Electric Corporation, and Asetek, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In March 2025, Vertiv Group Corp. partnered with Tecogen Inc., a U.S.-based clean energy company specializing in ultra-efficient, clean on-site power, heating, and cooling solutions. This collaboration allows Vertiv to incorporate Tecogen’s advanced natural gas-powered chiller technology into its offerings for data centers globally. The new solution aims to address power limitations and support the large-scale deployment of AI technologies. This addition enhances Vertiv’s already robust portfolio of industry-leading cooling solutions.

-

In December 2024, Schneider Electric introduced new AI-ready data center solutions to meet the energy, and sustainability demands of AI systems. In collaboration with NVIDIA, Schneider Electric launched a reference design for liquid-cooled AI clusters supporting up to 132 kW per rack. Additionally, the compact Galaxy VXL uninterruptible power supply (UPS), offering 52% space savings and high power density, is designed for AI and data centers, delivering efficient power in a smaller footprint.

Key Data Center Cooling Companies:

The following are the leading companies in the data center cooling market. These companies collectively hold the largest market share and dictate industry trends.

- Air Enterprises

- Asetek, Inc.

- Climaveneta Climate Technologies PVT. LTD.

- Coolcentric

- Dell Inc.

- Fujitsu

- Hitachi, Ltd.

- Johnson Controls

- Mitsubishi Electric Corporation

- Nortek Air Solutions, LLC

- NTT Ltd.

- Rittal GmBH & Co. KG

- Schneider Electric

- STULZ GMBH

- Vertiv Group Corp.

Data Center Cooling Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 26.28 billion |

|

Revenue forecast in 2030 |

USD 56.15 billion |

|

Growth rate |

CAGR of 16.4% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report services |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, solution, services, type, containment, structure, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Air Enterprises; Asetek, Inc.; Climaveneta Climate Technologies PVT. LTD.; Coolcentric; Dell Inc.; Fujitsu; Hitachi, Ltd.; Johnson Controls; Mitsubishi Electric Corporation; Nortek Air Solutions, LLC; NTT Ltd.; Rittal GmBH & Co. KG; Schneider Electric; STULZ GMBH; Vertiv Group Corp. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center Cooling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center cooling market report based on component, solution, service, type, containment, structure, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Air Conditioners

-

Precision Air Conditioners

-

Chillers

-

Air Handling Units

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Installation & Deployment

-

Support & Consulting

-

Maintenance Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Raised Floors

-

Non-Raised Floors

-

-

Containment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Raised Floor with Containment

-

Hot Aisle Containment (HAC)

-

Cold Aisle Containment (CAC)

-

-

Raised Floor without Containment

-

-

Structure Outlook (Revenue, USD Billion, 2018 - 2030)

-

Rack-Based Cooling

-

Row-Based Cooling

-

Room-Based Cooling

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Telecom

-

IT

-

Retail

-

Healthcare

-

BFSI

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The growing need for energy-efficient data centers is expected to present significant growth opportunities for the market. Many leading companies are planning expansions in response to this demand. Additionally, the positive growth outlook is driven by the rapid surge in data generation, which in turn fuels the increasing demand for data centers worldwide.

b. The global data center cooling market size was estimated at USD 22.13 billion in 2024 and is expected to reach USD 26.28 billion in 2025.

b. The global data center cooling market is expected to grow at a compound annual growth rate of 16.4% from 2025 to 2030 to reach USD 56.15 billion by 2030.

b. North America dominated the data center cooling market with a share of over 34.0% in 2024. This is attributable to the increasing demand for data processing and storage solutions. This expansion is largely fueled by the rising adoption of high-performance computing (HPC) and the escalating need for efficient cooling solutions to support advanced technologies such as artificial intelligence (AI).

b. Some key players operating in the data center cooling market include Air Enterprises, Asetek, Inc., Climaveneta ClimateTechnologies PVT. LTD., Coolcentric. Dell Inc., Fujitsu, Hitachi, Ltd., Johnson Controls, Mitsubishi Electric Corporation, Nortek Air Solutions, LLC, NTT Ltd., Rittal GmBH & Co. KG., Schneider Electric, STULZ GMBH,Vertiv Group Corp

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."