Data Center Colocation Market Size, Share & Trends Analysis Report By Colocation Type (Retail, Wholesale), By Enterprise Size, By Tier Level (Tier 1, Tier 2), By End Use (BFSI, Retail), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-583-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Data Center Colocation Market Size & Trends

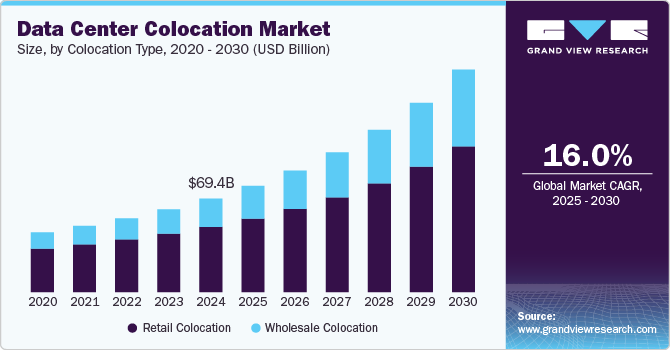

The global data center colocation market size was estimated at USD 69.41 billion in 2024 and is anticipated to grow at a CAGR of 16.0% from 2025 to 2030. Data centers play a crucial role in modern corporate operations by managing business applications and supporting IT infrastructure. As companies increasingly rely on data, the demand for robust IT solutions has grown, leading to greater adoption of cloud services. Colocation data centers provide businesses with the flexibility to scale IT resources efficiently. Additionally, the high costs associated with building and maintaining in-house data centers, especially for organizations with fluctuating data needs, have been a significant factor driving market growth.

The rise of technologies such as cloud computing, autonomous vehicles, IoT, and advanced robotics has driven demand for faster data processing and higher bandwidth. These technologies require low latency and high-speed network connectivity, making colocation data centers an ideal solution. By strategically locating facilities closer to end users, colocation providers enhance storage and networking capabilities. In the data center colocation industry, the expansion of 5G technology is expected to further boost colocation deployments, particularly in remote areas.

Additionally, the growing adoption of cloud data centers, driven by cost efficiency, is accelerating market growth. SMEs are increasingly turning to cloud solutions to reduce IT expenses, eliminate the need for dedicated IT staff, and benefit from scalable, low-cost infrastructure. To strengthen their market position, major industry players are engaging in strategic initiatives such as partnerships, acquisitions, and mergers.

Customers can leverage Digital Exchange to deploy IT infrastructure on demand, creating a foundation for modernizing operations in an increasingly digital landscape. The rise of 5G, AR, VR, and AI has significantly increased the demand for higher bandwidth to facilitate seamless data sharing between businesses. Additionally, the growing adoption of autonomous vehicles and advanced robotics has driven the need for low-latency solutions, further boosting the demand for colocation services. By allowing cloud service providers to establish data centers closer to end users, colocation ensures faster data transfers and higher bandwidth.

With the shift toward edge computing and cloud migration, businesses require high-capacity networks for seamless data processing. While colocation has some limitations, such as shared facilities and limited control over location and upgrades, its advantages, including enhanced connectivity, improved network security, redundant power supply, scalability, and cost efficiency, far outweigh the drawbacks. These benefits continue to attract businesses, accelerating the growth of the data center colocation market.

Colocation Type Insights

The retail colocation segment dominated the data center colocation industry and accounted for a revenue share of nearly 70.0% in 2024. Retail colocation allows businesses to lease smaller spaces within a data center, making it an ideal solution for managing smaller data volumes with minimal infrastructure requirements. This cost-effective model has driven strong adoption among SMEs, enabling them to access secure and scalable IT infrastructure without the high expenses of building their own data centers. The low-budget requirement further enhances its appeal, making retail colocation a preferred choice for SMEs seeking affordable, reliable, and flexible data solutions.

The wholesale colocation segment is expected to grow at a significant CAGR of 18.6% over the forecast period. Leading cloud service providers are increasingly adopting colocation to cater to large enterprises, which require extensive data storage and high-performance infrastructure. With a broad customer base generating massive data volumes, large enterprises demand spacious, scalable, and secure facilities to house their servers. This shift has been a key driver for the growth of the wholesale colocation segment, as enterprises seek cost-effective, high-capacity solutions to support their expanding digital operations, ultimately fueling overall market growth.

Tier Level Insights

The tier 3 segment accounted for a largest revenue share of over 58.0% in 2024, driven by enterprises, cloud service providers (CSPs), financial institutions, and technology firms that require high reliability, scalability, and redundancy. Tier 3 facilities offer a significant uptime guarantee of 99.982% (~1.6 hours of downtime annually) and include N+1 redundancy for power and cooling, making them a preferred choice for mission-critical workloads, hybrid cloud deployments, and digital transformation initiatives.

The tier 4 segment is expected to grow at a significant CAGR over the forecast period. The rise of hyper scale cloud providers, artificial intelligence (AI), and high-performance computing (HPC) is fueling demand for Tier 4 colocation facilities. AI-driven workloads, deep learning models, and data-intensive applications require high-density computing power, precision cooling, and uninterrupted operations, all of which Tier 4 colocation centers are designed to support.

Enterprise Size Insights

The large enterprises segment accounted for a largest revenue share of over 49.0% in 2024. Ensuring uninterrupted business operations is a top priority for large enterprises, especially those handling mission-critical applications such as financial transactions, cloud-based SaaS platforms, and government operations. Colocation data centers provide redundant power, backup generators, disaster recovery solutions, and geographically distributed infrastructure, ensuring 99.999% uptime and minimal downtime risks. This is particularly beneficial for enterprises that require real-time replication, failover strategies, and instant data recovery solutions.

The SMEs segment is expected to grow at a significant CAGR over the forecast period. The rapid growth of software-as-a-service (SaaS) startups, fintech companies, and digital-first SMEs is driving demand for secure, high-performance colocation services. These businesses require scalable IT environments to support continuous software development, cloud-native applications, and real-time financial transactions. Colocation provides enterprise-grade infrastructure that enables startups and tech-driven SMEs to accelerate innovation while ensuring data security and reliability.

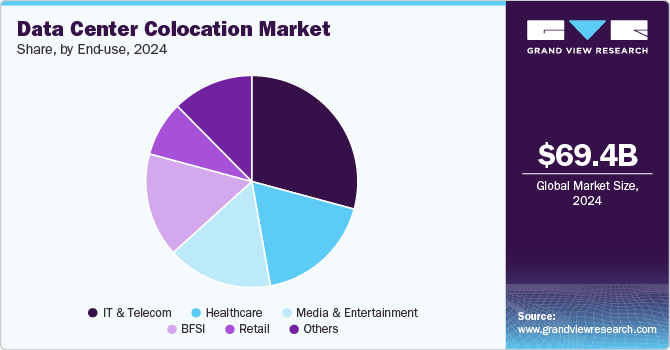

End Use Insights

The IT & telecom segment accounted for a largest revenue share of over 29.0% in 2024. The global 5G deployment is a key driver for colocation data centers, as telecom operators require low-latency infrastructure to support ultra-fast network speeds. According to GSMA, 5G networks are expected to cover over 60% of the global population by 2027, increasing the need for edge data centers to process data closer to end users. Colocation facilities offer high-speed fiber connectivity, carrier-neutral ecosystems, and edge computing capabilities, allowing telecom providers to reduce network congestion, improve mobile broadband performance, and support applications like IoT, smart cities, and autonomous vehicles.

The healthcare segment is expected to grow at a significant CAGR over the forecast period. The healthcare sector is witnessing a rapid digital transformation, driven by electronic health records (EHRs), telemedicine, AI-driven diagnostics, and medical IoT (IoMT). The growing volume of patient data, real-time monitoring applications, and regulatory compliance requirements has led to an increasing demand for high-performance, secure, and scalable IT infrastructure.

Regional Insights

The data center colocation industry in North America held a largest share of 39.0% in 2024, due to the expanding cloud computing industry, AI-driven workloads, and increasing enterprise digitalization. The region's strong presence of hyperscalers like AWS, Microsoft Azure, and Google Cloud drives demand for high-performance, interconnected colocation facilities. The rise of 5G, IoT deployments, and edge computing is also fueling colocation adoption, particularly in major hubs like Northern Virginia, Dallas, and Silicon Valley.

U.S. Data Center Colocation Market Trends

The data center colocation industry in the U.S. is expected to grow significantly at a CAGR of 14.9% from 2025 to 2030. The U.S. is the largest market for data center colocation globally, driven by the booming digital economy, AI innovations, and increasing cloud adoption. Key industries like BFSI, healthcare, media, and e-commerce rely on colocation for secure, scalable IT infrastructure.

Europe Data Center Colocation Market Trends

The data center colocation industry in Europe is anticipated to register a considerable growth from 2025 to 2030. The Europe market is expanding due to the rise in cloud adoption, stringent data protection laws (GDPR), and enterprise IT modernization. Countries like Germany, the UK, and the Netherlands are key colocation hubs due to strong connectivity infrastructure and favorable business environments. The demand for AI-ready, high-density colocation facilities is rising as businesses leverage big data, IoT, and machine learning.

The UK data center colocation market is expected to grow rapidly in the coming years, driven by the hybrid cloud revolution, AI investments, and financial services sector requiring secure, high-performance colocation facilities. London remains a top colocation hub, offering direct connectivity to global cloud providers and major financial institutions. The rise of post-Brexit data sovereignty laws is also compelling businesses to keep data within the country, increasing demand for Tier 3 and Tier 4 colocation.

The data center colocation market in Germany held a substantial market share in 2024. The demand for edge computing and low-latency processing is increasing, especially in cities like Berlin and Munich, where industrial and automotive sectors are digitizing rapidly. The country’s commitment to energy-efficient data centers, with mandates for sustainable cooling and renewable energy integration, is also driving colocation providers to invest in green infrastructure.

Asia Pacific Data Center Colocation Market Trends

Asia Pacific data center colocation industry is growing significantly at a CAGR of 19.2% from 2025 to 2030. The market is experiencing rapid expansion due to the rise of digital economies, AI-driven enterprises, and cloud computing adoption. Major tech hubs like Singapore, Tokyo, and Sydney are attracting investments in hyperscale colocation facilities to support growing internet penetration and e-commerce demand. The proliferation of 5G networks and smart city projects is also fueling colocation adoption.

The Japan data center colocation market is expected to grow rapidly in the coming years, due to the rise of AI, IoT, and 5G-driven digital infrastructure. Tokyo and Osaka serve as key colocation hubs, supporting cloud computing, financial services, and gaming industries that require low-latency, high-redundancy data centers. The country’s strict data privacy laws (APPI) and growing cybersecurity threats are driving demand for secure, compliant colocation facilities.

The data center colocation market in China held a substantial market share in 2024, due to the rapid expansion of cloud computing, AI-powered enterprises, and strict data localization laws. Major cities like Beijing, Shanghai, and Shenzhen are witnessing high demand for hyperscale colocation facilities, driven by domestic tech giants like Alibaba Cloud, Tencent, and Huawei Cloud.The government’s cybersecurity and data residency policies require businesses to store data within the country, increasing colocation investments.

Key Data Center Colocation Company Insights

Key players operating in the data center colocation industry are Equinix, Inc., Digital Realty Trust, China Telecom Corporation Limited, NTT Ltd., CyrusOne, and Telehouse. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2024, the US Department of Homeland Security (DHS) granted Equinix, Inc. a contract for colocation services for its Homeland Security Enterprise Network. The tender specifies the provision of "power, connectivity, and related operations and maintenance," with the services encompassing the "Homeland Security Enterprise Network (HSEN) COLO East and West Enterprise cloud access points."

-

In July 2024, Digital Realty Trust announced the acquisition of a colocation data center located in the Slough Trading Estate for USD 200 million. This acquisition expands the company's West London market presence and enhances its colocation capabilities in the City and Docklands areas.

Key Data Center Colocation Companies:

The following are the leading companies in the data center colocation market. These companies collectively hold the largest market share and dictate industry trends.

- China Telecom Corporation Limited

- Cologix

- Colt Technology Services Group Limited

- CoreSite

- CyrusOne

- Centersquare

- Digital Realty Trust

- Equinix, Inc.

- Flexential

- Iron Mountain, Inc.

- NTT Ltd. (NTT DATA)

- QTS Realty Trust, LLC

- Rackspace Technology

- Telehouse (KDDI CORPORATION)

- Zayo Group, LLC.

Data Center Colocation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 78.90 billion |

|

Revenue forecast in 2030 |

USD 165.45 billion |

|

Growth rate |

CAGR of 16.0% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report services |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Colocation type, tier level, enterprise size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

China Telecom Corporation Limited; Cologix; Colt Technology Services Group Limited; CoreSite; CyrusOne; Centersquare; Digital Realty Trust; Equinix, Inc.; Flexential; Iron Mountain, Inc.; NTT Ltd. (NTT DATA); QTS Realty Trust, LLC; Rackspace Technology; Telehouse (KDDI CORPORATION); Zayo Group, LLC. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center Colocation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the data center colocation market report based on colocation type, tier level, enterprise size, end use, and region:

-

Colocation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail Colocation

-

Wholesale Colocation

-

-

Tier Level Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tier 1

-

Tier 2

-

Tier 3

-

Tier 4

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

BFSI

-

IT & Telecom

-

Healthcare

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center colocation market size was estimated at USD 69.41 billion in 2024 and is expected to reach USD 78.90 billion in 2025.

b. The global data center colocation market is expected to grow at a compound annual growth rate of 16.0% from 2025 to 2030 to reach USD 165.45 billion by 2030.

b. The retail type segment dominated the data center colocation market with a share of over 70% in 2024, and is estimated to retain the leading position throughout the forecast period.

b. The IT & telecom segment led the global data center colocation market with a revenue share of around 29.0% in 2024. The high share of this segment is attributed to the increased number of mobile internet users and the continued development of new applications and software in the industry.

b. North America was the dominant regional market for data center colocation and accounted for a revenue share of around 39.0% in 2024. The region is estimated to expand further at a significant CAGR from 2025 to 2030 due to the strong presence of several major cloud service providers and SMEs deploying colocation data centers.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."