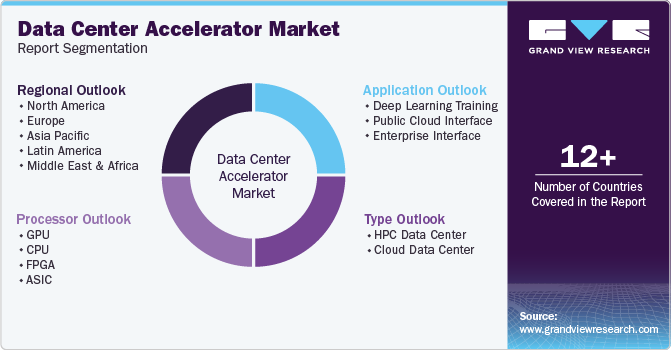

Data Center Accelerator Market Size, Share & Trends Analysis Report By Processor (GPU, CPU, FPGA, ASIC), By Type (HPC, Cloud), By Application (Deep Learning Training, Public Cloud Interface), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-001-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Data Center Accelerator Market Trends

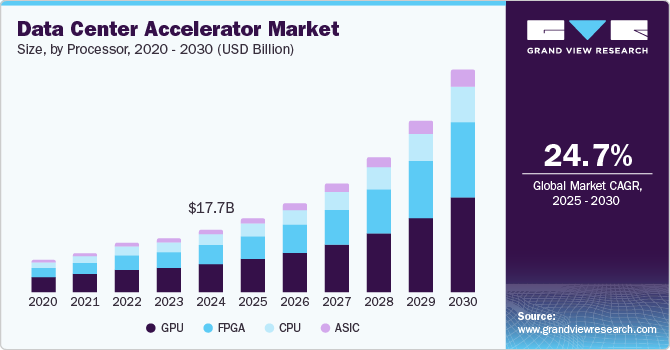

The global data center accelerator market size was valued at USD 17.67 billion in 2024 and is expected to grow at a CAGR of 24.7% from 2025 to 2030. Accelerators, including GPUs, FPGAs, and ASICs, are deployed to handle data-heavy operations more efficiently than traditional CPUs. The demand for accelerators is largely driven by hyperscale data centers and cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These companies require advanced hardware to meet the increasing computational needs of AI-driven applications. The increasing demand for artificial intelligence (AI) and machine learning capabilities, as industries utilize data analytics to improve decision-making processes.

Cloud computing expansion, particularly through hyperscale data centers, is another key driver. The rise of edge computing-where data is processed closer to its source for faster, real-time decision-making-also boosts accelerator adoption. The deployment of 5G networks is further driving demand for accelerators, as high-speed connectivity enables more complex, data-intensive applications like IoT, AR, and VR. Additionally, businesses are seeking energy-efficient solutions as they strive to reduce data center operational costs, where accelerators provide high computational power with lower energy consumption.

The transition to 5G technology and the rapid expansion of edge computing will require more powerful, efficient data centers equipped with advanced accelerators to process large volumes of data at unprecedented speeds. The market will also witness continued technological innovations from leading players like NVIDIA and AMD, making accelerators more accessible and affordable, even for small and medium enterprises (SMEs). As energy consumption in data centers remains a critical concern, the development of energy-efficient accelerators will be a key focus area, aligning with sustainability goals.

Processor Insights

The GPU segment accounted for the largest share of over 44% in 2024. The demand for GPUs in data centers is driven by the increasing volumes of big data, requiring advanced processing capabilities. GPUs excel in parallel processing, making them ideal for efficiently handling vast datasets and performing complex computations in big data analytics and real-time processing. Furthermore, the growth of cloud gaming and high-end graphics rendering also boosts GPU demand. These tasks require high computational power for rendering graphics at high speeds, with GPUs offering the performance necessary to meet the needs of cloud-based gaming platforms.

The FPGA segment is expected to grow steadily over the forecast period. FPGAs are gaining traction in data centers due to their superior energy efficiency compared to traditional CPUs and GPUs. This makes them an attractive choice for operators seeking to reduce power consumption and enhance sustainability. Additionally, FPGAs can handle diverse workloads, such as encryption, data compression, and high-performance networking, making them highly versatile. Their ability to accelerate these tasks, combined with low latency, drives demand in industries requiring rapid data processing, security, and high-speed communications, all critical in today's evolving data center environments.

Type Insights

The cloud data center segment dominated the market in 2024. The increasing adoption of cloud infrastructure by enterprises has led to a significant demand for acceleration technologies like GPUs, FPGAs, and ASICs. These technologies are essential for handling complex workloads, including high-performance computing, AI, and machine learning, which are often deployed in cloud environments. As cloud data centers increasingly host AI and big data applications, accelerators become critical for managing large-scale data processing efficiently. Accelerators boost the performance of these applications, ensuring faster computation, enhanced scalability, and reduced latency, making them essential for modern cloud operations.

The HPC data center segment is expected to grow steadily over the forecast period. HPC data centers require high-performance accelerators like GPUs and FPGAs to manage complex simulations, such as climate modeling, scientific research, and drug discovery. These simulations involve massive data sets and complex calculations, which need the parallel processing power of accelerators to run efficiently. Additionally, the demand for scalability and faster computation speeds in HPC environments is a key growth driver. Accelerators not only boost performance but also improve energy efficiency, allowing HPC centers to scale up operations while maintaining cost-effectiveness and handling more intensive workloads effectively.

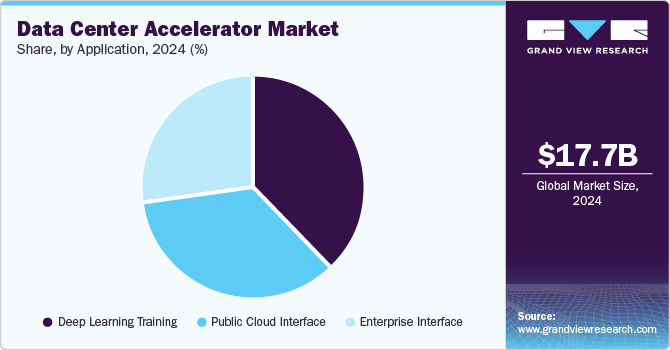

Application Insights

The deep learning training segment dominated the market in 2024. The increasing demand for artificial intelligence (AI) and machine learning (ML) is a key driver for the deep learning training segment in the data center accelerator market. As industries adopt AI and ML technologies, the need for efficient deep learning training solutions grows, necessitating powerful accelerators. Innovations in hardware technologies, particularly in Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), and Field-Programmable Gate Arrays (FPGAs), further enhance processing capabilities tailored for deep learning tasks. These advancements enable faster data processing and model training, leading to higher performance and efficiency. Consequently, the enhanced capabilities of these accelerators encourage their greater deployment in data centers, supporting the growing computational demands of AI and ML applications across various sectors.

The enterprise interface segment is expected to grow steadily over the forecast period. The increasing demand for real-time data processing is a crucial growth factor for the Enterprise Interface segment in the data center accelerator market. Enterprises require immediate access to data for informed decision-making, necessitating efficient interfaces that can facilitate quick data retrieval and processing. This urgency drives the adoption of accelerators capable of supporting high-performance interfaces. Additionally, the exponential rise in data volumes generated from diverse sources, such as IoT devices and digital transactions, creates challenges in managing and processing this data efficiently. Advanced enterprise interfaces are essential to handle these large datasets effectively, enabling organizations to extract valuable insights quickly. Together, these factors highlight the importance of robust interfaces supported by accelerators in today’s data-driven business landscape.

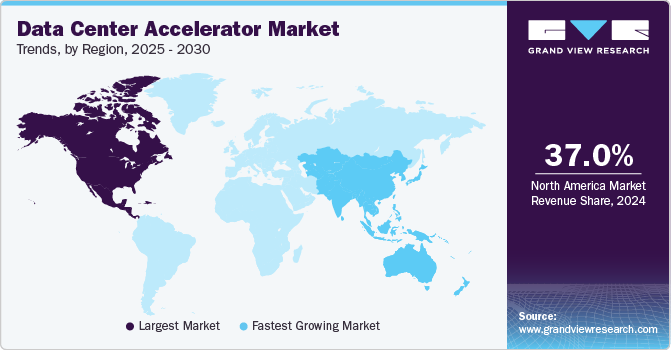

Regional Insights

North America data center accelerator market held the largest share of over 37% in the global market in 2024. Hyperscale data centers are expanding rapidly across North America, primarily driven by major cloud service providers like Amazon Web Services, Microsoft Azure, and Google Cloud. These large-scale facilities require data center accelerators, such as GPUs and ASICs, to handle the immense computational demands of AI, machine learning, and deep learning applications. Accelerators enhance computing power and efficiency, enabling faster processing of complex tasks while optimizing energy consumption. As AI adoption grows across industries, hyperscale data centers are increasingly relying on accelerators to meet the performance requirements of data-intensive workloads and improve overall operational efficiency.

U.S. Data Center Accelerator Market Trends

The data center accelerator market in the U.S. held a dominant position in 2024. The 5G rollout and growing interest in edge computing in the U.S. are driving demand for accelerators to process data closer to the source, enabling faster real-time analytics. This is crucial for applications like IoT and AI, where immediate data processing is required for tasks such as autonomous driving and smart cities. Accelerators enhance the performance and efficiency of data centers in these emerging technologies, supporting high-speed, low-latency operations.

Asia Pacific Data Center Accelerator Market Trends

The data center accelerator market in Asia Pacific is expected to grow significantly at a CAGR of 27.8% from 2025 to 2030. Countries in Asia Pacific, especially China, Japan, South Korea, and India, are experiencing rapid digital transformation, with growing investments in cloud computing, AI, and IoT. As businesses and governments digitize their operations, demand for efficient data centers is rising. Accelerators like GPUs and FPGAs are increasingly essential to manage the high computational requirements of AI-driven workloads, enabling faster processing and better performance. The region's digital ecosystem is also expanding with services such as e-commerce, smart cities, and autonomous systems, further driving the need for advanced data center infrastructure to handle large-scale, data-intensive applications efficiently.

Japan data center accelerator market is expected to grow rapidly in the coming years. Japan’s focus on advanced technologies like AI and IoT is increasing the demand for Data Center Accelerators (ADCs). These technologies require the efficient management of complex application environments, and ADCs help ensure optimal performance, scalability, and seamless integration across multiple platforms.

The data center accelerator market in China held a substantial market share in 2024. The rapid expansion of cloud computing services in China, driven by major providers like Alibaba Cloud, Tencent Cloud, and Baidu, is fueling a significant demand for data center accelerators. These companies need advanced hardware to efficiently manage high volumes of data processing, particularly for AI and machine learning applications. As cloud services continue to grow, the reliance on accelerators becomes crucial for enhancing performance, scalability, and operational efficiency in data centers.

Europe Data Center Accelerator Market Trends

The data center accelerator market of Europe was identified as a lucrative region in 2024. The increased adoption of cloud services across Europe is driving significant growth in the data center accelerator market. Organizations are transitioning to cloud-based solutions to achieve enhanced flexibility, scalability, and cost-effectiveness. This migration often involves processing large volumes of data and running complex applications, particularly those powered by artificial intelligence (AI) and machine learning. To support these demanding workloads, data centers require advanced accelerators, such as GPUs and FPGAs, which optimize processing power and improve operational efficiency. As businesses continue to embrace digital transformation, the reliance on data center accelerators will grow, reinforcing their importance in cloud environments.

The UK data center accelerator market is expected to grow rapidly in the coming years as the country is undergoing significant digital transformation across key sectors like finance, healthcare, and retail. This shift is driving increased demand for cloud services and advanced data processing capabilities. To meet these needs, organizations are adopting data center accelerators to enhance performance and operational efficiency. Accelerators are particularly essential for managing the computational demands of AI and big data applications, enabling businesses to leverage data-driven insights effectively.

The data center accelerator market in Germany is expected to hold a significant market share in the coming years. Germany's leadership in Industry 4.0 drives substantial investments in smart manufacturing and automation technologies. This industrial transformation demands advanced data processing capabilities, especially for AI and machine learning applications. As companies seek to optimize production efficiency and enhance decision-making, the need for data center accelerators becomes critical. These accelerators are essential for managing complex computations and enabling real-time data analytics, supporting Germany's position as a pioneer in the digital economy.

Key Data Center Accelerator Company Insights

Some of the key companies in the data center accelerator market include Advanced Micro Devices, Inc., Dell Inc., IBM Corporation, NVIDIA Corporation, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

NVIDIA is renowned for its graphics processing units (GPUs), which are essential for high-performance computing, deep learning, and AI workloads in data centers. NVIDIA has strategically positioned itself as a leader in AI and machine learning by providing powerful hardware and software solutions. NVIDIA’s software frameworks, such as CUDA, cuDNN, and TensorFlow, enable developers to leverage GPU capabilities for building AI applications. This comprehensive ecosystem supports the deployment of accelerators in various industries.

-

Advanced Micro Devices, Inc. is a significant player in the Data Center Accelerator (ADC) market. AMD’s Radeon Instinct GPUs provide significant performance advantages for deep learning and parallel processing tasks. With architectures like RDNA and CDNA, AMD delivers efficient, high-performance graphics and compute solutions optimized for data centers. AMD’s EPYC processors excel in virtualization capabilities, allowing data centers to run multiple workloads efficiently. This feature is essential for enterprises that require flexibility and scalability in their operations.

Key Data Center Accelerator Companies:

The following are the leading companies in the data center accelerator market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc.

- Dell Inc.

- IBM Corporation

- Intel Corporation

- Lattice Semiconductor

- Lenovo Ltd.

- Marvell Technology Inc.

- Microchip Technology Inc.

- Micron Technology, Inc.

- NEC Corporation

- NVIDIA Corporation

- Qualcomm Incorporated

- Synopsys Inc.

Recent Developments

-

In October 2024, AMD launched the Alveo UL3422, an electronic trading accelerator specifically designed for ultra-low latency applications in the financial sector. This slim-form factor card, powered by the AMD Virtex UltraScale+ FPGA, enables trading firms to achieve under 3ns latency for trade execution. The Alveo UL3422 offers a cost-effective solution for high-frequency trading, making advanced performance accessible to organizations of all sizes. It is already available for deployment on various servers.

-

In September 2024, Intel launched its next-generation AI solutions, featuring the Xeon 6 processor and Gaudi 3 AI accelerators. The Xeon 6 offers double the performance for AI and HPC workloads, while Gaudi 3 enhances throughput by 20% and provides a superior price-to-performance ratio. These innovations aim to support enterprises in deploying AI more effectively, focusing on performance, efficiency, and cost reduction. The products are designed for scalable AI infrastructure in data centers and cloud environments.

Data Center Accelerator Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 20.94 billion |

|

Revenue forecast in 2030 |

USD 63.22 billion |

|

Growth rate |

CAGR of 24.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Processor, type, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, Australia, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa. |

|

Key companies profiled |

Advanced Micro Devices, Inc.; Dell Inc.; IBM Corporation; Intel Corporation; Lattice Semiconductor; Lenovo Ltd.; Marvell Technology Inc.; Microchip Technology Inc.; Micron Technology, Inc.; NEC Corporation; NVIDIA Corporation; Qualcomm Incorporated; Synopsys Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data Center Accelerator Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center accelerator market report based on processor, type, application, and region:

-

Processor Outlook (Revenue, USD Billion, 2018 - 2030)

-

GPU

-

CPU

-

FPGA

-

ASIC

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

HPC Data Center

-

Cloud Data Center

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Deep Learning Training

-

Public Cloud Interface

-

Enterprise Interface

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center accelerator market size was estimated at USD 17.67 billion in 2024 and is expected to reach USD 20.94 billion in 2025.

b. The global data center accelerator market is expected to grow at a compound annual growth rate of 24.7% from 2025 to 2030 to reach USD 63.22 billion by 2030.

b. The cloud data center segment dominated the data center accelerator market with a share of over 65% in 2024. The increasing adoption of cloud infrastructure by enterprises has led to a significant demand for acceleration technologies like GPUs, FPGAs, and ASICs. These technologies are essential for handling complex workloads, including high-performance computing, AI, and machine learning, which are often deployed in cloud environments.

b. Some key players operating in the data center accelerator market include Advanced Micro Devices, Inc., Dell Inc., IBM Corporation, Intel Corporation, Lattice Semiconductor, Lenovo Ltd., Marvell Technology Inc., Microchip Technology Inc., Micron Technology, Inc., NEC Corporation, NVIDIA Corporation, Qualcomm Incorporated, and Synopsys Inc. .

b. The demand for accelerators is largely driven by hyperscale data centers and cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These companies require advanced hardware to meet the increasing computational needs of AI-driven applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."