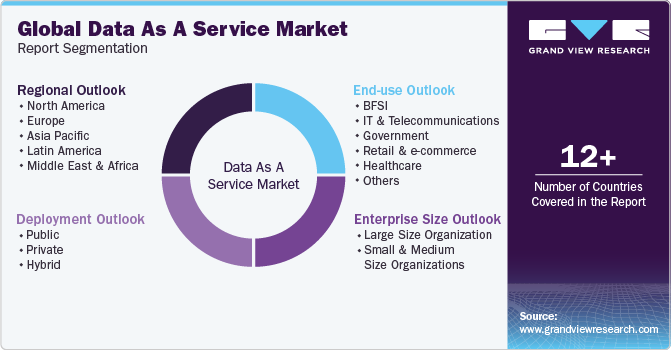

Data As A Service Market Size, Share & Trends Analysis Report By Deployment (Public, Private), By Enterprise Size (Large Size Organization, Small & Medium Size Organizations), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-318-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Data As A Service Market Size & Trends

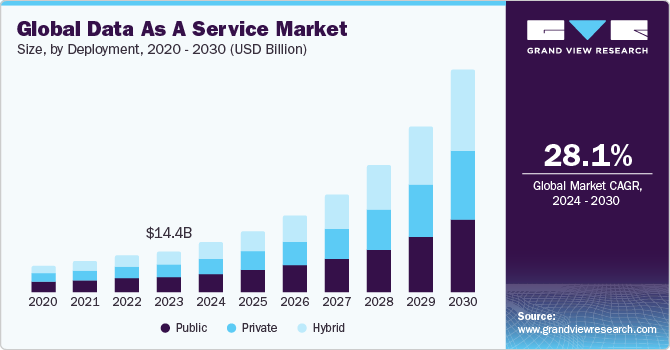

The global data as a service market size was estimated at USD 14.36 billion in 2023 and is projected to grow at a CAGR of 28.1% from 2024 to 2030. The integration of artificial intelligence and machine learning into data as a service (DaaS) platforms is transforming how businesses analyze and use data. AI-powered analytics provide deeper insights and predictive capabilities, helping organizations anticipate trends and make informed decisions. These technologies enable real-time data processing and automated decision-making, enhancing operational efficiency. DaaS platforms with advanced analytics capabilities are becoming essential for businesses aiming to stay competitive. This trend is pushing providers to continually enhance their offerings with cutting-edge AI and ML tools.

The growing use of graph databases and the need for sophisticated service solutions to handle data with complex relations are key drivers of the market. Graph databases enable the efficient storage and querying of complex relationships between data entities. This is particularly important in industries such as finance, healthcare, and social media, where data relationships are critical to decision-making. The need for advanced analytics and insights is driving the demand for DaaS solutions that can handle large and complex data sets.

As the volume of data generated at the edge continues to grow with the proliferation of IoT devices and sensors, there is a rising trend towards integrating DaaS solutions with edge computing architectures. This trend enables organizations to process and analyze data closer to the source, reducing latency and bandwidth requirements while improving real-time decision-making capabilities. By leveraging DaaS at the edge, businesses can extract valuable insights from distributed data sources, empowering them to deliver personalized services and optimize operational efficiency. With edge computing becoming increasingly prevalent across industries, the integration of DaaS solutions at the edge is poised to drive innovation in areas such as autonomous vehicles, smart cities, and industrial automation.

With increasing concerns about data privacy and regulations such as GDPR and CCPA, there's a growing trend towards privacy-preserving data analytics within DaaS solutions. This trend focuses on techniques such as differential privacy, federated learning, and homomorphic encryption to enable data analysis while protecting sensitive information. By incorporating privacy-preserving mechanisms into DaaS offerings, organizations can comply with regulations, build trust with customers, and mitigate the risk of data breaches.

Market Characteristics & Concentration

The trend of DaaS is experiencing a significant degree of innovation, with providers continually evolving their offerings to meet the dynamic needs of businesses. This innovation is evident in the integration of advanced analytics, AI/ML capabilities, and edge computing into DaaS platforms, enabling organizations to derive deeper insights and drive operational efficiencies. Additionally, innovations in data governance, privacy, scalability, and performance optimization are enhancing the security, compliance, and scalability of DaaS solutions, further fueling their adoption across industries. As technology continues to advance, we can expect DaaS to remain at the forefront of data management innovation, empowering organizations to harness the full potential of their data assets.

The market is witnessing a notable surge in merger and acquisition (M&A) activities as companies vie to strengthen their foothold in the data services market. This trend is propelled by the increasing recognition of data's pivotal role in decision-making and innovation across industries. Through strategic acquisitions, companies seek to enhance their capabilities, expand market reach, and capitalize on the growing demand for comprehensive data solutions.

The market is increasingly shaped by the impact of regulations governing data privacy and security. As governments worldwide enact stringent measures such as GDPR and CCPA, DaaS providers are innovating to ensure compliance and protect sensitive information. This trend emphasizes the need for organizations to prioritize regulatory compliance in their adoption of DaaS solutions, driving the evolution of data governance practices and technologies.

Within the sphere of DaaS, a discernible trend is the growing adoption of substitutes for conventional DaaS solutions. These substitutes encompass a spectrum of offerings, from managed data services providing tailored data management solutions to self-service data preparation tools empowering users to manipulate data independently. Additionally, open-source data management solutions and data virtualization platforms are gaining traction as alternatives, affording organizations greater flexibility and control over their data infrastructure. As organizations seek more customizable, agile, and cost-effective options, these substitutes are reshaping the landscape of data management, offering tailored solutions to meet diverse business needs.

The market is witnessing a shift in end user concentration towards catering to a broader range of users, including small to medium-sized enterprises (SMEs) and individual users. Traditionally, DaaS solutions primarily targeted large enterprises with extensive data management needs and resources. However, advancements in technology and pricing models are enabling DaaS providers to democratize access to data services, driving innovation and expanding their market reach to serve a more diverse set of end users.

Deployment Insights

The public segment led the market and accounted for 39.37% of the global revenue in 2023. The public sector is rapidly adopting cloud computing solutions due to their cost-effectiveness, scalability, and operational efficiency. Government agencies and public organizations are leveraging DaaS providers to access cloud-based data services, eliminating the need for expensive on-premises infrastructure. Cloud-based DaaS solutions offer unparalleled flexibility, allowing public entities to easily scale their data storage and processing capabilities up or down as needed. Furthermore, cloud providers often offer robust security and compliance measures, ensuring that sensitive public data is protected and handled in accordance with relevant regulations and industry standards. The shift towards cloud computing is enabling the public sector to leverage cutting-edge data services while minimizing upfront capital investments and reducing the burden of maintaining complex IT infrastructure.

The hybrid segment trend represents a shift towards hybrid cloud infrastructures, where organizations combine on-premises resources with cloud services to optimize performance, flexibility, and cost-efficiency. This approach allows businesses to leverage the benefits of both on-premises and cloud environments, addressing concerns such as data security, regulatory compliance, and workload scalability. In the hybrid segment, organizations can deploy sensitive workloads on-premises while utilizing the cloud for less critical tasks, providing a balance between control and scalability. Hybrid cloud solutions also enable seamless integration between legacy systems and modern cloud services, facilitating digital transformation initiatives. As businesses increasingly adopt hybrid cloud architectures to meet their diverse needs, the hybrid segment trend is expected to continue driving innovation in cloud computing.

Enterprise Size Insights

The large size organization segment has the highest revenue share in 2023. In the large size organization segment, a notable trend is the integration of DaaS with other cloud-based services to create comprehensive cloud ecosystems. This integration allows large organizations to streamline data management processes and benefit from the scalability and cost-effectiveness of cloud solutions. Another trend is the increasing emphasis on data security and compliance, highlighting the importance of protecting data assets while leveraging DaaS for improved decision-making. Large organizations are also focusing on data democratization, enabling easier access to data and analytics tools across the organization to drive informed decision-making and enhance competitiveness. The adoption of DaaS by large organizations is expected to continue growing, driven by the need for enhanced data management capabilities and the utilization of real-time data analytics for strategic insights.

The Data as a Service (DaaS) market is witnessing growing adoption among small and medium enterprises (SMEs). SMEs are increasingly recognizing the benefits of DaaS, which include improved data management, enhanced data analytics capabilities, and reduced IT infrastructure costs. DaaS allows SMEs to access enterprise-grade data and analytics services without the need for significant upfront investments in hardware and software. This is particularly beneficial for SMEs, which often have limited IT budgets and resources. The flexibility and scalability offered by cloud based DaaS solutions are also driving their adoption among SMEs, as they can easily scale their data management and analytics capabilities as their business needs evolve.

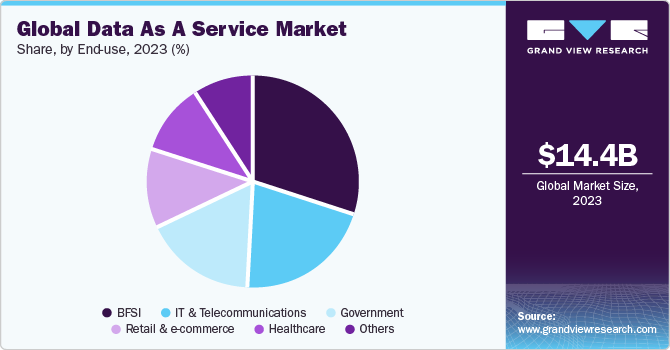

End Use Insights

The BFSI segment held the largest market share of the global revenue in 2023. The growing demand for real-time data analytics is another key trend in the BFSI sector. Financial institutions are increasingly using real-time data analytics to gain valuable insights and make timely decisions. DaaS provides access to a wide range of data sources, including social media, IoT devices, and other external data sources, which can be used for real-time analytics. The demand for real-time data analytics is expected to continue, driven by the need for financial institutions to stay competitive in the market.

DaaS is being combined with edge computing in telecom to manage information at the edge, reducing latency and enhancing real-time data processing. Edge computing enables telecom providers to process massive amounts of data closer to the source, consuming less bandwidth and providing faster insights. This is particularly important for applications that require low latency, such as autonomous vehicles, smart cities, and industrial IoT. By leveraging edge computing and DaaS, telecom companies can optimize network performance, reduce costs, and develop new revenue streams.

Regional Insights

North America dominated the market and accounted for a 35.3% share in 2023. The demand for real-time data analytics is rising in North America, driven by the need for businesses to make timely, data-driven decisions. DaaS provides access to a wide range of data sources, including social media, IoT devices, and other external data sources, which can be used for real-time analytics. This trend is particularly prevalent in industries such as BFSI, where financial institutions are using real-time data analytics to gain valuable insights and stay competitive in the market.

U.S. Data As A Service (DaaS) Market Trends

The U.S. has seen significant growth. In the U.S., the market is growing rapidly due to the adoption of advanced data analytics and cloud technologies, with key players like IBM and Oracle leading the way. There is a strong emphasis on data governance and security to ensure compliance and data integrity as AI and machine learning are integrated into operations. The demand for real-time analytics is driving businesses across various sectors to adopt DaaS solutions for timely and actionable insights.

Europe Data As A Service (DaaS) Market Trends

The European market is growing rapidly due to the widespread adoption of cloud-based analytics and extensive digitalization efforts. Key sectors driving this growth include government, manufacturing, consulting, and financial services.

Data As A Service market in the U.K. is experiencing significant investments in digital transformation and data analytics, especially in the financial services sector. The country's dynamic startup ecosystem also contributes to its market dominance.

France Data As A Service market is witnessing increased focus on data protection and privacy. With stringent regulations such as the GDPR (General Data Protection Regulation), French companies are prioritizing strong data protection measures. This emphasis on data security is driving the demand for DaaS solutions that can ensure compliance while providing seamless data access and management.

The Data As A Service market in Germany is driven by its strong industrial base and focus on Industry 4.0 initiatives. German companies are utilizing DaaS to enhance manufacturing processes and improve supply chain management.

Asia Pacific Data As A Service (DaaS) Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region is expected to be the fastest-growing market for DaaS solutions. The region's rapid economic growth, increasing adoption of cloud computing, and growing demand for data analytics are driving the growth of the market. The region's major economies, such as China and India, are expected to be key drivers of the market's growth.

China Data as a Service market has witnessed rapid growth due to the digital economy's growth and initiatives like the "Digital China" strategy, promoting data-driven innovation and smart city development.

The Data as a Service market in India is growing significantly due to increased business digitization and government initiatives like data localization. The IT and telecom sectors, along with a robust startup ecosystem and skilled workforce, are key drivers.

Japan Data as a Service market is driven by digital transformation across various sectors, with strong government support for cloud adoption and data utilization. Collaboration with global tech firms is also enhancing the development of advanced analytics platforms.

Middle East & Africa (MEA) Data As A Service (DaaS) Market Trends

The Middle East and Africa are expected to be significant growth markets for DaaS solutions. The region's rapid economic growth, increasing adoption of cloud computing, and growing demand for data analytics are driving the growth of the market.

Key Data As A Service Company Insights:

Major corporations are employing a diverse range of strategic initiatives to expand their market presence. These tactics include market expansions, mergers and acquisitions, partnerships, product launches, and collaborations. This multifaceted approach enables them to gain market share and solidify their position within competitive industries. For instance, SAP SE introduced a new concept within its SAP Signavio software in March 2022. This innovation aggregates end-user experience data from customer, supplier, or employee surveys with core IT systems. This enhancement allows businesses to optimize their end-to-end business processes, thereby increasing operational efficiency and customer satisfaction.

Key Data As A Service Companies:

The following are the leading companies in the data as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com Inc.

- Bloomberg L.P.

- Crunchbase Inc.

- Google LLC

- IBM

- Meta Platforms Inc.

- Nielsen Holdings N.V.

- Oracle Corporation

- SAP SE

- Salesforce, Inc.

- ZoomInfo Technologies Inc.

Recent Developments

-

In October 2022, Nulogy, a provider of supply chain collaboration solutions, launched its DaaS offering on the Multi-Enterprise Supply Chain Business Network Platform (MESCBN). This new self-serve analytics tool empowers Nulogy users to build advanced analytics capabilities for exploring complex data at scale. With DaaS, clients gain complete control over the end analytics output, enabling data-driven decision-making.

-

In June 2022, Alibaba established a new subsidiary called Lingyang Intelligent Service Co. to provide "data-intelligence-as-a-service" to businesses. This service aims to aid companies in improving decision-making and operational efficiency by leveraging Alibaba's expertise in using data intelligence for manufacturing, marketing, and other domains.

-

In September 2022, Asigra Inc., a pioneer in ultra-secure backup and recovery solutions, announced the general availability of its Tigris Data Protection software with Content Disarm & Reconstruction (CDR) functionality. This addition makes Asigra's backup and recovery platform the most security-focused solution on the market, complementing its existing suite of robust security features.

-

In June 2022, IMAT Solutions, a provider of real-time healthcare data management and population health reporting solutions, launched a new DaaS offering tailored for health payers. This new DaaS solution aligns with the Centers for Medicare & Medicaid Services' (CMS) initiative to transition all quality measures used in its reporting programs to digital quality measures (dQMs). The IMAT DaaS offering ingests patient data from various sources and converts it into FHIR-based records, simplifying the process for payers.

Data As A Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 17.38 billion |

|

Revenue forecast in 2030 |

USD 76.80 billion |

|

Growth Rate |

CAGR of 28.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, enterprise size, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE;(KSA); South Africa |

|

Key companies profiled |

Amazon.com Inc.; Bloomberg L.P.; Crunchbase Inc.; Google LLC; IBM; Meta Platforms Inc.; Nielsen Holdings N.V.; Oracle Corporation; SAP SE; Salesforce, Inc.; ZoomInfo Technologies Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global data as a service market report based on deployment, enterprise size, end use, and region.

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Size Organization

-

Small & Medium Size Organizations

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

IT and Telecommunications

-

Government

-

Retail & e-commerce

-

Healthcare

-

Others (Media and Entertainment, Manufacturing, Oil & Gas)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data as a service market size was estimated at USD 14.36 billion in 2023 and is expected to reach USD 17.38 billion in 2024.

b. The global data as a service market is expected to grow at a compound annual growth rate of 28.1% from 2024 to 2030 to reach USD 76.80 billion by 2030.

b. North America dominated the data as a service market with a share of 35.3% in 2024. This is attributable to adoption of advanced data analytics and cloud technologies, with key players like IBM and Oracle leading the way

b. Some key players operating in the data as a service market include Amazon.com Inc., Bloomberg L.P., Crunchbase Inc., Google LLC, IBM, Meta Platforms Inc., Nielsen Holdings N.V., Oracle Corporation, SAP SE, Salesforce, Inc., ZoomInfo Technologies Inc.

b. Key factors that are driving the market growth include increasing adoption of cloud-based analytics, growing demand in industries to gain actionable insights from big data, and emerging trends of AI and ML integration

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."