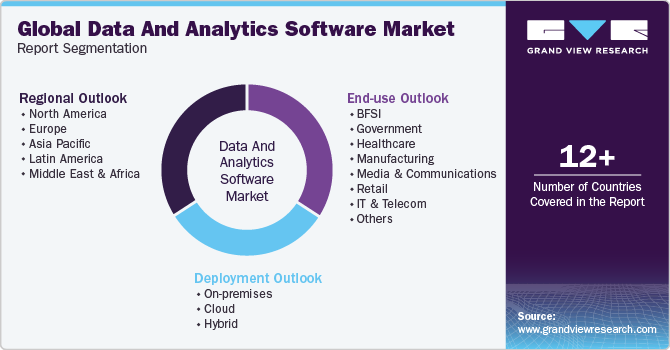

Data And Analytics Software Market Size, Share & Trends Analysis Report By Deployment (On-premise, Cloud & Hybrid), By End Use (BFSI, Government, Healthcare, Media & Communications, IT & Telecom, Manufacturing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-316-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Data And Analytics Software Market Trends

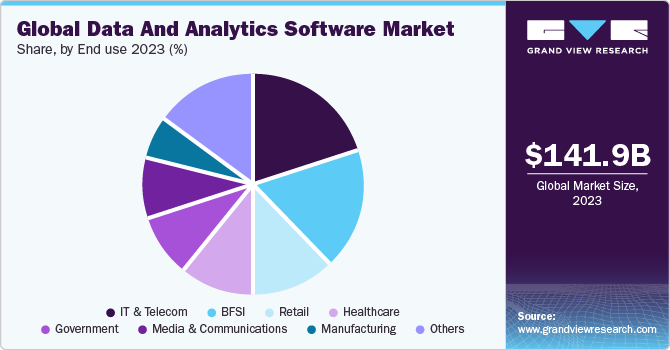

The global data and analytics software market size was estimated at USD 141.91 billion in 2023 and is expected to expand at a CAGR of 13.6% from 2024 to 2030. Businesses are increasingly recognizing the importance of ensuring adequate data security and privacy protection in maintaining a competitive edge and protecting their reputation. By adopting ethical data usage practices, organizations can ensure adequate regulatory compliance while building trust amongst customers and unlocking the full potential of data-driven insights without compromising moral and societal values.

As the market continues to evolve, the growing consideration for data security and privacy protection will remain a crucial trend, shaping the way organizations leverage data and ensure a responsible and sustainable approach to data-driven decision-making.

The use of AI is also helping foster a culture of continuous improvement and innovation within organizations. By harnessing the power of AI-driven analytics, businesses can gain a deeper understanding of their operations, customer behavior, market trends, and competitive landscape. These deeper insights can enable companies to make proactive decisions, optimize processes, and innovate products and services to meet evolving market demands.

The iterative nature of ML algorithms typically allows organizations to refine their data models over time, improving accuracy and predictive capabilities to derive better business outcomes. As AI and ML technologies continue to advance, the integration of these technologies in data and analytics is expected to become increasingly indispensable for organizations looking to stay ahead of the curve, adapt to changing market dynamics, and capitalize on the vast opportunities presented by data-driven decision-making.

The growing concerns over data breaches, misuse of personal information, and the potential for algorithmic bias have led to increased scrutiny and the need for seamless frameworks for data security and privacy protection in data and analytics. For instance, in February 2024, International Business Machines Corporation announced an update for IBM Databand, revealing the integration of its observability and incident management capabilities with Azure Data Factory (ADF). This integration aims to enhance data reliability and quality for customers using ADF as their data pipeline orchestration and transformation tool, offering end-to-end pipeline monitoring, trend analysis, custom alerting, and central logging to enable proactive anomaly detection and seamless data management across tools.

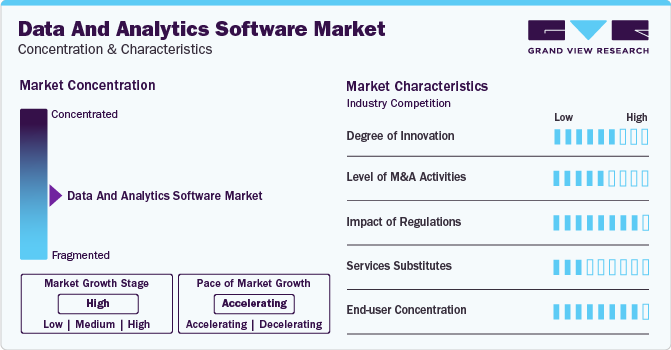

Market Characteristics & Concentration

The data and analytics industry are characterized by a high degree of innovation by advancements in technologies such as artificial intelligence, virtual reality, big data, and adaptive learning platforms. The integration of Artificial Intelligence (AI) and Machine Learning (ML) in data and analytics has become exceptionally significant, reshaping the landscape of data processing and decision-making for enterprises. These technologies are revolutionizing the process of data integration, particularly in data warehousing, by substantially enhancing data processing speed, accuracy, and operational efficiency. AI and ML are playing a crucial role in transforming the way businesses handle data, leading to improved processing of vast datasets and enhanced intelligence through autonomous learning.

The data and analytics industry is characterized by a high level of merger and acquisition (M&A) activity by the leading players as they seek to expand their market share by diversifying their product portfolios, targeting new customer segments, and strategically expanding their global presence into various industries.

Regulations like GDPR (Europe) and CCPA (California) are being strengthened, and new ones are emerging globally. These regulations grant individuals more control over their personal data and impose stricter requirements on organizations collecting and processing such data. Data breaches and cyberattacks are a growing concern. Regulations are likely to become stricter around data security measures, requiring organizations to implement robust security protocols to protect sensitive data.

There is no direct substitute for the data and analytics industry. While traditional analytics tools and manual data processing can be considered substitutes, the increasing sophistication and accessibility of advanced analytics solutions make them less viable alternatives.

End user concentration is a significant factor in the data and analytics industry. The increased use of AI and machine learning, real-time data analytics, cloud computing, and a significant increase in collaborative data sharing continue to drive the adoption of data and analytics solutions in the end users. End users are increasingly utilizing data analytics to enhance customer experience, develop new products and services, manage risk effectively, and prevent fraud.

Deployment Insights

The cloud segment led the market in 2023, accounting for over 48% share of the global revenue. Cloud deployment in data and analytics solutions has experienced notable growth in recent years due to its numerous advantages. The scalability and flexibility offered by cloud platforms allow organizations to easily scale resources up or down based on demand, optimizing costs and resource utilization. In addition, cloud solutions provide seamless access to a wide range of analytics tools and services, enabling organizations to rapidly deploy and experiment with new technologies.

The hybrid segment is predicted to foresee significant growth in the coming years. Hybrid deployment, combining on-premises and cloud resources, has emerged as a popular approach for organizations seeking to optimize their data and analytics infrastructure. Hybrid architectures allow organizations to leverage the best of both worlds, utilizing cloud services for scalable and flexible computing and storage while retaining sensitive data or workloads on-premises for compliance or performance reasons.

End Use Insights

The IT & telecom segment accounted for the largest market revenue share in 2023. In the Information Technology (IT) and telecommunications sector, data and analytics are pivotal drivers of innovation, efficiency, and customer satisfaction. Telecom companies leverage data analytics to monitor network performance in real-time, optimize infrastructure, and ensure seamless connectivity. Moreover, by analyzing vast amounts of customer data, including call records and browsing history, telecom providers can personalize services, anticipate needs, and enhance the overall customer experience.

The retail segment is predicted to foresee significant growth in the coming years. The integration of data analytics in the retail industry enables companies to make data-driven decisions, enhance customer satisfaction, and drive sales growth. Moreover, the advent of advanced technologies such as artificial intelligence and machine learning is enabling retailers to delve deeper into consumer insights, streamline operations, and stay ahead of the competition in the dynamic retail landscape. The future of data and analytics in the retail sector remains promising, offering endless opportunities for innovation, efficiency, and customer-centric strategies.

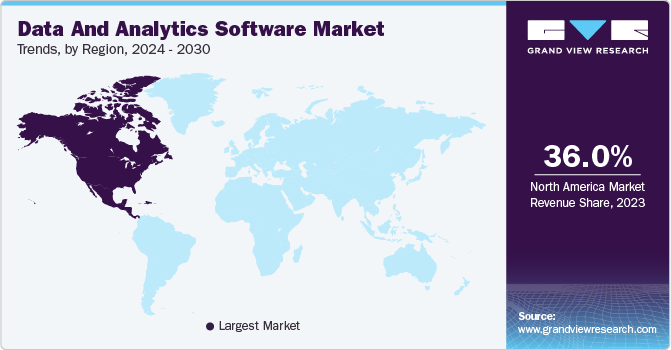

Regional Insights

North America dominated with a revenue share of over 36% in 2023. The market in North America is expanding rapidly in line with the growing adoption of cloud technology in the region, reflecting the increasing demand for advanced solutions to manage and analyze data effectively. With cloud-based offerings, businesses can access powerful analytics tools, surmount geographical limitations, and ensure cost efficiency, and adaptability, driving the growth of the regional market.

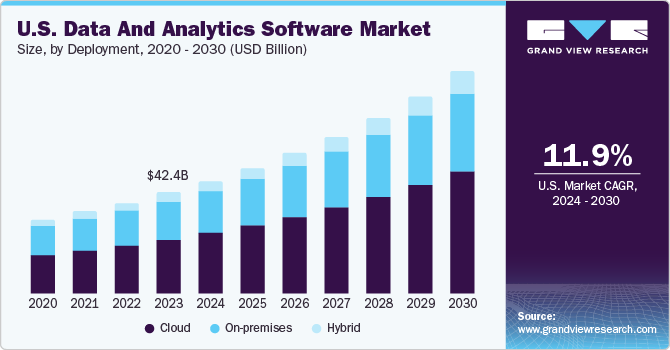

U.S. Data And Analytics Software Market Trends

The U.S. data and analytics software market is expected to grow at a CAGR of 11.9% from 2024 to 2030. In the U.S., businesses are emphasizing developing real-time analytical capabilities to make quick, data-driven decisions. Real-time analytics allow organizations to monitor and analyze data streams in real-time, enabling immediate response to change market conditions and customer needs. Companies, such as Uber Technologies Inc. and Netflix, are utilizing real-time analytics to drive rapid, data-driven decisions.

The data and analytics software market in Canada held a significant share in the North American region. In Canada, businesses are leveraging Machine Learning (ML), Natural Language Processing (NLP), and predictive modeling to advance their analytical capabilities, extract deeper insights from their data, and drive more informed decision-making. Major retailers, such as Loblaws Inc. and Best Buy Canada Ltd., are using AI-driven recommendation systems to personalize product offerings and enhance the shopping experience for consumers.

Europe Data And Analytics Software Market Trends

The Europe data and analytics software market is expected to witness significant growth over the forecast period. In Europe, businesses are increasingly opting for data-driven insights to improve operations, boost business performance, and enhance customer experiences. The increasing adoption of Digital Asset Management (DAM) solutions is particularly contributing to the growth of the data and analytics software market. These solutions help streamline asset management processes, facilitating efficient storage and distribution of digital assets, such as images and videos. The demand for innovative Content Management System (CMS) platforms, which can facilitate the creation, management, and distribution of digital content, is also rising in Europe.

The data and analytics software market in UK held a significant share in the European region. In the UK, open banking regulations enable the secure sharing of customers’ financial data with authorized third-party providers, fueling innovation in data-driven financial services and driving the demand for data and analytics solutions. Fintech firms, such as Revolut Ltd and Monzo Bank Limited, are securely accessing customers’ financial data and utilizing it to offer enhanced financial management tools and personalized services, driving innovation and increasing the demand for data and analytics solutions in the BFSI industry.

The Germany data and analytics software market is expected to grow at the fastest CAGR from 2024 to 2030. In Germany, several businesses, particularly the incumbents of the manufacturing, automotive, finance, and healthcare industries, are utilizing ML, AI, and predictive analytics to advance their analytical capabilities and gain competitive advantages. Modern technologies, such as AI and ML, are helping companies analyze large volumes of data; identify patterns, trends, and correlations; and derive better business outcomes. Regulations, such as the Digital Act and the Health Data Use Act, are indicative of the growing emphasis the government of Germany is putting on implementing data and analytics in the healthcare industry. These regulations are aimed at advancing healthcare research by providing pharmaceutical companies with access to patients' health data for research purposes.

The data and analytics software market in France is expected to grow at the fastest CAGR from 2024 to 2030. In France, companies are putting a strong emphasis on enhancing customer experience. Implementing data and analytics allows these companies to gain valuable insights into customer behavior and preferences. Companies can customize their offerings based on this data, enhancing engagement and satisfaction by better meeting customers’ needs.

Asia Pacific Data And Analytics Software Market Trends

The Asia Pacific data and analytics software market is anticipated to register the highest CAGR over the forecast period. The Asia Pacific market is growing in line with the rapid digitization underway across various industries and industry verticals throughout Asia Pacific. Businesses grappling with a surge in data generation are aggressively scouting for robust analytics tools. Integration of AI and ML into data and analytics is emerging as a dominant trend to facilitate automation, pattern recognition, and insightful decision-making.

The data and analytics software market in India held a significant share in the Asia Pacific region. In India, the growing population and the bustling digital world are producing huge amounts of data from online shopping, social media interactions, and connected devices. Businesses are increasingly realizing the strategic importance of utilizing data and analytics to gain actionable insights, improve decision-making, and enhance operational efficiency. Government initiatives, such as Digital India and Smart Cities Mission, are driving the adoption of data and analytics in governance, healthcare, and urban planning. As a result, the market in India is poised for significant growth, with a wide range of opportunities for businesses and technology providers to innovate and capitalize on the large volumes of data being generated across the country.

The China data and analytics software market held a significant share in the Asia Pacific region. China is known for its prominence in e-commerce and mobile payments. However, e-commerce and mobile payments rely heavily on the implementation of data and analytics to personalize user experiences, manage risk, and detect fraud. Businesses are increasingly investing in data and analytics tools to harness the wealth of data available. As China continues to lead in digital innovation, the demand for sophisticated data and analytics solutions is expected to grow over the forecast period.

The data and analytics software market in Japan held a significant share in the Asia Pacific region. The Japanese market is experiencing significant growth owing to strong marketing strategies and reasonable product offerings by companies such as NTT Education, Benesse Holdings, and Gakken. As the Japanese education system highly embraces local culture, international solution providers find it challenging to enter the Japanese market, thereby allowing local vendors to enhance their market share.

The South Korea data and analytics software market held a significant share in the Asia Pacific region. In South Korea, the robust semiconductor manufacturing industry, led by companies, such as SAMSUNG and SK HYNIX INC., is generating vast amounts of data from production processes and quality control measures. The country’s thriving electronics industry, led by SAMSUNG and LG Electronics, is equally contributing to the data deluge associated with the production of consumer goods, such as smartphones, televisions, and home appliances. As a result, the market in South Korea is experiencing significant growth, driven by the need to harness the growing volumes of data for gaining deeper insights into manufacturing efficiency, product quality optimization, and consumer behavior analysis.

The data and analytics software market in Australia held a significant share in the Asia Pacific region. In Australia, the growing implementation of connected devices as part of the smart city initiatives being pursued across the country for waste management and traffic optimization and in smart homes featuring connected appliances for automation and energy efficiency is driving the growth of the market in the country.

Middle East & Africa Data And Analytics Software Market Trends

The data and analytics software market in Middle East & Africa (MEA) is anticipated to thrive over the forecast period. In the Middle East & Africa (MEA), advances in AI and ML and widespread mobile usage are driving the growth of the market in the MEA regional market. The incumbents of finance, healthcare, retail, and manufacturing industries are increasingly utilizing modern technologies to drive predictive analytics, NLP, image recognition, and robotics. Mobile applications are transforming industries, such as banking, healthcare, e-commerce, and transportation, enhancing connectivity and easing access to information for a significant portion of the population.

Key Data And Analytics Software Company Insights

Key education technology companies include Accenture plc, Alteryx, Inc., and Amazon Web Services, Inc. active in the market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development.

For instance, in March 2024, International Business Machines Corporation expanded its technology expert labs in India to hasten the adoption of analytics and other pivotal technologies, aiding global clients in effectively integrating and expanding solutions. Utilizing profound expertise and access to product insights, these labs facilitate outcome-driven engagements, ensuring tangible ROI and overcoming implementation hurdles.

Key Data And Analytics Software Companies:

The following are the leading companies in the data and analytics software market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture plc

- Alteryx, Inc.

- Amazon Web Services, Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Sisense Inc.

- Tableau Software LLC

Recent Developments

-

In March 2024, Amazon Web Services, Inc. partnered with Accenture plc and Anthropic to deploy and scale customized generative AI technology in highly regulated industries. It aims to enhance innovation, customer service, and workforce productivity while ensuring data privacy and security. This collaboration emphasizes the importance of data analytics-driven insights in developing responsible and impactful AI applications.

-

In February 2024, Accenture plc acquired GemSeek, a customer experience analytics provider in Bulgaria, strengthening its data and AI capabilities, enabling clients to better understand and respond to evolving customer needs. This acquisition aims to empower organizations to drive growth through customer-centric, data-driven strategies.

-

In April 2023, International Business Machines Corporation acquired Software AG's enterprise data integration platforms, StreamSets and webMethods to strengthen its data and analytics capabilities, enhancing its AI, data management, and IT automation offerings. The aim is to empower businesses to unlock the full potential of their applications and data assets, leveraging hybrid cloud and AI technologies to drive innovation and prepare for future challenges.

Data And Analytics Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 160.31 billion |

|

Revenue forecast in 2030 |

USD 345.32 billion |

|

Growth rate |

CAGR of 13.6% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

Accenture plc; Alteryx, Inc.; Amazon Web Services, Inc.; International Business Machines Corporation; Microsoft Corporation; Oracle Corporation; SAP SE; SAS Institute Inc.; Sisense Inc.; Tableau Software LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Data And Analytics Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global data and analytics software market report based on deployment, end use, and region.

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premises

-

Cloud

-

Hybrid

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Government

-

Healthcare

-

Manufacturing

-

Media & Communications

-

Retail

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global data and analytics software market is expected to grow at a compound annual growth rate of 13.6% from 2024 to 2030, reaching USD 345.32 billion by 2030.

b. North America dominated the data and analytics software market with a share of 36.5% in 2023. The market is expanding rapidly in line with the growing adoption of cloud technology in the region, reflecting the increasing demand for advanced solutions to manage and analyze data effectively. With cloud-based offerings, businesses can access powerful analytics tools, surmount geographical limitations, and ensure cost efficiency and adaptability, driving the growth of the regional market.

b. Some key players operating in the data and analytics software market include Accenture plc; Alteryx, Inc.; Amazon Web Services, Inc.; International Business Machines Corporation; Microsoft Corporation; Oracle Corporation; SAP SE; SAS Institute Inc.; Sisense Inc.; and Tableau Software LLC.

b. Key factors that are driving the data and analytics software market growth include aggressive use of Artificial Intelligence (AI) And Machine Learning (ML), and growing consideration for data security and privacy protection.

b. The global data and analytics software market size was estimated at USD 141.91 billion in 2023 and is expected to reach USD 160.31 billion in 2024.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."