- Home

- »

- Consumer F&B

- »

-

Dairy Products Market Share & Growth Report, 2020-2027GVR Report cover

![Dairy Products Market Size, Share & Trends Report]()

Dairy Products Market (2020 - 2027) Size, Share & Trends Analysis Report By Product (Milk, Cheese), By Distribution Channel (Hypermarkets/Supermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-276-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dairy Products Market Summary

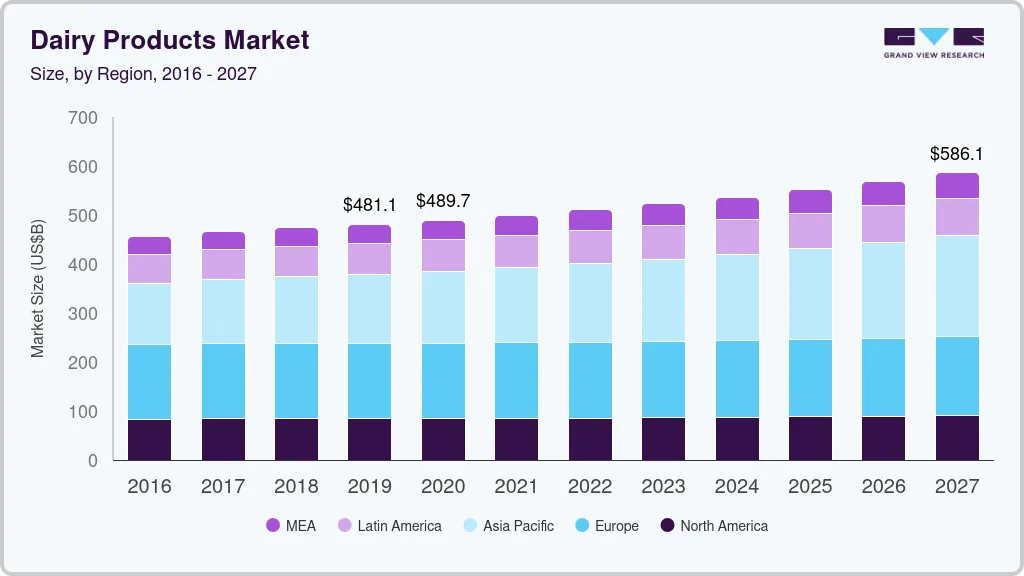

The Global Dairy Products Market size was estimated at USD 481.08 billion in 2019 and is projected to reach USD 586.11 billion by 2027, growing at a CAGR of 2.5% from 2020 to 2027. The rising consumption of dairy products and shifting consumer preference from meat to dairy products for protein enrichment are the significant drivers for this market’s growth.

Key Market Trends & Insights

- Europe accounted for the largest revenue share of around 31.9% in 2019 and is expected to continue its dominance over the forecast period.

- Based on product, the milk product segment accounted for the largest revenue share of 32.7% in 2019 and is anticipated to maintain its dominance over the forecast period.

- Based on distribution channel, the supermarkets/hypermarkets segment accounted for the largest revenue share of over 60% in 2019.

Market Size & Forecast

- 2019 Market Size: USD 481.08 Billion

- 2027 Projected Market Size: USD 586.11 Billion

- CAGR (2020-2027): 2.5%

- Europe: Largest market in 2019

The easy availability of dairy products due to modern retail facilities and cold chain logistics further drives the market growth. Furthermore, significant product sales through online distribution channels during the Covid-19 pandemic also supported the market growth. Dairy products offer various health benefits as they are rich in calcium, riboflavin, vitamin D, vitamin A, niacin, potassium, and phosphorus.

Regular consumption of dairy products improves bone and gut health and reduces the risks of Cardiovascular Diseases (CVDs) and type 2 diabetes. The rising demand for cheese in developing nations is also expected to drive the market. Earlier, cheese was considered unhealthy due to its association with a high amount of fats.

However, recent studies have shown that cheese is good for heart health and could be an excellent source of calcium for people with lactose intolerance. Growing focus on infant nutrition and demand for organic clean label dairy products are also expected to boost the market growth. The market has several growth opportunities, as consumers are willing to try new products.

Innovation in yogurts, such as fat-free, flavored, and drinkable yogurt, is expected to provide the manufacturers with significant growth opportunities. Innovation in the packaging, such as small portion size, on-the-go packs, and single-serve, is also driving the product demand, providing a massive opportunity to the manufacturers.

Product Insights

The milk product segment accounted for the largest revenue share of 32.7% in 2019 and is anticipated to maintain its dominance over the forecast period. This growth is due to rising milk consumption in developing countries as it is highly nutritious and offers protein and calcium. Moreover, milk consumption reduces the risk of osteoporosis among the elderly, which is expected to drive its demand at a substantial rate.

The yogurt segment is expected to witness significant growth during the forecast period owing to the high demand for yogurt in countries like Brazil, China, and India. Consumers in China prefer to eat yogurt as a part of their diet due to its role in maintaining a healthy gut, thus, improving immunity. Moreover, the preference for slightly sweet and flavored yogurt products in this country influences the growth of the overall market.

The cheese product segment is estimated to register the fastest CAGR from 2020 to 2027 due to rising product demand in Asia Pacific as a result of growing inclination towards western food habits. Furthermore, easy availability and innovation in cheese products are propelling the segment growth.

Distribution Channel Insights

The supermarkets/hypermarkets segment accounted for the largest revenue share of over 60% in 2019. A rise in the number of supermarkets/hypermarkets and the availability of a wide range of products in such stores are the primary factors driving the segment growth. Supermarkets have controlled temperature shelves for dairy products to avoid any spoilage. Consumers find it convenient to buy daily needs at lower prices in these stores, which is likely to drive the segment growth significantly in the coming years.

The online segment is expected to ascend at the fastest CAGR over the forecast period due to the convenience offered by these distribution channels. Some of the popular online distribution channels for dairy products include Just Milk, Sainsbury’s, Ocado, Mr. Case, and Walmart. Some companies also deliver the product online through their mobile application. For instance, India-based GCMMF (Amul) delivers milk and other dairy products via its mobile application. The growing usage of the internet and improved connectivity across the world will also augment the segment growth.

Regional Insights

Europe accounted for the largest revenue share of around 31.9% in 2019 and is expected to continue its dominance over the forecast period. Germany is expected to witness significant growth due to rising consumer demand for cheese, creamers, and milk desserts. Moreover, demand for clean label and high-quality dairy products is likely to propel the market growth in the region.

North America also captured a significant revenue share in the past. The U.S. accounted for the largest revenue share of the regional market due to the high consumption of cheese and milk in the country. Furthermore, innovation in milk products, such as low-fat and no-sugar milk, is expected to increase the consumption of milk.

Asia Pacific is anticipated to be the largest as well as the fastest-growing regional market during the forecast years due to rising demand for packaged and quality dairy products. Furthermore, the growth of the online distribution channels in the APAC region is driving the market. India, in particular, is expected to witness the fastest growth rate in the regional market due to the increasing demand for value-added dairy products like yogurt and cheese.

Key Companies & Market Share Insights

Major companies focus more on product and package innovation and business expansion to strengthen their market position. For instance, in June 2020, Arla Foods amba introduced its popular yogurt product skyr bucket in a sustainable packaging format that would contribute to a 30% reduction in CO2 emission. A lot of small-scale companies are focusing on product quality and clean label to attract more consumers. Some of the key players in the global dairy products market include:

-

Arla Foods amba

-

Fonterra Co-operative Group

-

GCMMF

-

The Kraft Heinz Company

-

Nestle S.A.

-

Danone S.A.

-

Royal FrieslandCampina

-

Dairy Farmers of America, Inc.

-

DMK Group

-

Meiji Holdings Co., Ltd.

Dairy Products Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 489.74 billion

Revenue forecast in 2027

USD 586.11 billion

Growth Rate

CAGR of 2.5% from 2020 to 2027

Base year for estimation

2019

Actual estimates/Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; France; China; Japan; India; Brazil; Saudi Arabia

Key companies profiled

Arla Foods amba; Fonterra Co-operative Group; GCMMF; The Kraft Heinz Company; Nestle S.A.; Danone S.A.; Royal FrieslandCampina; Dairy Farmers of America, Inc.; DMK Group; Meiji Holdings Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global dairy products market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2016 - 2027)

-

Milk

-

Cheese

-

Yogurt

-

Butter

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2016 - 2027)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2027)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global dairy products market size was estimated at USD 481.08 billion in 2019 and is expected to reach USD 489.74 billion in 2020.

b. The global dairy products market is expected to grow at a compound annual growth rate of 2.5% from 2020 to 2027 to reach USD 586.11 billion by 2027.

b. Europe dominated the dairy products market with a share of 31.9% in 2019. This is attributable to the high consumption of cheese and yogurt in this region.

b. Some key players operating in the dairy products market include Arla Foods; Fonterra Co-operative Group; GCMMF; The Kraft Heinz Company; Nestlé; Danone S.A; Royal FrieslandCampina; DMK Group; Meiji Holdings Co., Ltd. and Dairy Farmers of America, Inc.

b. Key factors that are driving the market growth include rising consumption of dairy products to fulfill the protein requirement of the body, a shift in consumers' preference from meat to dairy products for protein enrichment, and the development of modern cold chain logistics in developing nations including China and India.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.