- Home

- »

- Next Generation Technologies

- »

-

Dairy Herd Management Market Size & Share Report, 2030GVR Report cover

![Dairy Herd Management Market Size, Share & Trends Report]()

Dairy Herd Management Market Size, Share & Trends Analysis Report By Type (Milk Management, Feeding/Nutrition Management, Animal Waste Management, Breeding Management), By End-user, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-835-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Dairy Herd Management Market Trends

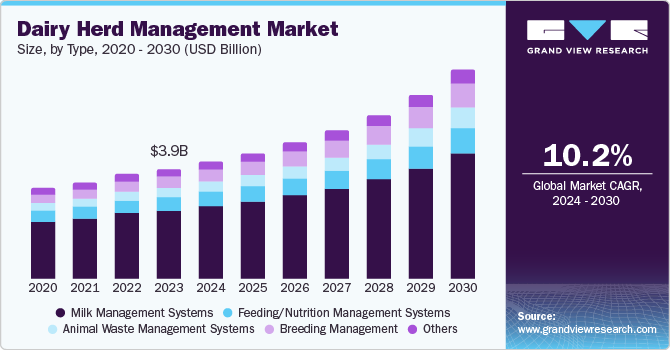

The global dairy herd management market size was estimated at USD 3.94 billion in 2023, and expected to grow at a CAGR of 10.2% from 2024 to 2030. Increasing demand for milk and other edible products such as cream, butter, and cheese, among others, is anticipated to boost the market over the forecast period. Also, long-term operational cost benefits associated with herd management are expected to augment market growth over the forecast period. This solution assists in maintaining the health of the livestock by keeping track of feeding habits, environment control, the diseases encountered, and the behavior of the livestock.

Managing a dairy herd is a labor-intensive process, and the labor costs are quite high, which adds up to the operational cost of any livestock owner. However, in recent times, several advanced products such as milking robots, feeding management systems, and waste management systems have made their way to the market and made cattle management possible with minimal human intervention. For example, several machines utilized in performing daily activities such as milking or feeding cattle are now performed with the adoption of dairy herd management products.

In the long term, growth in milk productivity becomes a necessity for the survival of a dairy farm. When the price of milk is low, farmers need to exercise even tighter controls on production costs to maximize the returns from fixed factors of production such as electricity. The application of automated technologies is a growing trend in the dairy industry and plays a crucial role in the prospects of the dairy herd management market. The automatic systems most commonly used in dairy production include automatic identification, milking, detection of estrus, feeding, detection of births, and other farm operations. The adoption of these systems has significantly reduced labor demand and increased the productivity of dairy farms.

Integrated herd management software solutions are gaining widespread adoption in the dairy farming industry. These solutions employ advanced data analytics to provide comprehensive insights and recommendations for optimizing various aspects of dairy operations. By collecting and analyzing real-time data from sensors and monitoring devices, the software offers valuable insights into individual animal health and productivity, enabling timely interventions and preventive measures. Additionally, these solutions facilitate efficient resource utilization, optimized feed formulations based on specific nutritional requirements, and streamlined operations. The adoption of such software is driven by the desire to improve overall productivity, profitability, and sustainability within the dairy farming sector while ensuring effective management of the herd and adherence to animal welfare standards.

The rising focus on animal welfare and the implementation of stringent regulations governing the housing and living conditions of dairy cattle emerged as a significant driver for the dairy herd management market. There is growing public awareness and consumer demand for the ethical treatment of livestock, leading to the introduction of various guidelines and standards related to factors such as stall dimensions, bedding materials, access to feed and water, and other aspects that impact the health and comfort of dairy cows. Consequently, dairy farmers are compelled to adopt advanced herd management solutions that enable them to monitor and optimize the living conditions of their cattle in compliance with these regulations while also catering to the consumer preference for ethically sourced dairy products and ensuring overall herd productivity and performance.

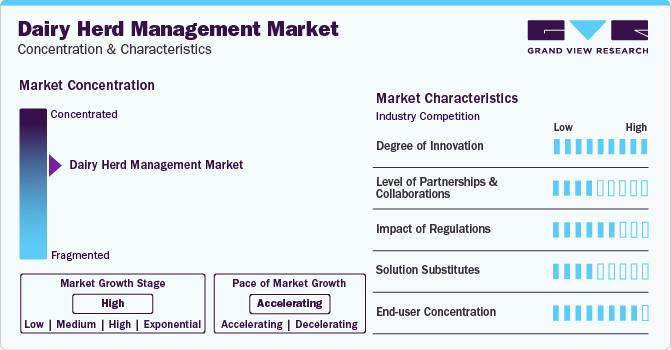

Market Concentration & Characteristics

The market is moderately competitive, with several key players dominating the industry. These companies continuously strive to innovate and differentiate their offerings to maintain a competitive edge. The presence of numerous regional and international competitors fosters a dynamic and evolving market landscape. The market is characterized by significant technological advancements and the integration of innovative solutions. The degree of innovation is high, with continuous development in automation, sensor technology, and data analytics. These advancements are aimed at improving farm efficiency and productivity, thereby driving market growth.

The level of partnership and collaboration within the industry is substantial. Key players frequently engage in strategic alliances, joint ventures, and partnerships with technology providers, research institutions, and governmental bodies. These collaborations are essential for driving innovation, expanding market reach, and enhancing product offerings. Regulation has a notable impact on the market. Governments across various regions implement policies and provide subsidies to encourage the adoption of advanced farming technologies. Compliance with environmental and animal welfare regulations also influences market dynamics, pushing companies to innovate and adhere to stringent standards.

Solution substitutes exist in the form of traditional farming methods and basic herd management practices. However, these alternatives are less efficient and offer limited scalability compared to advanced dairy herd management systems. As a result, the market is gradually shifting towards more sophisticated and data-driven solutions.

The end-user concentration in the market is diverse, ranging from small and medium-sized farms to large commercial dairy operations. Larger farms are more likely to adopt advanced systems due to their higher capital investment capacity and the need for efficient large-scale operations. However, small and medium-sized farms also represent a significant market segment, especially as costs decrease and more affordable solutions become available.

The market is moderately competitive, with several key players dominating the industry. These companies continuously strive to innovate and differentiate their offerings to maintain a competitive edge. The presence of numerous regional and international competitors fosters a dynamic and evolving market landscape.

Type Insights

In terms of type, the milk management systems segment dominated the market, gaining a market share of 62.1% in 2023. The market share is attributed to the increasing demand for precision and efficiency in milk production. These systems enable real-time monitoring and data analytics, optimizing milk yield and quality while ensuring animal health and welfare.

Rising global dairy consumption necessitates more efficient production methods, and these systems provide significant cost savings and operational efficiencies. Furthermore, regulatory pressures for higher standards in milk production and traceability are driving dairy farmers to adopt advanced milk management technologies, further propelling market growth.

The breeding management segment is expected to gain a significant CAGR of 12.9% from 2024-2030. The growth can be recognized due to the increasing focus on genetic improvement and reproductive efficiency. Advanced breeding management technologies enable farmers to enhance herd productivity by optimizing breeding cycles, improving genetic traits, and increasing the overall health and performance of the herd.

Additionally, the growing need for sustainable dairy farming practices and higher milk yields is driving the adoption of sophisticated breeding management solutions. These technologies also help in reducing calving intervals and increasing conception rates, which are crucial for maintaining a profitable dairy operation. As a result, the demand for effective breeding management systems is expected to surge, leading to significant market growth.

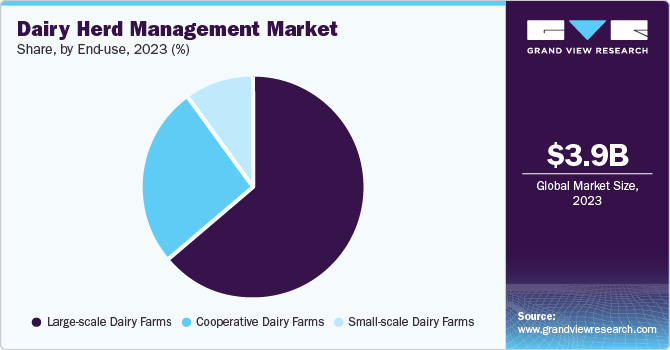

End-use Insights

In terms of end-use, the large-scale dairy farm segment dominated the market, gaining a market share of 64.0% in 2023. This higher share can be attributed to the ability of large-scale firms to invest in resources and infrastructure, allowing them efficient monitoring and optimization of herd health, productivity, and reproductive performance.

Additionally, economies of scale play a significant role, as larger operations can spread the cost of implementing and maintaining herd management systems across a larger number of animals, making the investment more financially feasible. Furthermore, larger dairy farms often face more complex operational challenges related to herd management, such as labor management, milk quality control, and regulatory compliance, driving the need for comprehensive herd management solutions.

The cooperative dairy farms segment is expected to gain a significant CAGR of 11.5% from 2024-2030. The cooperative dairy farms segment is anticipated to become the fastest-growing segment in the market due to its collaborative approach to resource allocation and cost-sharing. By pooling resources, cooperative farms can overcome financial barriers and afford advanced herd management technologies.

Moreover, these farms prioritize efficiency and productivity to stay competitive, leading them to adopt herd management solutions to optimize milk production and streamline operations. Additionally, potential government support or incentives aimed at promoting technological adoption in the agricultural sector may further drive growth in this segment.

Regional Insights

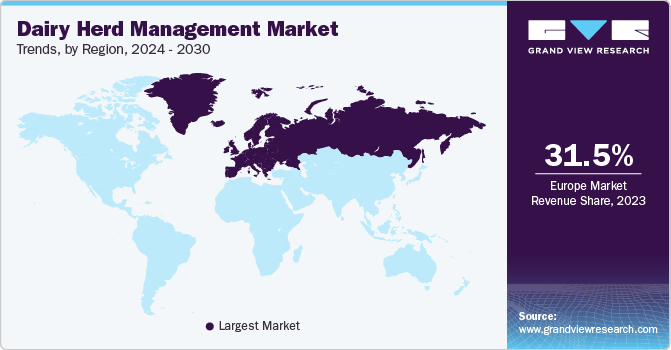

The dairy herd management industry in North America is witnessing notable growth due to several interconnected factors beyond productivity and efficiency gains. One key driver is the increasing consumer demand for transparency and traceability in the food supply chain. Dairy farmers are adopting herd management solutions to provide detailed records and data on animal health, living conditions, and the overall production process, enabling them to meet stringent food safety and quality standards. Furthermore, the industry's growth is fueled by the shift towards sustainable and environmentally friendly dairy farming practices. Herd management technologies offer insights into optimizing resource utilization, reducing waste, and minimizing the environmental impact of dairy operations.

The U.S. dairy herd management market held the largest market share of 75.7% in North America. The country boasts a significant number of large-scale commercial dairy operations, which are more inclined to adopt advanced herd management technologies to optimize productivity and profitability. Additionally, the U.S. dairy industry has been proactive in embracing technological advancements, facilitated by government initiatives and financial assistance programs that incentivize modernization and technological upgrades. The well-established and robust U.S. dairy industry, coupled with strong consumer demand for quality, traceability, and sustainable production methods, has created a conducive environment for the adoption of herd management solutions.

Europe Dairy Herd Management Market Trends

The dairy herd management market of Europe dominated the overall market in 2023, with a market share of 31.5%. Europe dominates the market due to its well-established dairy farming tradition, supported by robust infrastructure and regulatory frameworks. The region's dairy industry faces increasing pressure to enhance efficiency, productivity, and animal welfare while complying with strict environmental and food safety standards. This demand drives the adoption of advanced herd management technologies. Furthermore, Europe's diverse landscape of small to medium-sized farms creates a significant market for these solutions, fostering competition and innovation among providers.

U.K. dairy herd management market held a considerable market share in Europe in 2023, due to the growing emphasis on efficiency and productivity within the dairy sector, driven by factors such as fluctuating milk prices, labor shortages, and changing consumer demands. Dairy farmers are increasingly turning to herd management technologies to optimize milk production, improve animal health, and reduce operational costs. Secondly, advancements in technology, such as sensors, data analytics, and automation, are making herd management solutions more accessible and cost-effective for farmers of all sizes.

Asia Pacific Dairy Herd Management Market Trends

The dairy herd management market of Asia Pacific is anticipated to grow at the fastest CAGR of 10.7% from 2024 to 2030. This can be attributed to the rapidly growing dairy industry across countries like China, India, and Southeast Asian nations, fueled by rising incomes, population growth, and evolving dietary preferences. Governments in the region are promoting the modernization of agricultural practices, including dairy farming, through favorable policies, subsidies, and investments that encourage the adoption of advanced technologies such as herd management solutions.

Additionally, the increasing focus on food safety, quality, and traceability, coupled with the growing urbanization and emergence of a middle-class consumer base, has created a demand for high-quality dairy products, driving the need for efficient herd management practices. The entry of international players and leading global solution providers into the Asia Pacific market, attracted by its growth potential, is further expected to accelerate the adoption of dairy herd management technologies in this region.

China dairy herd management market is expected to register the fastest CAGR of 12.0% from 2024-2030 in Asia Pacific Market. The country has witnessed a significant surge in demand for dairy products, fueled by rising disposable incomes, urbanization, and evolving dietary preferences among its burgeoning middle-class population. To meet this growing domestic demand, China's dairy sector is undergoing large-scale expansion, with the establishment of numerous commercial dairy farm operations. These large-scale dairy operations are increasingly adopting advanced herd management technologies and solutions to optimize productivity, enhance efficiency, ensure food safety and quality compliance, and maximize profitability in this highly competitive and rapidly evolving market landscape.

Key Dairy Herd Management Company Insights

Some of the key companies operating in the market include Verizon, DeLaval, BouMatic, and GEA Group Aktiengesellschaft. among others.

-

DeLaval, a Sweden-based company, is a subsidiary of Tetra Laval International S.A. The company manufactures and distributes feeding, cooling, milking, and farm management systems. Its solution offerings include milking, herd management, animal traffic control, cooling, ventilation, feeding, and energy recovery. The company has a vast geographic presence across the Americas, Europe, Asia Pacific, and MEA. The company markets its products to family farmers, medium-sized enterprises, and large dairy operations. It continuously enters into corporate partnerships in an attempt to enhance its product offering.

-

BouMatic is a farm equipment and milking system manufacturer. The company provides herd management equipment, milking parlors, milk cooling devices, cattle healthcare products, hoof care merchandise, dairy hygiene chemicals, and dairy equipment spare components. The company also offers automation systems, cow traffic systems, milk harvest systems, and dairy robotics systems. It markets its products through distributors. The company’s service offering includes training and maintenance.

Leky and Afimilk Ltd.are some of the emerging market companies in the target market.

-

Lely is a company that specializes in agricultural technology, specifically for the dairy farming industry. Lely is one of the leading companies to develop and produce innovative agricultural machinery to enhance the productivity and sustainability of dairy farmers. Its product portfolio consists of robotic milking systems, automated feeding systems, automated feed pushers, cow brushes, and manure robots. Lely has operations in more than 60 countries, primarily in North America, Europe, and Asia. The global customer base is supported by a large network of dealers and service providers owned by the company.

-

Afimilk Ltd. is a global company specializing in advanced computerized systems for modern dairy farms and herd management. The company offers products such as herd management software, milk meters, and health monitoring devices to enhance dairy farming operations. Their solutions help farmers maximize milk production, improve animal welfare, and boost farm efficiency through data-driven insights and automation. The company's product range includes herd management software, cow monitoring systems, real-time milk analyzers, automated cow sorting systems, and precision milk meters. The company has operations in North America, Europe, Asia, and Latin America, and its products are used in various dairy farms across more than 50 countries.

Key Dairy Herd Management Companies:

The following are the leading companies in the dairy herd management market. These companies collectively hold the largest market share and dictate industry trends.

- DeLaval

- Merck & Co., Inc.,

- Afimilk Ltd.

- BouMatic

- GEA Group Aktiengesellschaft

- Fullwood JOZ

- DAIRYMASTER

- Lely

- VAS

- SUM-IT

- Pearson Milking Technoloy

- Waikato Milking Systems NZ LP

- AB Agri Ltd

- Hokofarm Group

- Alta Genetics Inc.

- Moocall

Recent Developments

-

In April 2024, DeLaval announced a strategic partnership with SERAP. SERAP would be taking over global development, manufacturing, and quality assurance of DeLaval's milk cooling tanks starting from the fourth quarter of 2024. This strategic approach would allow DeLaval to focus on increasing the production of its core products, such as VMS robotic milking machines. This partnership ensures DeLaval-branded milk coolers will be produced to specific technical standards, while SERAP will also continue selling its own range independently.

-

In April 2024, BouMatic and Brolis Sensor Technology announced a partnership to integrate the Brolis in-line milk analyzer into BouMatic milking systems, including the Gemini UP milking robot. This partnership aims to enhance milk quality, detect early signs of disease, and assist in genetic selection and feeding strategies, aligning with BouMatic's focus on efficiency and sustainability in dairy farming.

-

In October 2023, Lely announced a partnership with Konrad Pumpe GmbH to enhance the flexibility of its Lely Vector automatic feeding system by integrating Konrad Pumpe's dosing systems. This partnership allowed Lely to offer farmers more options in feed loading methods and increase the capacity of the Vector kitchen, benefiting larger dairy farms.

Dairy Herd Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.19 billion

Revenue forecast in 2030

USD 7.48 billion

Growth rate

CAGR 10.2% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Iran; Egypt; South Africa

Key companies profiled

DeLaval; Merck & Co., Inc.; Afimilk Ltd.; BouMatic; GEA Group Aktiengesellschaft; Fullwood JOZ; DAIRYMASTER; Lely; VAS; SUM-IT; Pearson Milking Technoloy; Waikato Milking Systems NZ LP; AB Agri Ltd; Hokofarm Group; Alta Genetics Inc.; Moocall

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dairy Herd Management Market Report Segmentation

This report forecasts market revenue growths at global, regional, as well as at country levels and offers an analysis of the qualitative and quantitative market trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global dairy herd management market report based on type, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Milk Management Systems

-

Feeding/ Nutrition Management Systems

-

Animal Waste Management Systems

-

Breeding Management

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Small-scale Dairy Farms

-

Large-scale Dairy Farms

-

Cooperative Dairy Farms

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia-pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Iran

-

Egypt

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dairy herd management market size was estimated at USD 3.94 billion in 2023 and is expected to reach USD 4.19 billion in 2024.

b. The global dairy herd management market is expected to grow at a compound annual growth rate of 10.2% from 2024 to 2030 to reach USD 7.48 billion by 2030.

b. Europe dominated the dairy herd management market with a share of over 31.5% in 2023. This is attributable to the well-established dairy industry, and stringent animal care regulations.management systems.

b. Some key players operating in the dairy herd management market include DeLaval, Merck & Co., Inc., Afimilk Ltd., BouMatic , GEA Group Aktiengesellschaft , Fullwood JOZ , DAIRYMASTER, Lely, VAS, SUM-IT, Pearson Milking Technoloy, Waikato Milking Systems NZ LP, AB Agri Ltd, Hokofarm Group, Alta Genetics Inc., and Moocall.

b. Key factors driving market growth include increasing demand for dairy products, focus on productivity and yield optimization, animal health and welfare concerns, and labor shortage and cost management.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."