Dairy Alternatives Market Size, Share & Trends Analysis Report By Source (Soy, Almond), By Product (Milk, Yogurt), By Distribution Channel (Supermarket & Hypermarkets, Convenience Stores), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-070-5

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Dairy Alternatives Market Size & Trends

The global dairy alternative market size was valued at USD 32.77 billion in 2024 and is expected to grow at a CAGR of 12.7% from 2025 to 2030. The market growth is fueled by the increasing prevalence of milk allergies among consumers. Furthermore, changing dietary preferences and the rising popularity of vegan diets are expected to drive market expansion during the forecast period. According to the data published in April 2023 by the National Library of Medicine, approximately 65% of the global population is lactose intolerant.

The growing prevalence of lactose intolerance and milk allergies is expected to be a major driver of the dairy alternatives market during the forecast period. Lactose intolerance, a genetic condition, is particularly common among Southeast Asian populations. Consumers affected by this condition often turn to lactose-free, plant-based alternatives to enhance their intake of calcium and vitamins. Additionally, increasing health consciousness among consumers and rising disposable incomes in both developed and developing countries are anticipated to further fuel the demand for dairy alternatives during the forecast period.

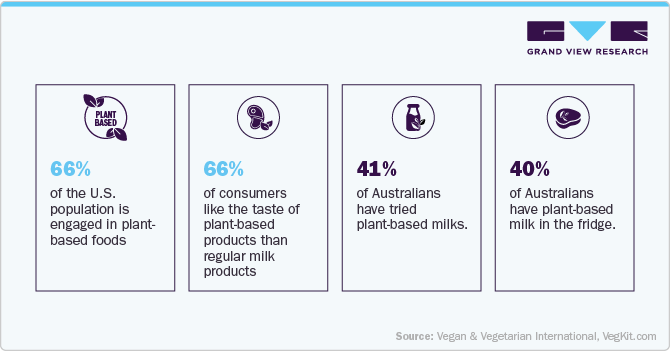

Consumer Insights for Dairy Alternatives:

The rising prevalence of dairy allergies and lactose intolerance among the global population fuels the dairy alternatives market. For instance, according to the data published by the National Institute of Diabetes and Digestive and Kidney Diseases (NIH), about 68% of the world population has lactose malabsorption. Additionally, the increasing adoption of vegan and plant-based diets, fueled by health, ethical, and environmental concerns, is further propelling market growth. Consumer awareness of the health benefits of plant-based products, combined with innovations in alternative dairy offerings, such as almonds, oats, and soy milk, is expanding the market. Moreover, rising disposable incomes, especially in developed and emerging markets, along with greater availability and accessibility of these products, contribute significantly to the growing demand for dairy alternatives.

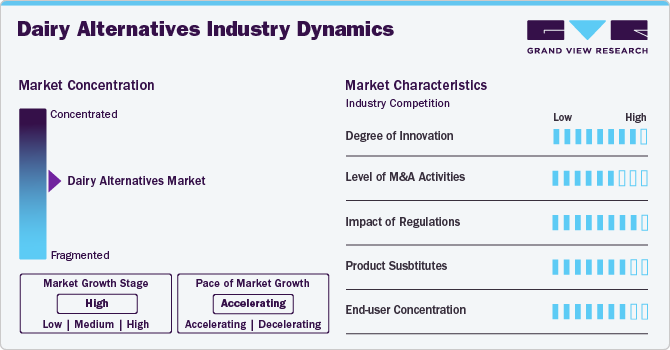

Market Concentration & Characteristics

The industry has witnessed significant innovation in recent years, with companies continually developing new plant-based products that mimic dairy's taste, texture, and nutritional profile. For instance, in August 2023, Chobani, LLC introduced a creamy pumpkin spiced flavored oat drink made with whole oat grains called Chobani Oat Milk Pumpkin Spice. The new product is vegan-friendly, packed with calcium, and free from dairy and lactose.

The dairy alternatives sector has seen a growing trend of mergers and acquisitions, as large food and beverage companies acquire smaller plant-based brands to tap into the growing demand. For instance, in October 2024, Rude Health, a plant-based milk firm, was acquired by Finland-based company- Oddlygood. Through this acquisition, Oddlygood aims to become a leading company in the U.K. in the dairy alternatives market.

The regulation of dairy alternatives varies for each region and country. In regions like the EU and the U.S., regulations require clear labeling of plant-based dairy alternatives to distinguish them from traditional dairy. Regulations also cover ingredient sourcing, allergen labeling, and sustainability claims, which can vary from region to region. In Canada, Section B.08.003 of the Food and Drug Regulations (FDR) states that milk: “shall be the normal lacteal secretion obtained from the mammary gland of the cow, genus Bos.” In Europe, milk and milk products are regulated by the European Union (EU), which has banned the addition of carrageenan, an almond milk additive, in infant formulas. EU member states currently have verifying definitions of lactose-free, but the EU is working on a uniform standard under Food Information for Consumers (FIC) regulations.

The industry faces competition from traditional dairy as well as other substitutes such as nut milk, hemp milk, rice milk, and even lab-grown dairy products. However, the demand for plant-based substitutes is rising due to health, ethical, and environmental concerns, especially among vegan, lactose-intolerant, and environmentally-conscious consumers. Key players are introducing innovative formulations of non-dairy products. For instance, in February 2023, PlantBaby launched organic milk made from macadamia nuts under its Kiki milk portfolio.

The industry is concentrated across various consumer segments. The global market shows a higher concentration in developed regions such as North America and Europe, where health trends and veganism are on the rise. However, emerging markets are beginning to see increasing demand due to growing awareness and adoption of plant-based lifestyles, expanding the market globally.

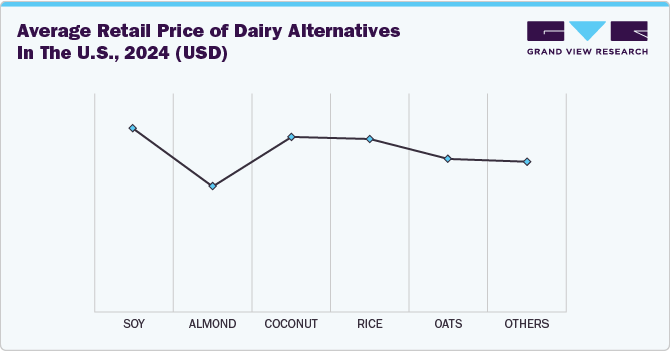

Pricing Analysis:

The pricing analysis of dairy alternatives in the U.S. indicates that these products generally carry a premium over traditional dairy items due to the use of specialized ingredients like almonds, oats, soy, and coconut. Plant-based milk, yogurt, and cheese are the most widely available, with pricing influenced by factors such as the type of plant base, nutritional content, ingredient quality, and brand positioning. Plant-based butter and ice cream, often marketed as dairy-free and lactose-free options, exhibit price variations depending on formulation and added health benefits, such as probiotics or fortified vitamins.

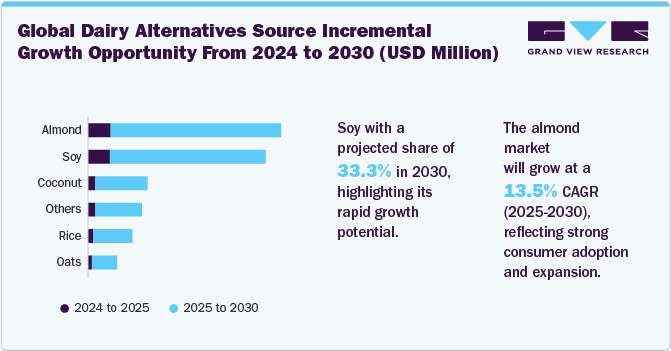

Source Insights

Soy sources for dairy alternatives accounted for a share of 34.8% of the global revenue in 2024. The segment of the dairy alternatives market that focuses on soy is anticipated to expand, as soymilk represents a significant portion of dairy alternative products consumed globally and is regarded as a traditional staple in East Asian diets. The growth of this segment is expected to be fueled by the nutritional advantages of soy, particularly its higher protein content relative to other dairy alternatives. Moreover, soy farming requires less water, resulting in lower eutrophication compared to other sources such as oats and almonds. Additionally, increasing awareness regarding lactose intolerance and milk allergies is likely to positively influence the global demand for soymilk. The health benefits associated with soymilk include a reduction in cholesterol levels, cancer risk, and obesity. Furthermore, it contributes to better cardiovascular health and lowers the likelihood of various issues related to post-menopause.

The almond for dairy alternatives market is projected to grow at a CAGR of 13.5% from 2025 to 2030. Almonds are the second most popular dairy alternative, owing to their high Vitamin B content, which boosts the body's metabolism and helps it burn fat and calories more effectively. Almonds are a rich source of proteins, vitamin E, calcium, magnesium, and vitamin B, and they have essential minerals such as iron, phosphorus, zinc, and copper that help in controlling blood pressure, improving blood oxygenation, and providing the body protection against diseases.

Coconut-based products are becoming a significant driver in the dairy alternatives market due to their unique flavor profile, nutritional benefits, and appeal to those with dietary restrictions. Coconuts are rich in healthy fats, particularly medium-chain triglycerides (MCTs), and are perceived as beneficial for heart health and weight management.

The oats source market is projected to grow at a CAGR of 13.0% from 2025 to 2030. Oats have emerged as a leading source of dairy alternatives in the market, driven by their mild flavor, creamy texture, and nutritional benefits. The increasing shift toward vegan food and drinks and rising awareness about dairy substitutes have fueled the demand for oat milk and products in the food and beverage industry globally. The key players are introducing new dairy alternative products sourced from oats to cater to rising demand. For instance, in March 2021, Starbucks introduced a new category in dairy-based drinks called Oatly oat milk with two flavors—honey oat milk latte and ice brown sugar oat milk shaken expresso to fulfill the needs of consumers opting for non-dairy drinks.

Product Insights

Milk accounted for a share of 67.6% of the global revenue in 2024. The growing demand for plant-based milk in the U.S. dairy alternatives market is driven by a combination of health, environmental, and ethical factors. The growing elderly population has led to a preference for milk-based dairy alternatives in developed regions such as North America and Europe. However, concerns about the health effects of soymilk, particularly for breast cancer survivors, may slow market growth. On the other hand, the rising demand for low-calorie foods, along with the increasing popularity of plant-based nutritional products, is expected to drive the demand for milk-based dairy alternatives in the coming years. For instance, according to the published data, plant-based milk has a high repeat purchase rate of 75%, while vegan milk contributes 35% of the plant-based food market.

The non-dairy ice cream market is projected to grow at a CAGR of 14.2% from 2025 to 2030. The growing demand for dairy-free desserts, such as soy, rice, almond, and coconut-based ice creams, is anticipated to drive market growth in the coming years. As consumers increasingly shift towards low-calorie desserts made from soy and almond milk, the demand for plant-based ice cream products is expected to rise.

According to The Good Food Institute Europe data published, the plant-based ice cream unit sales between 2020 and 2022 increased by 15%. To enhance the flavor, various flavoring and masking agents have been developed, making these ice creams more appealing to taste-conscious consumers. Additionally, these ice creams are priced lower than their dairy counterparts, attracting both lactose-tolerant individuals and the vegan population. With these factors in play, the market for ice cream made with dairy alternatives is poised for significant growth during the forecast period. The key players are introducing new products in the category to cater to changing consumer preferences. For instance, in February 2023, Valsoia, an Italian company known for its plant-based products, introduced an exciting range of vegan gelato inspired by traditional Italian flavors.

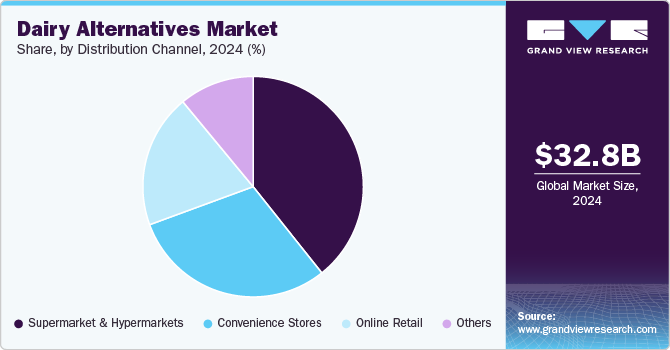

Distribution Channel Insights

The sales of dairy alternatives through supermarkets & hypermarkets accounted for a share of around 39.3% of the global revenue in 2024. The rising investments by international retailers aiming to establish a presence in the rapidly expanding market, the growth of domestic retailers seeking to expand their customer base, and the increasing purchasing power of consumers in developing economies are expected to boost the presence of hypermarkets and supermarkets in these regions. For instance, foreign retailers such as Lotte Shopping and Central Group are investing in building hypermarkets and supermarkets in Vietnam to attract shoppers.

The online segment is projected to grow at a CAGR of 13.8% from 2025 to 2030. Sales of dairy alternatives through online channels are expected to experience the highest growth in the coming years. Factors such as the increasing number of internet users, easy access to a variety of brands, busy lifestyles, 24/7 product availability, the convenience of shopping, and the wide selection of products are driving the global sales of dairy alternatives online. Additionally, the ability for customers to compare prices, browse numerous brands, and read customer reviews is further boosting online sales. The presence of discussion forums, discounts and offers, easy payment options, and various promotional strategies are also expected to contribute to the growth of online sales of dairy alternatives during the forecast period.

Regional Insights

North America dairy alternatives market is driven by the growing consumer demand for plant-based products with high nutritional value. The rising prevalence of milk intolerance in North America is expected to boost the demand for non-dairy alternatives like soymilk and almond milk. North America is anticipated to hold a significant market share during the forecast period due to the increasing popularity of innovative plant-derived products. Consumers in the region are increasingly choosing non-dairy options over cow's milk, as these alternatives offer superior nutritional benefits and lower calorie content. This increasing demand is encouraging the key companies in the region to introduce new products in the category. For instance, in July 2023, Daiya Foods unveiled two new products across Canada: Feta Cheeze Flavor Crumbles and Goat Cheeze Flavor Crumbles. These plant-based cheese crumbles, made with oat flour, offer a creamy and rich texture that sets them apart from other alternatives.

U.S. Dairy Alternatives Market Trends

The dairy alternatives market in U.S. is expected to grow at a CAGR of around 12% from 2025 to 2030. The Dairy Farmers of America, which represents over 30% of milk producers in the United States, reported that a decline in milk sales led to a USD 1.45 drop in the average milk price, driven by the growing popularity of soy, oat, nut, and other milk alternatives in grocery stores, coffee shops, and other outlets nationwide.According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIH), approximately 36% of Americans experience lactose malabsorption. The dairy alternatives market is expanding due to increasing health concerns. Additionally, the market is benefiting from innovations in product offerings, including fortified alternatives with added nutrients, enhanced taste profiles, and dairy-free cheese and yogurt options.

Europe Dairy Alternatives Market Trends

The dairy alternatives market in Europe is driven by the increasing demand for plant-based products with high nutritional value. The rising prevalence of milk allergies and health concerns related to harmful additives in dairy products are expected to further boost the demand for dairy alternatives like soymilk, almond milk, and rice milk, among others. According to the data published, approximately 54% of European consumers prefer plant-based milk. The dairy alternatives market in Europe is expected to grow due to the rising demand for healthy food and beverage options in the region. Dairy alternative beverages are frequently consumed as substitutes for traditional dairy drinks.

The U.K. dairy alternatives market is expected to grow over the forecast period. Plant-based milk has moved into the mainstream, with more than 1 in 10 of Pret-a-Manger's hot drinks in the U.K. now made with dairy alternatives, particularly organic rice-coconut milk and soy milk. The perception of milk as a healthy food is being challenged due to growing concerns over the use of bovine antibiotics, increasing awareness of animal cruelty, and a rise in lactose intolerance diagnoses. According to the data published in September 2021, one out of three U.K. consumers now drink plant-based milk, resulting in an increased usage from 25% in 2020 to 32% in 2021. These factors have created new opportunities for manufacturers of dairy alternatives in recent years.

The dairy alternatives market in Germany is projected to experience significant growth due to the increasing demand for plant-based products from consumers. Rising health concerns have shifted consumer preferences toward lactose-free, low-fat, and plain soy-based products in the region. Soymilk has been a prominent product segment in Germany's dairy alternatives market. Additionally, almond milk is expected to capture a larger share of the German dairy alternatives market during the forecast period, driven by the increasing popularity of other non-dairy beverages, such as rice and oat drinks, which are expected to positively influence market growth.

Asia Pacific Dairy Alternatives Market Trends

The dairy alternatives market in Asia Pacific is driven by the growing consumer awareness about health and nutrition, combined with the rising prevalence of lactose intolerance. Additionally, ongoing innovations in dairy alternatives are expected to further drive market growth in the region in the near future. Almond-based dairy alternatives have gained popularity in the Asia Pacific in recent years, driven by the various health benefits of almonds, including their ability to lower blood sugar levels, cholesterol, and blood pressure, among others.

China dairy alternatives market is a leading market in the region and has held a dominant position for the past few years. It is projected to experience substantial growth due to the increasing demand for plant-based products. Due to a series of food safety scandals, parents are placing greater emphasis on infant nutrition and the quality of milk formula. Rising disposable incomes and growing awareness of infant allergies are expected to fuel the growth of the dairy alternatives market in the coming years. Additionally, increasing health concerns are driving consumer preference for lactose-free, low-fat, and gluten-free dairy alternative products.

The dairy alternatives market in Australia is growing as consumers are choosing dairy alternatives over traditional milk products in food and beverage applications due to the health benefits they offer. According to the data published in July 2024, about 25% of the population in Australia is lactose intolerant. The rising consumer preference for foods free from chemicals and additives is expected to drive market growth in the coming years. Soy has been extensively used in Australia for producing dairy alternatives in recent years. The growing demand for soy-based beverages, known for their nutritional benefits, such as reducing the risk of cholesterol, cancer, and obesity, is likely to further fuel market growth during the forecast period. This increased demand and changing preferences are encouraging key players to introduce new products. For instance, in August 2022, Vitasoy International Holdings Ltd introduced a soy yogurt range in a dairy-free and plant-based format In Australia. The new product is a Greek-style yogurt available in 4 flavors: a plain, a hint of Vanilla, a hint of strawberry, a hint of mango, and passionfruit.

India dairy alternatives market is driven by the growing lactose-intolerant population which is driving consumers to seek dairy-free alternatives to traditional dairy products. Additionally, the increasing adoption of vegan diets and heightened consumer awareness about the importance of reducing animal cruelty are expected to further accelerate the growth of the dairy alternatives market in the country in the coming years.

Latin America Dairy Alternatives Market Trends

The dairy alternatives market in Latin America is driven by the rising health concerns and the increasing popularity of the nutritional benefits offered by dairy alternatives in food and beverage applications. The global decline in dairy product consumption is likely to affect dairy intake in the Central and South American markets. Additionally, consumers in the region are expected to progressively opt for flavorful and nutritious dairy alternative products in the coming years. In addition, emerging countries such as Brazil, Argentina, Chile, and Venezuela are expected to offer significant growth opportunities for companies operating in the region.

Middle East & Africa Dairy Alternatives Market

The dairy alternatives market in the Middle East and Africa is projected to experience significant growth during the forecast period, driven primarily by increasing consumer awareness of the product benefits and the rising demand for plant-based products. Saudi Arabia is expected to be a key market due to its growing population and rising disposable income. However, the expanding dairy industry in the region may pose a challenge to the growth of the dairy alternatives market over the forecast period.

Key Dairy Alternatives Company Insights

Many brands in the global dairy alternatives industry have identified untapped opportunities within their product lines and are taking steps to address these market gaps. This often involves developing new product designs or marketing campaigns to meet consumer needs and preferences better.

Key Dairy Alternatives Companies:

The following are the leading companies in the dairy alternatives market. These companies collectively hold the largest market share and dictate industry trends.

- Chobani, LLC

- Danone S.A.

- Hain Celestial

- Daiya Foods

- Eden Foods

- NUTRIOPS, SL

- Earth’s Own

- SunOpta

- Melt Organic

- Oatly AB

- Blue Diamond Growers

- Ripple Foods

- Vitasoy International Holdings Ltd

- Organic Valley

- Living Harvest

Dairy Alternatives Market Report Scope

|

Report Attribute |

Details |

|

Market value size in 2025 |

USD 36.83 billion |

|

Revenue Forecast in 2030 |

USD 66.91 billion |

|

Growth rate |

CAGR of 12.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain: China; Japan; India; Australia; Brazil; Argentina; South Africa |

|

Key companies profiled |

Chobani, LLC, Danone S.A., Hain Celestial, Daiya Foods, Eden Foods, NUTRIOPS, SL, Earth’s Own, SunOpta, Melt Organic, Oatly AB, Blue Diamond Growers, Ripple Foods, Vitasoy International Holdings Ltd, Organic Valley, and Living Harvest |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Dairy Alternatives Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dairy alternatives market report on the basis of source, product, distribution channel, and region.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Soy

-

Almond

-

Coconut

-

Rice

-

Oats

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Milk

-

Yogurt

-

Cheese

-

Ice Cream

-

Creamer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket & Hypermarkets

-

Convenience Stores

-

Online retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dairy alternatives market was estimated at USD 32.77 billion in 2024 and is expected to reach USD 36.83 billion in 2025.

b. The dairy alternatives market is expected to grow at a compound annual growth rate of 12.7% from 2025 to 2030 to reach USD 66.91 billion by 2030.

b. The soy segment dominated the dairy alternatives market with a share of 35.08% in 2023. Drinking soy milk is popular as an alternative therapy among women to increase estrogen levels, which is further expected to drive the market.

b. Some of the key market players in the dairy alternatives market are Chobani, LLC, Danone S.A., Hain Celestial, Daiya Foods, Eden Foods, NUTRIOPS, SL, Earth’s Own, SunOpta, Melt Organic, Oatly AB, Blue Diamond Growers, Ripple Foods, Vitasoy International Holdings Ltd, Organic Valley, and Living Harvest

b. Asia Pacific dominated the dairy alternatives market with a share of 45.80% in 2024, driven by the growing consumer awareness about health and nutrition, combined with the rising prevalence of lactose intolerance in the Asia Pacific population, has led to a surge in the consumption of plant-based milk products in recent years.

b. The market growth is fueled by the increasing prevalence of milk allergies among consumers. Moreover, the changing dietary preferences and the rising popularity of vegan diets are expected to drive market expansion during the forecast period. Additionally, increasing health consciousness among consumers and rising disposable incomes in both developed and developing countries are anticipated to further fuel the demand for dairy alternatives industry growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."