- Home

- »

- Clinical Diagnostics

- »

-

D-dimer Testing Market Size, Share And Trends Report, 2030GVR Report cover

![D-dimer Testing Market Size, Share & Trends Report]()

D-dimer Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Test Type (Clinical Laboratory, POC), By Method (ELISA, LETIA, FIA), By Application (DVT, PE, DIC), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-052-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

D-dimer Testing Market Summary

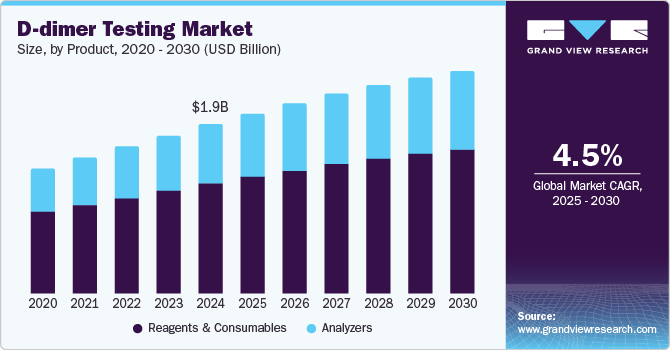

The global D-dimer testing market size was estimated at USD 1.86 billion in 2024 and is projected to reach USD 2.46 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. Market growth worldwide is driven primarily by the increasing prevalence of blood clotting disorders such as venous thromboembolism (VTE).

Key Market Trends & Insights

- North America D-dimer testing market dominated the global market with a revenue share of 33.8% in 2024.

- Asia Pacific D-dimer testing market is expected to register the fastest CAGR of 6.1% in the forecast period.

- Based on product, the reagents and consumables segment dominated the market and accounted for a share of 65.1% in 2024.

- Based on test type, the clinical laboratory tests segment led the market with a revenue share of 62.0% in 2024.

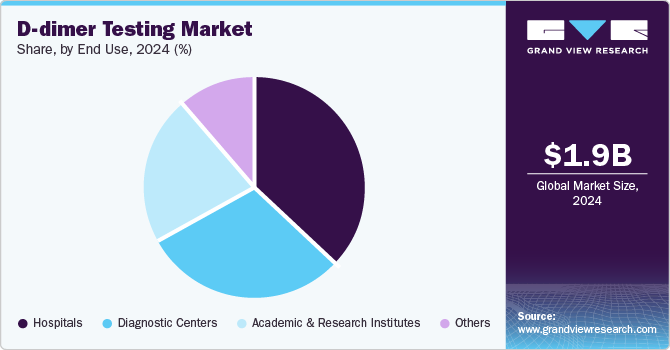

- Based on end use, the hospitals segment led the market with a revenue share of 36.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.86 Billion

- 2030 Projected Market Size: USD 2.46 Billion

- CAGR (2025-2030): 4.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to the CDC, approximately 5% to 8% of individuals in the U.S. carry genetic risk factors associated with VTE, a statistic that underscores the urgent need for effective diagnostic tools. With a staggering 900,000 people affected by VTE annually in the United States and 60,000 to 100,000 deaths attributed to this condition, the demand for D-dimer testing will continue to rise as healthcare professionals seek efficient methods to identify at-risk patients.

Technological advancements also play a critical role in propelling the D-dimer testing market forward. Innovations in Point-of-Care (POC) testing solutions have made rapid diagnostics more accessible, benefiting both patients and healthcare providers. Next-generation devices provide quick results, significantly reducing waiting times and enhancing clinical decision-making capabilities. This aspect is crucial as healthcare facilities increasingly prioritize timely interventions, setting a foundation for greater adoption of D-dimer testing protocols in 2023 and beyond.

As a compelling trend, there has been a notable shift from traditional laboratory methods to POC D-dimer testing, fueled by its convenience and efficiency. These tests can be conducted in various settings, enabling immediate assessment and effective management of patients suspected of having clotting disorders. The 2023 healthcare landscape reveals a growing preference for POC solutions, with medical institutions leveraging these tests to streamline patient care and improve outcomes, thereby solidifying their role in modern diagnostics.

Moreover, the cost-effectiveness of D-dimer testing serves as a significant driver in its market growth. Offering a non-invasive method to rule out VTE, D-dimer tests can substantially reduce reliance on expensive imaging procedures. Economic advantages have become a prioritized consideration among healthcare facilities in 2023, as they aim to optimize resource allocation while delivering quality care. Concurrently, increased awareness of thrombotic disorders and the importance of early diagnosis are promoting the implementation of D-dimer testing protocols across healthcare systems, reinforcing its market position.

Product Insights

Reagents and consumables dominated the market and accounted for a share of 65.1% in 2024. Reagents and consumables are vital for the frequent testing needs associated with D-dimer assays, enabling prompt diagnosis of VTE. The emergence of automated D-dimer testing enhances efficiency and accuracy, while the rising use of POC solutions emphasizes the necessity of a reliable supply to optimize patient care and clinical workflows.

Analyzers are expected to grow at the fastest CAGR of 4.8% over the forecast period. Segment growth is propelled by essential factors such as POC testing solutions, which deliver rapid results and minimize patient waiting times, thereby improving the overall patient experience. The rising incidence of blood clotting disorders and the necessity for prompt diagnostics in emergency scenarios further enhance the demand for these innovative analyzers.

Test Type Insights

Clinical laboratory tests led the market with a revenue share of 62.0% in 2024. Clinical laboratory tests are vital for diagnosing VTE conditions, such as deep vein thrombosis (DVT) and pulmonary embolism (PE). These tests facilitate accurate diagnosis by confirming or ruling out blood clots, which can be life-threatening if left untreated. The growing occurrence of clotting disorders drives demand for reliable diagnostic solutions.

Point-of-care tests are expected to register the fastest CAGR of 4.8% over the forecast period. These tests facilitate rapid decision-making in critical environments, such as emergency departments, where swiftly ruling out conditions such as DVT is crucial. Moreover, advancements in POC technology have produced user-friendly devices operable by diverse healthcare personnel, enhancing accessibility and convenience, thus increasing demand driven by the rising incidence of VTE.

Method Insights

The Enzyme-linked Immunosorbent Assay (ELISA) segment held the largest share of 41.6% in 2024, owing to its exceptional sensitivity and specificity for detecting D-dimer levels, critical for diagnosing thrombotic events. As the gold standard in laboratory testing, automated ELISA systems improve efficiency by reducing turnaround times and labor intensity, enhancing accessibility in clinical environments.

Fluorescence Immunoassays (FIA) are expected to register the fastest CAGR of 5.4% over the forecast period, fueled by the method’s nearly 100% sensitivity and user-friendly design, ideal for POC settings. Automated FIA solutions improve workflow efficiency and reduce turnaround times, facilitating timely clinical decision-making in diagnosing thrombotic conditions.

Application Insights

Deep vein thrombosis (DVT) dominated the market and accounted for a share of 37.4% in 2024, highlighting the importance of D-dimer tests for diagnosis. These non-invasive tests effectively identify elevated D-dimer levels associated with thrombus formation, facilitating prompt intervention. Growing awareness of thromboembolic disorders and the demand for rapid diagnostic solutions are driving the need for D-dimer testing in DVT management.

Disseminated intravascular coagulation (DIC) is expected to register the fastest CAGR of 5.5% over the forecast period. If left untreated, DIC can result in severe outcomes and high mortality rates. D-dimer tests are crucial for early detection of elevated fibrin degradation products, enabling timely intervention. As awareness of DIC increases and its triggering conditions become more prevalent, demand for effective diagnostic tools such as D-dimer tests is surging.

End Use Insights

The hospitals segment led the market with a revenue share of 36.8% in 2024. Hospitals play a vital role in managing VTE, with nearly 60% of DVT cases arising during hospitalization. D-dimer tests, essential diagnostic tools in emergency departments, facilitate safe VTE exclusion, minimizing unnecessary imaging costs and improving patient outcomes, thereby increasing demand for these services.

Diagnostic centers are projected to grow at the fastest CAGR of 5.0% over the forecast period. Diagnostic centers are equipped with cutting-edge technologies that facilitate rapid and accurate D-dimer testing, essential for diagnosing DVT and PE. The rising incidence of VTE and the demand for timely diagnoses propel utilization of these facilities, while POC solutions improve patient throughput and satisfaction.

Regional Insights

North America D-dimer testing market dominated the global market with a revenue share of 33.8% in 2024. The region is experiencing an increasing demand for POC testing, which accelerates diagnostics and improves patient outcomes. Abundant research publications and clinical guidelines further bolster the effective use of D-dimer tests.

U.S. D-dimer Testing Market Trends

The D-dimer testing market in U.S. dominated the North America D-dimer testing market with a revenue share of 84.9% in 2024. The country boasts a strong healthcare system that promotes the swift adoption of innovative diagnostic technologies, such as automated and POC testing solutions. Regulatory backing from organizations such as the American Society of Hematology further solidifies D-dimer tests as standard tools in emergency diagnostics, driving market expansion.

Europe D-dimer Testing Market Trends

Europe D-dimer testing market held substantial market share in 2024. The region exhibits a significant prevalence of conditions necessitating D-dimer testing, such as PE and DIC. Furthermore, the adoption of advanced technologies and increased awareness among healthcare professionals is boosting the demand for D-dimer tests in Europe.

The D-dimer testing market in Germany is expected to grow in the forecast period. The country’s commitment to enhancing clinical outcomes via advanced testing methods promotes the adoption of D-dimer tests. Germany’s proactive management of thromboembolic disorders through established guidelines further positions D-dimer testing as a key diagnostic tool.

Asia Pacific D-dimer Testing Market Trends

Asia Pacific D-dimer testing market is expected to register the fastest CAGR of 6.1% in the forecast period. The growth of public health initiatives focused on enhancing diagnostic capabilities, coupled with advancements in POC testing technologies, improves access to D-dimer testing in the Asia Pacific. Furthermore, the rising incidence of DVT and PE propels demand for effective diagnostic solutions across the region.

The D-dimer testing market in China dominated the Asia Pacific D-dimer testing market in 2024, aided by the increasing prevalence of thromboembolic disorders such as DVT and PE. The Chinese government promotes D-dimer tests through updated clinical guidelines and enhanced healthcare infrastructure, while advancements in POC testing improve accessibility and efficiency in both urban and rural settings.

Key D-dimer Testing Company Insights

Some key companies operating in the market include Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd; Siemens Healthcare; among others. Strategic initiatives encompass R&D, partnerships, and product innovations to enhance diagnostic accuracy and efficiency, intensifying competition and driving market growth to meet evolving healthcare demands.

-

F. Hoffmann-La Roche Ltd produces advanced D-Dimer assays that improve the detection of fibrin degradation products, aiding in the diagnosis of thromboembolic diseases and enhancing clinical outcomes for patient management.

-

BIOMÉRIEUX specializes in diagnostic solutions, notably the VIDAS® D-Dimer Exclusion test, validated for excluding VTE and supported by extensive clinical studies as a reference tool for accurate thrombotic diagnosis.

Key D-dimer Testing Companies:

The following are the leading companies in the d-dimer testing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd

- Siemens Healthcare

- Abbott

- BIOMÉRIEUX

- WERFEN

- HORIBA, Ltd.

- QuidelOrtho Corporation

- Diazyme Laboratories

- Biomedica Diagnostics

- SEKISUI Diagnostics

Recent Developments

-

In February 2023, Carolina Liquid Chemistries Corp. and Diazyme Laboratories partnered to expand the DZ-Lite c270 analyzer’s menu, adding 25 new assays to enhance diagnostic capabilities in various clinical settings.

D-dimer Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.97 billion

Revenue forecast in 2030

USD 2.46 billion

Growth rate

CAGR of 4.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, test type, method, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd; Siemens Healthcare; Abbott; BIOMÉRIEUX; WERFEN; HORIBA, Ltd.; QuidelOrtho Corporation; Diazyme Laboratories; Biomedica Diagnostics; SEKISUI Diagnostics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global D-dimer Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global D-dimer testing market report based on product, test type, method, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Analyzers

-

Reagents & Consumables

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Laboratory Tests

-

Point-of-Care Tests

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzyme-linked Immunosorbent Assay (ELISA)

-

Latex-enhanced Immunoturbidimetric Assays

-

Fluorescence Immunoassays

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Deep Vein Thrombosis (DVT)

-

Pulmonary Embolism (PE)

-

Disseminated Intravascular Coagulation (DIC)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Academic & Research Institutes

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.