- Home

- »

- Petrochemicals

- »

-

Cyclohexanone Market Size & Share, Industry Report, 2030GVR Report cover

![Cyclohexanone Market Size, Share & Trends Report]()

Cyclohexanone Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Caprolactam, Adipic Acid, Solvents), By Grade (Technical Grade, Reagent, Grade), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68038-450-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cyclohexanone Market Size & Trends

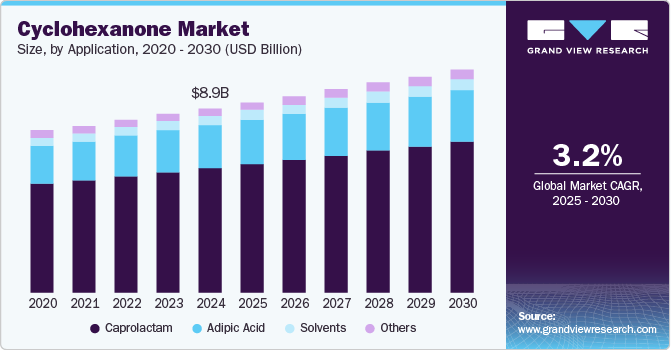

The global cyclohexanone market size was valued at USD 8.86 billion in 2024 and is projected to grow at a CAGR of 3.2% from 2025 to 2030. The market is primarily driven by its critical role in producing caprolactam and adipic acid for nylon-6 and nylon-6,6, which are increasingly used in automotive, textile, and packaging applications. The automotive sector's demand for lightweight and durable materials to enhance fuel efficiency and growth in the textile industry's need for synthetic fibers bolsters market expansion. In addition, cyclohexanone's use as a solvent and intermediate in chemical and pharmaceutical manufacturing broadens its application scope.

Technological advancements in production processes, including efficient and eco-friendly catalytic methods, further support market growth by improving yields and ensuring regulatory compliance. According to Fibrant, cyclohexanone is primarily used for captive consumption in its isolated form or as part of a mixture to produce nylon intermediates such as adipic acid and caprolactam. Approximately 4% of cyclohexanone is utilized in non-nylon markets, serving as a solvent in paints, dyes, and pesticides. In addition, it is employed in manufacturing pharmaceuticals, films, soaps, and coatings.

The adoption of efficient and eco-friendly catalytic methods is bolstering the growth of the cyclohexanone market. These innovations enhance production efficiency, reduce environmental impact, and meet increasing regulatory and sustainability demands, which helps manufacturers meet industry standards while catering to the rising demand for high-quality cyclohexanone. American Chemical Society (ACS) reported an electrochemical method for synthesizing cyclohexanone oxime using aqueous nitrate as a nitrogen source under ambient conditions. Zn-Cu alloy catalysts, particularly Zn93Cu7, effectively drive the nitrate reduction, achieving a 97% yield and 27% Faradaic efficiency at 100 mA/cm². The process involves the formation of a hydroxylamine intermediate, which reacts with cyclohexanone in the electrolyte.

Cyclohexanone as a solvent and intermediate in chemical and pharmaceutical manufacturing enhances its demand due to its vital role in producing key products such as nylon and various pharmaceuticals. This broad application scope supports market growth by catering to diverse industrial needs. According to the National Center for Biotechnology Information (NCBI), Cyclohexanone is a solvent in various applications, including cellulosic, spot removers, paint and varnish removers, wood stains, insecticides, and natural and synthetic resins and lacquers. It is also used as an additive in detergents, for degreasing metals, as a mold release agent in paints and varnishes, as a leveling agent in dyeing and delustering silk, and as an additive in lube oils, particularly for aircraft piston engines. In addition, cyclohexanone is a monomer that produces copolymers, polyvinyl chloride, cyclohexanone resins, and methacrylate ester polymers.

Application Insights

Caprolactam accounted for the largest share of 67.8% in 2024. This high percentage can be attributed to the increased production of Nylon 6, used extensively in textiles, engineering plastics, and consumer goods. Expanding automotive and textile industries, particularly in emerging markets, amplify the need for caprolactam, fueling cyclohexanone consumption as a key precursor.

The solvents segment is expected to grow at the fastest CAGR of 3.5% over the forecast period. The cyclohexanone market benefits from its extensive use in the chemical industry as a solvent for paints, dyes, and resins. Its high solvency power makes it ideal for dissolving various substances, driving demand. This adaptability positions cyclohexanone as a preferred solvent among chemical manufacturers. According to the BASF Report 2023, global chemical production was expected to grow by 2.7% in 2024, improving from 1.7% in 2023. Advanced economies were set for modest growth at 0.8% after a 4.9% decline, while emerging markets faced a slight slowdown from 4.8% to 3.5%.

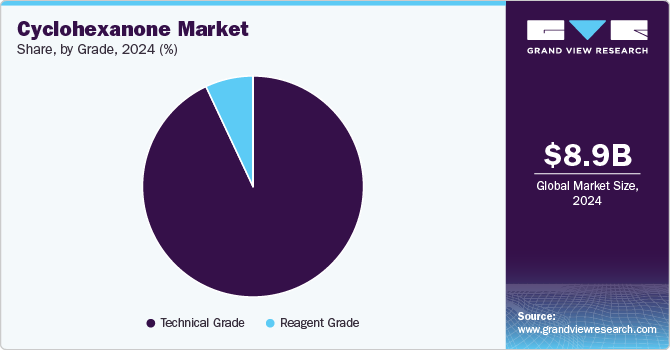

Grade Insights

The technical grade segment held the largest market share in 2024. The segment is driven by its role as a solvent in paints and coatings, essential for the expanding construction and infrastructure sectors. Its use as a precursor in pharmaceutical synthesis also boosts demand, supported by the growth of the pharmaceutical industry. These applications underscore their importance in both industrial and healthcare markets. For instance, the September/October 2023 edition of International Construction noted record-high North American equipment sales in 2022, with an expected dip in 2023. Instead, sales increased by 8%, surpassing expectations, driven by federal funding that boosted construction activities projected to continue through 2026.

The reagent grade segment is expected to grow significantly over the forecast period. The segment is driven by its essential use in laboratories for research and development. It serves as a crucial solvent and reagent in organic synthesis. Environmental regulations further push manufacturers to produce high-purity versions to meet sustainability standards. These factors collectively boost demand across academic and industrial applications.

Regional Insights

Asia Pacific cyclohexanone market held the largest share of 75.6% in the global market in 2024. The growing demand for nylon production drives the market, fueled by the expanding automotive and textile industries. Rapid industrialization, urbanization, and infrastructure growth also boost the consumption of synthetic fibers, engineering plastics, and construction materials. In addition, cyclohexanone's use in paints, coatings, and adhesives supports market expansion. For instance, in April 2024, NILIT, an Israeli nylon manufacturer, announced a joint venture with a Chinese firm to produce high-quality industrial-grade nylon in China. This collaboration was expected to expand NILIT's global footprint and enhance its presence in the Asian market. The joint venture would use advanced technology to meet the growing demand for nylon in various industries, including automotive and textiles.

China Cyclohexanone Market Trends

The China cyclohexanone market held a dominant position in 2024 due to the growing demand for high-quality materials in industries such as textiles and automotive, driven by local production capacity expansions and advancements in energy-efficient manufacturing technologies. For instance, in August 2024, INVISTA, a U.S.-based chemical company, announced its expansion in Shanghai, doubling its annual production capacity of nylon 6,6 to 400,000 metric tons. This expansion enhances local supply and market response and supports the demand for high-quality materials with heat and abrasion resistance properties. The site integrates INVISTA’s facilities, including an R&D center, employing energy-efficient technology. This move aligns with China's leading role in global nylon consumption and mitigates past industry supply concerns.

The India cyclohexanone market is expected to grow rapidly in the coming years due to the increasing demand for high-quality lubricants and industrial oils, driven by growing automotive and industrial sectors, particularly in hot climates. For instance, in September 2023, Gazpromneft-Lubricants and Enso Global Trading expanded their partnership to enhance the supply of lubricants in India. The agreement included the regular distribution of motor, hydraulic, base, and gearbox oils to meet the growing demand in the Indian market. Enso Oils & Lubricants, part of Enso Group, would import and distribute Gazpromneft's high-quality oils and lubricants. This collaboration was expected to support the automotive and industrial sectors, offering premium engine oils and transmission fluids for Indian vehicles, particularly suited for hot climates.

Europe Cyclohexanone Market Trends

The Europe cyclohexanone market was expected to grow at the fastest CAGR over the forecast period. The market is driven by the high demand from the automotive industry for nylon in vehicle production, the increasing need for adipic acid in textiles and packaging, and the growth of chemical manufacturing. Its key use in producing nylon 6/6, resins, and coatings also fuels market growth. In addition, its applications in industrial and household cleaning products support ongoing demand. For instance, Nippon Paint signed an agreement to acquire AOC, a global specialty formulator of composite resins and materials used in automotive, construction, and marine industries, for EUR 2.24 billion. This acquisition was a part of Nippon Paint's strategy to grow its presence in the specialty chemicals sector, aligning it with its "Asset Assembler" model. The deal, expected to close in the first half of 2025, would enhance Nippon Paint's product offerings and is anticipated to positively impact its earnings from the first year of ownership.

The Germany cyclohexanone market held a substantial market share in 2024 due to the key industries such as automotive, textiles, and electronics used in nylon and polymer production. The growth of these sectors boosts cyclohexanone consumption. In addition, Germany's focus on sustainability and green chemistry encourages eco-friendly production processes, further stimulating market growth.

Key Cyclohexanone Company Insights

Some of the key companies in the cyclohexanone market include Gujarat State Fertilizers & Chemicals Limited (GSFC), Asahi Kasei Corporation, BASF, and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

BASF is a global chemical company producing a wide range of products, including crop protection, plastics, chemicals, and performance products. It serves the automotive, electronics, agriculture, construction, and paint industries. The company emphasizes R&D in collaboration with global partners and operates a network of manufacturing facilities worldwide.

-

Asahi Kasei Corporation manufactures various chemical products, including acrylonitrile, styrene, medical devices, and prescription drugs. Its product portfolio serves chemicals, healthcare, electronics, and construction industries. The company also offers advanced solutions such as membrane filtration and ion exchange membranes.

Key Cyclohexanone Companies:

The following are the leading companies in the cyclohexanone market. These companies collectively hold the largest market share and dictate industry trends.

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- Asahi Kasei Corporation

- BASF

- Domo Chemicals

- Ostchem

- Fibrant

- Shreeji Chemicals.

- JIGCHEM UNIVERSAL

- ARIHANT SOLVENTS AND CHEMICALS

- Qingdao Hisea Chem Co., Ltd.

- LUXI GROUP

- Chang Chun Group

- UBE Corporation

Recent Developments

-

In October 2024, Gujarat State Fertilizers & Chemicals Limited (GSFC) inaugurated a manufacturing plant in Fertilizer Nagar, Vadodara, dedicated to producing Hydroxylamine Sulphate Crystals (FIX Crystal). This plant has an annual manufacturing capacity of 6,600 metric tons of FIX Crystal.

-

In September 2024, Domo Chemicals introduced sustainable polyamide solutions, emphasizing eco-friendly materials. The company highlighted polyamides made from recycled post-consumer fishing nets in partnership with Sea2See. These innovations are part of Domo's commitment to sustainability and reducing environmental impact through circular economic practices.

Cyclohexanone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.17 billion

Revenue forecast in 2030

USD 10.73 billion

Growth Rate

CAGR of 3.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, grade, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, France, China, India, Japan, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Gujarat State Fertilizers & Chemicals Limited (GSFC); Asahi Kasei Corporation; BASF; Domo Chemicals; Ostchem; Fibrant; Shreeji Chemicals; JIGCHEM UNIVERSAL; ARIHANT SOLVENTS AND CHEMICALS; Qingdao Hisea Chem Co., Ltd.; LUXI GROUP; Chang Chun Group; UBE Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cyclohexanone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cyclohexanone market report based on application, grade, and region.

-

Application Outlook (Revenue, USD Billion, Volume, Kilotons, 2018 - 2030)

-

Caprolactam

-

Adipic Acid

-

Solvents

-

Paints & Dyes

-

Agriculture

-

Others

-

-

Others

-

-

Grade Outlook (Revenue, USD Billion, Volume, Kilotons, 2018 - 2030)

-

Technical Grade

-

Reagent Grade

-

-

Regional Outlook (Revenue, USD Billion, Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.